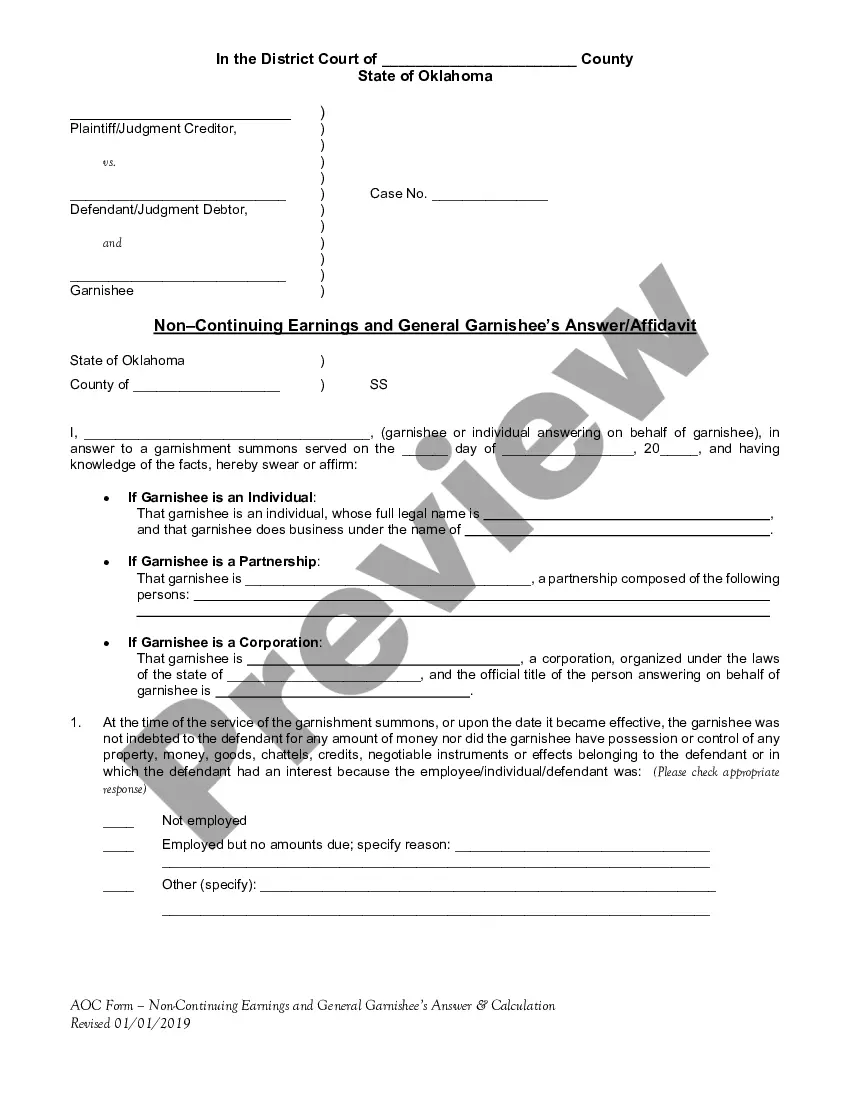

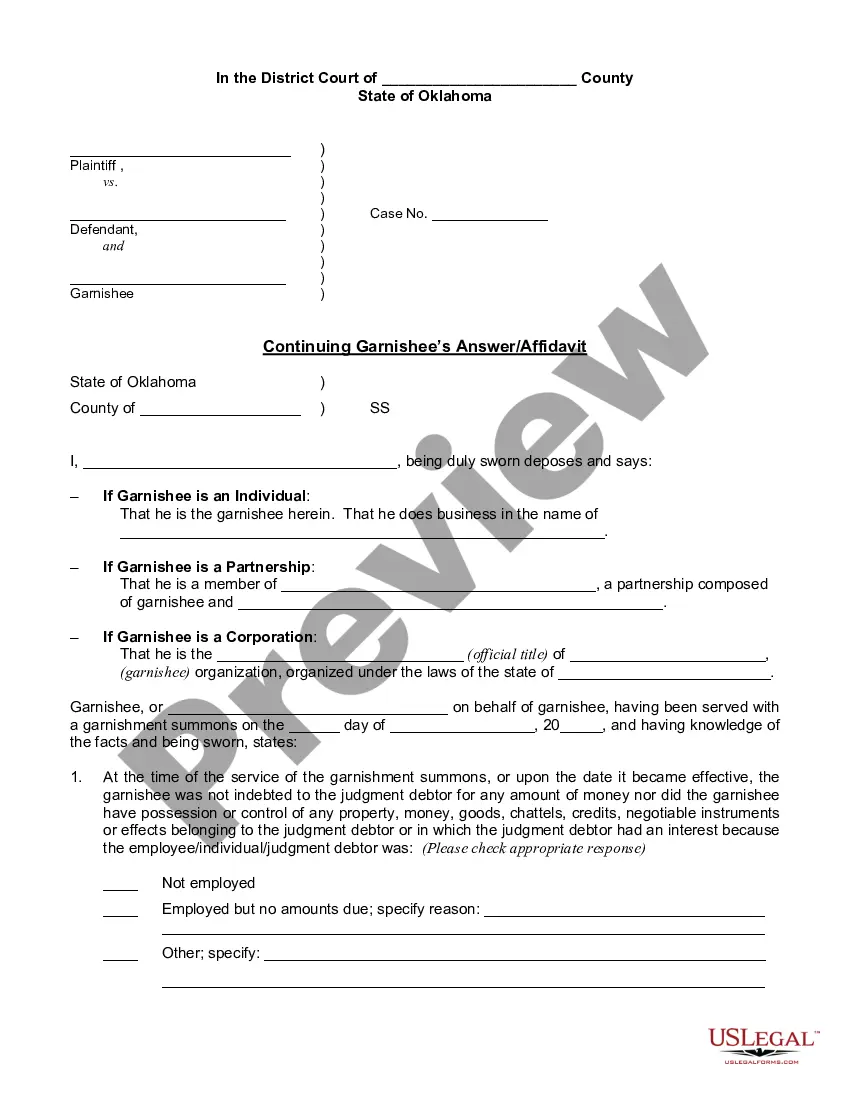

Oklahoma Noncontinuing & General Garnishee's Answer/Affidavit; Calculation for Non-continuing Garnishment of Earnings

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oklahoma Noncontinuing & General Garnishee's Answer/Affidavit; Calculation For Non-continuing Garnishment Of Earnings?

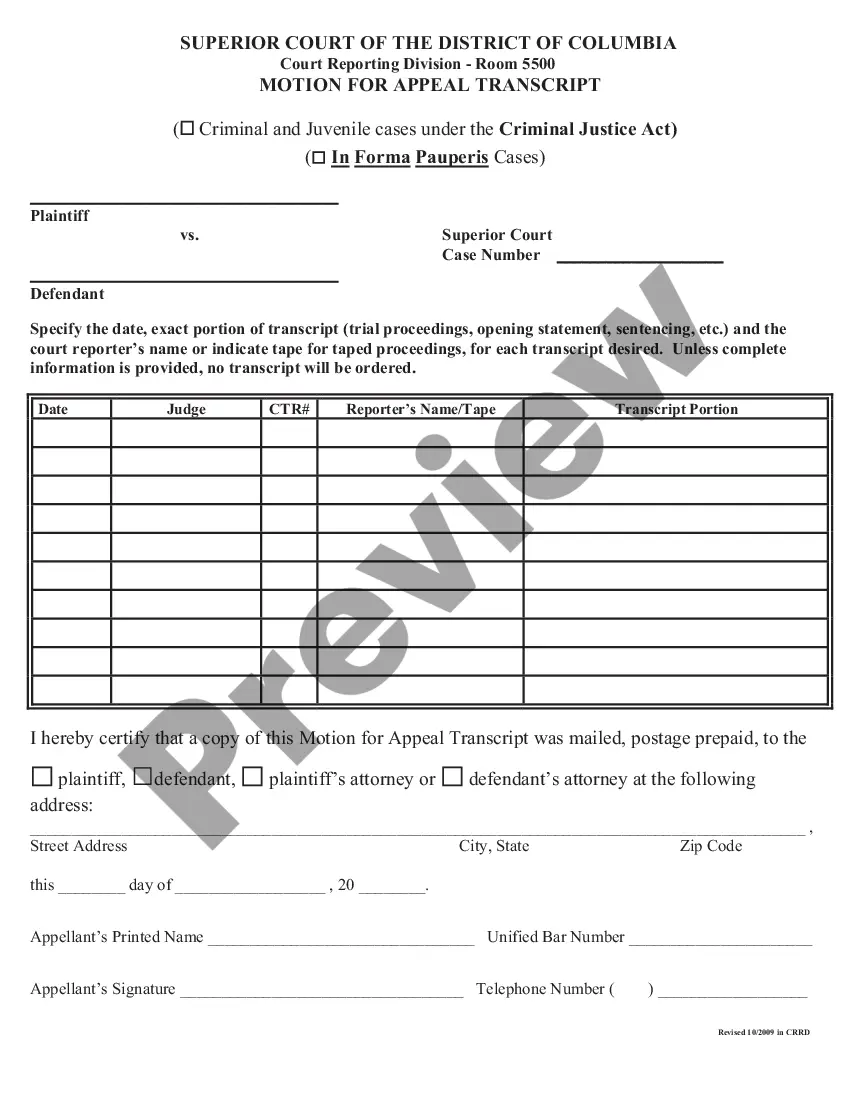

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state laws and are examined by our specialists. So if you need to prepare Oklahoma Noncontinuing & General Garnishee's Answer/Affidavit; Calculation for Non-continuing Garnishment of Earnings, our service is the perfect place to download it.

Getting your Oklahoma Noncontinuing & General Garnishee's Answer/Affidavit; Calculation for Non-continuing Garnishment of Earnings from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance verification. You should carefully review the content of the form you want and ensure whether it suits your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now once you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Oklahoma Noncontinuing & General Garnishee's Answer/Affidavit; Calculation for Non-continuing Garnishment of Earnings and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

That said, Oklahoma does limit garnishments to one creditor at a time, unlike many other states. Wage garnishment limitations and protections in Oklahoma are the same under federal law and Oklahoma state law.

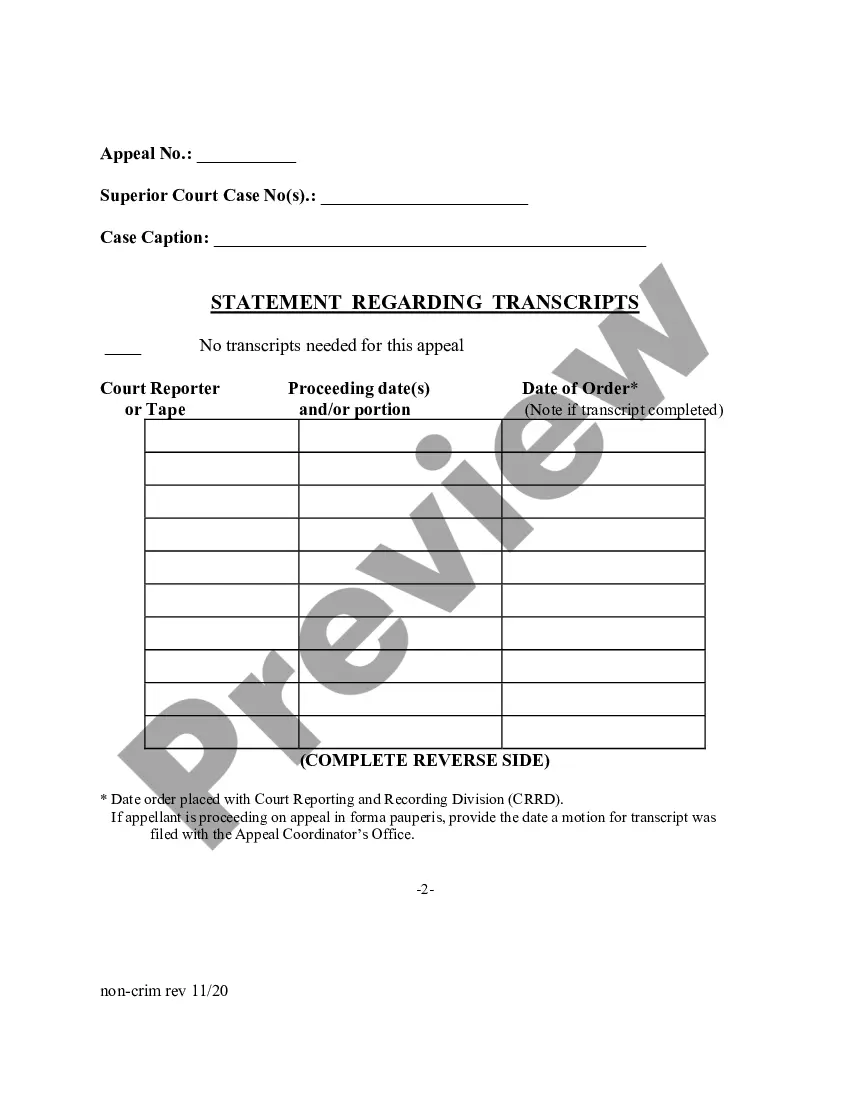

Non-continuing garnishment This is essentially a bank levy, which allows the creditor to take non-exempt money directly from your account. This may also result in a bank account freeze while they take funds from the balance of your account to pay the judgment.

A creditor MUST have a judgment against you before it can get a garnishment. There are two basic limits on the amount creditors can take from your wages. First, they cannot take more than 25% of your take-home pay. Second, a creditor must leave you with at least $217.50 a week or $870 a month in net (take-home) pay.

A creditor MUST have a judgment against you before it can get a garnishment. There are two basic limits on the amount creditors can take from your wages. First, they cannot take more than 25% of your take-home pay. Second, a creditor must leave you with at least $217.50 a week or $870 a month in net (take-home) pay.

Once this happens, the creditor can legally collect on delinquent debt. In Oklahoma, a creditor can try to collect on a judgment for (5) years from the date the judgment goes into effect. This period is known as the statute of limitations. Once this time expires, the judgment becomes unenforceable in the court of law.

In Oklahoma, a judgment creditor can attempt execution of a judgment for five years from the date of the judgment. This is known as the statute of limitations. After the statute of limitations has expired, it becomes unenforceable by the operation of law.

Employers are required to provide employees with a copy of garnishment paperwork. With regard to child support garnishments, all states are required to use the "Order/Notice To Withhold Income For Child Support" notice for Child Support.