Oklahoma Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Are you currently in a situation where you require paperwork for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, such as the Oklahoma Agreement for Acquisition of Business Assets from a Corporation, which can be tailored to meet federal and state requirements.

Once you find the appropriate form, click on Purchase now.

Choose the pricing plan you prefer, fill in the necessary information to process your payment, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oklahoma Agreement for Acquisition of Business Assets from a Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and ensure it is suitable for the correct city/state.

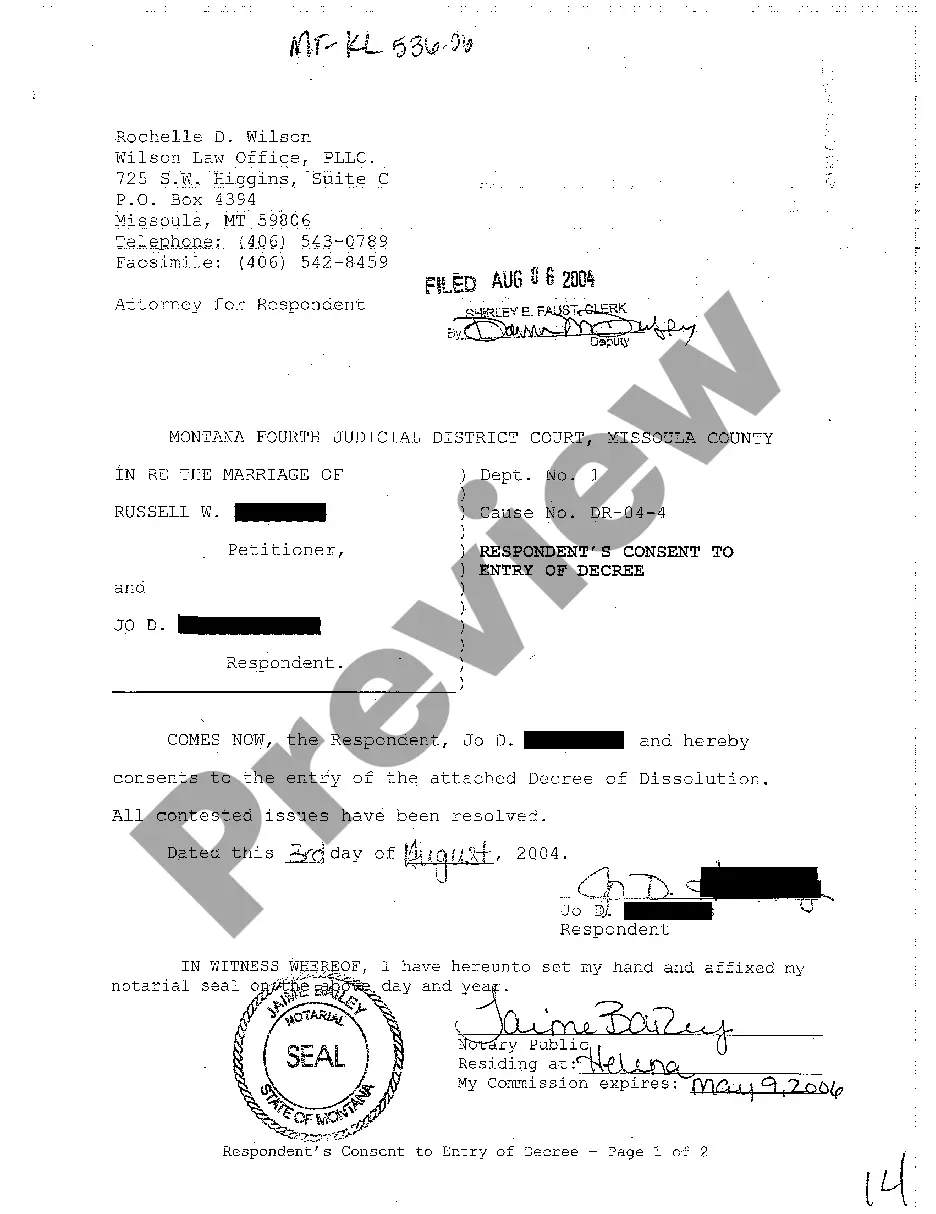

- Utilize the Review button to evaluate the form.

- Examine the details to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search field to locate the form that fits your requirements.

Form popularity

FAQ

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Generally, stock purchases are more straightforward than asset purchases. The parties sign the Stock Purchase Agreement and related documents that outline the terms of the deal, and the seller(s) transfer the target company's stock to the purchaser. With this the purchaser assumes all the target company's liabilities.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

You would use an asset purchase agreement for a variety of situations. These contracts are advantageous when buyers and sellers want flexibility over the transaction. Additionally, the APA may be a component of a more significant transaction, such as a joint venture (JV) or the sale of a business entity.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.