Oklahoma Assignment of Website Creator

Description

How to fill out Assignment Of Website Creator?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site`s straightforward and user-friendly search feature to locate the documents you need.

An assortment of templates for business and personal purposes is categorized by type and region, or keywords.

Step 4. Once you have located the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to access the Oklahoma Assignment of Website Creator with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Obtain button to retrieve the Oklahoma Assignment of Website Creator.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

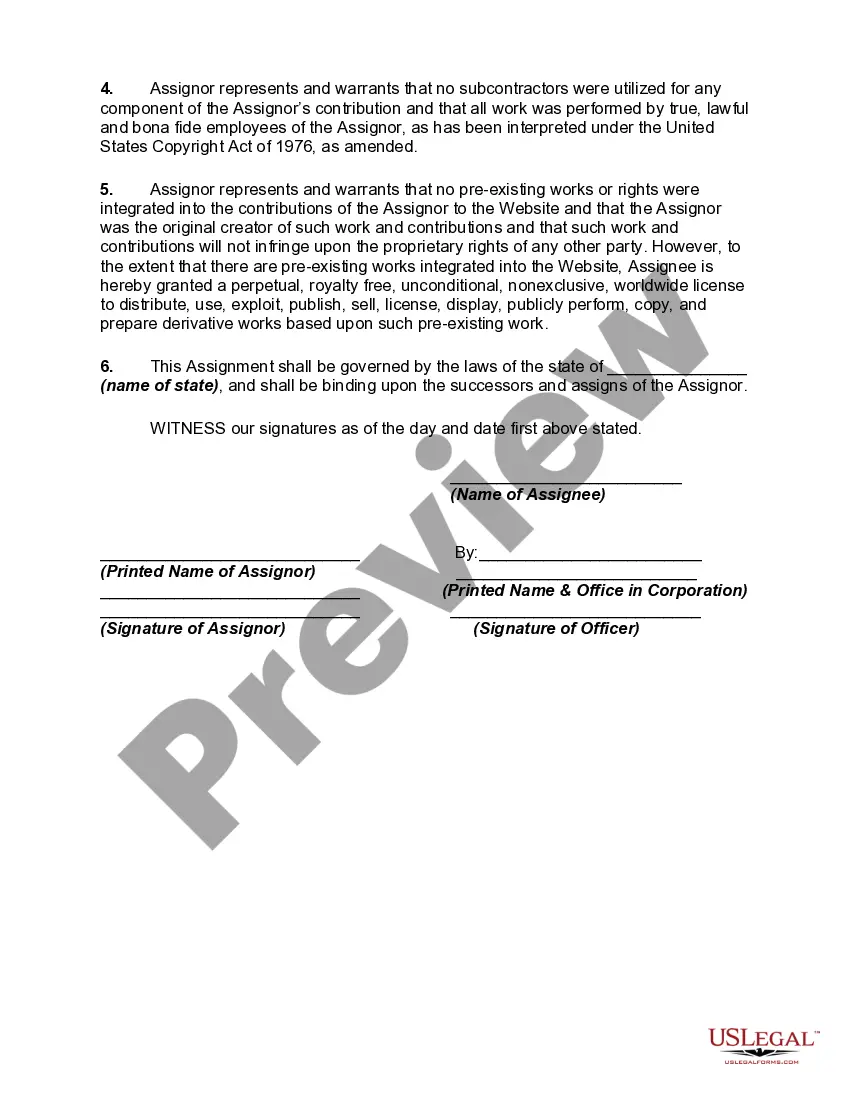

- Step 2. Use the Preview option to review the form`s content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

2 forms for Oklahoma employees must be filed with the Oklahoma Tax Commission, typically along with the IRS copies. Filing these forms accurately is crucial for both employer and employee tax obligations, particularly for businesses involved in the Oklahoma Assignment of ebsite Creator. Using uslegalforms can simplify the filing process and ensure compliance with local laws.

Yes, if you are selling tangible goods or certain services in Oklahoma, you must obtain a sales tax permit. This process is essential to operate legally and efficiently, especially for entrepreneurs working in the Oklahoma Assignment of Website Creator domain. It ensures compliance with state tax laws and allows for smooth business operations.

Failing to file a 1099 can lead to penalties from the IRS, which may include fines and interest on unpaid taxes. It's important to stay on top of your filing obligations, especially for activities associated with the Oklahoma Assignment of Website Creator. If you’re unsure how to proceed, platforms like uslegalforms can provide guidance to help you meet regulatory requirements.

Yes, residents and businesses in Oklahoma are required to file state taxes based on their income. Understanding your tax obligations is crucial, particularly if your business is active in the Oklahoma Assignment of Website Creator. By staying informed and compliant, you can focus on growing your online presence without unnecessary stress.

Yes, filing 1099 forms with the state is required in Oklahoma for certain types of payments. The process ensures that all taxable income is reported accurately. This requirement is especially relevant for businesses involved in the Oklahoma Assignment of Website Creator, as it helps maintain compliance with both state and federal laws.

Yes, in Oklahoma, you must file 1099 forms with the state if you are reporting payments made to contractors or service providers. This requirement aligns with the Oklahoma Assignment of Website Creator, where accurate reporting of payments ensures compliance with state tax regulations. Filing these forms correctly helps maintain transparency and avoid potential penalties.