Oklahoma Receipt for Payment of Loss for Subrogation

Description

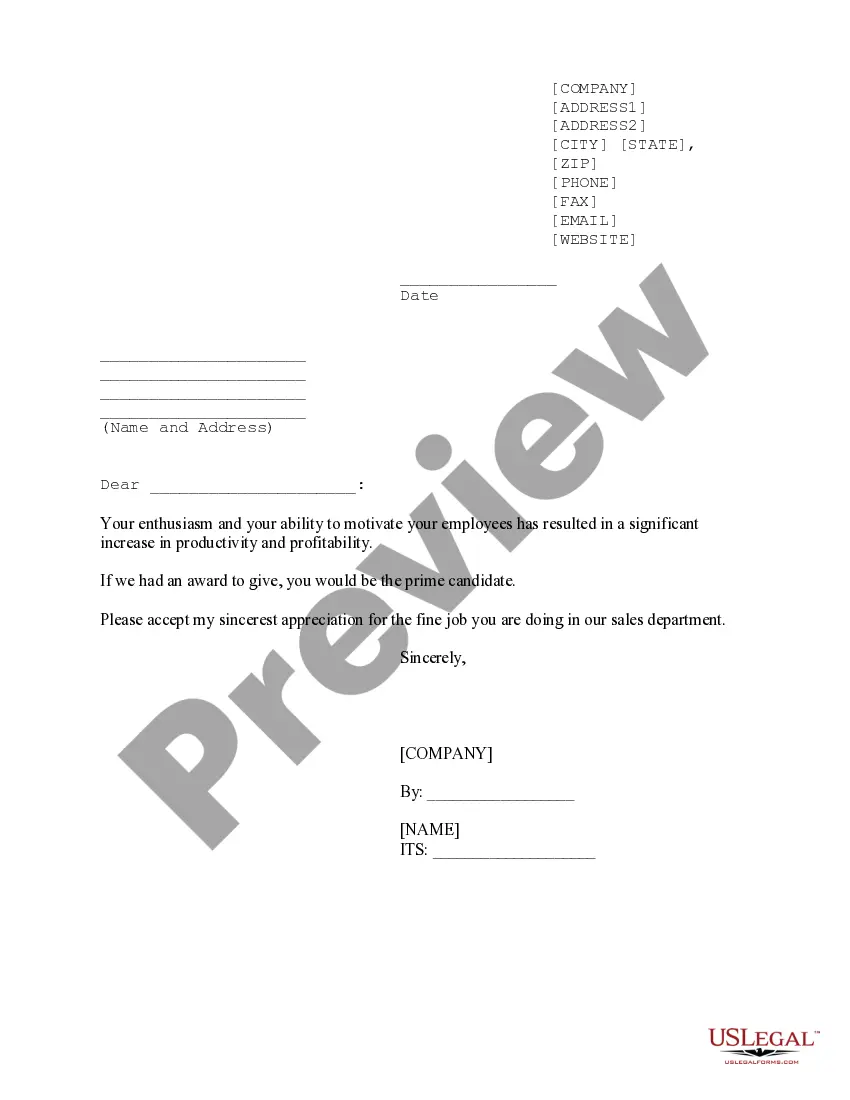

How to fill out Receipt For Payment Of Loss For Subrogation?

US Legal Forms - one of several largest libraries of legal kinds in the USA - delivers a wide array of legal document templates it is possible to download or produce. Using the web site, you can get thousands of kinds for company and person uses, sorted by categories, says, or key phrases.You can get the latest versions of kinds like the Oklahoma Receipt for Payment of Loss for Subrogation in seconds.

If you have a monthly subscription, log in and download Oklahoma Receipt for Payment of Loss for Subrogation in the US Legal Forms local library. The Download key will show up on each type you look at. You have accessibility to all previously saved kinds from the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, listed here are straightforward recommendations to help you began:

- Make sure you have picked out the proper type for your metropolis/state. Select the Review key to examine the form`s articles. Browse the type information to actually have selected the right type.

- When the type doesn`t fit your specifications, make use of the Look for area on top of the monitor to obtain the one who does.

- If you are happy with the form, confirm your decision by clicking on the Purchase now key. Then, opt for the pricing prepare you prefer and supply your credentials to register for the account.

- Method the transaction. Utilize your charge card or PayPal account to complete the transaction.

- Select the formatting and download the form on your product.

- Make changes. Fill up, edit and produce and indication the saved Oklahoma Receipt for Payment of Loss for Subrogation.

Every template you put into your account does not have an expiration time which is your own property forever. So, if you would like download or produce an additional version, just check out the My Forms portion and click on about the type you want.

Get access to the Oklahoma Receipt for Payment of Loss for Subrogation with US Legal Forms, the most considerable local library of legal document templates. Use thousands of skilled and condition-particular templates that satisfy your business or person needs and specifications.

Form popularity

FAQ

An insurance claim is a formal request filed by a policyholder seeking compensation for a covered loss. There are several different types of insurance claims ? the type of claim that you need to file depends on the policies that you have and what they cover.

At the minimum, your subrogation file should contain all elements corresponding to liability determination and proof of damages. Being able to prove who is at fault is essential. You'll want to include documentation and any information you've gathered, such as witness statements or police reports.

Indemnity is a type of insurance compensation paid for damage or loss. When the term is used in the legal sense, it also may refer to an exemption from liability for damage. Indemnity is a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.

A Proof of Loss form is typically a notarized, sworn statement detailing the losses you suffered and the amount you're claiming after an insured event. Most but not all insurance companies require this document after an insurance claim has been filed.

The insured's loss results in the insurer's obligation to pay the proceeds of the insurance policy. An insurance policy is the insurance contract that describes the conditions and circumstances under which the insurer will indemnify the insured or other named beneficiaries.

Subrogation has been described as: the right of an insurance company to recover money from the person that caused the accident for the damages it paid to you as the insured party. the insurance company's right to be put in the position of you to pursue recovery from the person responsible for the accident.

Subrogation allows your insurer to recoup costs (medical payments, repairs, etc.), including your deductible, from the at-fault driver's insurance company, if the accident wasn't your fault. A successful subrogation means a refund for you and your insurer.

Subrogation, in the legal context, refers to when one party takes on the legal rights of another, especially substituting one creditor for another. Subrogation can also occur when one party takes over another's right to sue.