Oklahoma Bond Claim Notice

Description

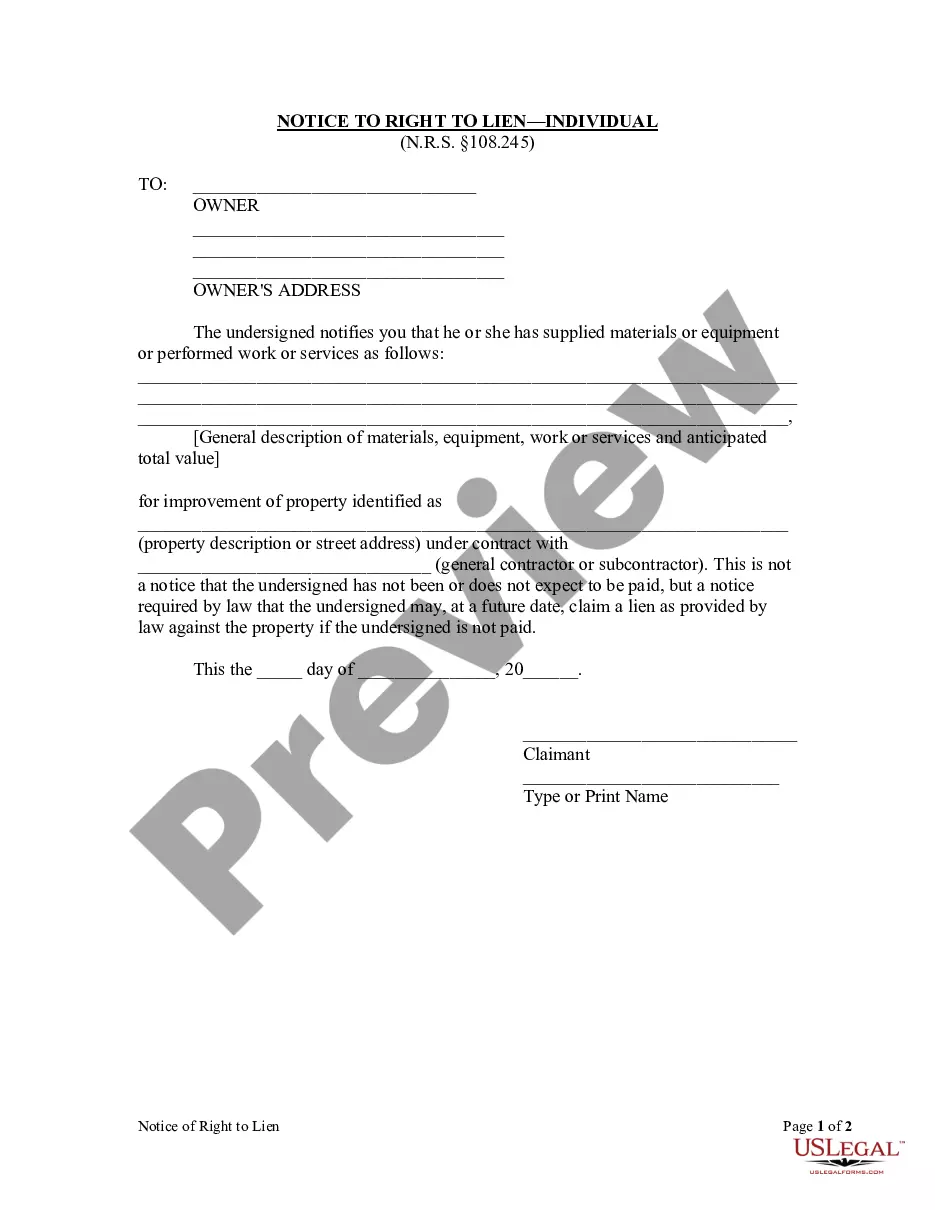

How to fill out Bond Claim Notice?

US Legal Forms - one of several biggest libraries of legitimate varieties in America - provides a wide range of legitimate file web templates you may obtain or produce. Making use of the internet site, you may get a large number of varieties for organization and personal functions, categorized by classes, states, or keywords and phrases.You can find the latest types of varieties like the Oklahoma Bond Claim Notice within minutes.

If you already have a registration, log in and obtain Oklahoma Bond Claim Notice from the US Legal Forms catalogue. The Down load key can look on each kind you view. You have access to all previously acquired varieties in the My Forms tab of your profile.

If you want to use US Legal Forms the first time, listed here are straightforward guidelines to obtain started out:

- Be sure you have picked the best kind for the area/area. Click the Preview key to review the form`s articles. Browse the kind description to ensure that you have chosen the appropriate kind.

- In case the kind does not satisfy your requirements, take advantage of the Look for area on top of the monitor to get the one who does.

- When you are content with the shape, verify your selection by clicking the Get now key. Then, pick the prices strategy you like and give your references to register for an profile.

- Procedure the deal. Use your bank card or PayPal profile to finish the deal.

- Choose the file format and obtain the shape on the device.

- Make alterations. Fill up, change and produce and sign the acquired Oklahoma Bond Claim Notice.

Every design you put into your bank account does not have an expiry day and is also yours forever. So, in order to obtain or produce yet another backup, just check out the My Forms area and click on the kind you want.

Obtain access to the Oklahoma Bond Claim Notice with US Legal Forms, probably the most considerable catalogue of legitimate file web templates. Use a large number of skilled and status-specific web templates that satisfy your organization or personal demands and requirements.

Form popularity

FAQ

Any person claiming a lien as aforesaid shall file in the office of the county clerk of the county in which the land or property is situated, a statement setting forth the amount claimed and the items thereof, as nearly as practicable, the names of the managers, lessees, sublessees, operators, mortgagees, trustees and ...

A surety bond is a risk transfer mechanism where the surety company assures the project owner (obligee) that the contractor (principal) will perform a contract in ance with the contract documents.

The bond claim must be sent to the general contractor, and the surety. It may also be advisable to send notice of the bond claim to the contracting public entity. Summary of Oklahoma bond claim and notice laws and requirements for private Oklahoma projects including free forms, FAQs, resources and more.

Filing a Bond Claim The consumer will contact the surety directly to engage this process. Claims against a surety company may be filed by homeowners, any person damaged by a willful and deliberate violation of a construction contract or by employees damaged by the contractor's failure to pay wages.

Surety bonds are a vital part of the construction industry in Oklahoma, protecting project owners, general contractors, subcontractors, and suppliers. Surety bonds ensure that contractors will fulfill their obligations and complete their work ing to the terms of their contracts.

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.

Being bonded means that an insurance and bonding company has procured funds that are available to the customer contingent upon them filing a claim against the company. If you are a contractor or other type of business owner, you may have good reason to explore what it means to be surety bonded.

Surety bonds generally cost 1-15% of the required bond amount. Costs vary significantly depending on the bond amount you need and your rate (which is the percentage of the full bond amount you must pay). You can get an instant estimate by using our bond premium calculator, or apply online to get a firm bond quote.