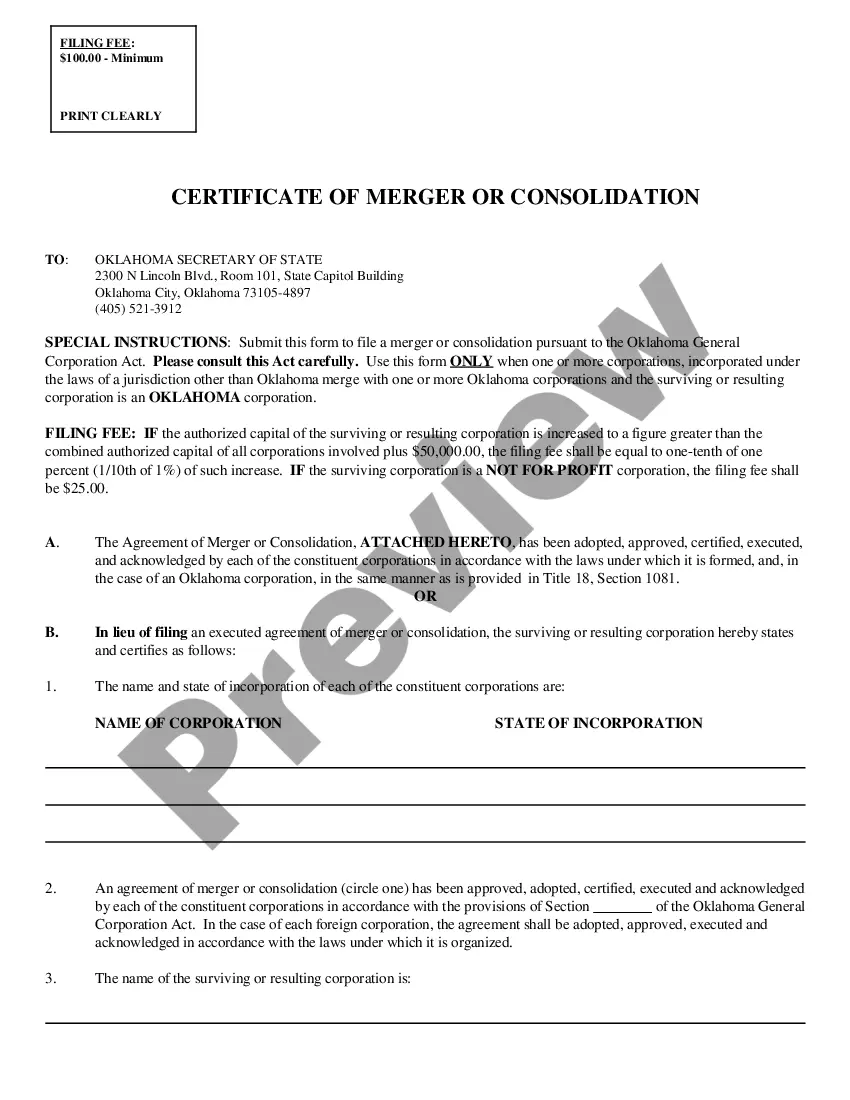

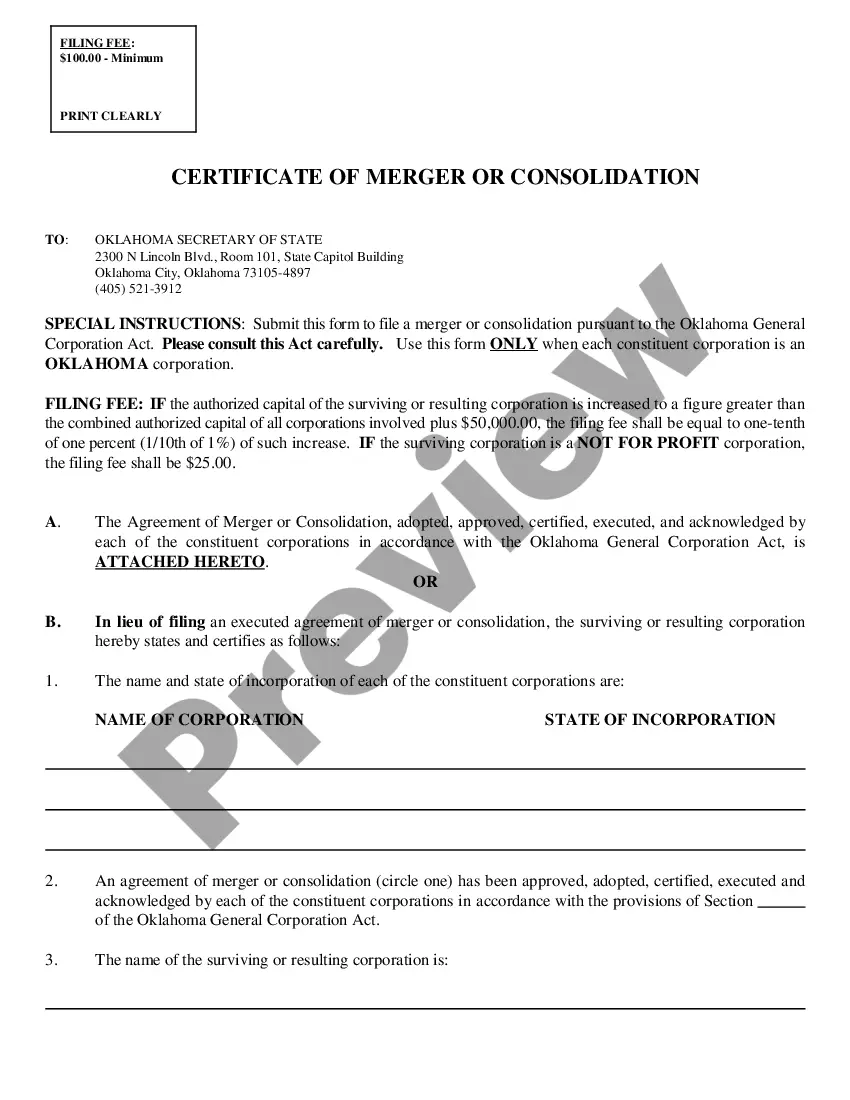

This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Certificate of Merger or Consolidation - Oklahoma Corporation into Foreign Corporation

Description

How to fill out Certificate Of Merger Or Consolidation - Oklahoma Corporation Into Foreign Corporation?

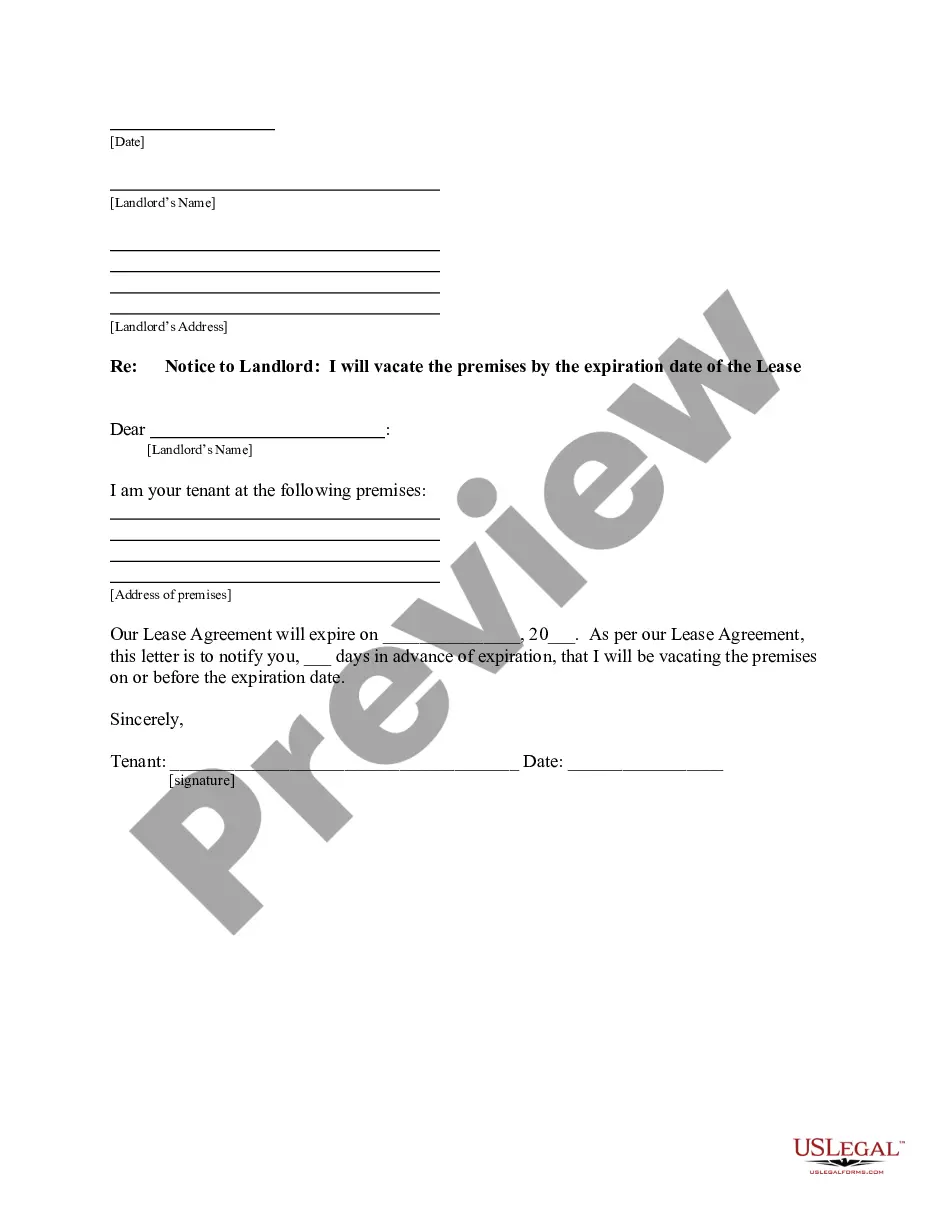

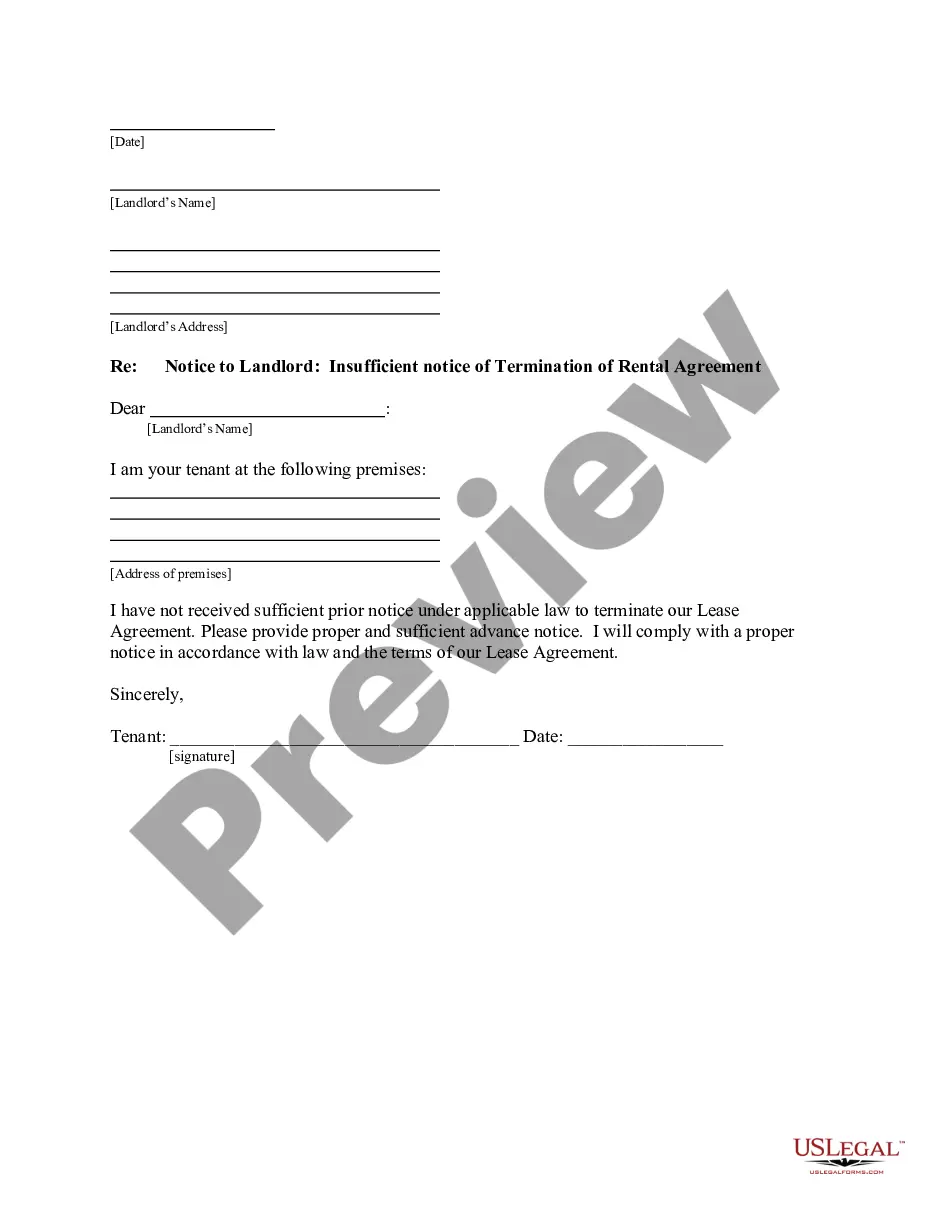

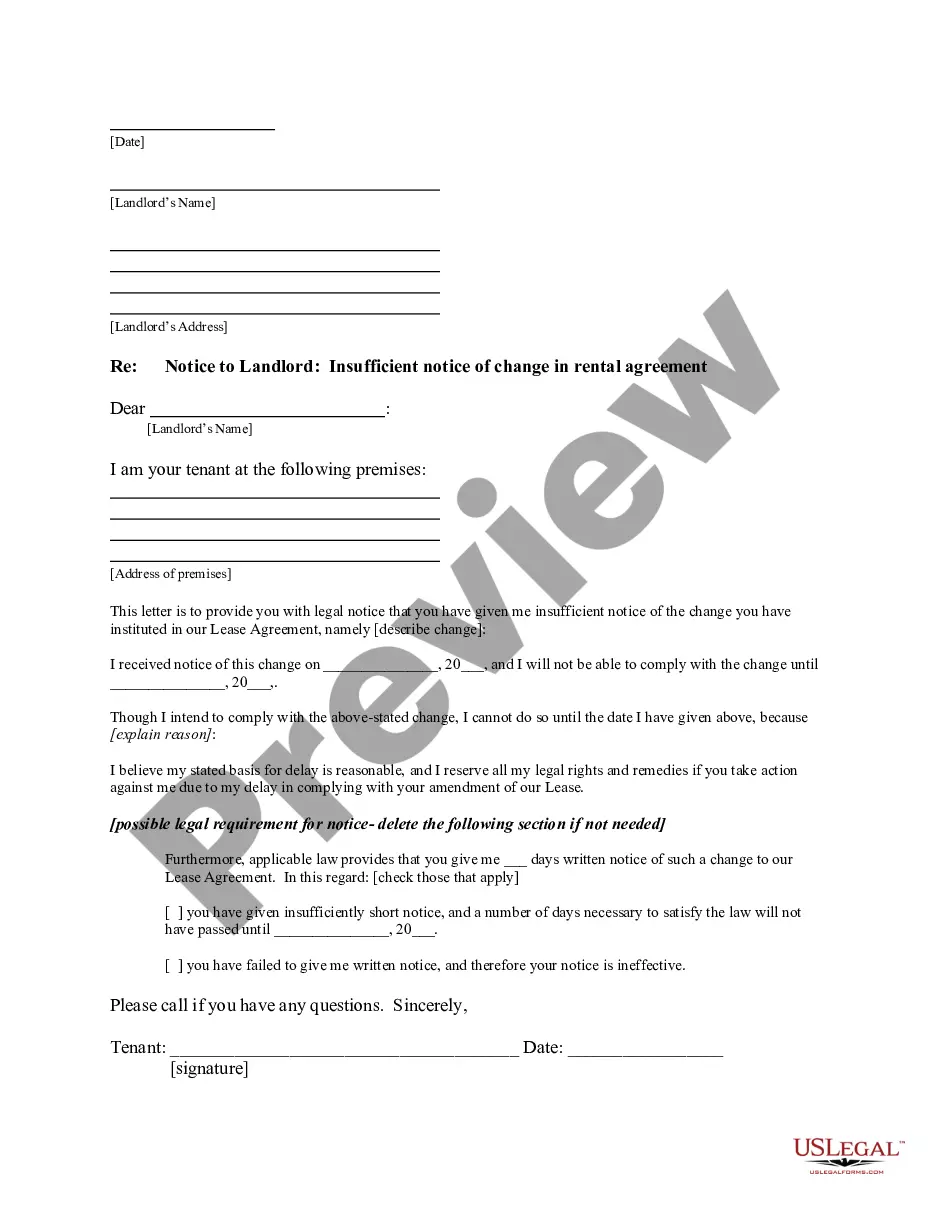

When it comes to submitting Certificate of Merger or Consolidation - Oklahoma Corporation into Foreign Corporation, you almost certainly imagine a long procedure that consists of getting a perfect sample among hundreds of similar ones and after that being forced to pay out a lawyer to fill it out for you. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific template in just clicks.

For those who have a subscription, just log in and click on Download button to find the Certificate of Merger or Consolidation - Oklahoma Corporation into Foreign Corporation sample.

If you don’t have an account yet but need one, stick to the point-by-point manual listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do this by reading the form’s description and through clicking on the Preview option (if accessible) to see the form’s information.

- Click on Buy Now button.

- Find the appropriate plan for your budget.

- Subscribe to an account and select how you would like to pay out: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Find the document on the device or in your My Forms folder.

Skilled attorneys work on drawing up our templates to ensure that after downloading, you don't need to bother about editing and enhancing content outside of your personal information or your business’s information. Be a part of US Legal Forms and receive your Certificate of Merger or Consolidation - Oklahoma Corporation into Foreign Corporation sample now.

Form popularity

FAQ

Step 1: Name Your Oklahoma Corporation. Step 2: Choose an Oklahoma Registered Agent. Step 3: Hold an Organizational Meeting. Step 4: File the Oklahoma Certificate of Incorporation. Step 5: Get an EIN for Your Oklahoma Corporation.

Oklahoma businesses are not legally required to obtain a certificate of good standing. However, your business may choose to get one if you decide to do business outside of Oklahoma or get a business bank account.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.

To start an LLC in Oklahoma you will need to file the Articles of Organization with the Oklahoma Secretary of State, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Oklahoma Limited Liability Company.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

For many businesses, filing annual reports is among them. If you operate your business as an LLC or corporation (depending on the state in which your company is registered), you may need to publish an annual report to keep in good standing with the state.

You have the option of filing your Corporation and LLC Annual Certificate online or by mail. To file online, visit the Oklahoma Secretary of State's website, otherwise, you can download and fill out the Annual Certificate Form.

Visit us at tax.ok.gov to file your Franchise Tax Return, Officer Listings, Balance Sheets and Franchise Election Form (Form 200-F).

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Certificate.