Ohio Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

If you want to obtain, acquire, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms that are accessible online.

Take advantage of the site’s simple and convenient search feature to find the documents you need.

Different templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click on the Get Now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to get the Ohio Door Contractor Agreement - Self-Employed in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to obtain the Ohio Door Contractor Agreement - Self-Employed.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form pertinent to your city/state.

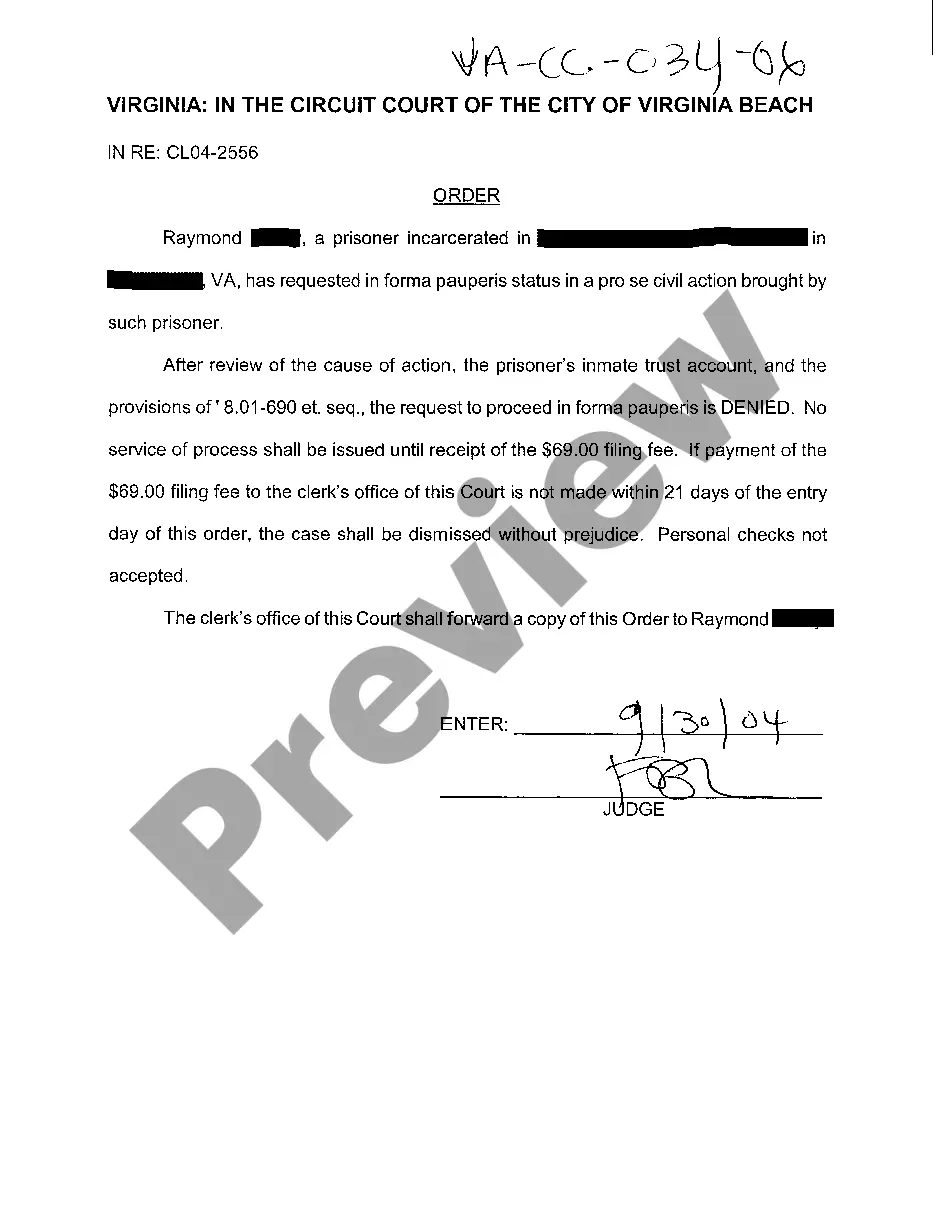

- Step 2. Utilize the Review option to examine the form's content. Don't forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In Ohio, an operating agreement is not required for sole proprietors or independent contractors. However, if your business structure is an LLC, having an operating agreement can clarify the management and ownership of your business. While it’s not a legal necessity, it can benefit you by defining roles and protecting your interests. Consider using US Legal Forms to get straightforward templates to assist you.

Creating an independent contractor agreement is key to defining your working relationship. Start by outlining the scope of work, payment terms, and deadlines. It's also wise to include confidentiality clauses and dispute resolution methods. US Legal Forms offers customizable templates that can help you draft an Ohio Door Contractor Agreement - Self-Employed easily and efficiently.

As an independent contractor in Ohio, you typically do not need a specific license to operate, but it’s important to check local regulations. Ensure you understand any permits or zoning laws that apply to your work. If you're involved in specialized areas, like electrical work or plumbing, additional licensing may be required. For details, consult the Ohio Department of Commerce or your local authority.

Independent contractors in Ohio are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. Additionally, they must file income taxes based on their earnings, and they can often deduct business expenses from their taxable income. Using an Ohio Door Contractor Agreement - Self-Employed can help clarify your income sources and expenses, making tax preparation more straightforward.

Yes, an independent contractor falls under the category of self-employed individuals. They have the freedom to choose how and when they work, which distinguishes them from employees. With an Ohio Door Contractor Agreement - Self-Employed, these contractors can define their roles and responsibilities, ensuring a mutual understanding with clients.

Yes, an independent contractor is indeed considered self-employed. This classification means they operate their own business and manage their own schedules, rather than following a traditional employment structure. An Ohio Door Contractor Agreement - Self-Employed is a great tool for independent contractors because it outlines terms clearly, helping them establish their business relationships.

To be considered self-employed, you must work for yourself rather than an employer. This means you offer services or products independently, without a permanent contract to a specific company. In the context of an Ohio Door Contractor Agreement - Self-Employed, you would receive payment directly from clients, rather than through a payroll system.

To fill out an independent contractor agreement, provide the contractor's name and contact info, then describe the services to be rendered in detail. You should also include payment schedules, project milestones, and termination conditions. Make sure to review your document carefully; platforms like uslegalforms can guide you in crafting a solid Ohio Door Contractor Agreement - Self-Employed.

An independent contractor typically completes various paperwork, including their agreement, tax forms, and invoices. They may also need to submit a W-9 form for tax purposes and any additional documentation specific to their project. Utilizing resources like uslegalforms can help simplify the process of creating an Ohio Door Contractor Agreement - Self-Employed.

To complete a declaration of independent contractor status form, begin by listing your personal information and the legal entity details if applicable. Describe the services you provide and confirm your relationship status as a self-employed contractor. For precise templates, check uslegalforms for an Ohio Door Contractor Agreement - Self-Employed that suits your needs.