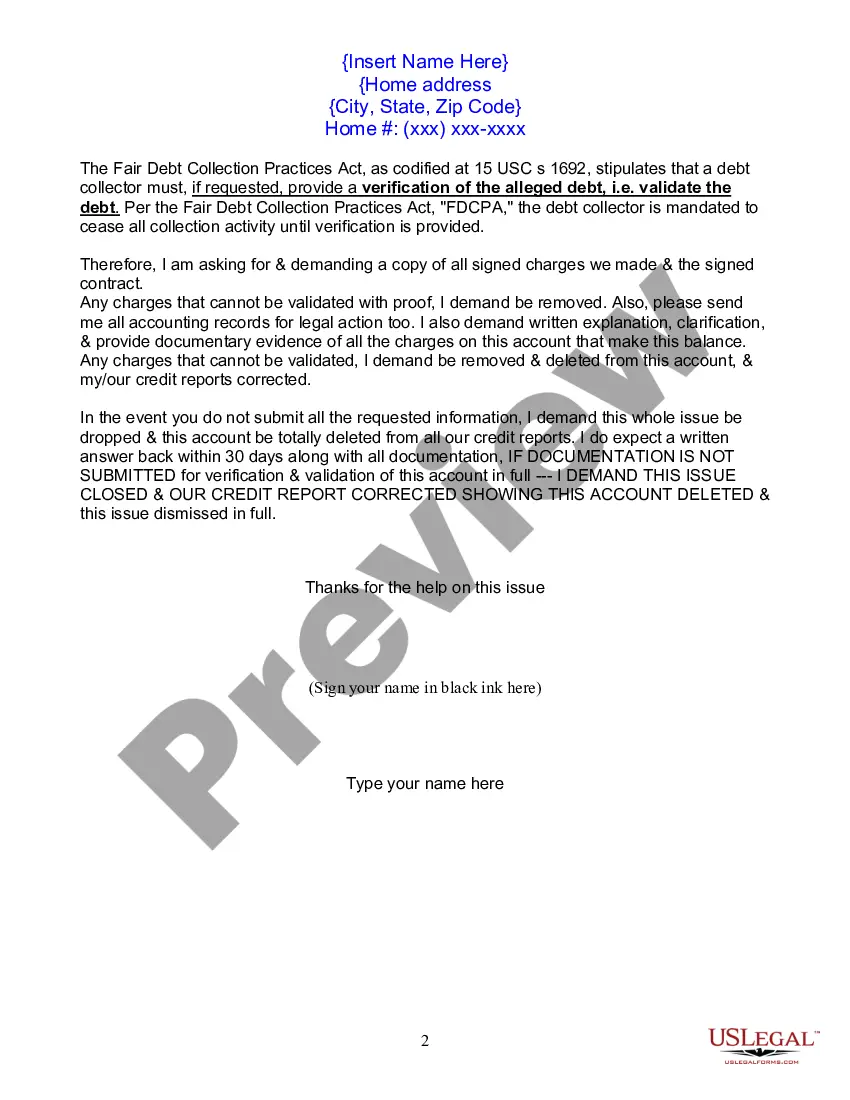

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Ohio Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

If you need to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the site’s user-friendly and efficient search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, select the Get Now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Ohio Letter of Dispute - Complete Balance in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Ohio Letter of Dispute - Complete Balance.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

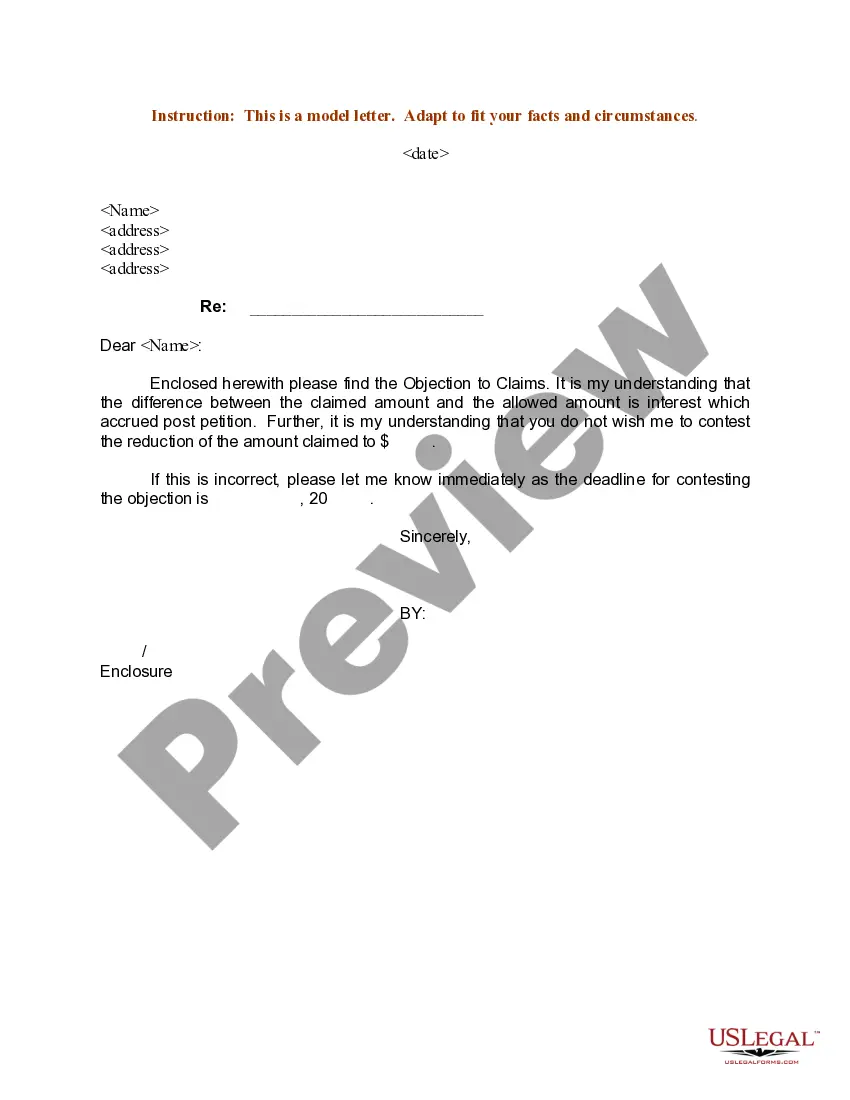

When writing a payment dispute letter, start by clearly identifying the payment in question and the reason for the dispute. Use the Ohio Letter of Dispute - Complete Balance to structure your letter effectively, ensuring you include any supporting documentation that validates your claim. It’s important to maintain a professional tone throughout the letter while clearly articulating your stance. This approach will help facilitate a resolution and ensure your concerns are taken seriously.

Writing a successful dispute letter involves being clear and concise about the issue at hand. Begin your letter with a clear statement of the dispute, including any pertinent details. Incorporate the Ohio Letter of Dispute - Complete Balance format to guide you through the process and ensure you cover all necessary points. Conclude by stating your desired outcome and providing your contact information for further communication.

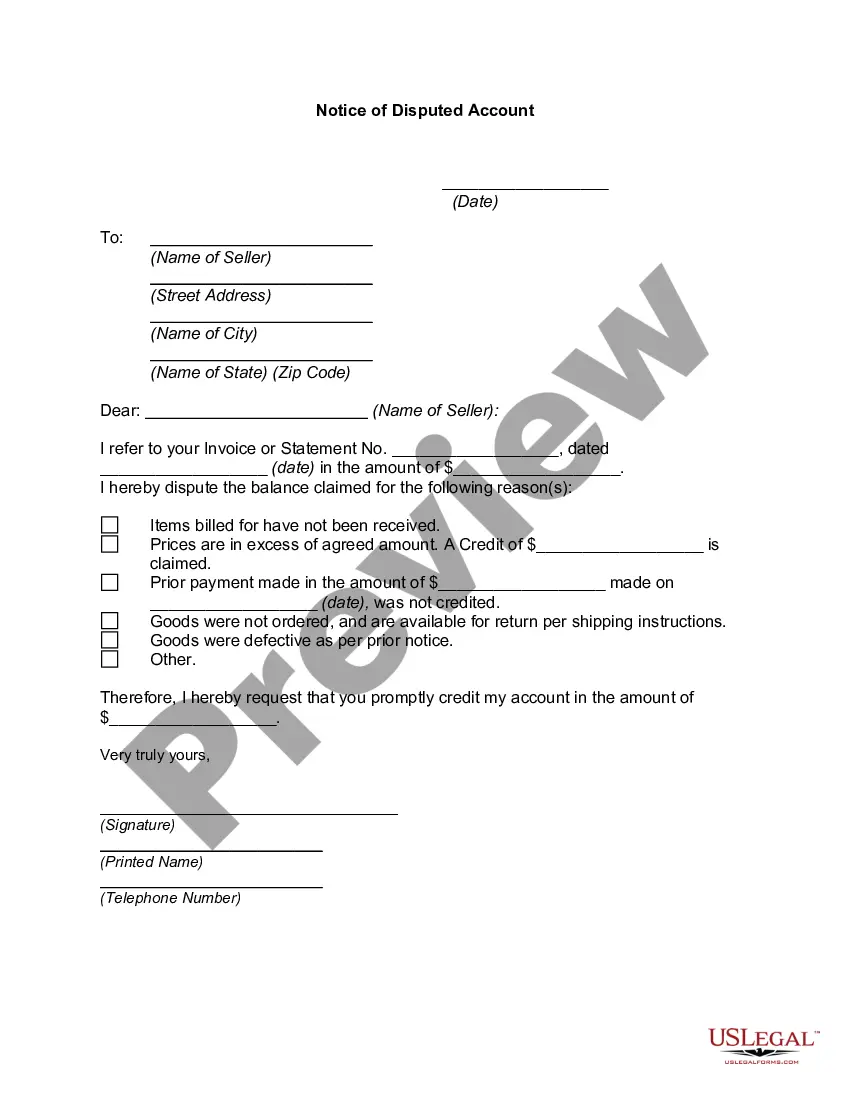

To fill out a dispute form effectively, start by gathering all relevant information regarding the dispute. Clearly state the nature of the dispute, providing any necessary details such as account numbers and dates. Use the Ohio Letter of Dispute - Complete Balance template available on US Legal Forms to ensure you include all required sections. Finally, review your completed form for accuracy before submission to strengthen your case.

In Ohio, a debt typically becomes uncollectible after six years, starting from the last payment date or the last time you acknowledged the debt. This timeframe is crucial because it impacts your rights and obligations. If you're unsure about your debt status, consider using an Ohio Letter of Dispute - Complete Balance to formally challenge any inaccuracies. This letter can help clarify your position and potentially resolve issues before they escalate.

Yes, 609 dispute letters can be effective in resolving inaccuracies on your credit report. When properly drafted and submitted to credit bureaus, they often lead to corrections or removals of erroneous information. By leveraging the Ohio Letter of Dispute - Complete Balance, you can improve your chances of achieving a favorable outcome.

The primary difference between a 609 and a 604 dispute letter lies in their focus. A 609 letter requests verification of information, while a 604 letter focuses on the accuracy of consumer reports. Both letters serve important roles, and using the Ohio Letter of Dispute - Complete Balance can help you identify which approach best suits your needs.

A 609 dispute letter is a type of correspondence you send to credit bureaus to challenge inaccurate or unverifiable information on your credit report. The letter references Section 609 of the Fair Credit Reporting Act, which gives you the right to request the details of the information being reported. Using the Ohio Letter of Dispute - Complete Balance can streamline this process and ensure you cover all necessary points.

An example of a 609 credit dispute letter includes a clear statement of your identity, details of the account in question, and the specific items you dispute. It should also request that the credit bureau verify the accuracy of the information. By utilizing the Ohio Letter of Dispute - Complete Balance, you can ensure that your letter is organized and effective in addressing the issues with your credit report.

Typically, you may start seeing results from a 609 letter within 30 to 45 days. This timeframe allows credit bureaus to investigate your dispute and respond to your claims. When you use the Ohio Letter of Dispute - Complete Balance, you enhance your chances of a timely and accurate response, as it provides a structured approach to presenting your case.

An example of a dispute letter for debt is a formal letter you send to a creditor or credit bureau, stating that you believe there is an error in your account. In this letter, you clearly identify the disputed debt, explain the reason for the dispute, and request verification. Using the Ohio Letter of Dispute - Complete Balance template can help you create a comprehensive letter that clearly communicates your concerns.