Puerto Rico Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

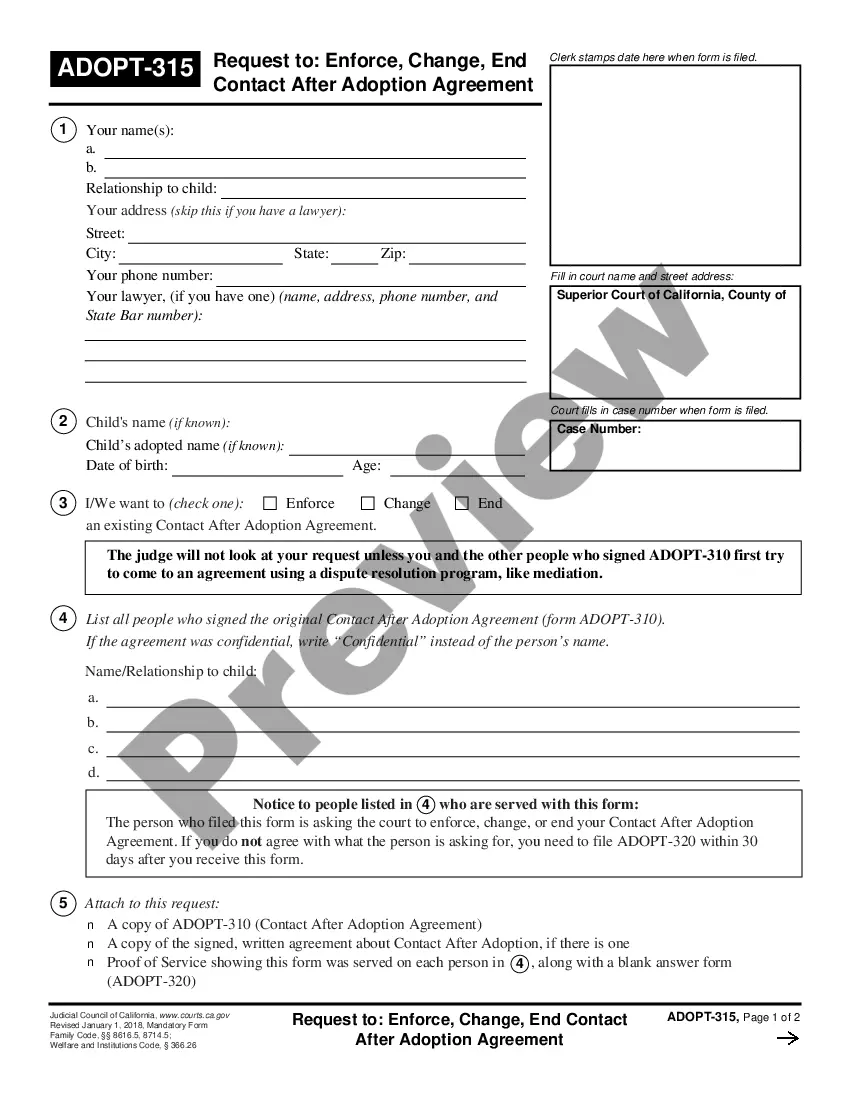

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

If you require to finish, acquire, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and user-friendly search to obtain the documentation you need.

Various templates for corporate and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have located the form you need, select the Buy now button. Choose your preferred pricing plan and provide your details to register for an account.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to procure the Puerto Rico Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Puerto Rico Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's content. Always remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

There are no tax treaties between foreign countries and Puerto Rico. The Puerto Rico Supreme Court has recognised that Puerto Rico is not a signatory party to a treaty entered into by the United States; if an international treaty does not explicitly include Puerto Rico, the treaty will not be applicable to Puerto Rico.

The new tax contributes 1% to the municipality level and 10.5% to the "state" level. The IVU was scheduled to expire on 1 April 2016, to be replaced with a value-added tax (VAT) of 10.5% for the state level, with the 1% IVU continuing for the municipalities.

Excise tax: depends on the category of goods. Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT.

Foreign corporations are generally not subject to Canadian corporate tax, so dividends you receive from foreign corporations are not subject to the gross-up, nor are you eligible for the dividend tax credit. Foreign dividends you receive, such as those paid by U.S. or European companies, are fully taxable to you.

Dividends from eligible businesses are exempt from Puerto Rican income tax. To be eligible, a company must commit to having at least one employee when annual projected or actual volume of business is more than $3 million.

Dividend income from sources within Puerto Rico is generally subject to a 15% income tax rate.

Puerto Rico will soon be replacing its existing state-level sales and use tax with a value added tax (VAT) system.

Dividend income from sources within Puerto Rico is generally subject to a 15% income tax rate. The distributable share of the income from a corporation of individuals is subject to a 33% income tax rate.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

2 As a result, although Puerto Rico belongs to the United States and most of its residents are U.S. citizens, the income earned in Puerto Rico is considered foreign- source income and Puerto Rico corporations are considered foreign.