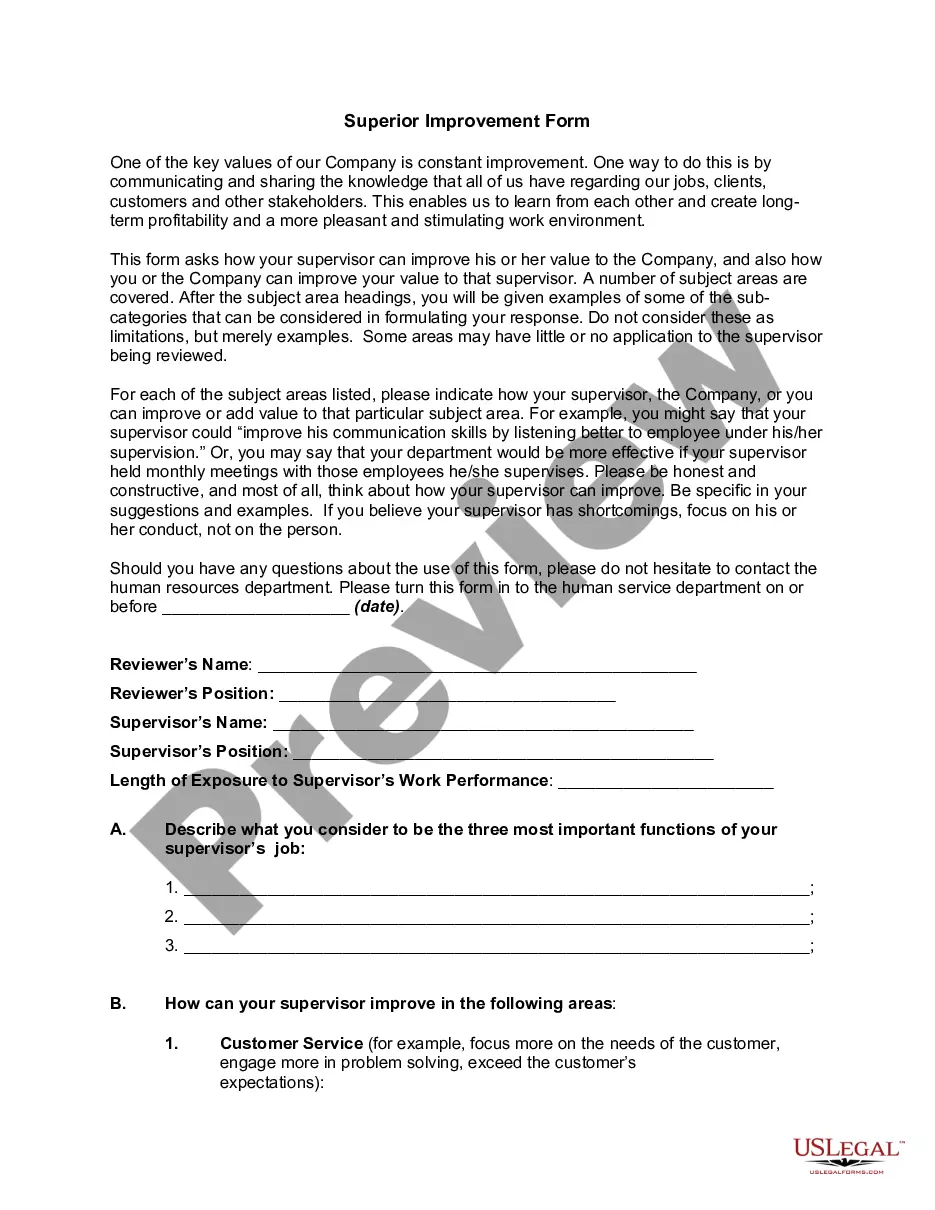

Oklahoma Superior Improvement Form

Description

How to fill out Superior Improvement Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse array of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Oklahoma Superior Improvement Form in just minutes.

If you have a monthly subscription, Log In and download the Oklahoma Superior Improvement Form from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the payment. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Oklahoma Superior Improvement Form. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need. Access the Oklahoma Superior Improvement Form with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Before using US Legal Forms for the first time, here are some simple tips to get started.

- Ensure you have selected the correct form for your area/region.

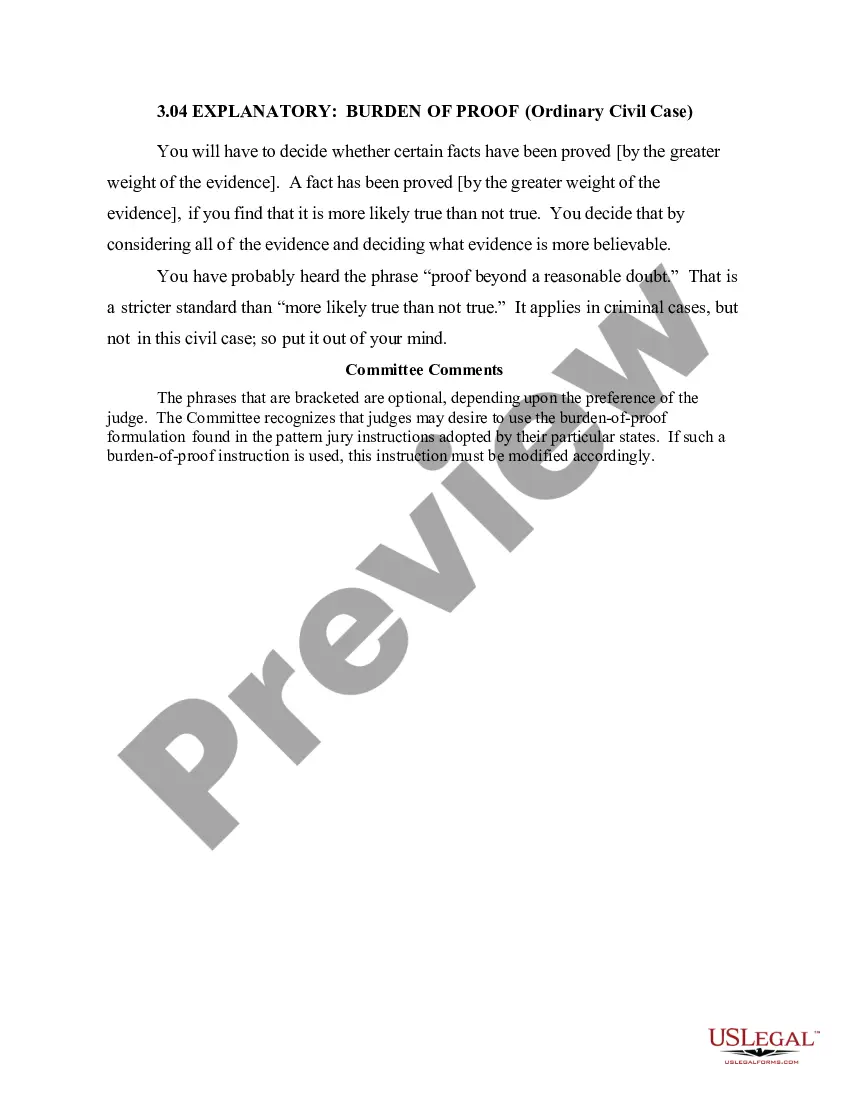

- Click the Preview button to review the content of the form.

- Read the form details to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, verify your selection by clicking the Get now button.

- Then, choose the payment plan you want and provide your information to register for an account.

Form popularity

FAQ

To obtain property tax exemption in Oklahoma, you must fill out an exemption application available through your local county assessor's office. Ensure you meet the eligibility criteria, which may include specific property types or financial qualifications. Utilizing the Oklahoma Superior Improvement Form can enhance your application by outlining changes to property that may affect its assessment.

You can acquire Oklahoma tax forms from the Oklahoma Tax Commission's official website. They offer a comprehensive list of forms including those needed for personal and business taxes, as well as the Oklahoma Superior Improvement Form. You can easily download or print these forms for your convenience.

Qualification for assisted living in Oklahoma typically requires that an individual needs help with daily activities and meets specific health assessments. You may need to provide medical documentation, including evaluations from physicians. Also, completing the Oklahoma Superior Improvement Form can help facilitate modifications in housing that better suits assisted living needs.

To obtain a farm tax exempt card in Oklahoma, you will need to apply through your local county assessor's office. Provide relevant documentation to establish your farm’s eligibility. Furthermore, experts recommend using the Oklahoma Superior Improvement Form when making improvements to your farm property, as it may streamline the process.

You can access Oklahoma state tax forms online at the Oklahoma Tax Commission's website. The site offers a variety of forms, including income tax forms and the Oklahoma Superior Improvement Form, which can assist in various tax situations. Just enter the relevant section, and you will find all the forms you need.

In Oklahoma, whether a mobile home is classified as real property varies based on certain factors. If you own the land the mobile home sits on, and if it is permanently affixed and meets specific conditions, it may be considered real property. Additionally, utilizing the Oklahoma Superior Improvement Form can help clarify the ownership and classification of such properties.

Form 561 in Oklahoma serves the purpose of reporting income from property sales, ensuring that such transactions meet tax obligations. This form plays a significant role when completing the Oklahoma Superior Improvement Form, fostering clarity in your financial dealings. Properly utilizing Form 561 can prevent potential tax issues and provide accurate records for your property transactions. Understanding its purpose supports better financial planning.

In Oklahoma, specific criteria determine eligibility for capital gain deductions, revolving around the nature of the asset and the gain realized upon sale. Typically, property owned for longer periods may qualify for more favorable tax treatments. Filling out the Oklahoma Superior Improvement Form can help ensure that you disclose necessary information about your property, maximizing potential deductions. It's advisable to consult a tax professional to navigate these rules effectively.

To obtain a Form 936 in Oklahoma, you can visit the Oklahoma Tax Commission website or request it through your local tax authority. This form is essential for certain tax filings, especially for those claiming specific deductions. By incorporating Form 936 with the Oklahoma Superior Improvement Form, you can achieve comprehensive compliance in your property transactions. Ensure you have the correct details on hand to complete the form accurately.

Avoiding capital gains tax on real estate in Oklahoma requires careful planning and smart investment strategies. One recommended approach involves utilizing exclusions available under the state law, such as the primary residence exclusion. Completing the Oklahoma Superior Improvement Form correctly can help in documenting your claims and ensuring compliance. Consulting a tax expert familiar with Oklahoma laws can provide tailored strategies for minimizing your tax burden.