Oklahoma Acknowledgement and Acceptance of Order

Description

How to fill out Acknowledgement And Acceptance Of Order?

It is feasible to dedicate time on the Internet searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are evaluated by professionals.

You can effortlessly obtain or print the Oklahoma Acknowledgement and Acceptance of Order from your service.

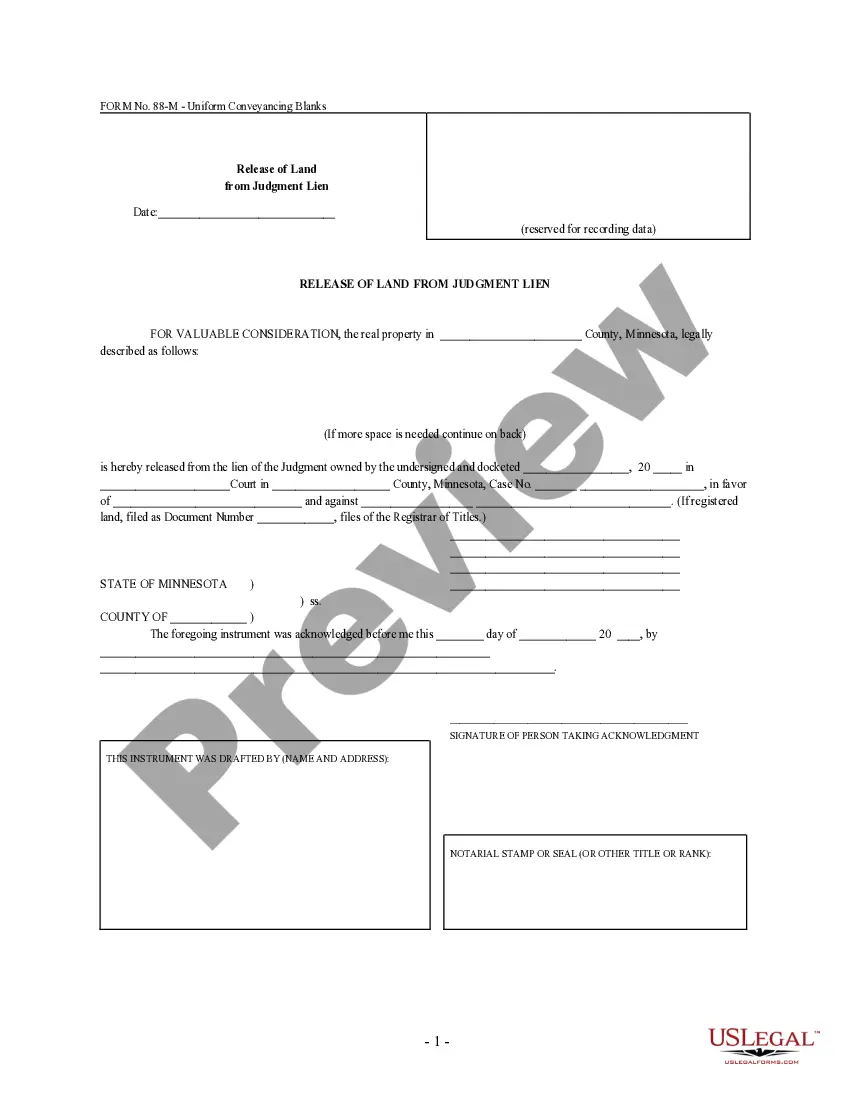

If available, use the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can fill out, modify, print, or sign the Oklahoma Acknowledgement and Acceptance of Order.

- Each legal document template you obtain is yours permanently.

- To acquire an additional copy of the purchased document, visit the My documents section and click the respective option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area that you choose.

- Check the document description to confirm that you have selected the correct template.

Form popularity

FAQ

You can file your Oklahoma W-2 with the Oklahoma Tax Commission or electronically through certified tax software. It’s crucial to ensure that your W-2 information aligns with the guidelines provided in the Oklahoma Acknowledgement and Acceptance of Order. Resources like UsLegalForms can assist you in filing accurately and efficiently.

The processing time for a petition in Oklahoma can differ based on the court’s workload. Generally, it may take anywhere from a few weeks to several months to process. Factors affecting this include adherence to the Oklahoma Acknowledgement and Acceptance of Order. Utilizing a structured legal form platform can speed up the process.

Responding to a motion in Oklahoma usually requires a response time of 15 days, but this may vary based on specific court rules. Ensuring prompt action is essential, especially to meet the conditions related to the Oklahoma Acknowledgement and Acceptance of Order. Consider consulting legal experts for timely and structured responses.

The time to hear back from Oklahoma can vary significantly based on the type of application or request submitted. For common inquiries, you can expect responses within a few weeks. However, for processes linked to the Oklahoma Acknowledgement and Acceptance of Order, timing could differ. It’s always a good practice to check status updates regularly.

You generally have 20 days to answer a petition in Oklahoma, starting from the date of service. This is important for adhering to the Oklahoma Acknowledgement and Acceptance of Order. If you require assistance in understanding these timelines, consider using tools or services that provide legal guidance for better compliance.

In Oklahoma, the timeframe to answer a petition typically ranges from 20 to 30 days depending on the court rules. It is crucial to stay informed about deadlines to meet the requirements of the Oklahoma Acknowledgement and Acceptance of Order. If you miss a deadline, it may affect your case negatively, so keep track of your schedule.

Form 511 is the Individual Income Tax Return form used in Oklahoma. This form allows you to report your income, deductions, and credits. When you file this form, ensure you are familiar with the rules regarding the Oklahoma Acknowledgement and Acceptance of Order, as it can impact your tax situation. Utilizing platforms like UsLegalForms can streamline this process.

Yes, Oklahoma accepts federal extensions for individuals. When you file for a federal extension, it automatically extends your state tax deadline as well. This process also ensures your compliance with the Oklahoma Acknowledgement and Acceptance of Order. You can manage your tax requirements easily with the right resources.

To complete a warranty deed in Oklahoma, gather all necessary details about the property and the involved parties. Ensure that you follow the required format and legally describe the property. After completing the deed, sign it in front of a notary, as this step seals the Oklahoma Acknowledgement and Acceptance of Order, making it enforceable.

Filling out a warranty form involves entering specific details such as the names of the parties, property description, and any contingencies or additional terms. It is crucial to ensure that the wording is clear to avoid ambiguities and disputes. Using uslegalforms can help you create a precise warranty form aligned with the Oklahoma Acknowledgement and Acceptance of Order.