This agreement allows one lien holder to subordinate its deed of trust to the lien of another lien holder. For valuable consideration, a particular deed of trust will at all times be prior and superior to the subordinate lien.

Oklahoma Subordination Agreement of Deed of Trust

Description

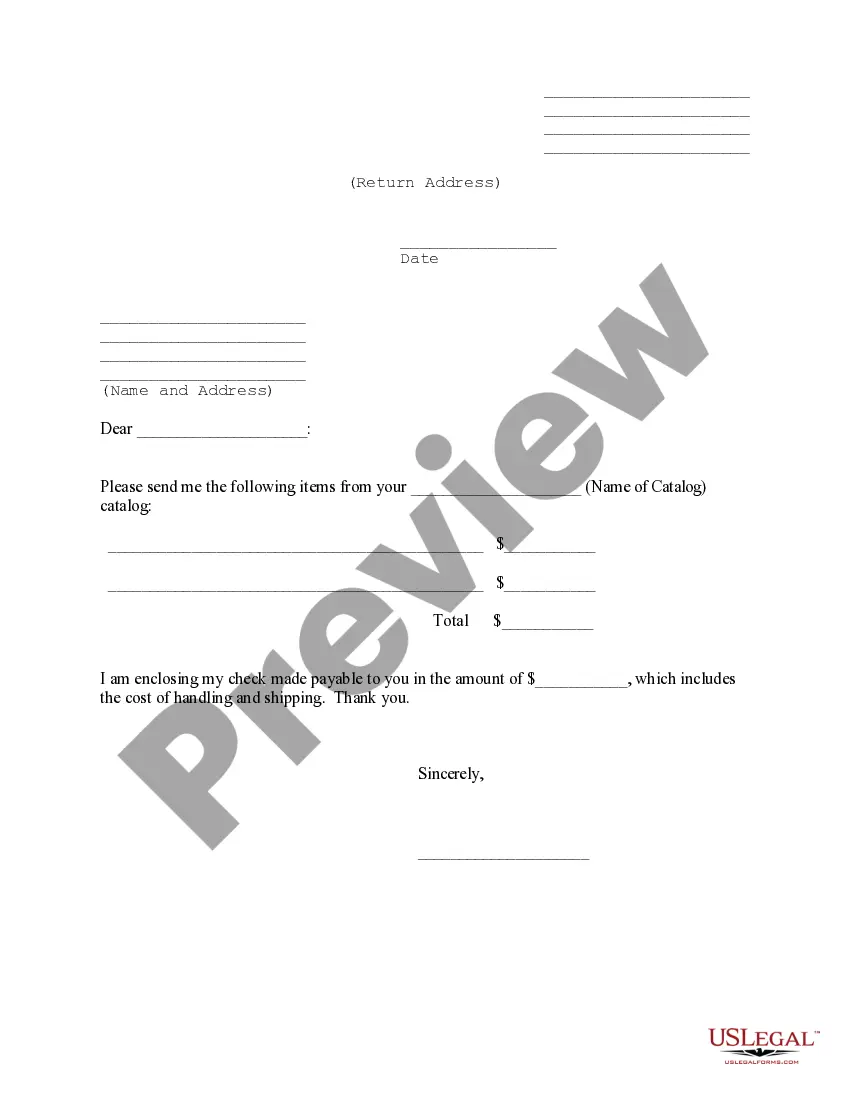

How to fill out Subordination Agreement Of Deed Of Trust?

You can invest hours online looking for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides a wide array of legal forms that have been reviewed by experts.

You can download or print the Oklahoma Subordination Agreement of Deed of Trust from my services.

If available, utilize the Review option to check the document template as well. If you wish to find another version of the form, use the Search box to locate the template that fits your needs and specifications. Once you have found the template you require, click on Buy now to proceed. Choose the pricing plan you need, input your credentials, and register for a free account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal document. Select the template of your document and download it to your device. Make modifications to your document if necessary. You can complete, alter, sign, and print the Oklahoma Subordination Agreement of Deed of Trust. Access and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and select the Purchase option.

- After that, you can complete, modify, print, or sign the Oklahoma Subordination Agreement of Deed of Trust.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents section and select the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

- Review the form description to confirm you have selected the appropriate template.

Form popularity

FAQ

The new lender prepares the subordination agreement in conjunction with the subordinating lienholder. Then the parties typically sign the agreement. But in some cases, just the subordinating lender will need to sign the paperwork.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

Subordination. This Security Instrument is and shall be automatically subordinate to a loan made to Borrower evidenced by a purchase money promissory note and secured by a first deed of trust (the ?First Deed of Trust?) recorded concurrently herewith on the Property.

Get the terminology right In addition, a deed of priority usually addresses what steps each lender may take to enforce its security. Subordination deed ? this deals with the entitlement of the different creditors to receive payments .

What is subordination? Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans ? your mortgage and HELOC. Both are secured by the collateral in your home at the same time.