Oklahoma Lien Notice

Description

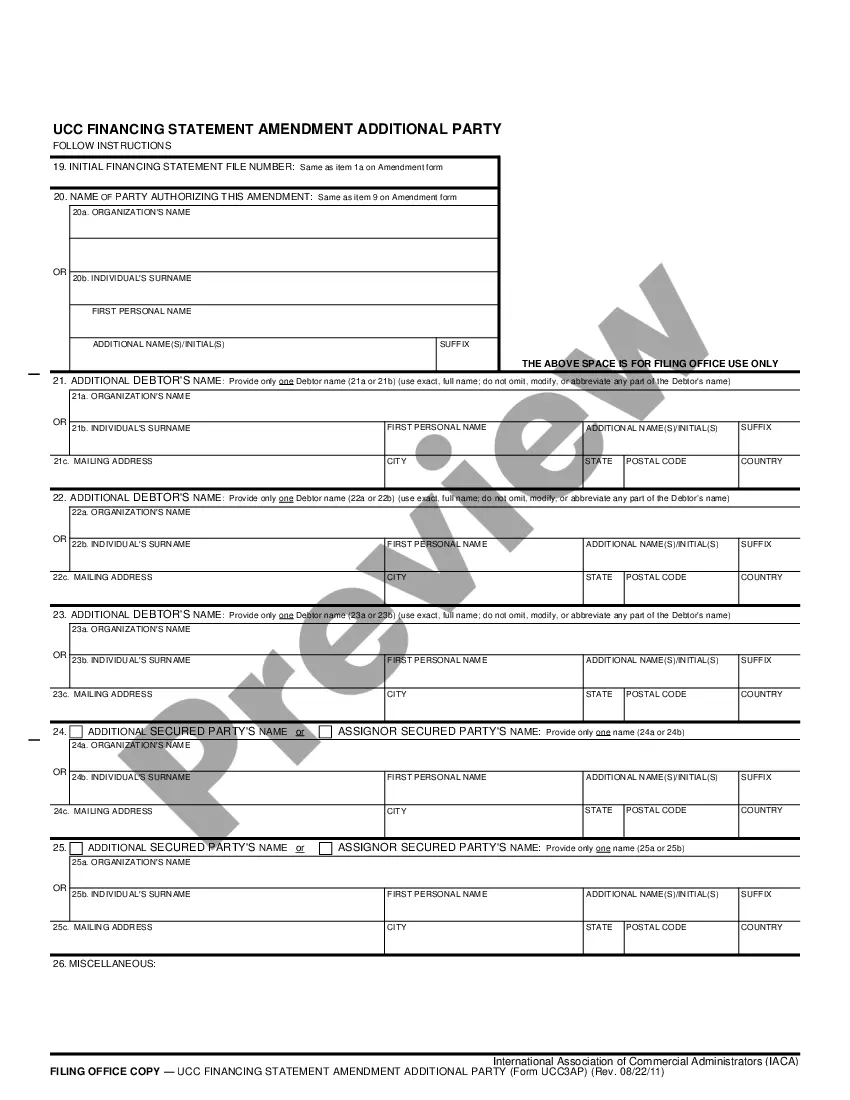

How to fill out Lien Notice?

Finding the correct authorized document template can be a challenge.

Of course, there are numerous templates available online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website. This service provides a wide array of templates, including the Oklahoma Lien Notice, which can be utilized for both business and personal needs.

Ensure you have selected the correct form for your area/region. You can view the form using the Review button and read the form description to confirm it is the right one for you.

- All forms are reviewed by experts and comply with state and federal requirements.

- If you are already a client, Log In to your account and click the Download button to access the Oklahoma Lien Notice.

- Leverage your account to browse through the legal documents you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

To put a lien on someone in Oklahoma, you must file the appropriate documents with the county clerk after obtaining a judgment or following applicable laws regarding unpaid debts. This process often involves drafting an Oklahoma Lien Notice, so ensure all necessary information is included for its validity. Seeking legal guidance can be helpful in navigating this process.

Yes, liens against property in Oklahoma do expire after a certain period, which is typically five years if no action is taken. Once expired, they lose their legal effect, so it is important to monitor the status of any liens you may be involved with. This knowledge helps you effectively manage an Oklahoma Lien Notice.

To release a lien in Oklahoma, you must file a release document with the county clerk's office. This document serves as formal notice that the debt has been satisfied. Completing this step promptly ensures that your Oklahoma Lien Notice is updated and reflects the release of the claim.

To check for liens in Oklahoma, you can visit the county clerk's office or utilize online public record databases. These resources allow you to search property records and identify any existing liens on your property. Knowing how to access this information helps you stay informed about any Oklahoma Lien Notices associated with your property.

A notice of intent to lien is a preliminary notice informing a property owner of a potential lien due to unpaid debts. This document serves to initiate communication and can prompt the owner to settle the debt before the lien is recorded. Understanding this process can make managing an Oklahoma Lien Notice smoother.

To file a lien notice in Oklahoma, you need specific information including the identification of the property, the amount owed, and details of the debt. This ensures that your Oklahoma Lien Notice is clear and legally binding. Keep accurate records to help support your claim.

Oklahoma operates primarily as a lien state. This means that a lien can be placed on a property for debts owed, rather than transferring the title to the lienholder. When handling an Oklahoma Lien Notice, understanding the difference between lien and title laws can aid in navigating property disputes.

A lien in Oklahoma generally lasts for five years from the date it is filed. After this period, the lien may expire unless extended or renewed. Being aware of the duration is crucial when dealing with an Oklahoma Lien Notice.

An intent to lien letter is a formal document that notifies property owners of an impending lien. This letter provides them an opportunity to address unpaid debts before a lien is officially placed. Sending an intent to lien letter can help ensure the property owner is aware of the situation before receiving an Oklahoma Lien Notice.

Yes, you can file a lien without a contract in Oklahoma under certain circumstances. This situation often arises in cases of mechanic's liens where services or materials have been provided. However, having a written agreement is always recommended for clarity when issuing an Oklahoma Lien Notice.