Oklahoma Mileage Reimbursement Form

Description

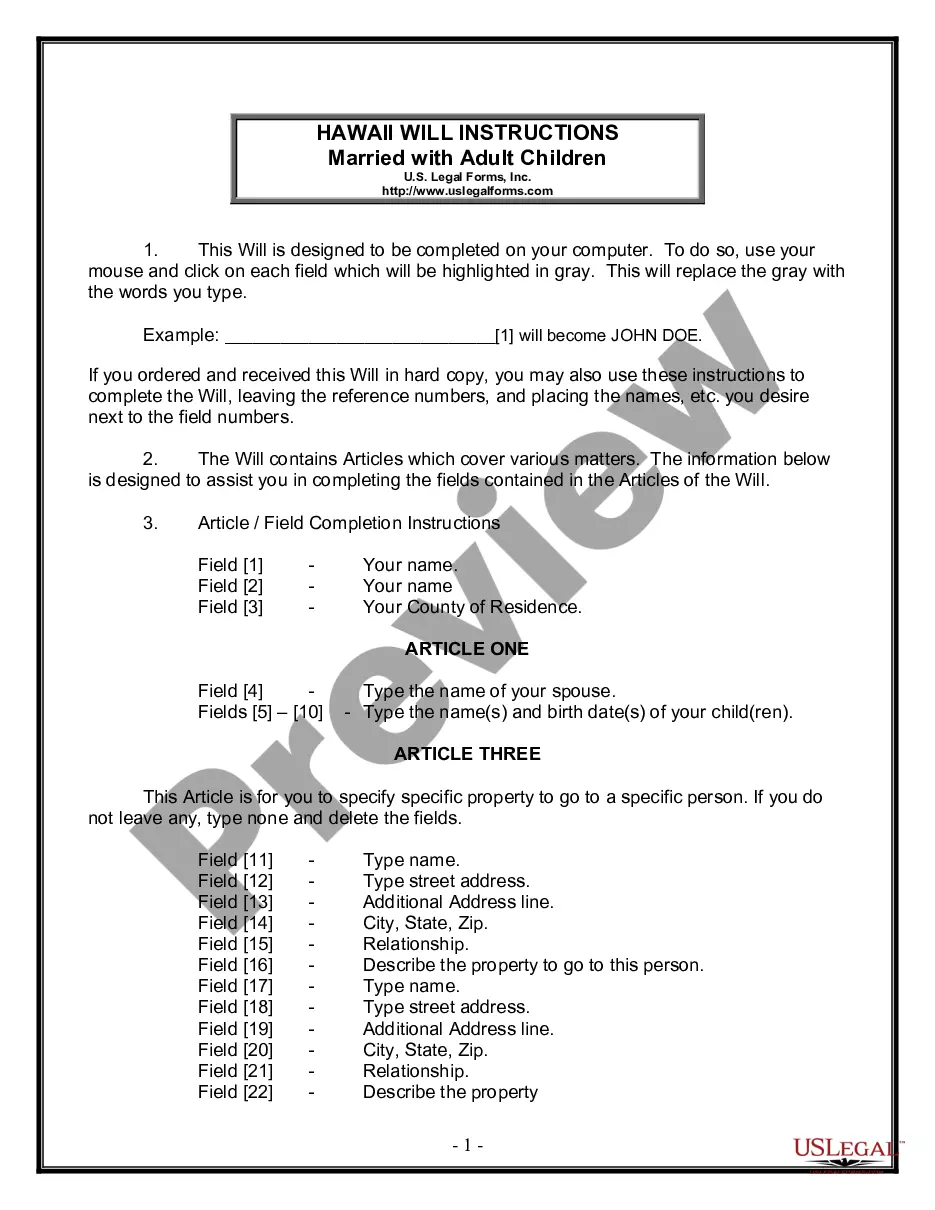

How to fill out Mileage Reimbursement Form?

You might spend hours online searching for the legal document template that satisfies the state and federal specifications you need.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

You can download or print the Oklahoma Mileage Reimbursement Form from my service.

Review the form description to confirm you have selected the correct form. If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Oklahoma Mileage Reimbursement Form.

- Every legal document template you obtain is yours permanently.

- To get another copy of the purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have chosen the correct document template for your state/city that you select.

Form popularity

FAQ

IRS Mileage Rates for 2021-2022: Business, Moving, Charity, Medical Mileage Rates. For 2021, they're $0.56 per mile for business, $0.14 per mile for charity and $0.16 per mile for moving or medical. Many or all of the products featured here are from our partners who compensate us.

The Internal Revenue Service has announced an increase in the mileage reimbursement rate, effective Jan. 1, 2022, to $0.585 per mile. This is an increase from the $0.56 IRS rate for 2021.

The Internal Revenue Service announced gas mileage reimbursement rates for 2020 in December. For this year, the mileage rate in 2 categories have gone down from previous years: 57.5 cents per mile for business miles (58 cents in 2019) 17 cents per mile driven for medical or moving purposes (20 cents in 2019)

Beginning January 1, 2020, the standard mileage rates for the use of a car (van, pickup or panel truck) will be: 57.5 cents per mile for business miles driven, down from 58 cents in 2019. 17 cents per mile driven for medical or moving purposes, down from 20 cents in 2019.

For 2020, the standard mileage rate for businesses will be 57.5 cents per mile, a decrease of 0.5 cents from 58 cents per mile in 2019. According to critics, the issue with these annually-fixed, national rates is that they do not account for variables such as location and fluctuating fuel prices.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

Mileage Reimbursement. $0.40 Per Mile. 1 hour advance notice.

The line is called the "Where's My Ride" line and the phone number to call is 800-435-1034.

Most employers will pay travel expenses, including a mileage rate. Some employers use a fixed rate for travel. You may find it interesting to know that unless you are a Workers Compensation claimant, they are not required to do so. There are no state laws governing how much an employer must pay for mileage.