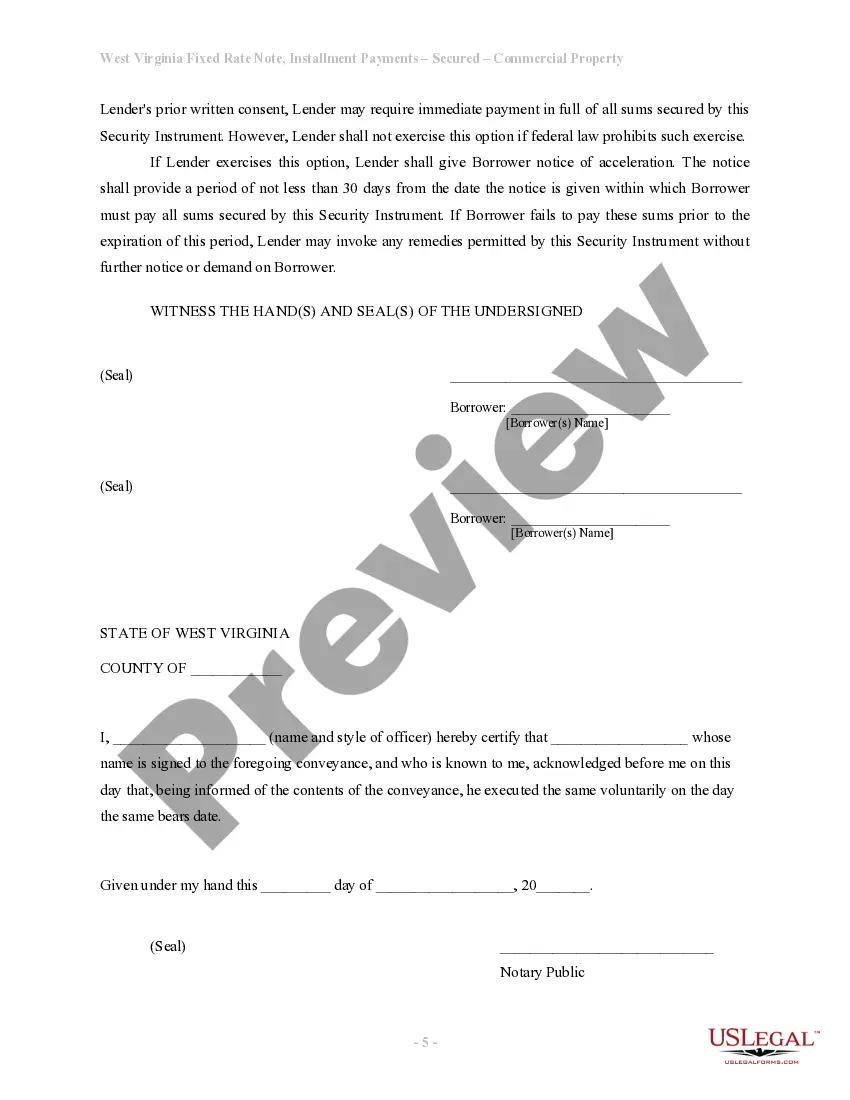

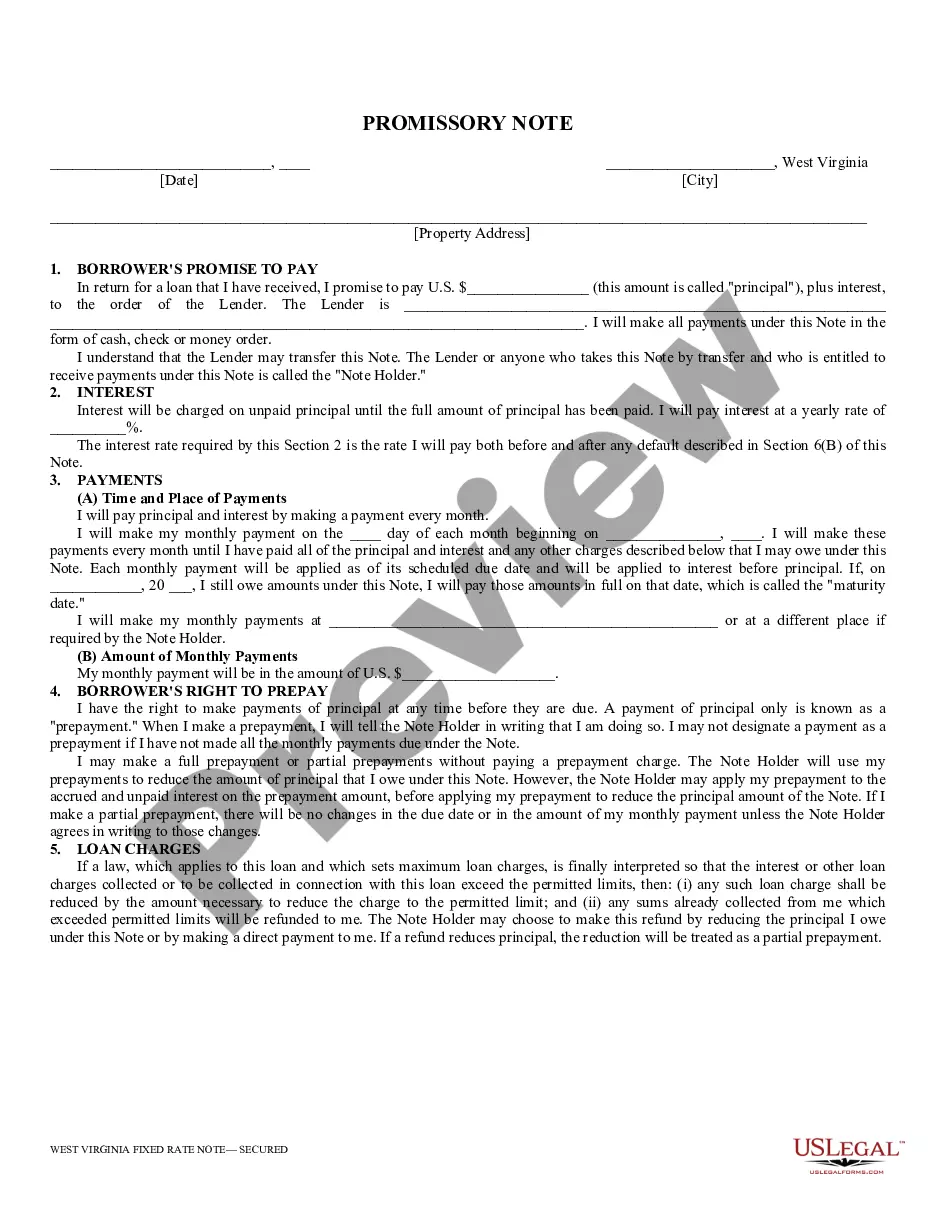

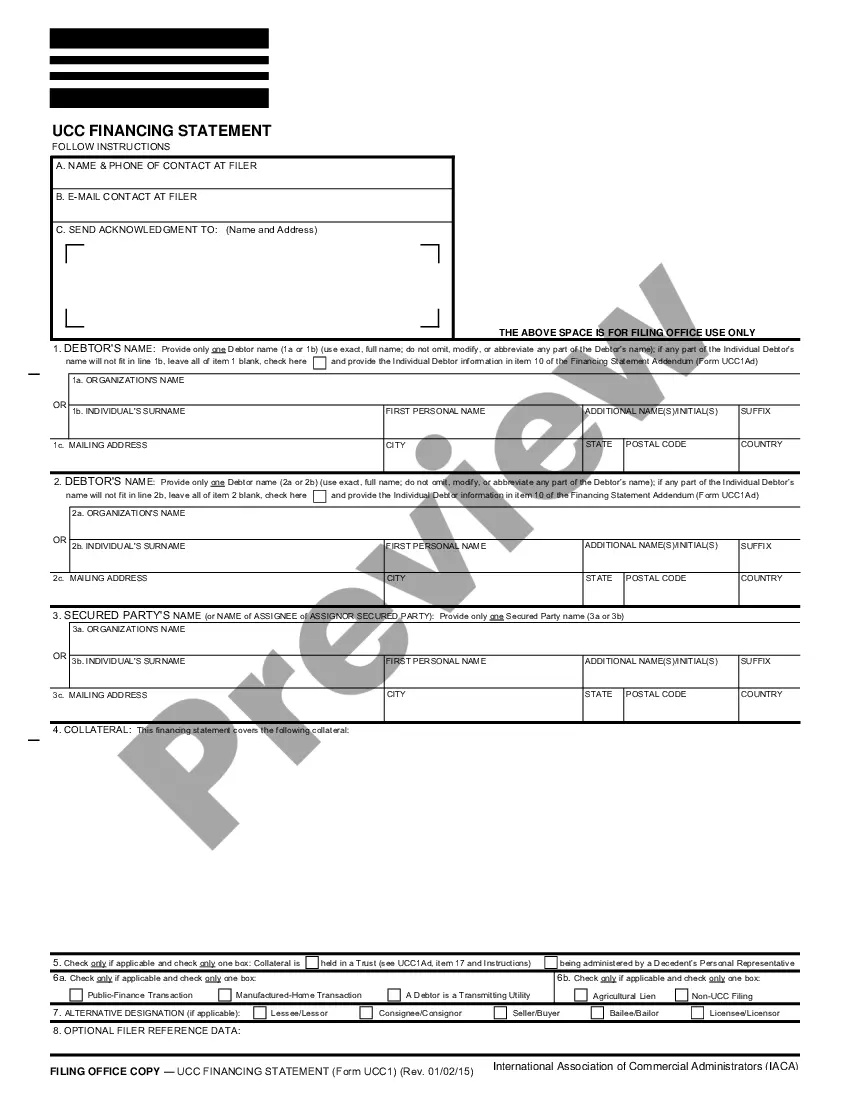

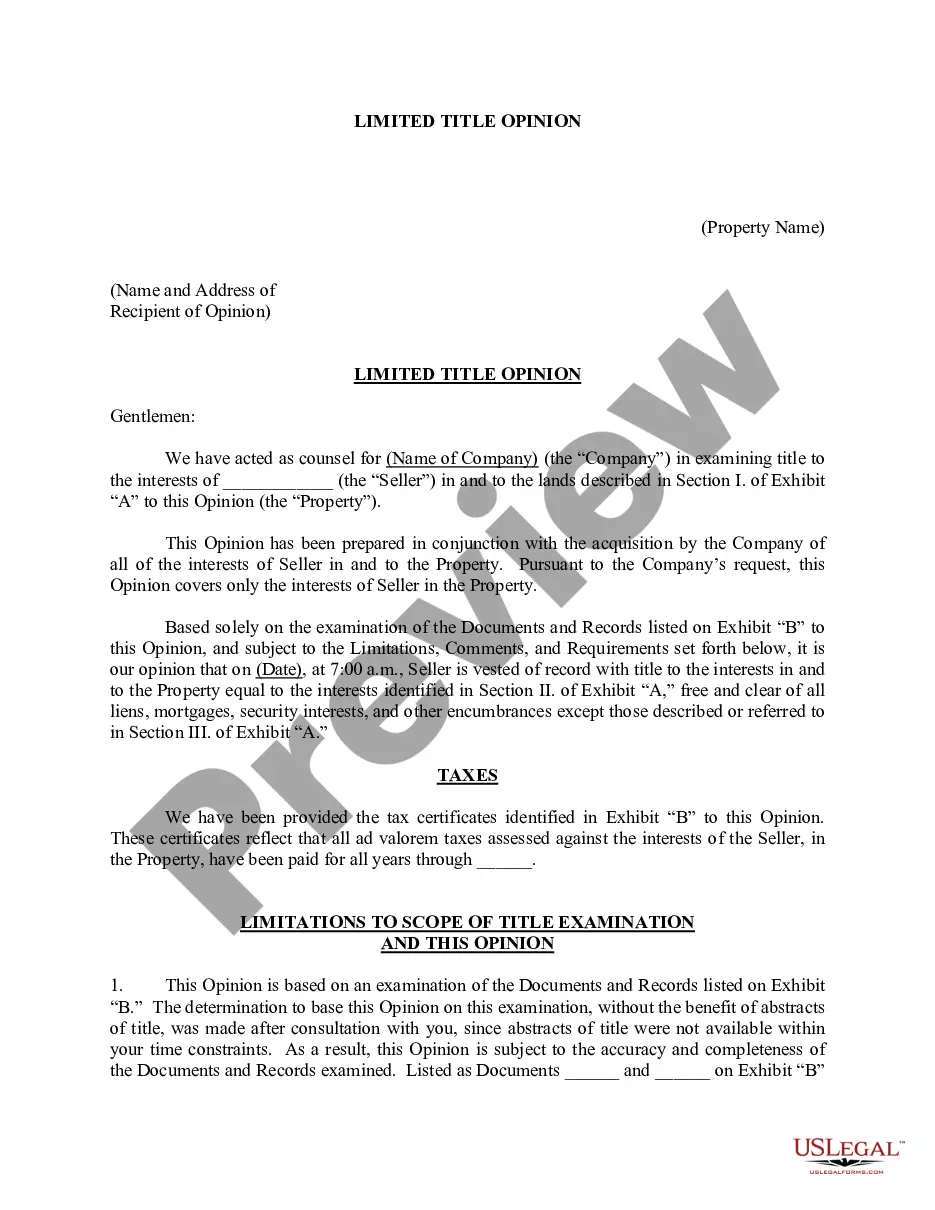

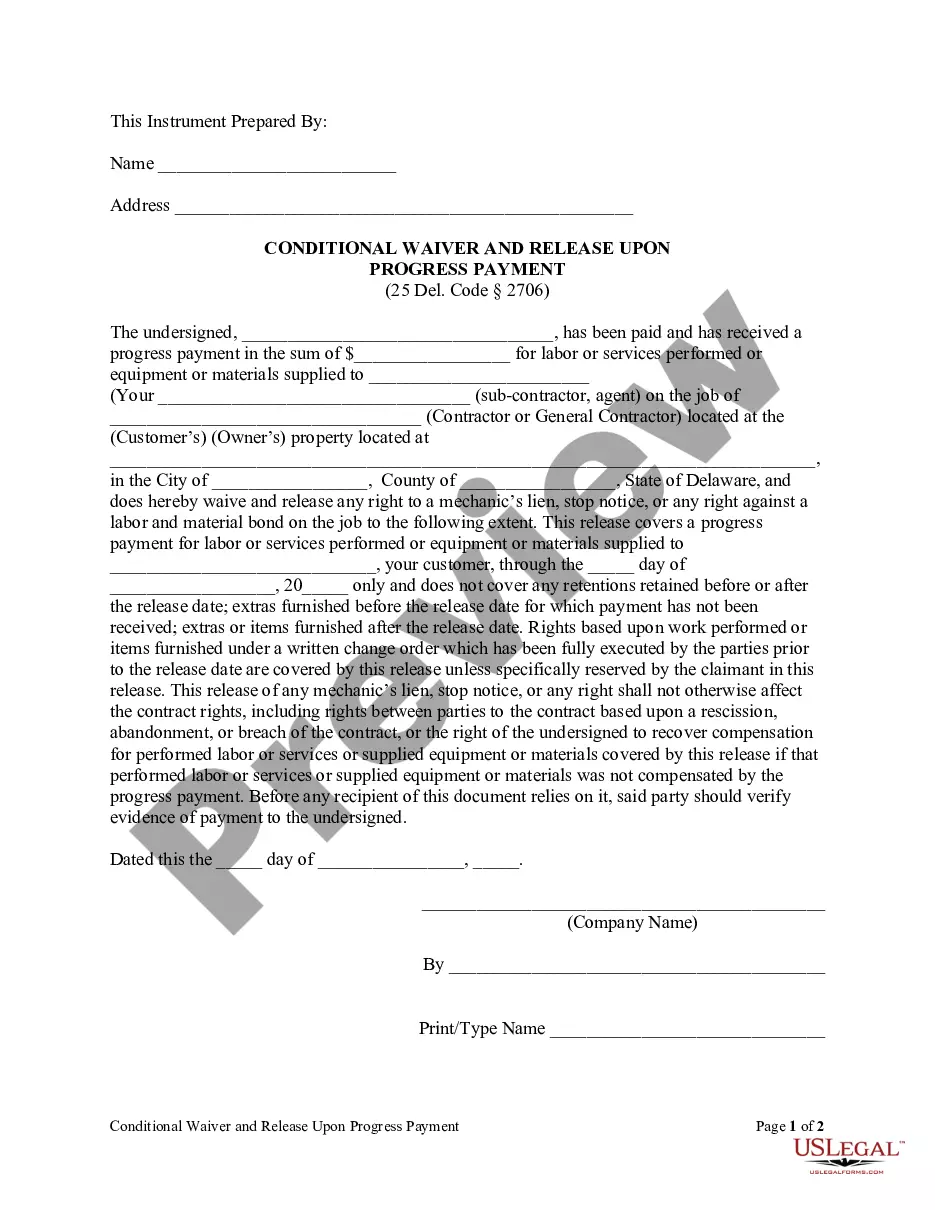

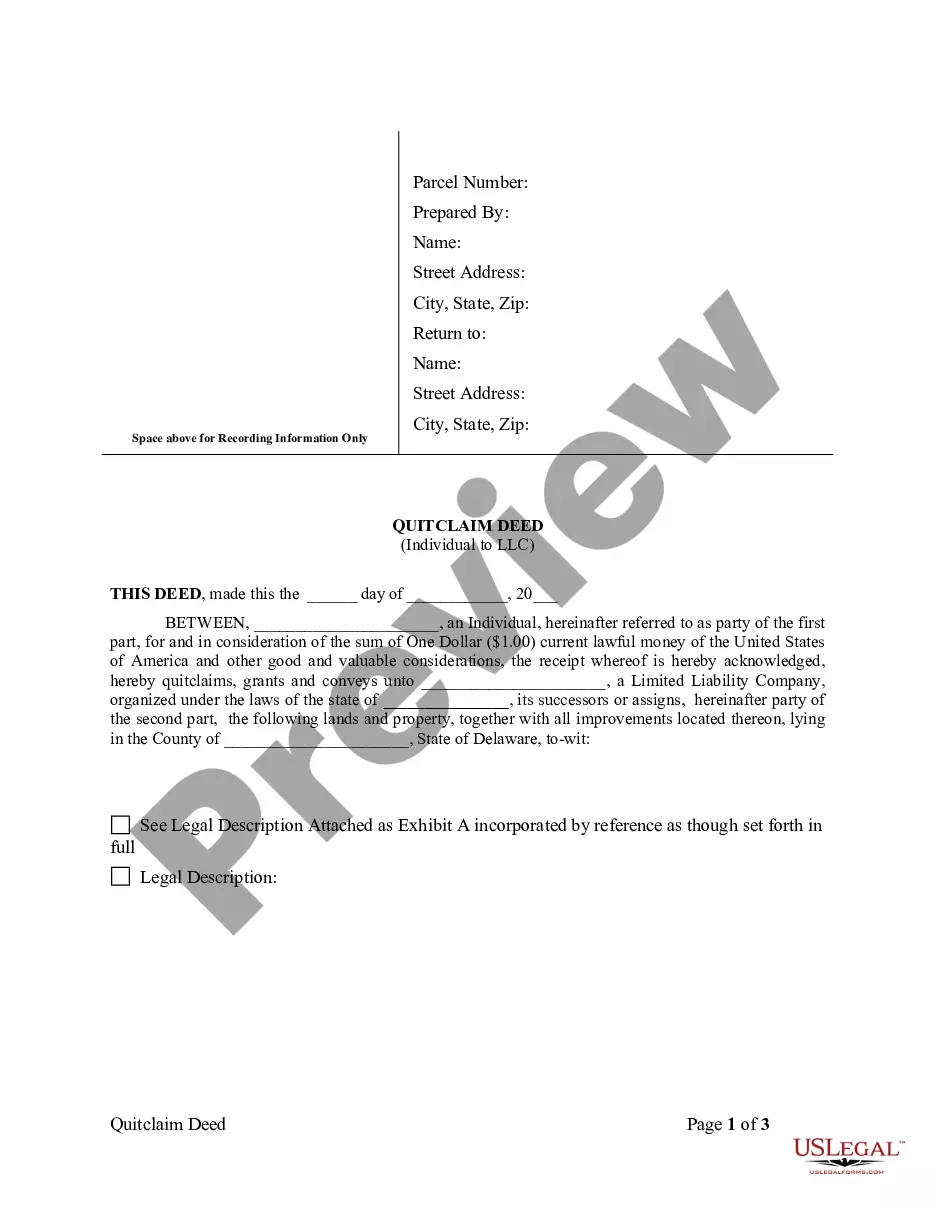

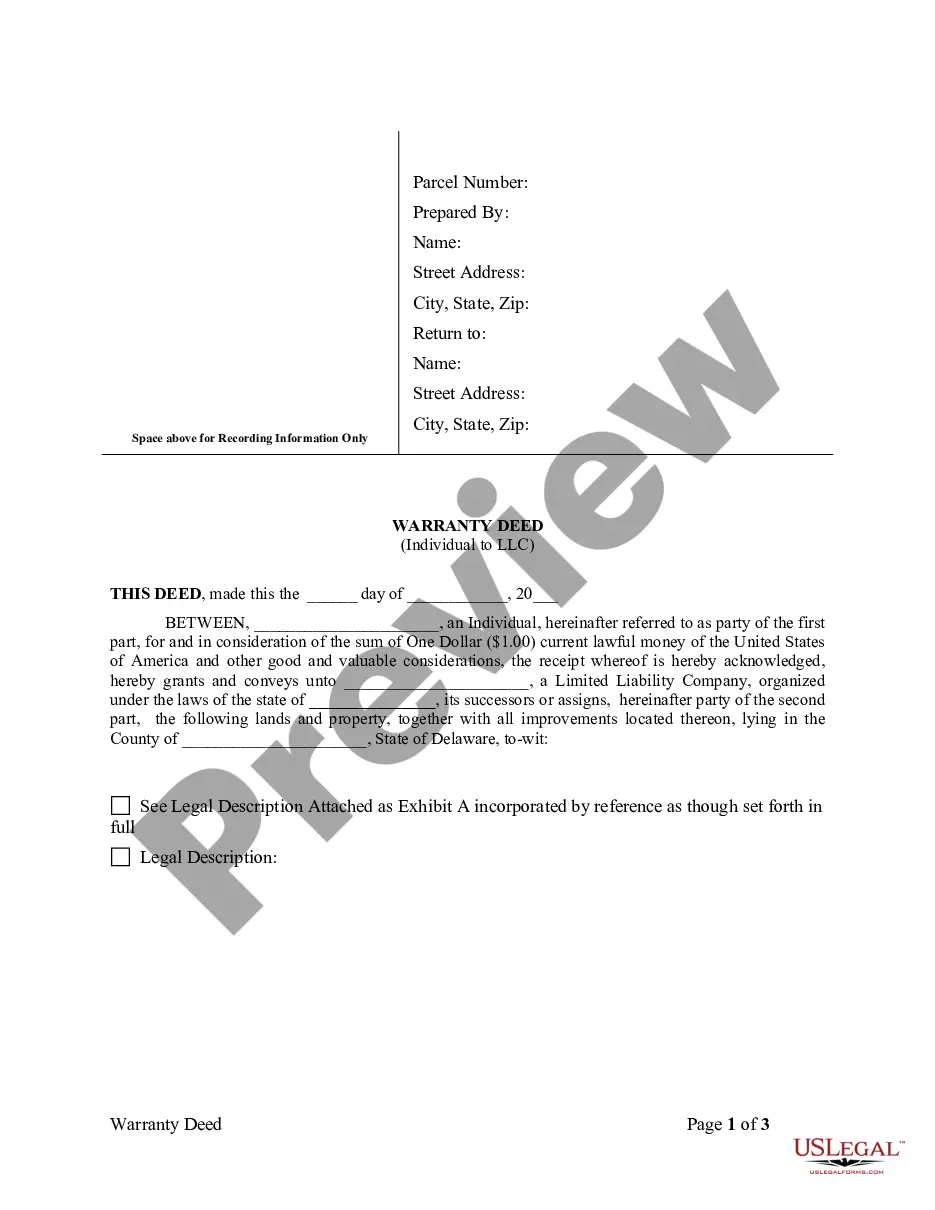

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

West Virginia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out West Virginia Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Out of the multitude of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms before buying them. Its comprehensive library of 85,000 templates is categorized by state and use for efficiency. All of the forms available on the service have been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, click Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all of your saved forms.

Follow the guidelines below to obtain the form:

- Once you find a Form name, ensure it is the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the template.

- Search for a new template using the Search engine if the one you’ve already found isn’t appropriate.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

When you’ve downloaded your Form name, you can edit it, fill it out and sign it in an web-based editor of your choice. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our service provides quick and easy access to templates that suit both lawyers and their customers.

Form popularity

FAQ

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

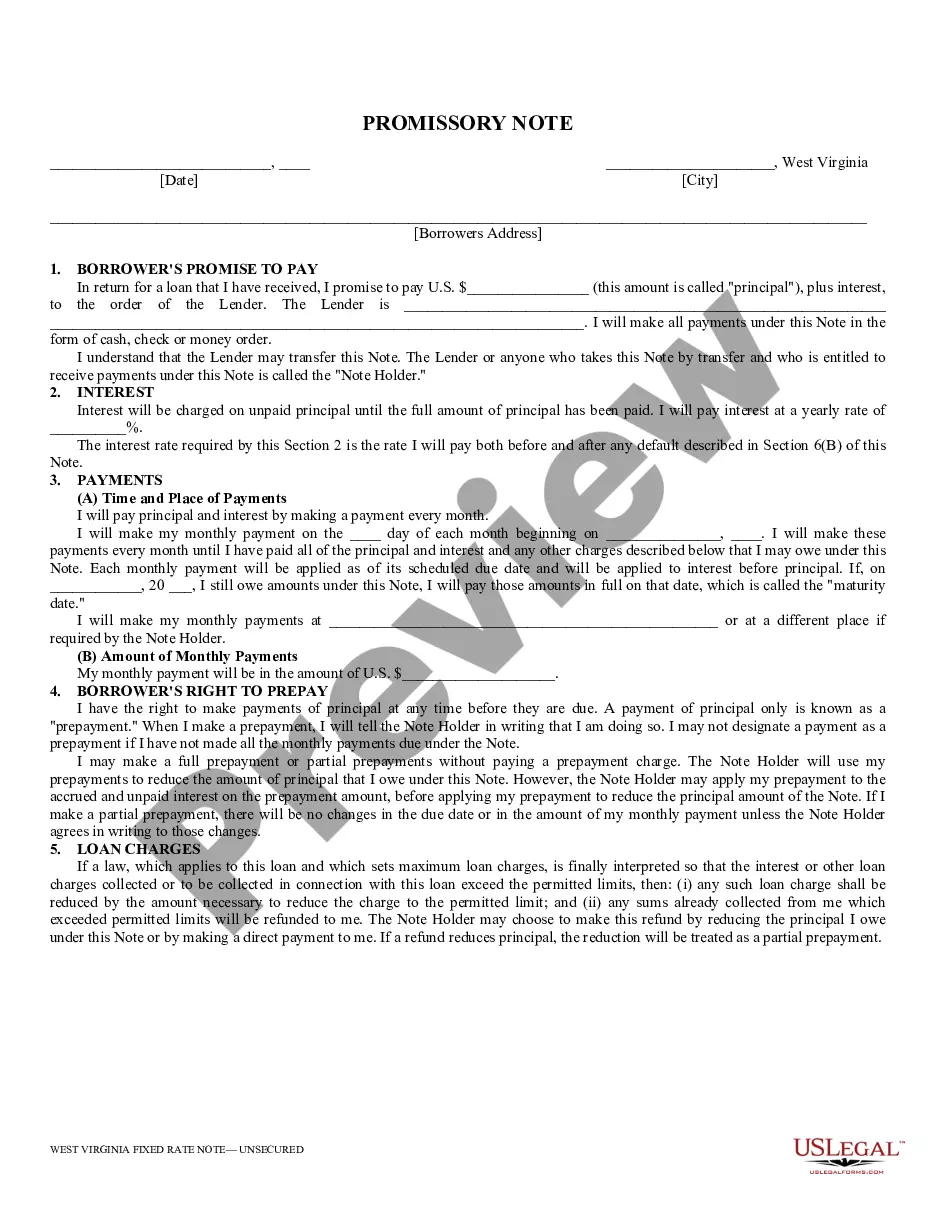

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.