An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Oklahoma Income Statement

Description

How to fill out Income Statement?

Are you presently in a scenario where you require documents for various organizational or personal purposes almost daily.

There is a selection of legal document templates available online, but locating reliable versions isn't easy.

US Legal Forms offers thousands of form templates, including the Oklahoma Income Statement, designed to meet state and federal requirements.

When you find the appropriate form, click Get now.

Select the pricing plan you desire, complete the necessary details to create your account, and purchase your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Oklahoma Income Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it corresponds to the correct city or county.

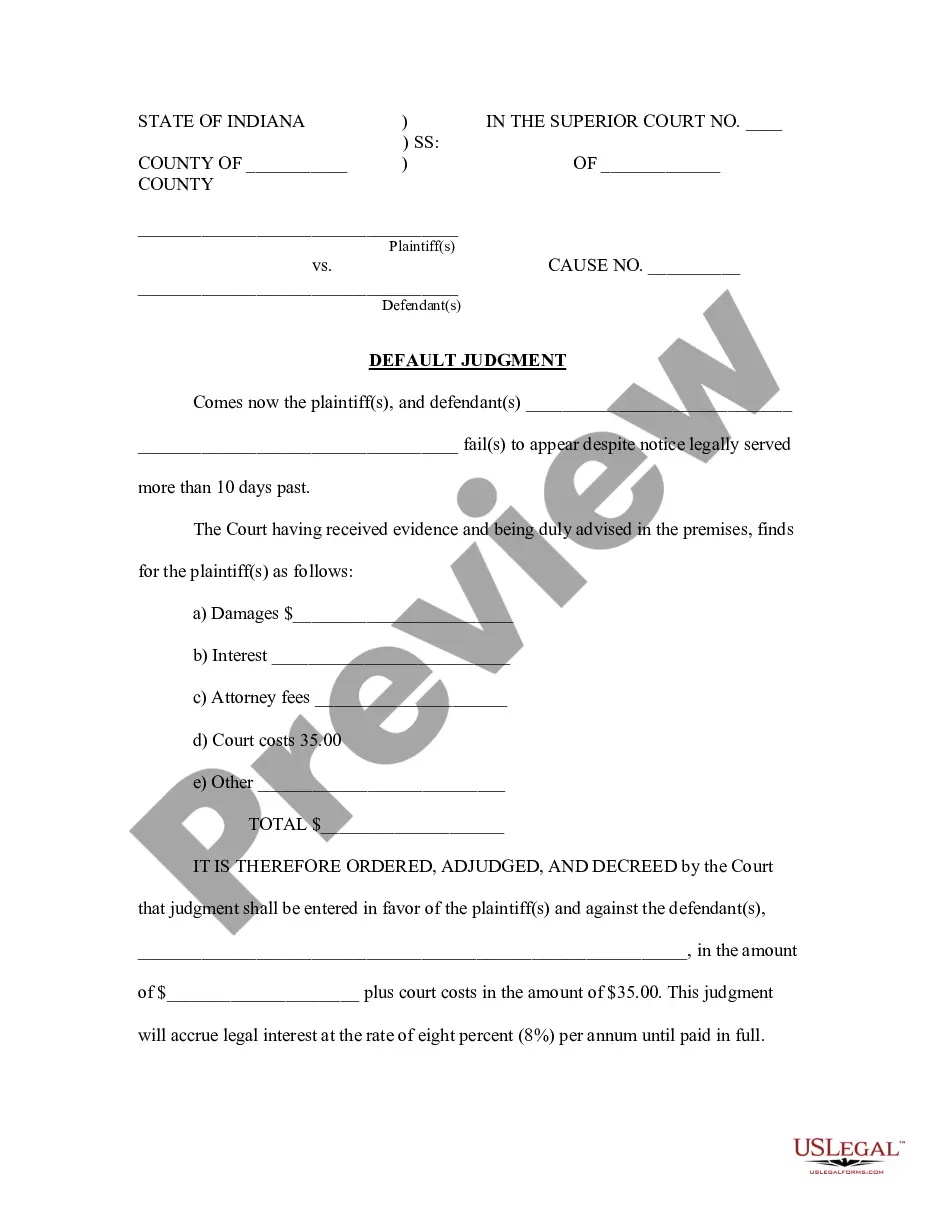

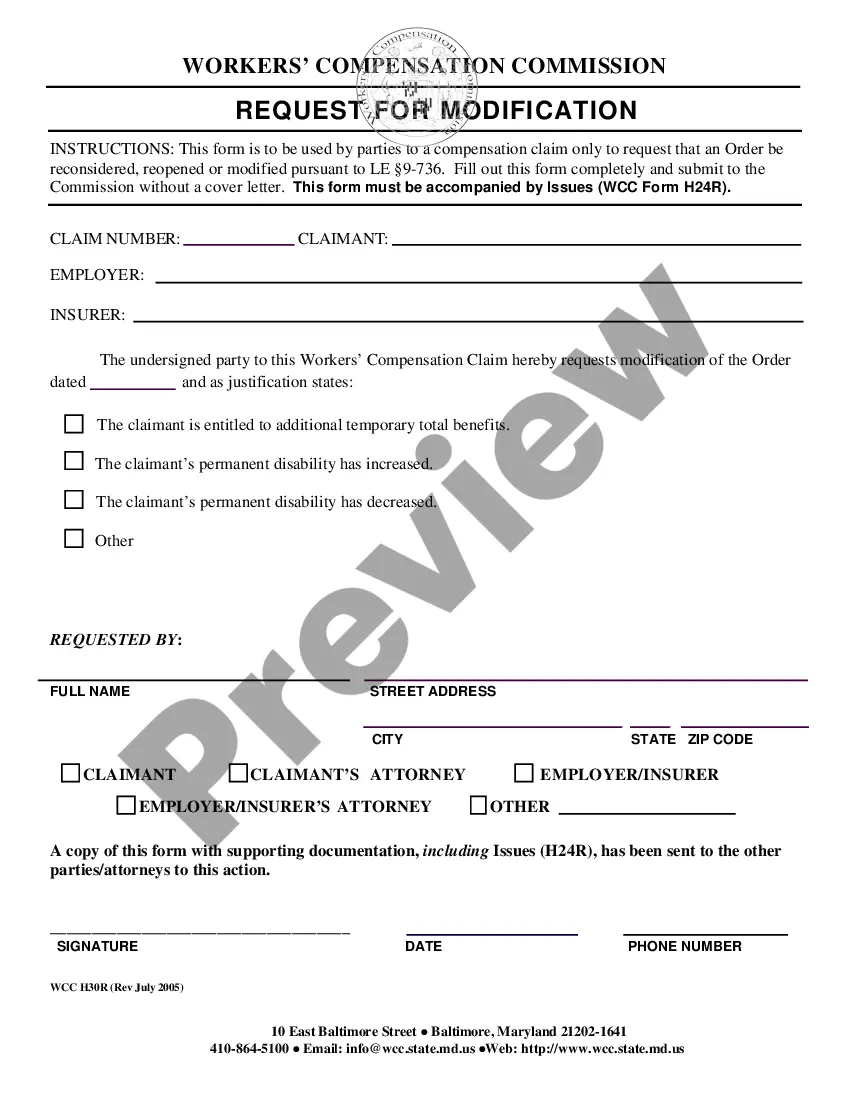

- Utilize the Preview feature to review the document.

- Check the outline to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Search box to locate the form that suits your requirements.

Form popularity

FAQ

You must file an Oklahoma income tax return if you meet the income thresholds set by the Oklahoma Tax Commission. This requirement applies to individuals who have taxable income, even if they have minimal earnings. Completing your Oklahoma Income Statement helps you fulfill your tax obligations.

If you earn income from another state while residing in Oklahoma, you must report it on your Oklahoma Income Statement. You may also need to file a tax return in the other state as well, depending on its laws. To correctly report your income, consult the Oklahoma Tax Commission guidelines or use resources like US Legal Forms to facilitate your paperwork.

Certain individuals may be exempt from Oklahoma income tax, including specific types of organizations and individuals meeting particular criteria. Generally, exemptions apply to non-profit organizations and some government workers. Review the Oklahoma Tax Commission regulations to understand eligibility for exemption from the Oklahoma Income Statement.

Yes, Oklahoma does have a state income tax form, which you are required to complete when filing your taxes. The primary form used is the Oklahoma Income Statement, along with various schedules depending on your situation. Ensure you use the most recent version of the form available on the Oklahoma Tax Commission website.

Filing an income tax statement in Oklahoma can be completed online or via mail. You can use the Oklahoma Tax Commission's website to access the necessary forms and guidelines for completing your Oklahoma Income Statement. For convenience, consider using platforms like US Legal Forms to streamline your filing process.

To determine if you need to file taxes in Oklahoma, your income must exceed certain thresholds that vary by filing status, such as single, married, or head of household. If your income exceeds the specified limit, you need to submit an Oklahoma Income Statement. Always confirm the current limits on the official Oklahoma Tax Commission website.

In Oklahoma, the minimum income threshold for not filing a tax return varies based on your filing status, age, and other factors. For most individuals, if your gross income is below a certain level, you do not need to file an Oklahoma Income Statement. Checking the latest requirements from the Oklahoma Tax Commission can provide clarity on your specific situation.

You are required to file an Oklahoma tax return if you earn income from sources in the state or if you meet specific criteria based on your filing status. Generally, if your gross income exceeds certain limits, you must file an Oklahoma Income Statement. It is important to review the guidelines provided by the Oklahoma Tax Commission to ensure compliance.

The amount of state tax withheld in Oklahoma varies based on your income level and the withholding allowances you claim. Typically, the state tax withholding is a percentage of your gross income as determined by the Oklahoma Income Statement. Make sure to review your withholding periodically to ensure it aligns with any changes in your financial situation.

Oklahoma source income typically includes earnings derived from work performed in the state, rental income from properties located in Oklahoma, and business income from Oklahoma-based operations. Understanding what qualifies as Oklahoma source income is crucial for accurately reporting on your Oklahoma Income Statement and fulfilling your tax obligations.