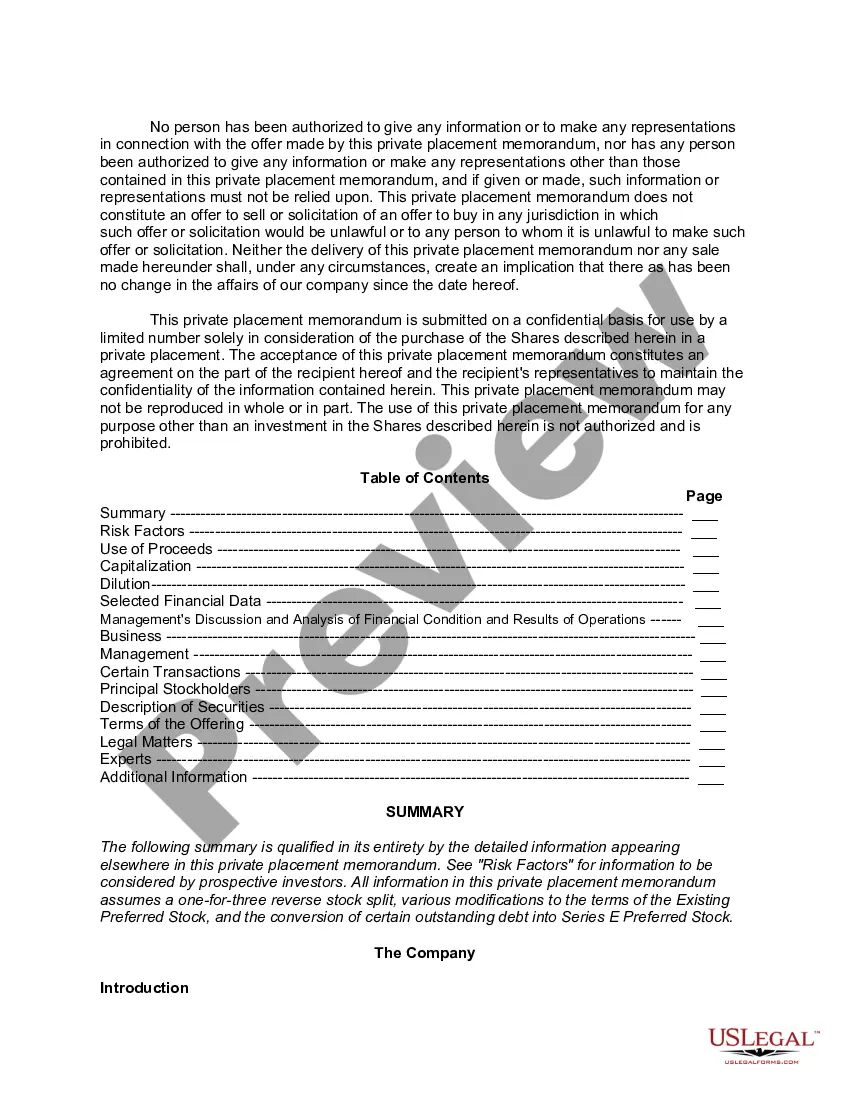

A private placement memorandum (PPM) is a document providing information about a proposed private placement of securities, where a company sells securities to select investors, rather than releasing them to the public. This document is sent to proposed investors so they can review the information and make a decision about whether they want to invest. Firms draft private placement memoranda in consultation with their attorneys to ensure accuracy and completeness Private placement of securities usually involves the sale of stocks, bonds, and other securities to institutional investors who are willing to buy large blocks of securities. The private placement allows a company to raise capital for activities without needing to formulate an initial public offering and it is highly discreet in nature, as members of the public are generally not aware of the sale of securities until after it is complete. In addition, private placements conducted within specific limits do not need to be registered with the Securities and Exchange Commission.

Oklahoma Sample Private Placement Memorandum

Description

How to fill out Sample Private Placement Memorandum?

If you need to sum up, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need.

A selection of templates for business and personal uses are organized by categories and states or keywords. Use US Legal Forms to obtain the Oklahoma Sample Private Placement Memorandum with just a few clicks.

If you are already a US Legal Forms customer, sign in to your account and then click the Get button to acquire the Oklahoma Sample Private Placement Memorandum. You can also access forms you previously downloaded under the My documents tab in your account.

Every legal document format you acquire is yours indefinitely. You will have access to each form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Acquire and download, and print the Oklahoma Sample Private Placement Memorandum with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you desire, click the Get now button. Select the pricing plan you want and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oklahoma Sample Private Placement Memorandum.

Form popularity

FAQ

The content of a private placement memorandum includes critical information designed to protect both the issuer and the investor. This content often covers the business background, the investment opportunity, financial projections, and potential risks. Reviewing an Oklahoma Sample Private Placement Memorandum can enlighten you on the standard content you should expect to see.

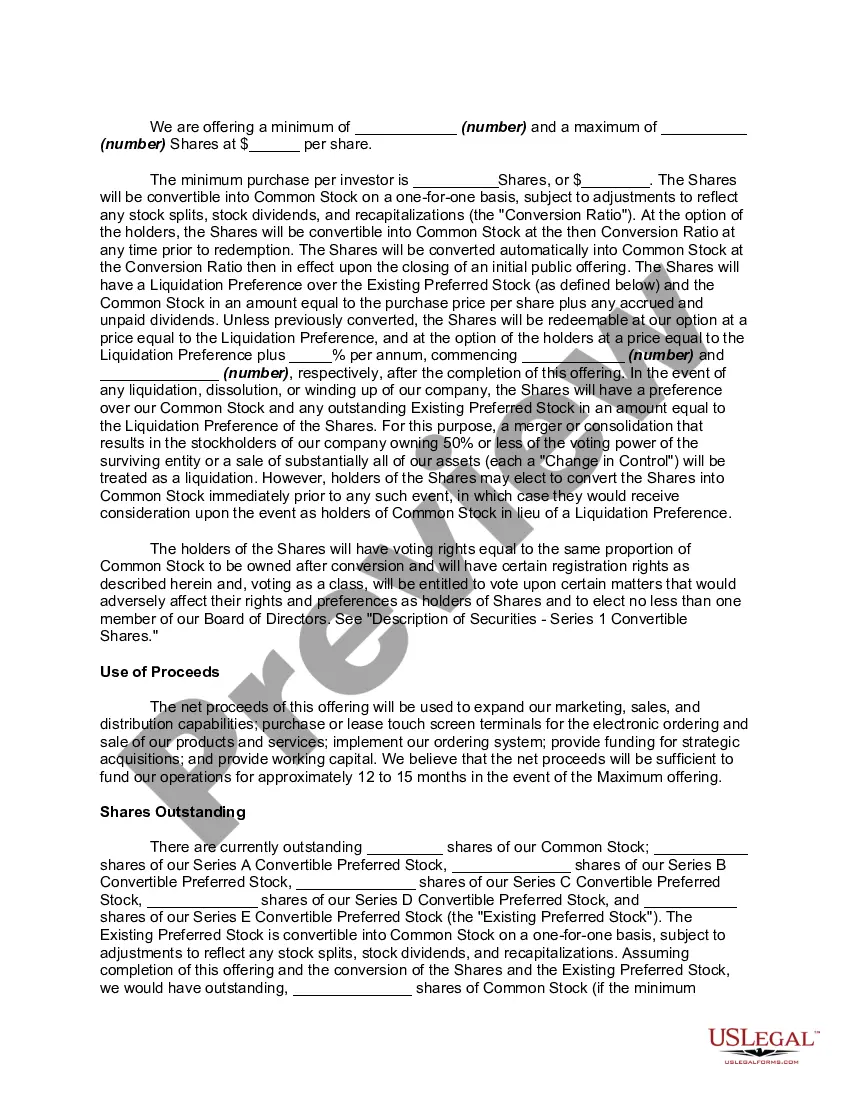

The Private Placement Memorandum also includes the Subscription Agreement which is the actual "sales contract" for the shares of stock being placed. This is the document that the investor will sign and send in with their investment capital.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

The ppm file format is one of the simplest image format because it has no encoding or. compression, and it can be written in plain ascii.p3. 256 128....p3. 256 128.Below is pseudo code for writing out a ppm file. FILE fp;for (i=height-1; i>=0; i--)write the pixel i,j 's red, green, and blue value;

Also known as an Offering Memorandum or PPM. A document that outlines the terms of securities to be offered in a private placement. Resembles a business plan in content and structure.

In nearly any private placement offering, while the PPM (private placement memorandum) is the core disclosure document, it is not in itself a contract, nor is it the final word on the process.

Private Placement Memorandum vs. prospectus is that a private placement memorandum explains the terms and conditions of a private placement. A prospectus is an offering document that performs the same function but for publicly traded issues, such as companies selling common stock or introducing an IPO.

How to Write a Private Placement MemorandumChoosing a Sample. Look for a sample document dealing with a similar type of offering.Using Multiple Samples. The best tactic to follow if you intend to start by writing your PPM from scratch, is to use multiple samples.Formatting.Disclosures.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

An private placement memorandum, also referred to as an PPM, is like a prospectus and the term is used interchangeably worldwide for private offerings, yet for private offerings the term mostly used is prospectus.