Ohio Self-Employed Steel Services Contract

Description

How to fill out Self-Employed Steel Services Contract?

Are you currently in a scenario where you require documents for either business or personal needs nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a wide array of template forms, such as the Ohio Self-Employed Steel Services Contract, that are crafted to comply with state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you want, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Self-Employed Steel Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

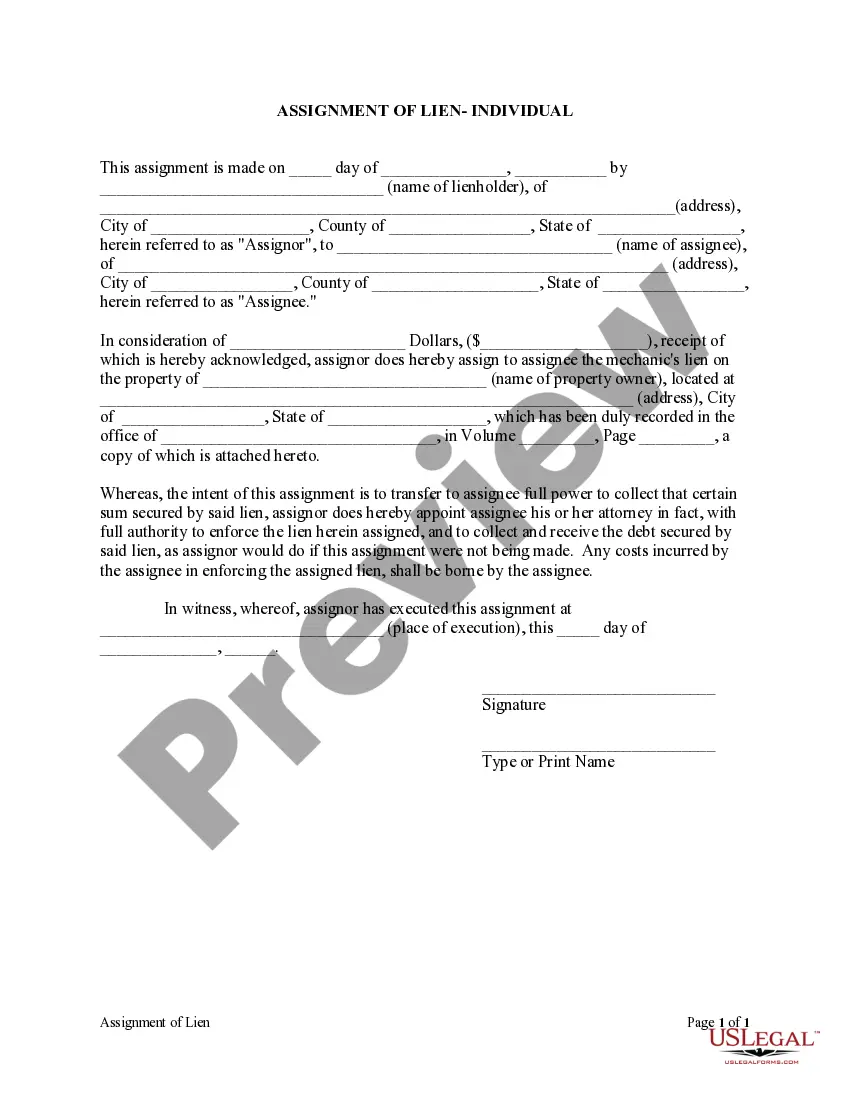

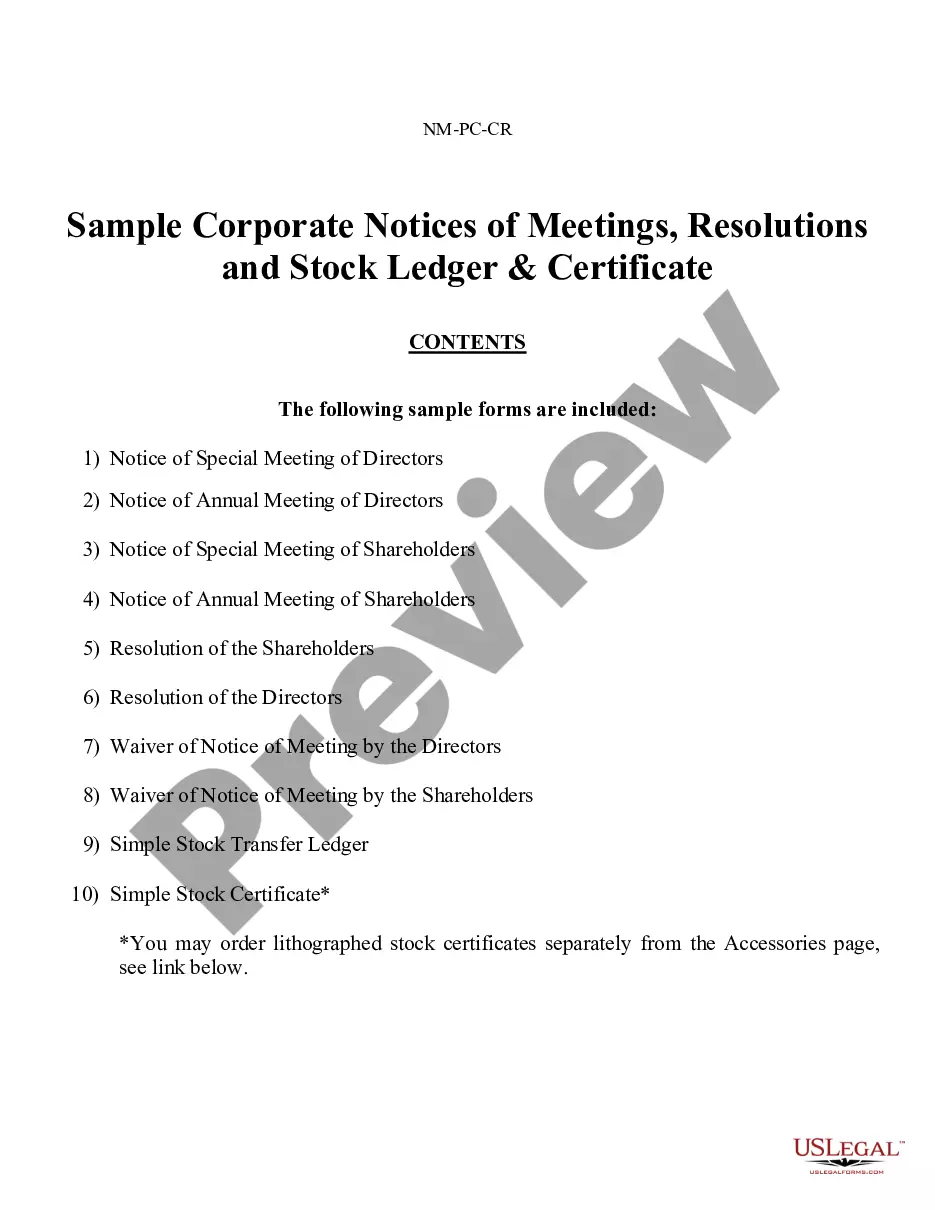

- Use the Review feature to evaluate the form.

- Examine the details to ensure you have selected the correct form.

- If the form is not what you need, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Yes, you can write your own legally binding contract for your Ohio Self-Employed Steel Services Contract. It is important to ensure that your contract includes all necessary legal elements, such as offer, acceptance, and consideration. For added assurance, consider using templates from uslegalforms, which can help you create a contract that stands up in court.

To write a contract agreement for services related to your Ohio Self-Employed Steel Services Contract, start by detailing the services to be performed, timelines, and payment terms. Clearly outline responsibilities and any conditions for termination. Using uslegalforms can simplify this process by providing templates that ensure all essential elements are included.

To become an independent contractor in Ohio, you need to register your business, obtain any necessary licenses, and understand tax obligations. It is also important to create a solid Ohio Self-Employed Steel Services Contract that outlines your services and payment terms. Platforms like uslegalforms can provide valuable resources and templates to help you navigate this process.

Writing a simple service agreement for your Ohio Self-Employed Steel Services Contract involves outlining the services offered, the duration of the agreement, and the payment structure. It is important to use clear language to avoid misunderstandings. Consider using uslegalforms, where you can find straightforward templates to guide you in crafting a comprehensive service agreement.

To write a simple contract agreement for your Ohio Self-Employed Steel Services Contract, start by clearly defining the parties involved and the services to be provided. Include sections for payment details, timelines, and any specific terms or conditions. Utilizing a service like uslegalforms can streamline this process, offering templates that cover all necessary aspects.

Yes, you can write your own service agreement for your Ohio Self-Employed Steel Services Contract. However, it is essential to include key elements such as the scope of work, payment terms, and responsibilities of both parties. By using a template from a reliable platform, like uslegalforms, you can ensure that your agreement meets legal standards and protects your interests.

Establishing yourself as an independent contractor requires planning and professionalism. Begin by defining your services and target market clearly. Utilize an Ohio Self-Employed Steel Services Contract to formalize client agreements and set expectations. By delivering quality work and maintaining good communication, you can build a strong reputation and a steady stream of clients.

To become a subcontractor in Ohio, start by registering your business and obtaining any necessary licenses. Networking with general contractors is key, as they often seek reliable subcontractors for projects. Additionally, consider using an Ohio Self-Employed Steel Services Contract to formalize your agreements. This contract can help you outline your responsibilities and payment terms, making you a more attractive partner in the industry.

Yes, having a contract is essential for independent contractors. An Ohio Self-Employed Steel Services Contract clearly outlines the terms of your work, payment details, and project expectations. This not only protects your interests but also ensures clarity for your clients. By using a well-drafted contract, you can prevent misunderstandings and establish a professional relationship.

In Ohio, construction services are generally subject to sales tax. This includes services related to the installation of tangible personal property. However, if you are operating under an Ohio Self-Employed Steel Services Contract, certain exemptions may apply depending on the specifics of your project. It's essential to consult with a tax professional or utilize resources like USLegalForms to ensure you comply with all tax obligations.