Oklahoma Correction Mineral Deed

Overview of this form

The Correction Mineral Deed is a legal document used to amend errors in a previously filed mineral deed. It serves the purpose of correcting a mutual mistake made by both the Grantor and Grantee, ensuring that the mineral rights are accurately represented. This form is particularly important because it helps maintain the accuracy of property records and clarifies ownership rights, distinguishing it from other types of deeds, which may not specifically address such errors.

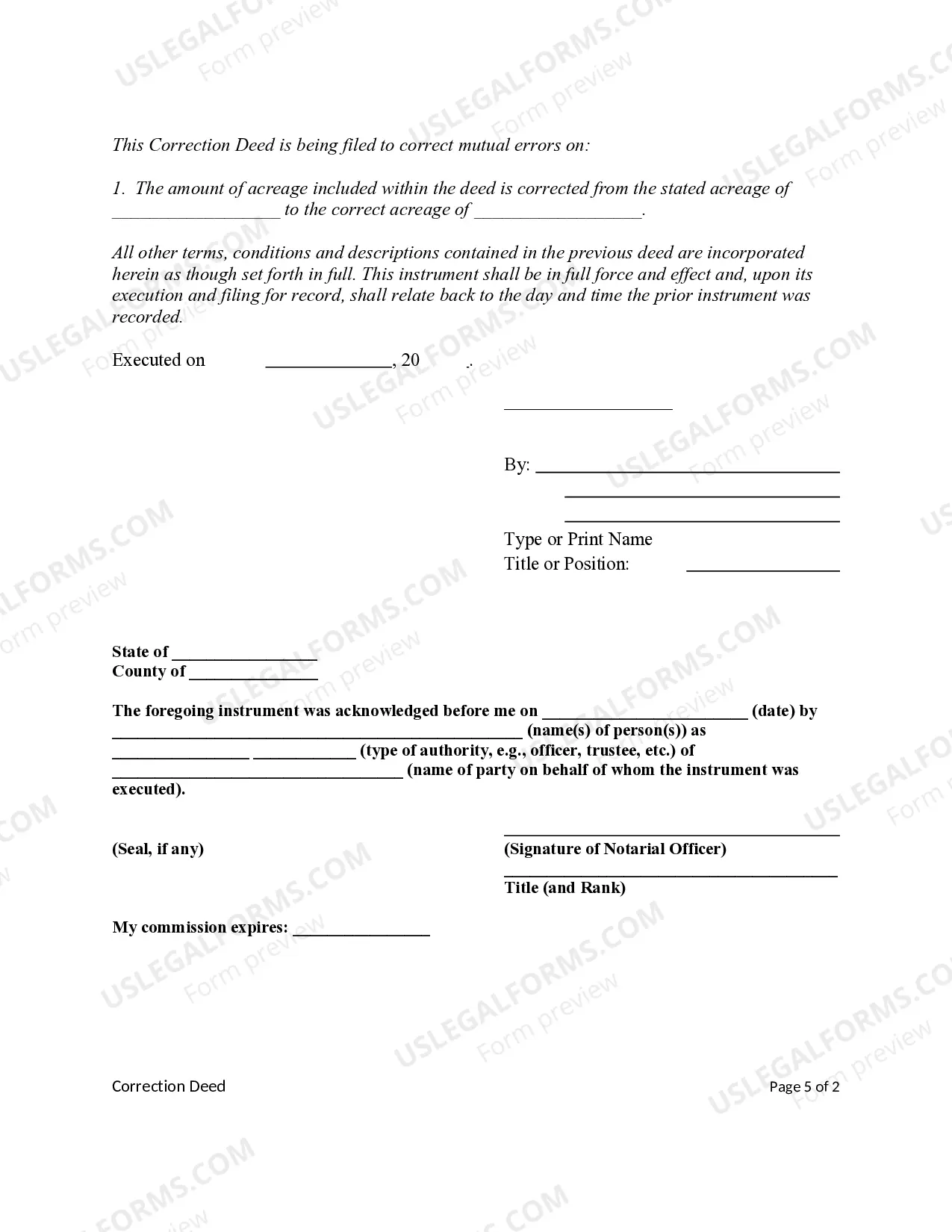

Form components explained

- Identification of parties: Names of the Grantor and Grantee involved in the deed.

- Correction details: Specific areas of the mineral deed that require correction.

- Property description: Legal description of the mineral rights or property involved.

- Signatures: Required signatures from both the Grantor and Grantee to validate the correction.

- Date of execution: The date on which the Correction Mineral Deed is signed.

Common use cases

This form should be used when there has been a mutual mistake in a previously executed mineral deed. Common scenarios include instances where the acreage stated was incorrect or where specific terms were not accurately reflected. Utilizing a Correction Mineral Deed ensures that all parties have a clear and corrected understanding of their mineral rights.

Intended users of this form

- Individuals who have previously entered into a mineral deed and need to amend it due to errors.

- Grantors who need to correct details affecting their rights or interests in mineral properties.

- Grantees seeking to clarify their ownership or legal rights following an error in a prior deed.

- Anyone involved in mineral rights transactions where accurate documentation is essential for legal clarity.

Completing this form step by step

- Identify the parties by filling in the names of the Grantor and Grantee.

- Specify the property by accurately describing the mineral rights being amended.

- Enter the corrections needed, such as the correct acreage or any other details that need adjustment.

- Ensure all parties review and sign the document to affirm the corrections.

- Date the document at the time of signing to establish when the correction becomes effective.

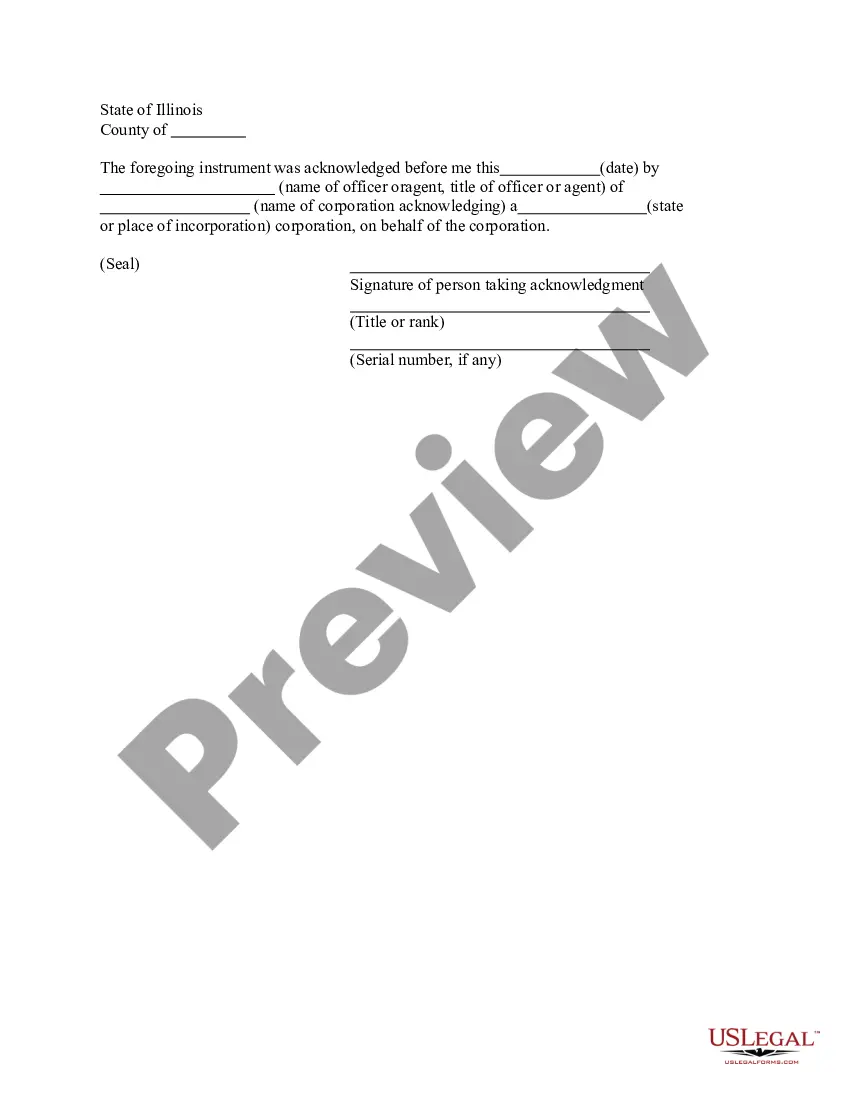

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all required signatures from both Grantor and Grantee.

- Not accurately describing the property details leading to confusion over ownership.

- Using the wrong form for minor corrections instead of a Correction Mineral Deed.

- Neglecting to date the form, which can create issues for record-keeping.

Why use this form online

- Convenient access to professionally crafted legal forms available for instant download.

- Editability in formats that allow users to enter correct information readily.

- Ensures compliance with state laws through attorney-reviewed materials.

- Time-saving by eliminating the need for in-person visits to legal offices.

Looking for another form?

Form popularity

FAQ

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds. The county will return the recorded original documents to the new owner.

A mineral owner's rights typically include the right to use the surface of the land to access and mine the minerals owned. This might mean the mineral owner has the right to drill an oil or natural gas well, or excavate a mine on your property.

Step 1 Fill in the grantor's name and address along with indicating whether or not the grantor is married. Step 2 Enter the consideration to be paid for the property. Step 3 Write in the grantee's name and address and check the box showing how they intend to hold the property.

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

A: Mineral rights are the legal rights to the minerals in a property. Whoever owns a property's mineral rights has full legal rights to mine for and profit from those minerals.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

The price of mineral rights per acre ranges from under $500 to over $5,000.

Fill out the "grantor" section of the warranty deed. The grantors are the givers, or current owners, of the property. Use the legal name of each grantor and insert current addresses after each grantor's name.