Oklahoma Assignment of Debt

Description

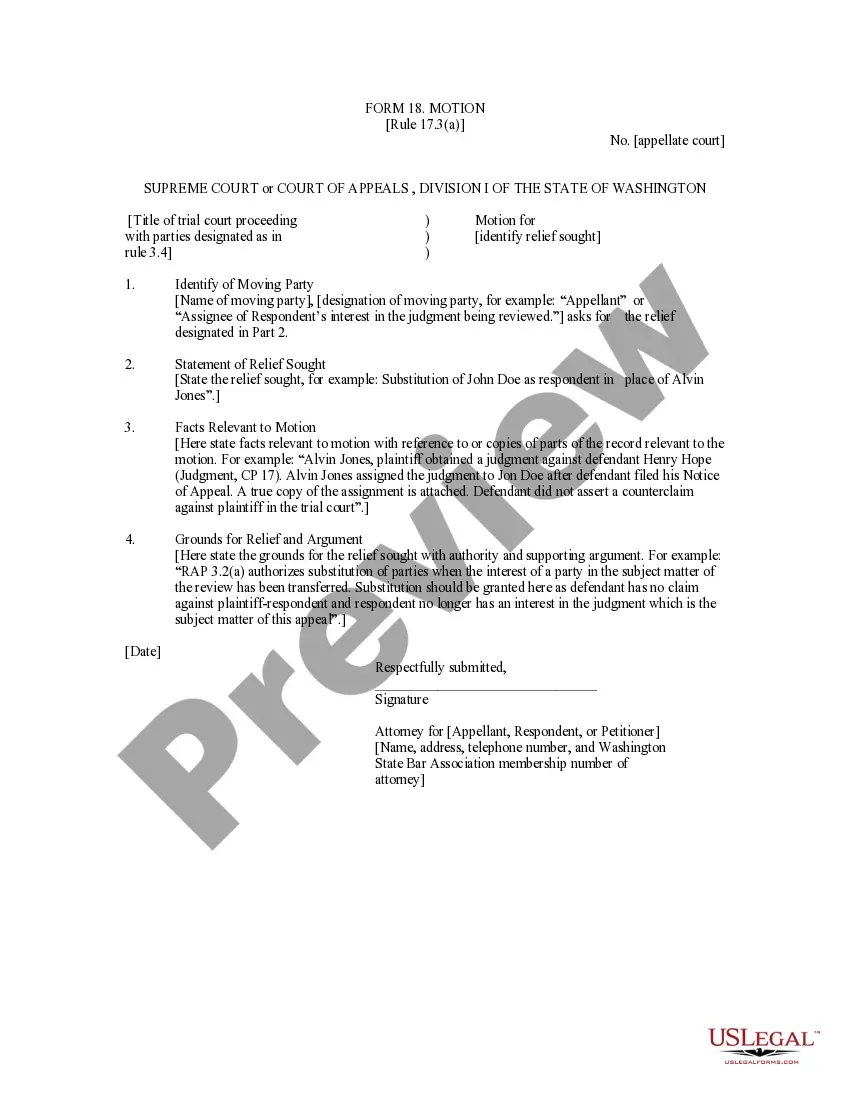

How to fill out Assignment Of Debt?

If you need to finish, obtain, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you require.

A variety of templates for business and personal use are categorized by types and states, or keywords. Use US Legal Forms to acquire the Oklahoma Assignment of Debt in just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Compete and obtain, and print the Oklahoma Assignment of Debt with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download option to retrieve the Oklahoma Assignment of Debt.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions listed below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other templates in the legal form catalog.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oklahoma Assignment of Debt.

Form popularity

FAQ

To assign a debt, start by drafting a clear, written assignment agreement outlining all relevant details. Make sure both you and the person you are assigning the debt to sign it. It's also essential to communicate this change with the creditor to update their records. You can use uslegalforms to find templates tailored specifically for Oklahoma Assignment of Debt, simplifying the entire process.

The process of debt assignment begins with drafting an assignment agreement that details the terms of the transfer. This includes information about the original debt, the parties involved, and any relevant conditions. After both parties sign the agreement, it is crucial to inform the original creditor about the assignment. Following these steps carefully can help avoid future disputes regarding the Oklahoma Assignment of Debt.

Yes, you can assign your debt to someone else, provided that the terms of the original agreement allow for such actions. Check with your creditor to understand any restrictions they may have regarding debt assignment. Properly documenting the assignment through a legal agreement is essential to protect all parties involved. Utilizing services like uslegalforms can help ensure that you follow the necessary steps for a valid Oklahoma Assignment of Debt.

Yes, a debt can be transferred to another person through a process known as assignment. This means that the original debtor can legally pass the responsibility for the debt to someone else. The new debtor then becomes responsible for repaying the assigned debt under the terms of the original agreement. It’s important to ensure that all parties involved understand the terms of the Oklahoma Assignment of Debt.

Yes, an assignment of debt typically needs to be in writing to be considered valid and enforceable. A written document provides clarity on the terms and confirms the transfer of rights between parties. To make this process easier, you can utilize uslegalforms to access templates for your Oklahoma Assignment of Debt.

For an assignment of debt to be valid, the original creditor must clearly transfer their rights to another party, and this transfer must be documented. Both parties involved should agree to the assignment, and there should be a record of this agreement. Using uslegalforms can help you navigate the requirements and ensure your Oklahoma Assignment of Debt is legally sound.

Yes, under the Fair Debt Collection Practices Act, debt collectors must send you a written notice of the debt within five days of their initial contact. This notice should include important details such as the amount owed and the name of the creditor. This requirement protects consumers, ensuring that they receive all necessary information regarding their Oklahoma Assignment of Debt.

When you receive a summons for debt collection in Oklahoma, read it carefully to understand your rights and obligations. Prepare a written response, addressing the claims made against you and providing any defenses you may have. If you feel overwhelmed, consider using uslegalforms to find templates and resources that simplify the process of addressing your Oklahoma Assignment of Debt.

To fill out a proof of debt form, start by gathering all relevant information about the debt, such as the original creditor's name and the amount owed. Clearly state your details, including your name and contact information. Be honest and accurate when providing information to ensure your Oklahoma Assignment of Debt is valid.

Debt typically becomes uncollectible in Oklahoma once the statute of limitations expires, which is usually five years for most debts. After this period, collection efforts may cease, but it’s important to note that this does not erase the debt itself. Educating yourself about Oklahoma Assignment of Debt can help you make informed decisions regarding old debts.