Oklahoma Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

Have you found yourself in a situation where you require documentation for either business or personal purposes almost every day.

There are plenty of legal document templates accessible online, but finding versions you can trust is not easy.

US Legal Forms provides thousands of form templates, such as the Oklahoma Bill of Sale of Mobile Home with or without Existing Lien, which are designed to comply with state and federal regulations.

When you find the right form, just click Get now.

Select the pricing plan you require, fill in the necessary information to process your payment, and pay for your order using PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Oklahoma Bill of Sale of Mobile Home with or without Existing Lien anytime, if needed. Simply click on the required form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Oklahoma Bill of Sale of Mobile Home with or without Existing Lien template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

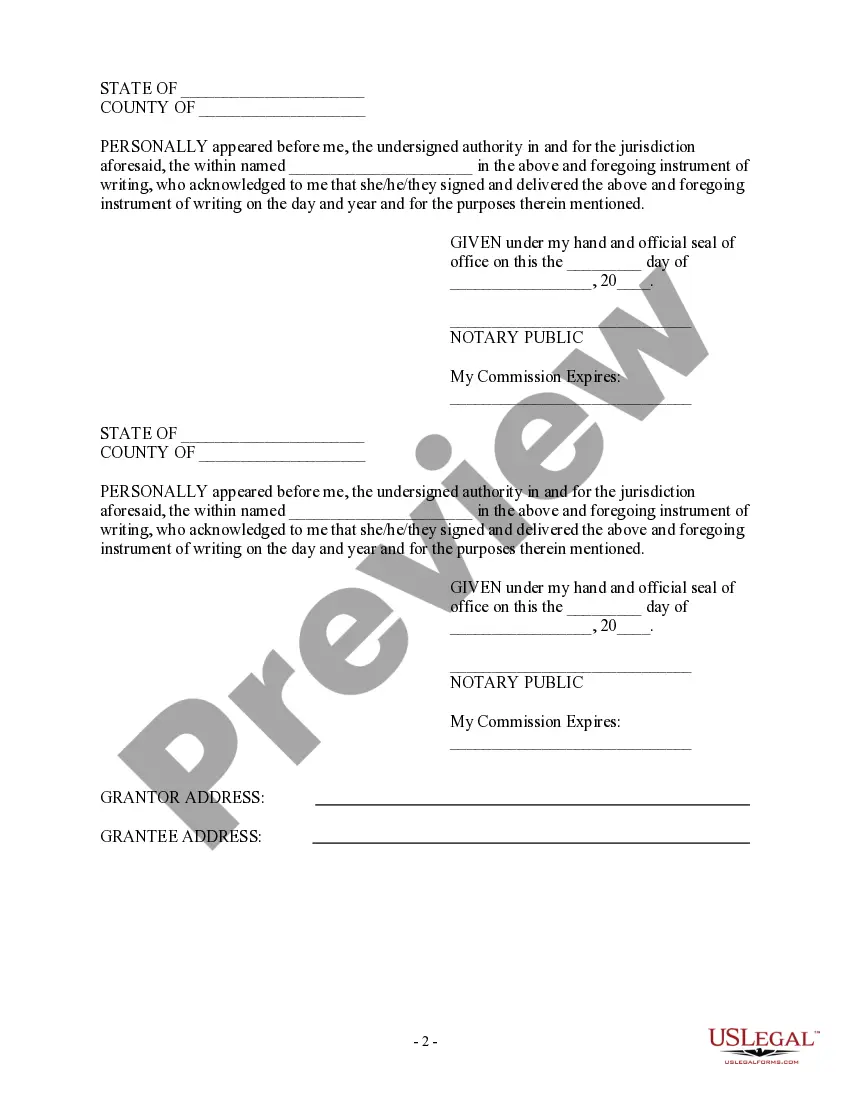

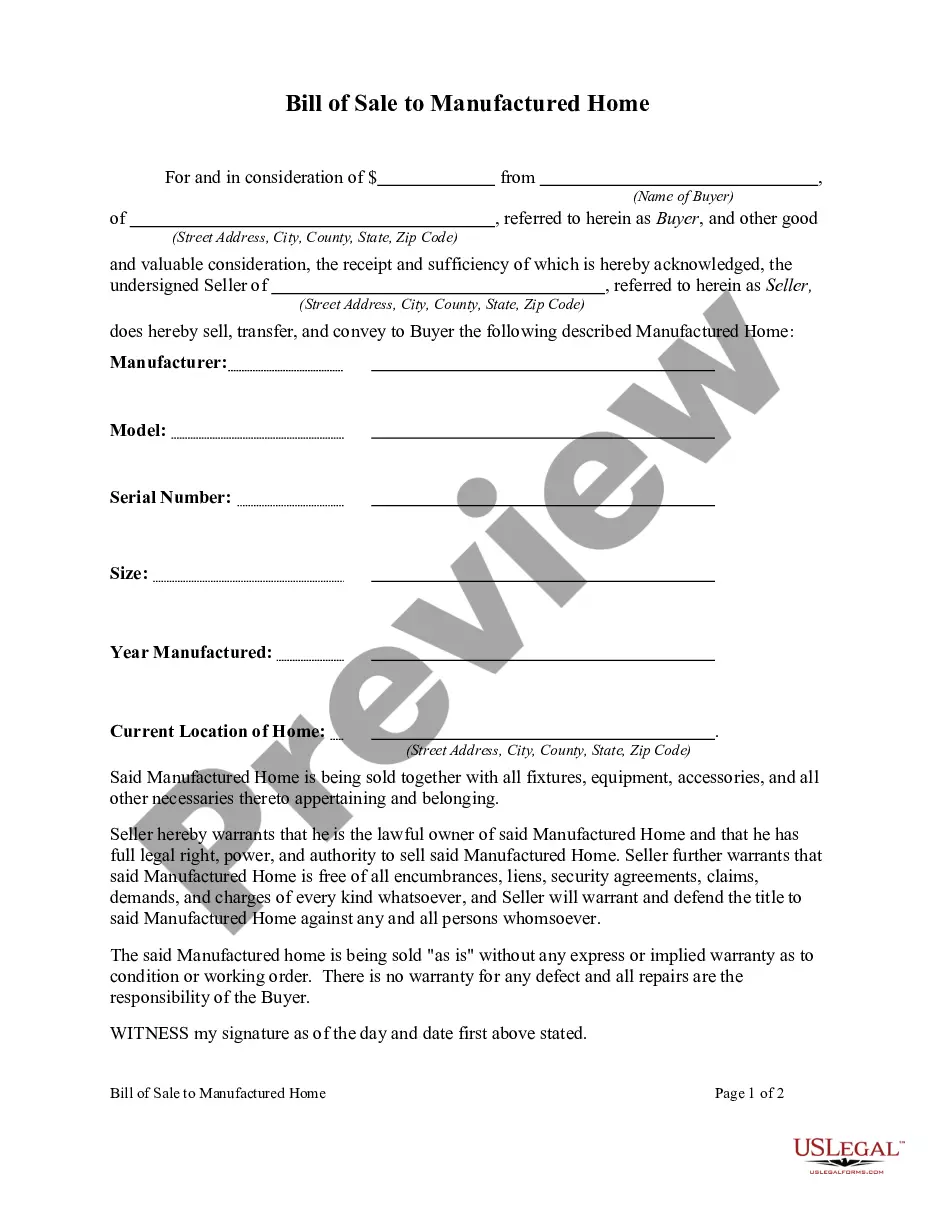

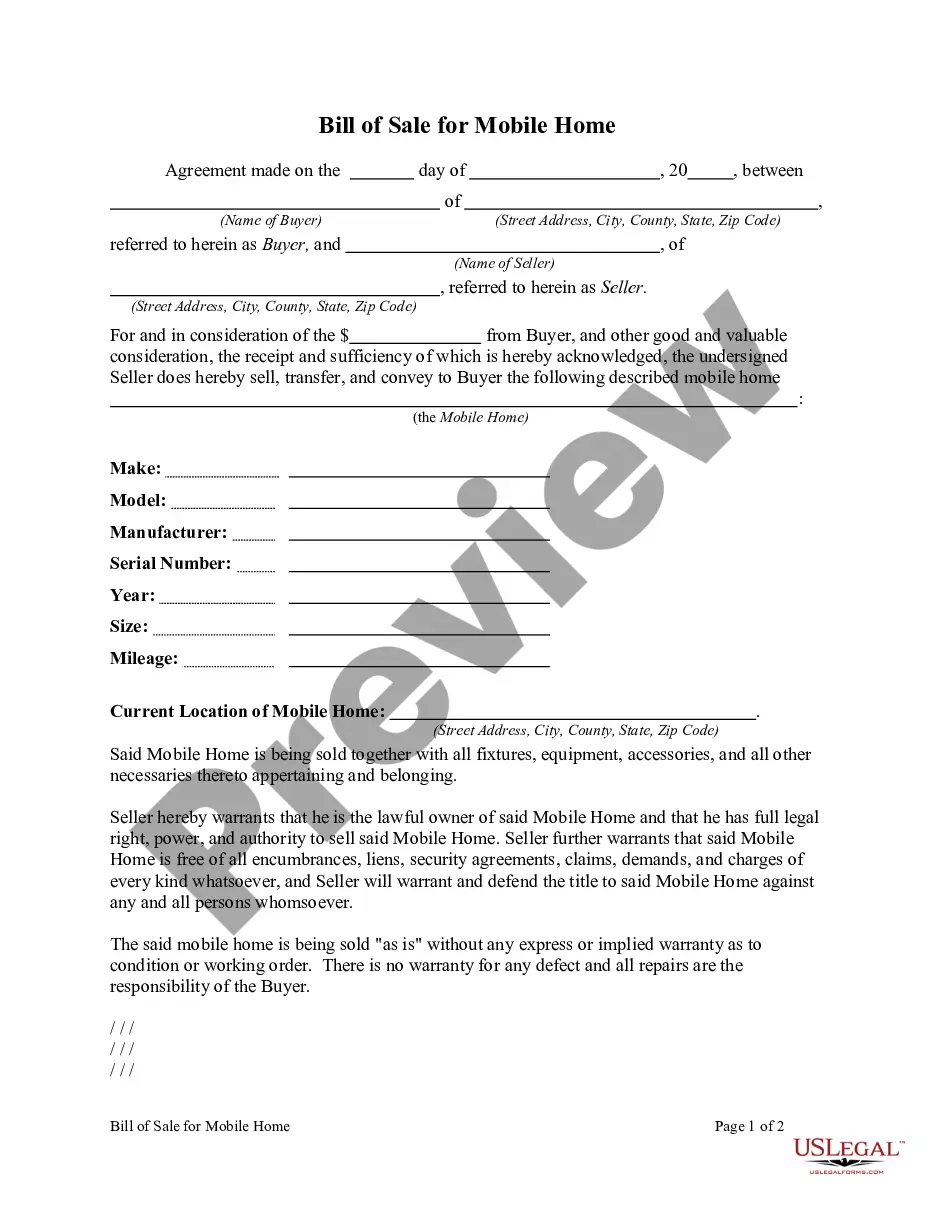

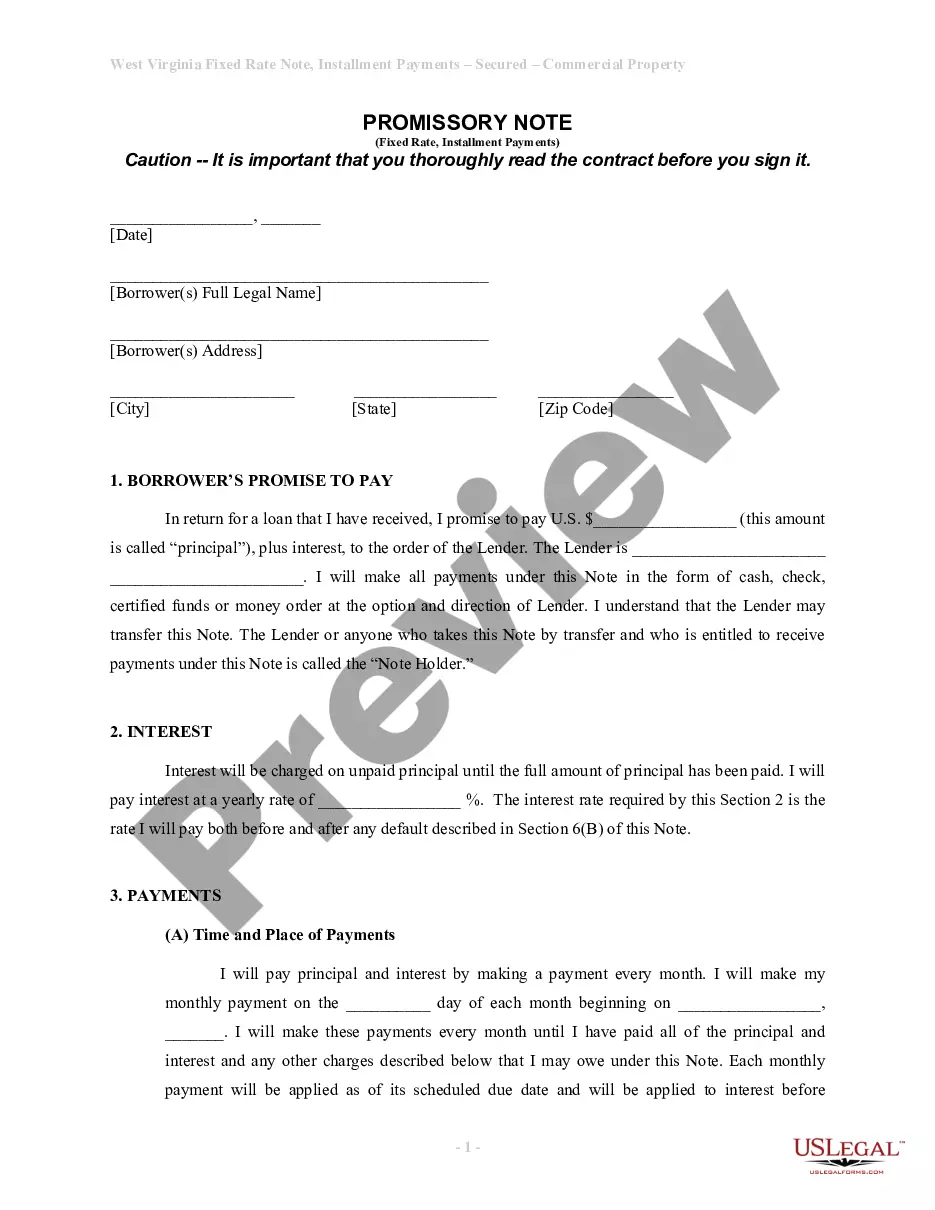

- Use the Review option to evaluate the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are searching for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

Mobile Home CharacteristicsIf the home is situated on land owned by the owner of the manufactured home, it should be classified as real property. If it is located on land owned by someone else, it is classified as personal property.

You can replace your title in-person at a local Oklahoma Motor Vehicle Division (Tax Commission) tag office. Or, you can submit your duplicate title application by mail if you choose to avoid a trip to the DMV. You'll need to file the Application for Duplicate Title (701-7).

The excise tax rate is levied by the Oklahoma Statutes. Sales tax is not assessed on manufactured homes. (h) Sale of manufactured home; transfer of title; change of basis. If the manufactured home is sold, the title must be transferred to the new owner, who will have the title issued in his/her name.

After closing Transferring ownershipBring forms (Title, Bill of sale, and Form-936R) to your local MVD office or local tag agent in the county to pay transfer tax and transfer ownership.Bring 2 forms of valid ID.Fees: Registration fees are based upon the purchase price listed on the Bill of Sale.More items...

No person shall transport or move a manufactured home on any public road or highway in this state, except as otherwise provided by law, without a permit issued pursuant to the provisions of Sections 14-103A and 14-103C of this title and subsection B of this section, and without a current calendar year decal or current

Aside from calling us here at National Cash Offer to help you sell your mobile home without a title, it is NOT impossible to sell your mobile home without a title. Although without the title, you can't legally transfer ownership of the property the owner will just be the sole owner of the mobile home.

Oklahoma law requires that owners moving or relocating a manufactured home obtain a moving permit from the Department of Public Safety. If the home is undergoing change of ownership, proof of paid taxes is required, or proof that no taxes are required to be paid.

In most instances, manufactured homes purchased new or brought in from another state are initially titled and registered at motor license agencies. Thereafter, they are placed on county ad valorem tax rolls and will be issued registration renewal decals by the County Treasurer.