Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

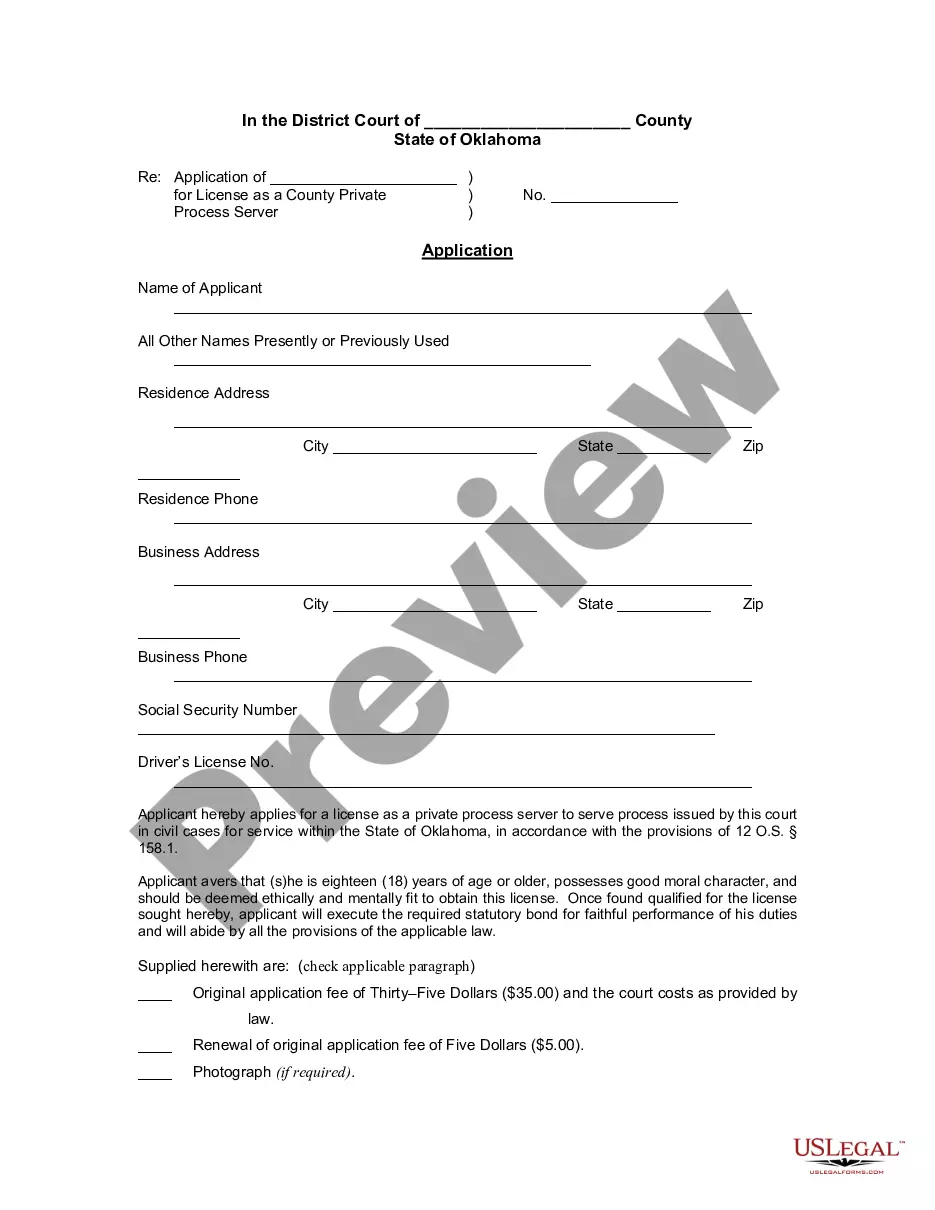

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

US Legal Forms - one of several biggest libraries of lawful types in America - delivers a wide range of lawful record templates you can obtain or print. Utilizing the website, you will get thousands of types for enterprise and specific uses, categorized by classes, says, or keywords.You can find the most recent variations of types such as the Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on within minutes.

If you currently have a monthly subscription, log in and obtain Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on from the US Legal Forms collection. The Download option can look on every type you look at. You have accessibility to all previously saved types within the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed here are straightforward recommendations to get you started out:

- Be sure you have selected the correct type for the town/state. Go through the Review option to examine the form`s content material. Look at the type explanation to ensure that you have selected the right type.

- If the type does not match your needs, utilize the Research industry on top of the display screen to obtain the one that does.

- When you are pleased with the form, confirm your decision by clicking the Purchase now option. Then, select the pricing program you like and supply your qualifications to sign up for the accounts.

- Procedure the transaction. Make use of credit card or PayPal accounts to finish the transaction.

- Select the formatting and obtain the form on your own gadget.

- Make adjustments. Load, edit and print and sign the saved Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Each and every design you included with your account lacks an expiration date and it is the one you have for a long time. So, if you want to obtain or print another duplicate, just visit the My Forms section and click on the type you want.

Obtain access to the Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on with US Legal Forms, one of the most comprehensive collection of lawful record templates. Use thousands of skilled and condition-certain templates that satisfy your small business or specific requirements and needs.