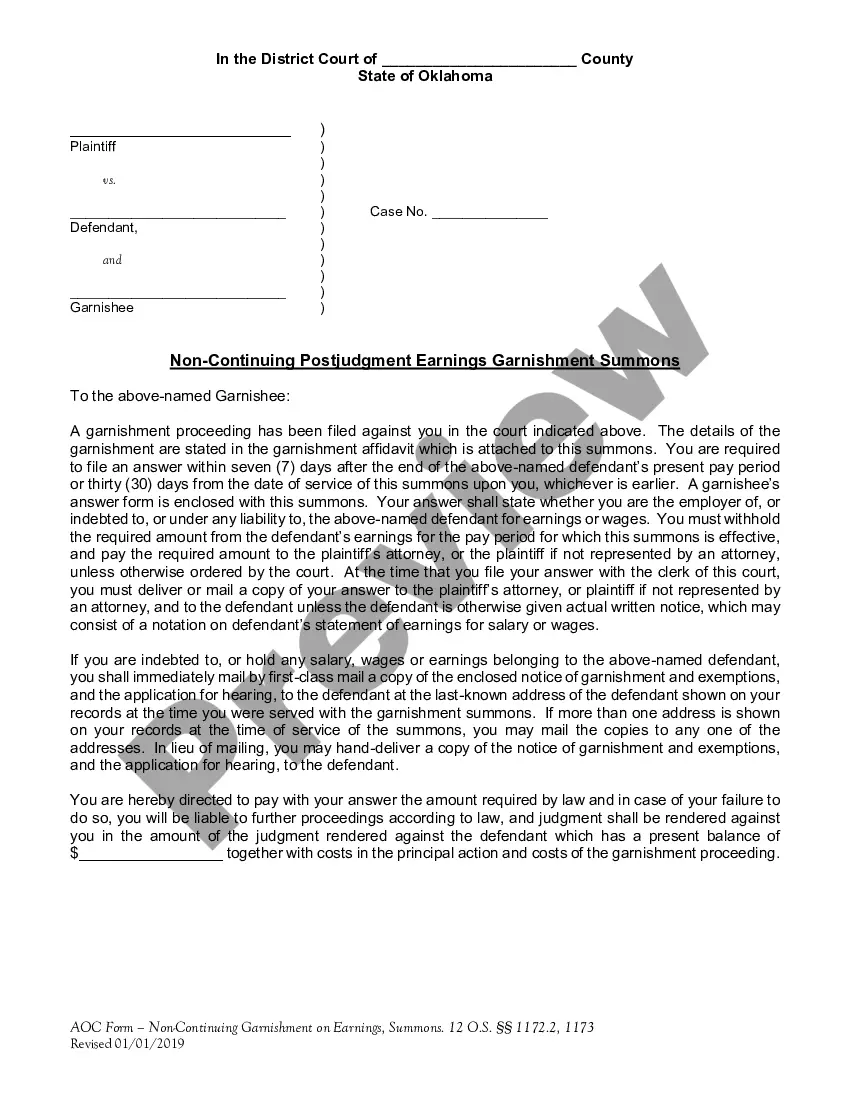

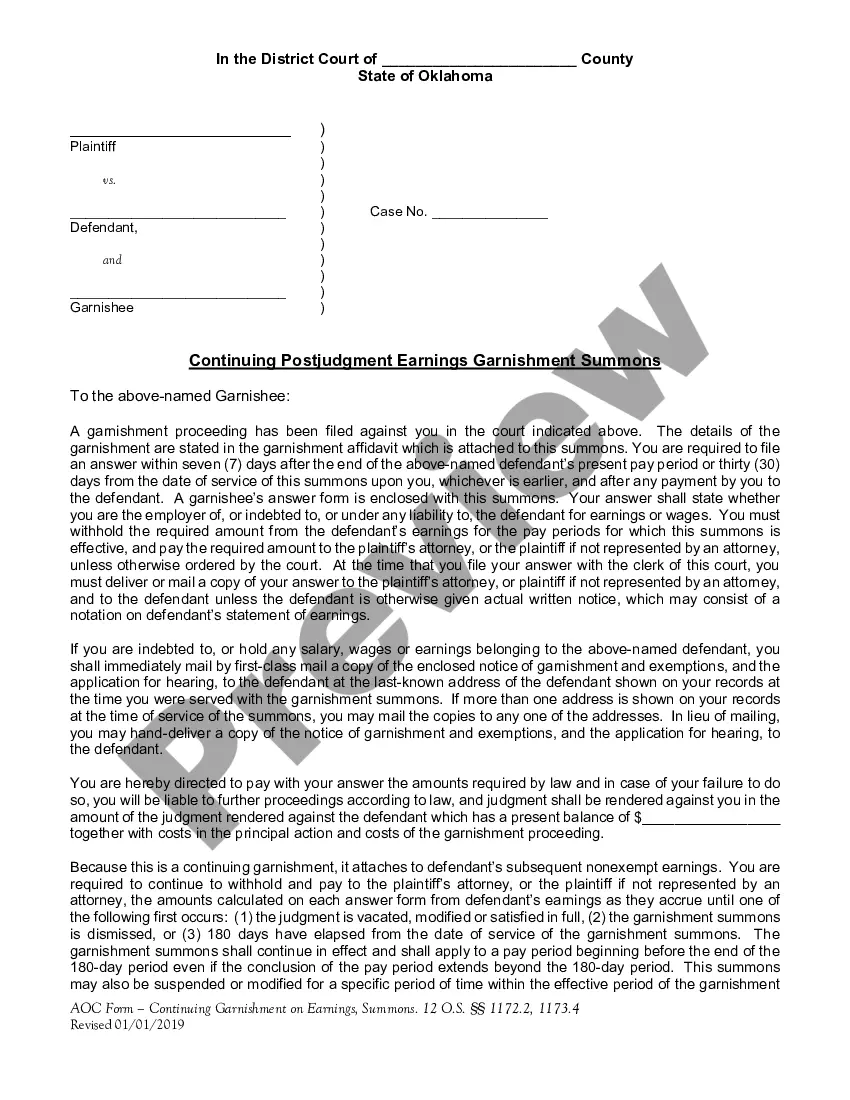

Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons

Description

How to fill out Oklahoma Noncontinuing And Continuing Post-Judgment Earnings Garnishment Summons?

In terms of completing Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons, you probably visualize an extensive procedure that consists of getting a appropriate sample among numerous very similar ones then being forced to pay out an attorney to fill it out to suit your needs. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and pick out the state-specific document within clicks.

In case you have a subscription, just log in and click on Download button to find the Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons template.

In the event you don’t have an account yet but need one, stick to the point-by-point guideline listed below:

- Make sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and also by visiting the Preview option (if readily available) to view the form’s information.

- Click Buy Now.

- Select the suitable plan for your financial budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Get the document on your device or in your My Forms folder.

Professional attorneys draw up our samples to ensure after downloading, you don't need to worry about modifying content outside of your personal information or your business’s details. Be a part of US Legal Forms and receive your Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons example now.

Form popularity

FAQ

The case number and case caption (ex: XYZ Bank vs. John Doe) the date of your objection. your name and current contact information. the reasons (or grounds) for your objection, and. your signature.

If money is being taken out of your paycheck or bank account, you may be able to ask the court to stop or lower the amount of the garnishment. Lawyers call this a "Request or Claim for Exemption" from garnishment. An "exemption" means you will not have to pay the money to the creditor.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

A writ of continuing garnishment serves as a lien and continuing levy against the nonexempt earnings of the judgment debtor, until such time earnings are no longer due; the underlying judgment is vacated, modified or satisfied in full; or the writ is dismissed.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

Continuous writ of garnishment could refer to a garnishment order granting a third party to attach money or property of a defendant on a continuing basis for so long as the court may decide or until otherwise ordered by the court having competent jurisdiction.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.