Oklahoma Employee Payroll Record

Description

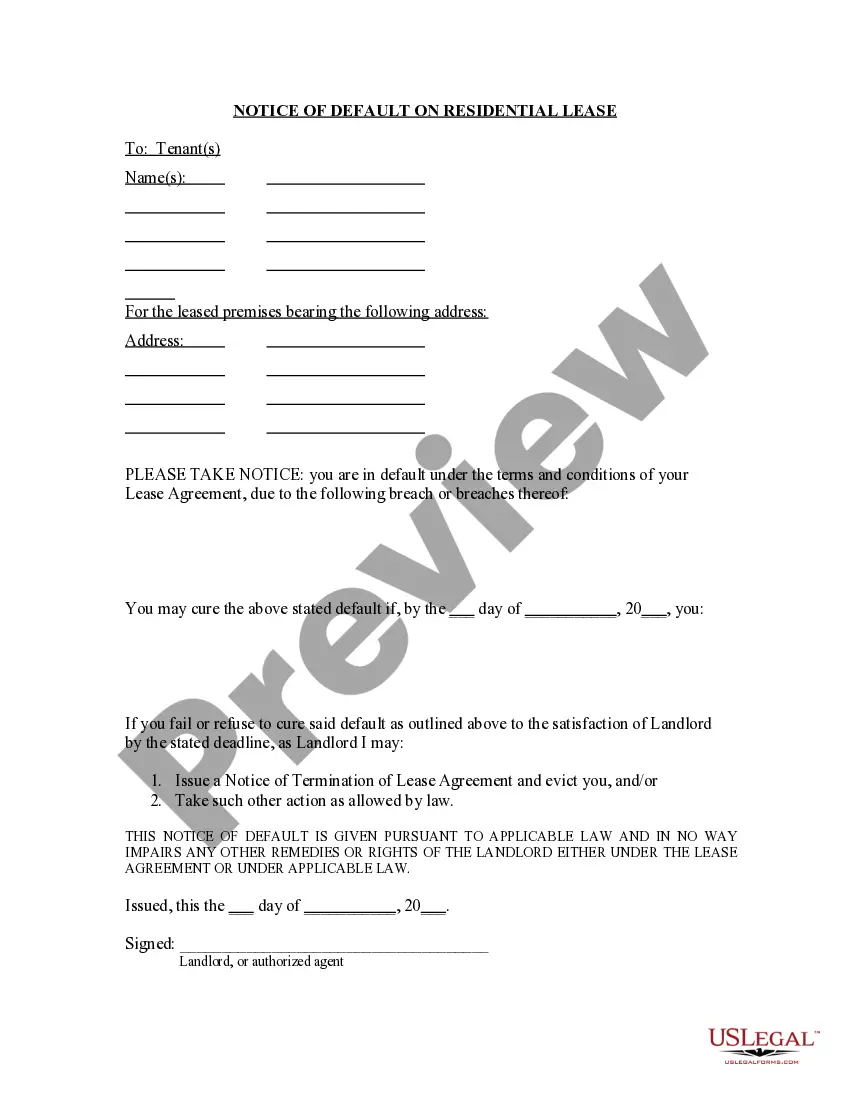

How to fill out Employee Payroll Record?

Have you ever been in a situation where you need documents for both business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast collection of form templates, including the Oklahoma Employee Payroll Record, which can be customized to comply with state and federal regulations.

Once you find the suitable form, click Buy now.

Select the pricing plan you desire, complete the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Oklahoma Employee Payroll Record template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

States that require weekly pay for at least some workers include:California.Connecticut.Iowa.Massachusetts.Michigan.New Hampshire.New York.Rhode Island.More items...

A waged employee will often be paid on a weekly basis, though it can be monthly in certain organisations. This means you don't have to budget yourself for as long as you do as a salaried employee, which may see you having to budget over a bi-monthly period between getting paid.

Every employee (except exempt employees) shall be paid all wages due at least twice each calendar month. State, county, municipal and exempt employees shall be paid a minimum of once each calendar month. 6.

Oklahoma requires that final paychecks be sent either on the next scheduled payday or with 14 days, whichever is later. The final paycheck should contain the employee's regular wages from the most recent pay period, plus other types of compensation such as commissions, bonuses, and accrued sick and vacation pay.

California Payday Laws The laws which regulate paydays, in general, says most employees must be paid twice a month. Wages warned between the 1st and the 15th of the month must be paid by the 26th day of that month. Wages earned from the 16th of the month to the final day must be paid by the 10th of the following month.

The State of Oklahoma provides services to Oklahomans via roughly 30,000 state employees working across dozens of state agencies.

Some of Oklahoma's agencies pay their employees on a monthly basis, others biweekly. The top chart looks at monthly-issued paychecks, while the bottom focuses on biweekly.

State, county, municipal and exempt employees shall be paid a minimum of once each calendar month.