Ohio Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

If you require to thoroughly, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Leverage the site's user-friendly and convenient search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Ohio Drafting Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Ohio Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms client, sign in to your account and click the Download button to obtain the Ohio Drafting Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

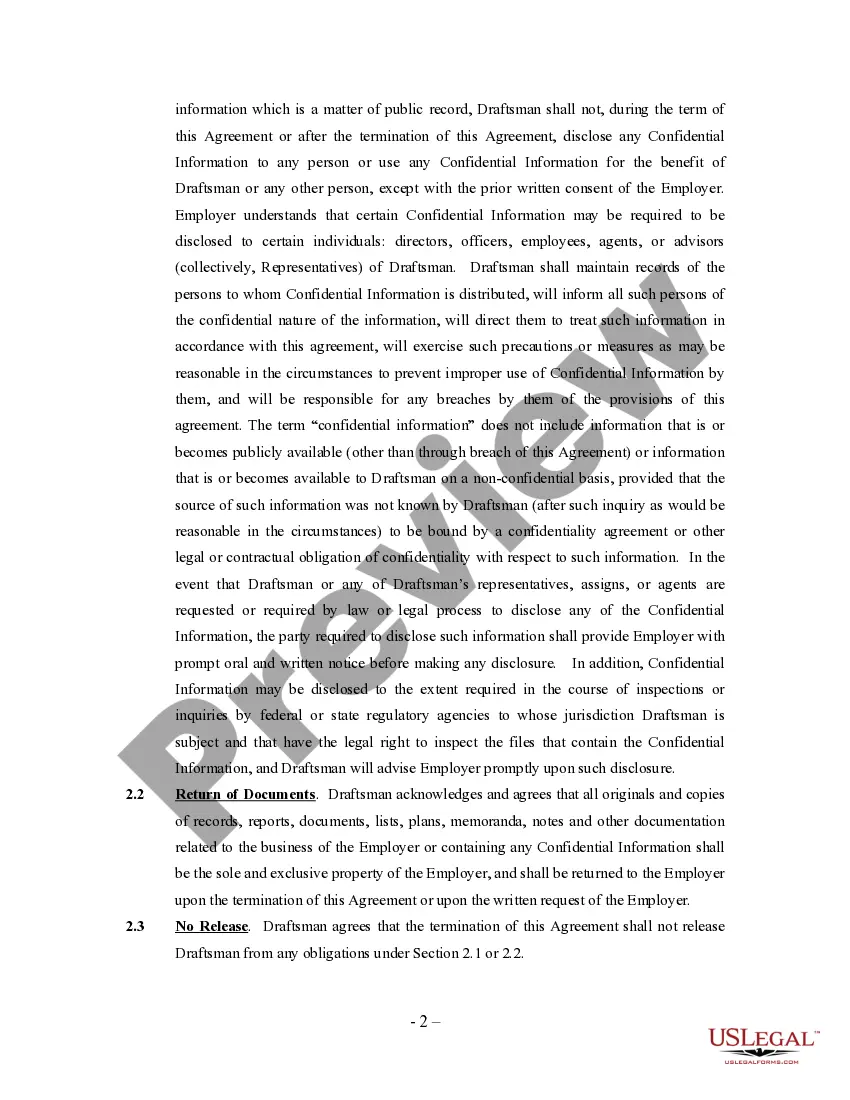

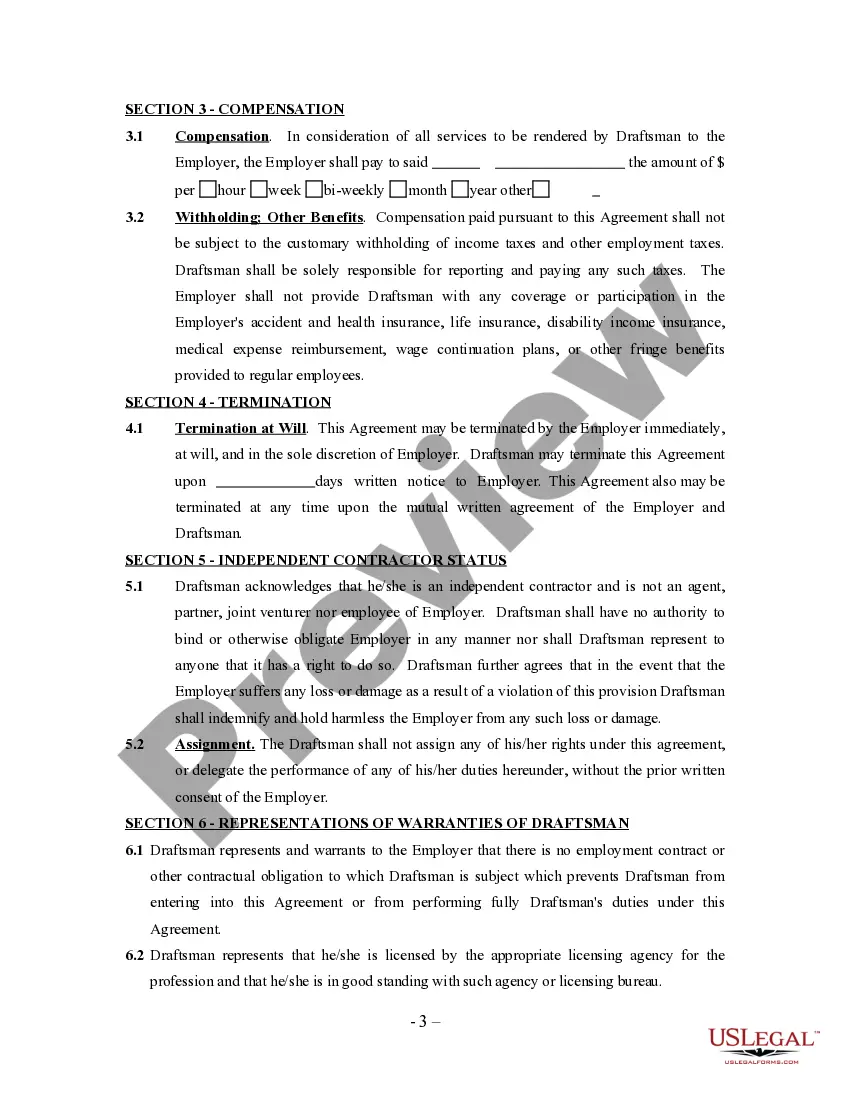

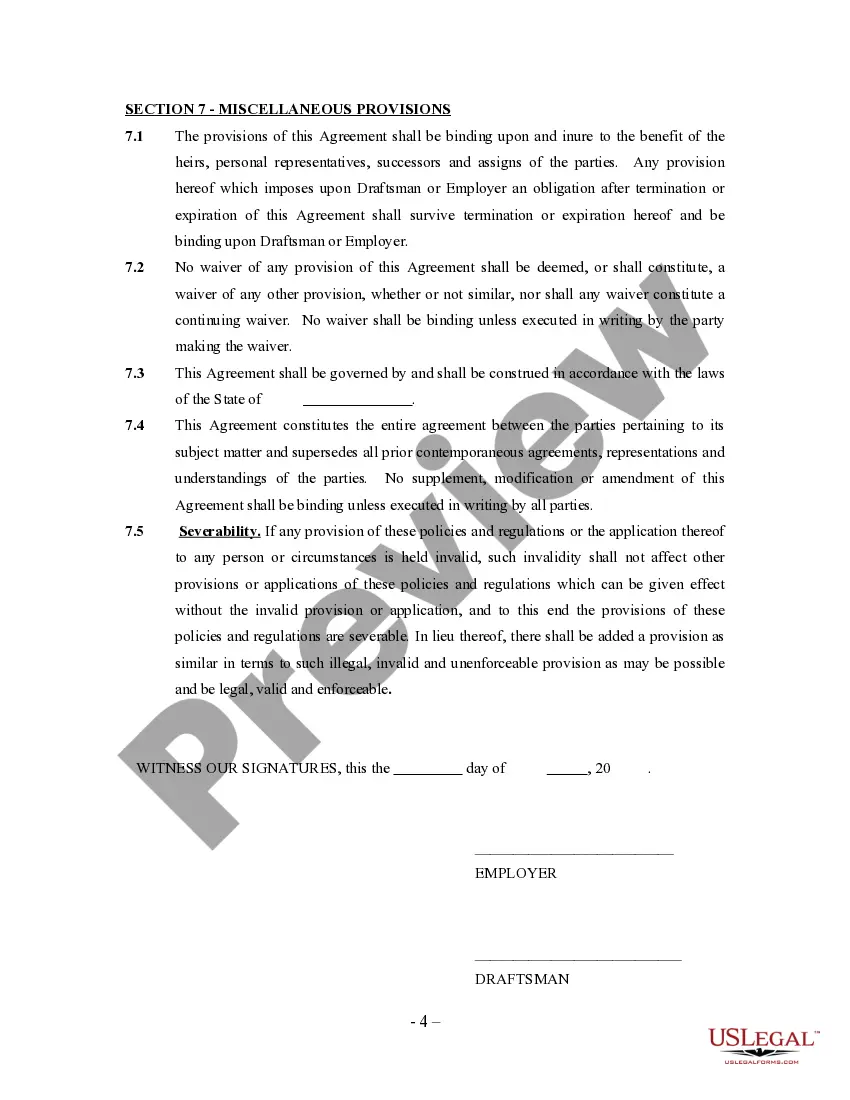

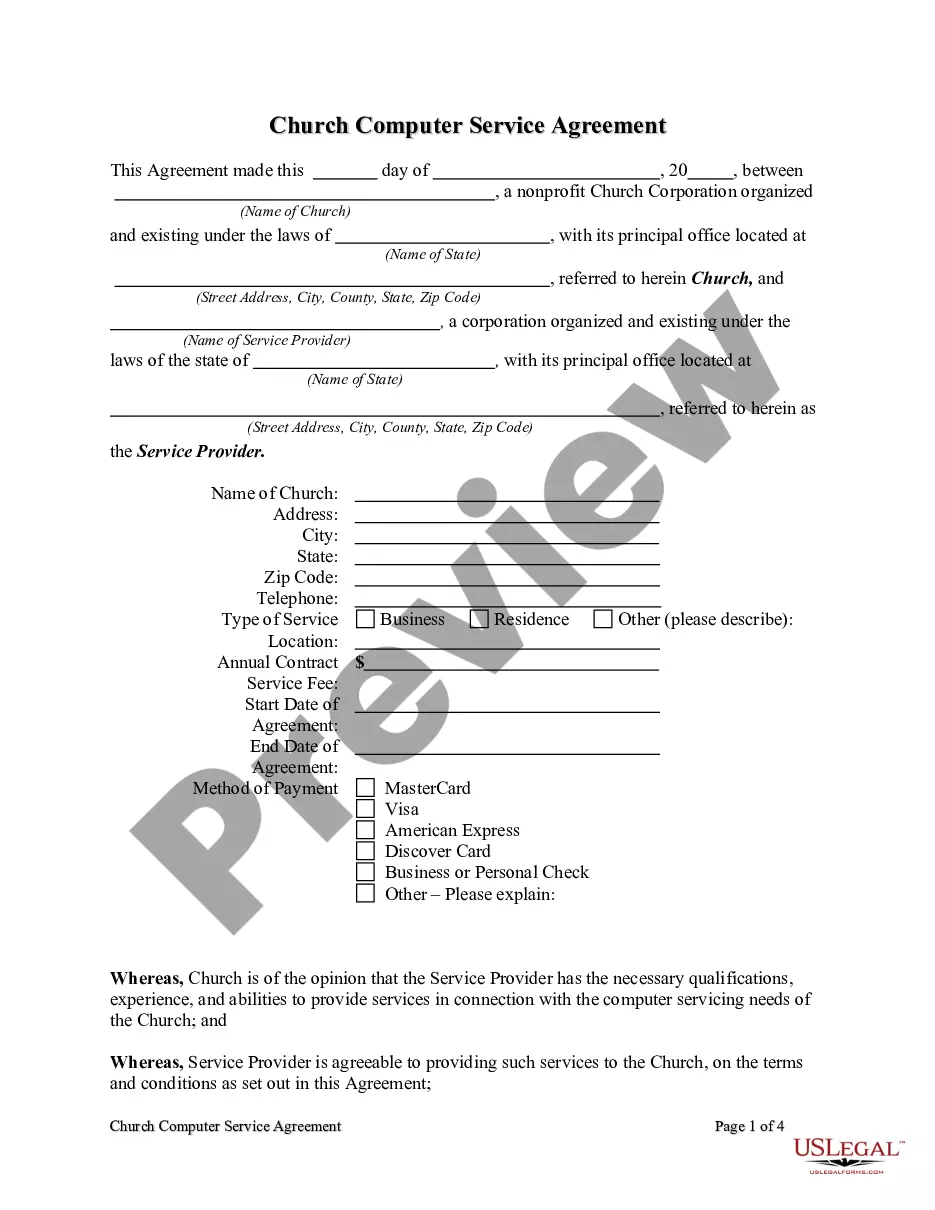

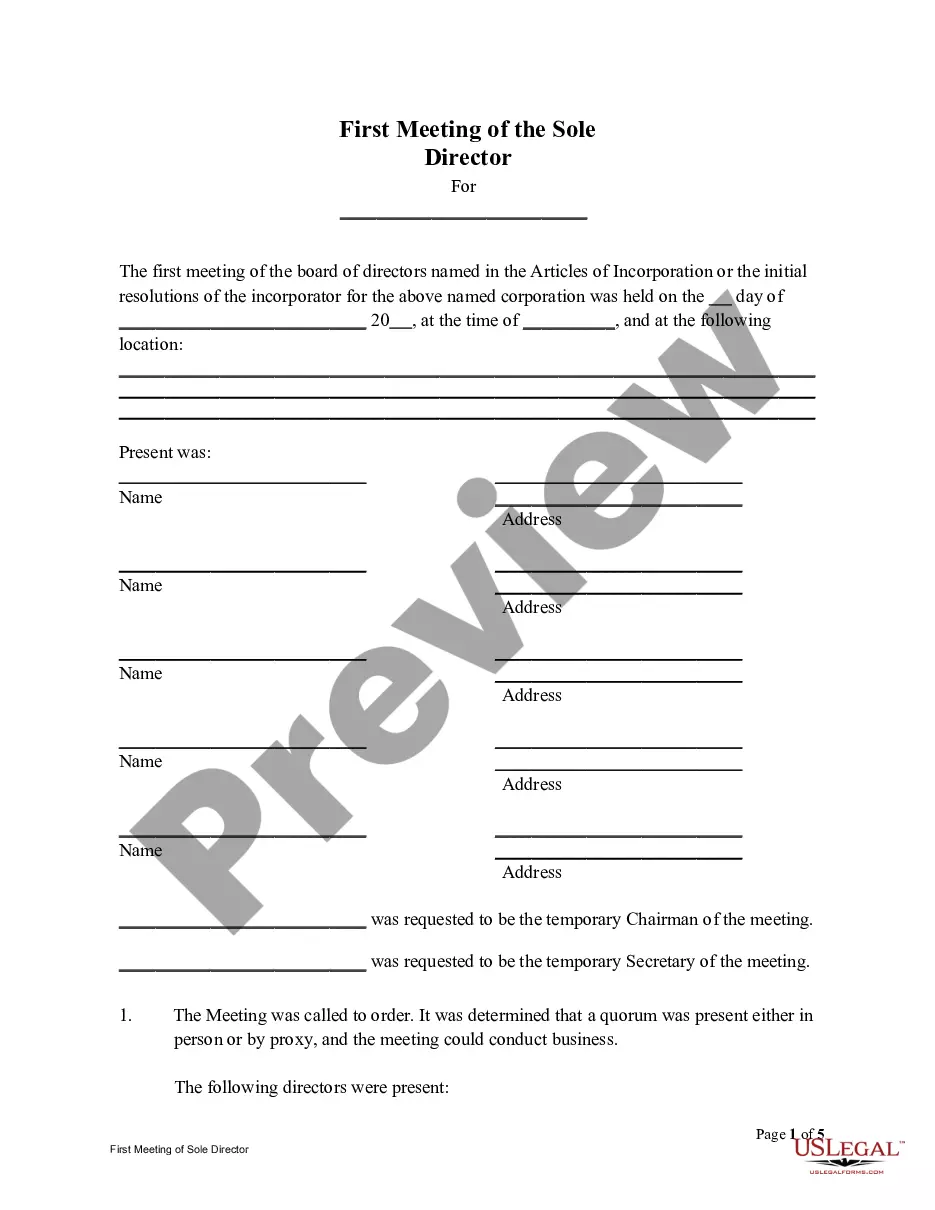

- Step 2. Use the Preview option to review the form's content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms in the legal form format.

- Step 4. Once you have found the form you need, click the Buy now button.

- Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Ohio Drafting Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Yes, you can create your own legally binding contract in Ohio, provided it meets legal requirements. A well-crafted Ohio Drafting Agreement - Self-Employed Independent Contractor can protect your rights and outline the terms of your work. It is advisable to make sure your contract addresses essential elements, such as payment terms and project scope. Using platforms like uslegalforms can simplify the drafting process and ensure your agreement is tailored to your needs.

In Ohio, you generally do not need a specific license to work as an independent contractor. However, depending on your profession, you may need certain permits or certifications. It is crucial to check local regulations to ensure compliance. Having a clear Ohio Drafting Agreement - Self-Employed Independent Contractor can also help formalize your business arrangement.

To create an independent contractor agreement, start by clearly defining the roles and responsibilities of both parties involved. Include pertinent details such as payment terms, project deadlines, and any confidentiality requirements in the Ohio Drafting Agreement - Self-Employed Independent Contractor. You can draft the agreement from scratch or use a template for efficiency. For a simple approach, consider uslegalforms, where you can find easy-to-use templates that cover all critical aspects of contractor agreements.

Typically, the employer or business owner writes the independent contractor agreement. They outline the terms and expectations for the work involved in the Ohio Drafting Agreement - Self-Employed Independent Contractor. However, both parties can discuss and modify the contract to fit their needs. Utilizing a service like uslegalforms can help streamline the drafting process and ensure that all legal requirements are met.

Yes, you can write your own legally binding contract, including an Ohio Drafting Agreement - Self-Employed Independent Contractor. However, it's essential to ensure that your contract includes all necessary elements, such as the scope of work, payment terms, and termination clauses. Using a template can guide you in structuring your contract correctly. Consider using a reliable platform like uslegalforms, which offers customized templates for independent contractor agreements.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.