Oklahoma Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

Are you presently inside a position that you need files for sometimes business or specific uses just about every day time? There are tons of authorized record layouts available on the Internet, but getting types you can rely isn`t easy. US Legal Forms delivers 1000s of type layouts, much like the Oklahoma Renunciation of Legacy in Favor of Other Family Members, which are written in order to meet federal and state requirements.

If you are previously informed about US Legal Forms site and have your account, merely log in. Afterward, you can down load the Oklahoma Renunciation of Legacy in Favor of Other Family Members web template.

If you do not offer an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is to the appropriate town/region.

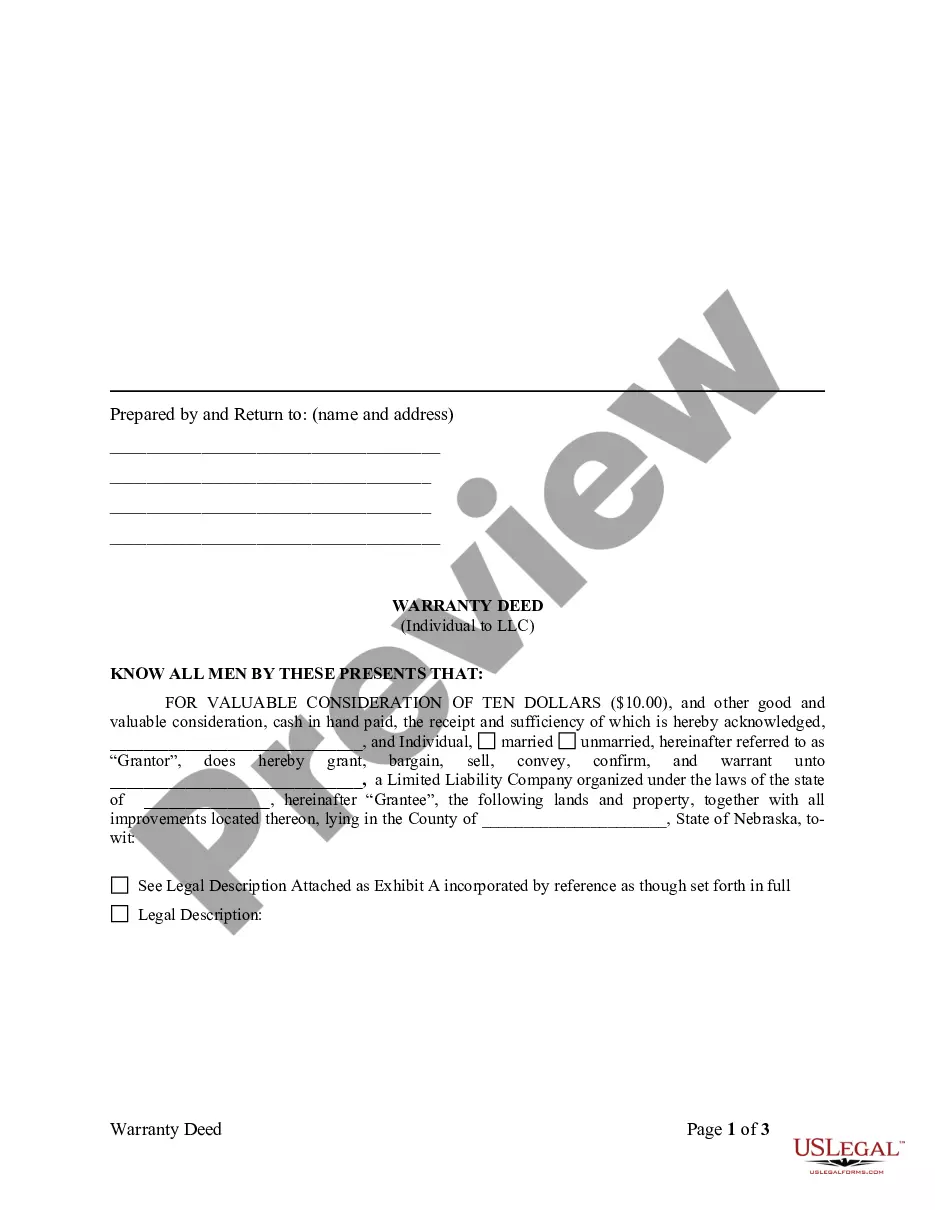

- Take advantage of the Preview switch to review the shape.

- Look at the information to ensure that you have selected the right type.

- If the type isn`t what you`re trying to find, utilize the Research field to get the type that meets your needs and requirements.

- When you get the appropriate type, click Get now.

- Pick the prices plan you would like, fill in the required details to generate your bank account, and purchase the order utilizing your PayPal or Visa or Mastercard.

- Pick a practical document structure and down load your version.

Get all of the record layouts you might have bought in the My Forms food selection. You can aquire a additional version of Oklahoma Renunciation of Legacy in Favor of Other Family Members anytime, if required. Just select the needed type to down load or printing the record web template.

Use US Legal Forms, the most extensive assortment of authorized types, to save lots of some time and stay away from blunders. The services delivers expertly made authorized record layouts which you can use for a range of uses. Produce your account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

Oklahoma's statute of limitations regarding probate litigation generally range between two to five years following the date of the testator's death, depending on the aspect of the will you're contesting; for instance, if your issue is with the conduct of an adjudicator which may have corrupted a will's intent, you will ...

Heirship Determinations When a landowner dies without a will, or beneficiaries are not named in the will, it may be necessary to determine the rightful heirs in Oklahoma court, including intestate succession or probate proceedings. This is known as an heirship determination.

Under Oklahoma law, people who are not your relatives cannot inherit your property unless you make a will leaving them your property. For example, if you want to leave money to someone who is not a relative, like a charitable organization, you need a will to be able to do this. You cannot disinherit your spouse.

You may have heard of a ?239 sale,? which is a reference to Oklahoma Statutes, title 58, section 239; this section is often used to sell real estate owned by a decedent while the probate case is still ongoing and not yet complete.

Oklahoma's statute of descent and distribution (legalese for what happens to property when someone dies without a will), located at Oklahoma Statutes title 84, section 213, provides in detail who receives what from a deceased person who left no will.

The full probate procedure in Oklahoma is used if an estate is worth over $200,000. The simplified probate procedure may be available for estates worth less than $200,000.

§58-3001. Short title - Uniform Power of Attorney Act. This act shall be known and may be cited as the "Uniform Power of Attorney Act". Added by Laws 2021, c.