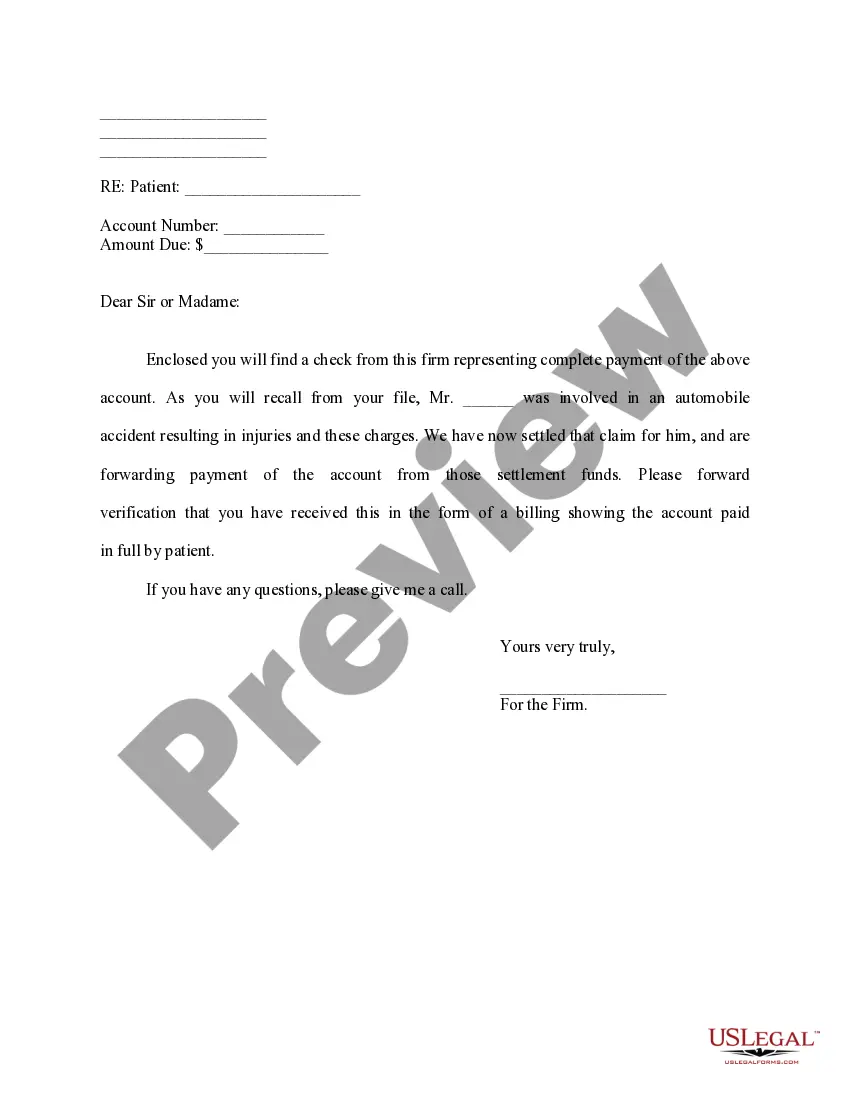

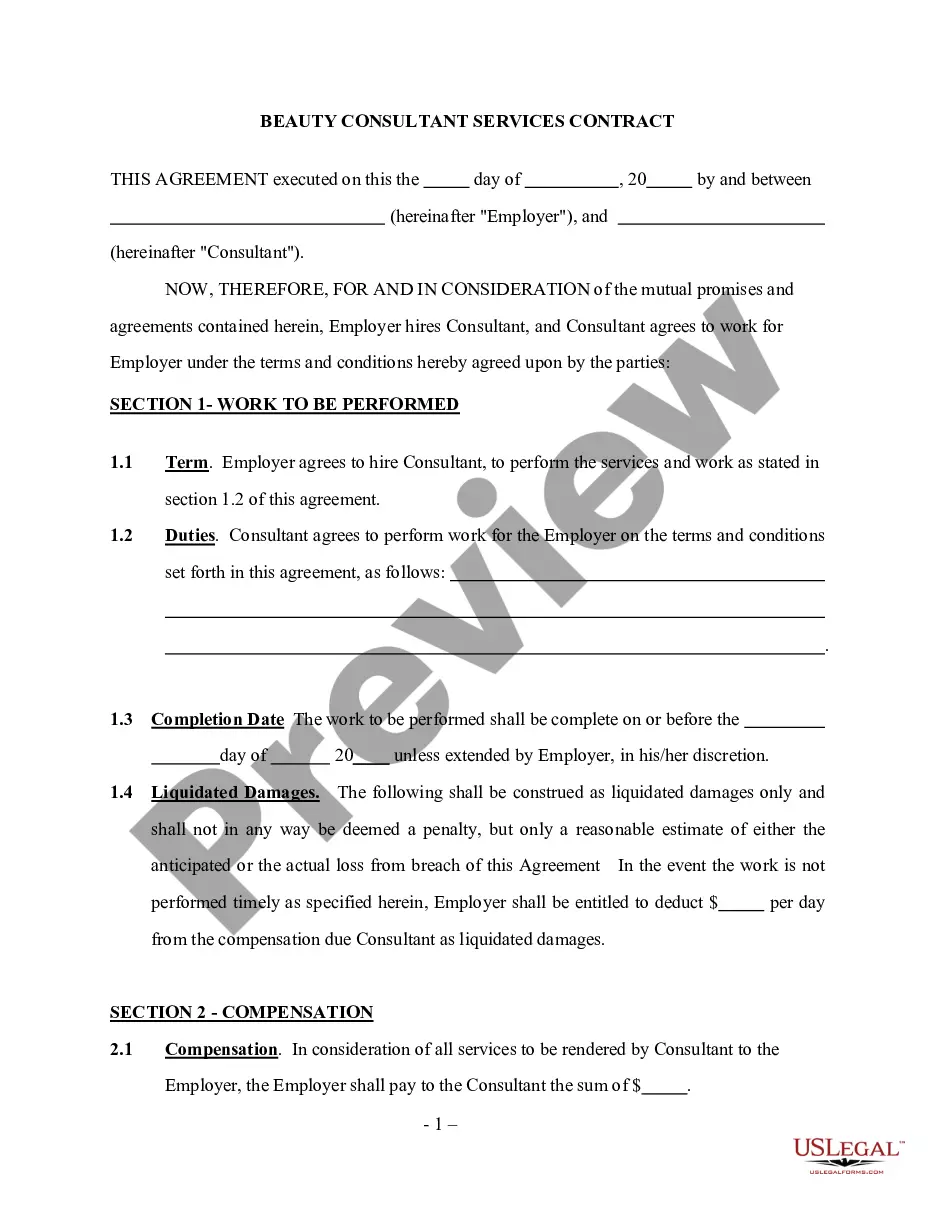

Ohio Letter regarding Wage Statement

Description

How to fill out Letter Regarding Wage Statement?

If you wish to comprehensive, down load, or print legal papers layouts, use US Legal Forms, the largest collection of legal forms, that can be found on the Internet. Utilize the site`s simple and easy handy search to discover the papers you need. Various layouts for business and specific reasons are categorized by types and says, or key phrases. Use US Legal Forms to discover the Ohio Letter regarding Wage Statement within a handful of clicks.

In case you are already a US Legal Forms buyer, log in to your account and click the Acquire button to get the Ohio Letter regarding Wage Statement. You can even gain access to forms you previously saved inside the My Forms tab of your respective account.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the form for your proper area/land.

- Step 2. Use the Preview choice to look over the form`s information. Never forget about to read the information.

- Step 3. In case you are not happy together with the develop, make use of the Look for industry towards the top of the display screen to get other variations in the legal develop web template.

- Step 4. After you have discovered the form you need, click the Buy now button. Pick the costs strategy you choose and add your accreditations to register on an account.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting in the legal develop and down load it on your gadget.

- Step 7. Full, revise and print or sign the Ohio Letter regarding Wage Statement.

Each legal papers web template you get is the one you have forever. You have acces to every single develop you saved with your acccount. Click the My Forms segment and choose a develop to print or down load again.

Compete and down load, and print the Ohio Letter regarding Wage Statement with US Legal Forms. There are thousands of skilled and status-specific forms you may use for the business or specific demands.

Form popularity

FAQ

Reciprocity Exemption: If you are a resident of Indiana, Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax on your compensation. Instead, you should have your employer withhold income tax for your resident state.

Ohio's overtime law requires employees to be paid at a rate of 1.5 times the employee's wage rate for hours worked over 40 in a work week, except for those employers grossing less than $150,000 per year. Ohio requires employers to pay employees no less than on or before the 15th and 30th of each month.

Every employer maintaining an office or transacting business within the state of Ohio and making payment of any compensation to an employee, whether a resident or nonresident, must withhold Ohio income tax.

Go to the Ohio Department of Job and Family Services website to register your business. You'll receive your account number and tax rate instantly after completing the online registration. The new employer SUTA rate for 2023 is 2.7% or 5.6% if your business is in the construction industry, with a wage base of $9,000.

How do I file a wage/hour or labor standards claim in Ohio? The Ohio Department of Commerce's Division of Labor and Worker Safety, Wage and Hour Bureau handles wage and hour complaints. There are separate forms for filing a minimum wage complaint and for filing a prevailing wages complaint.