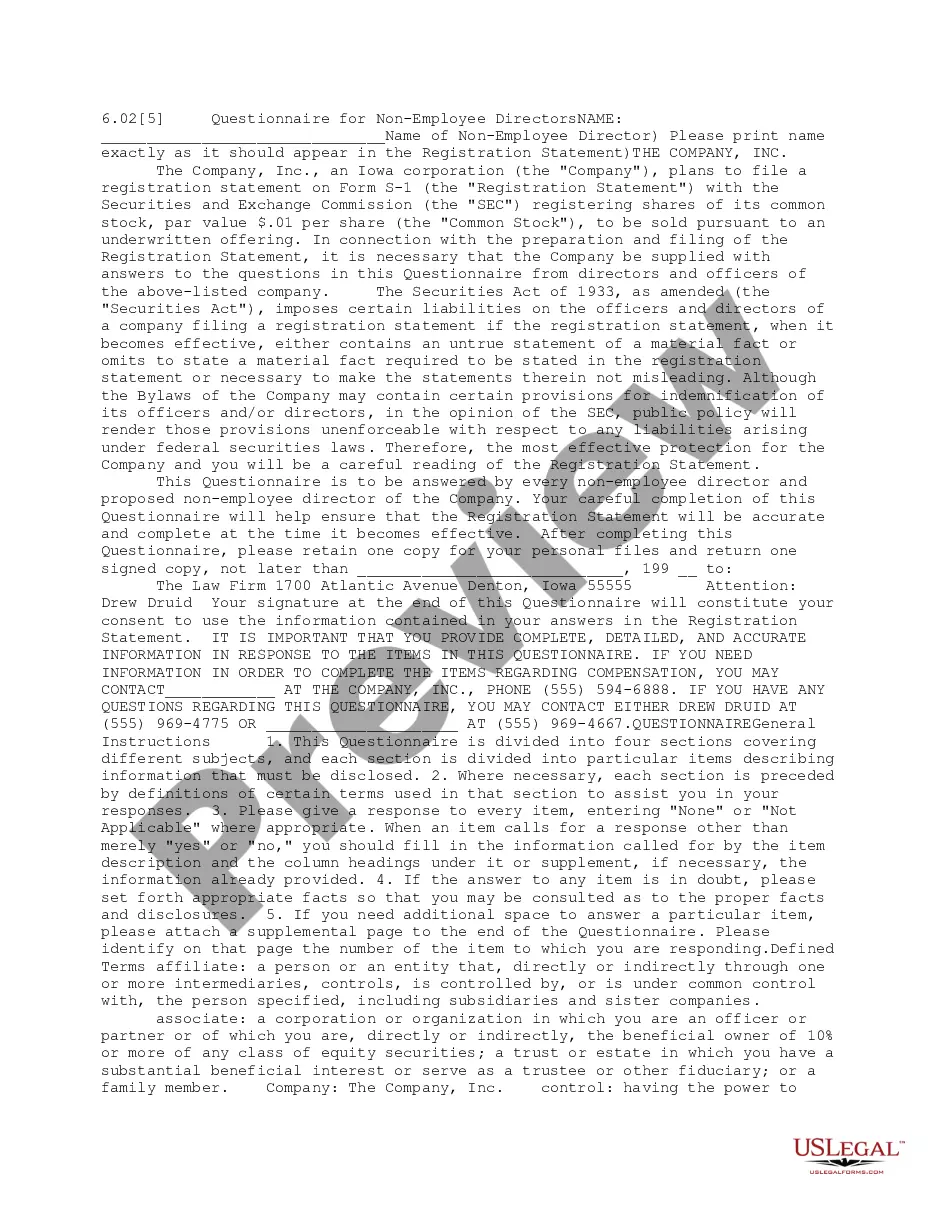

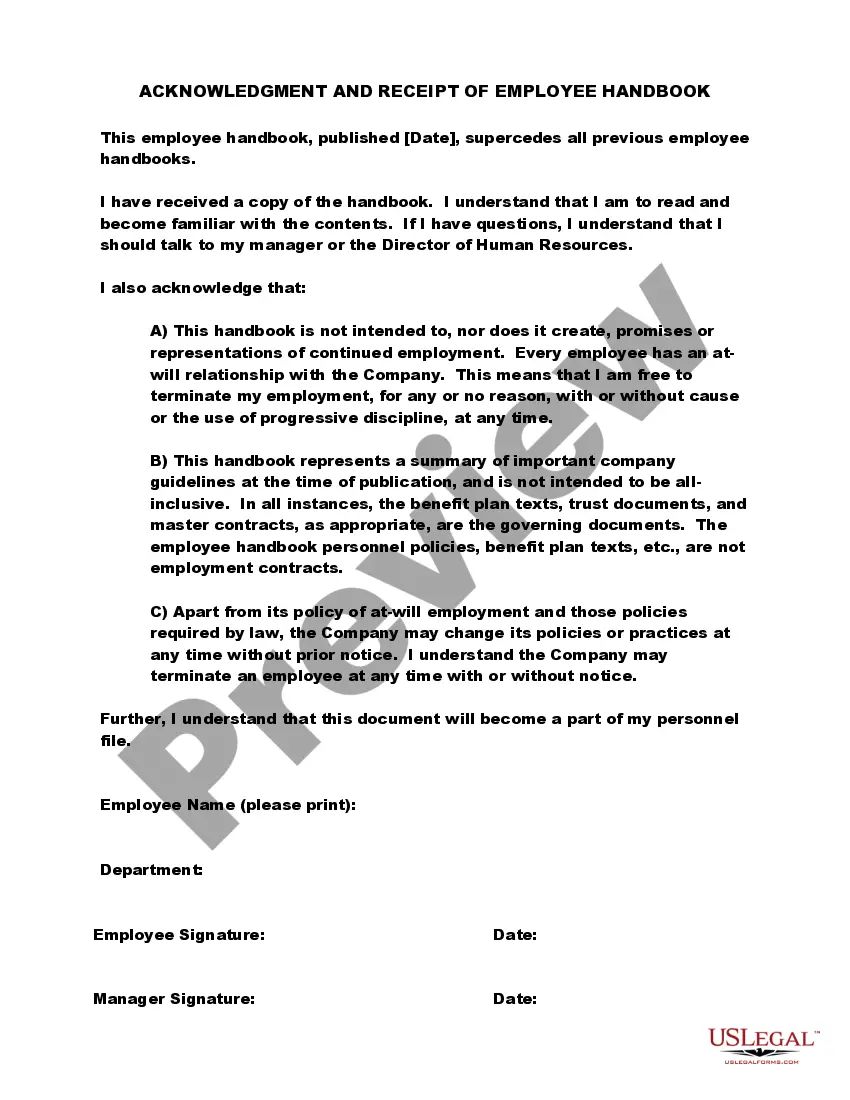

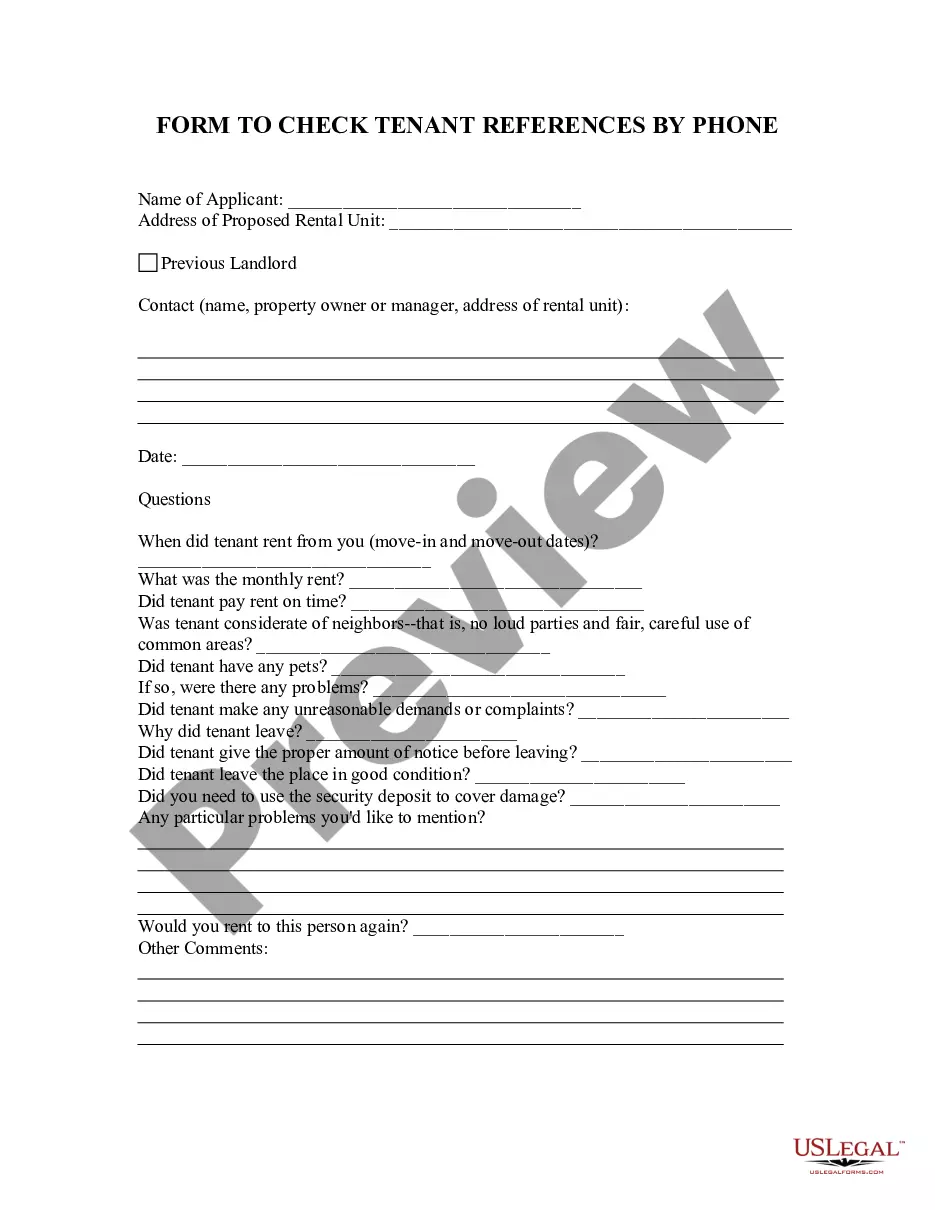

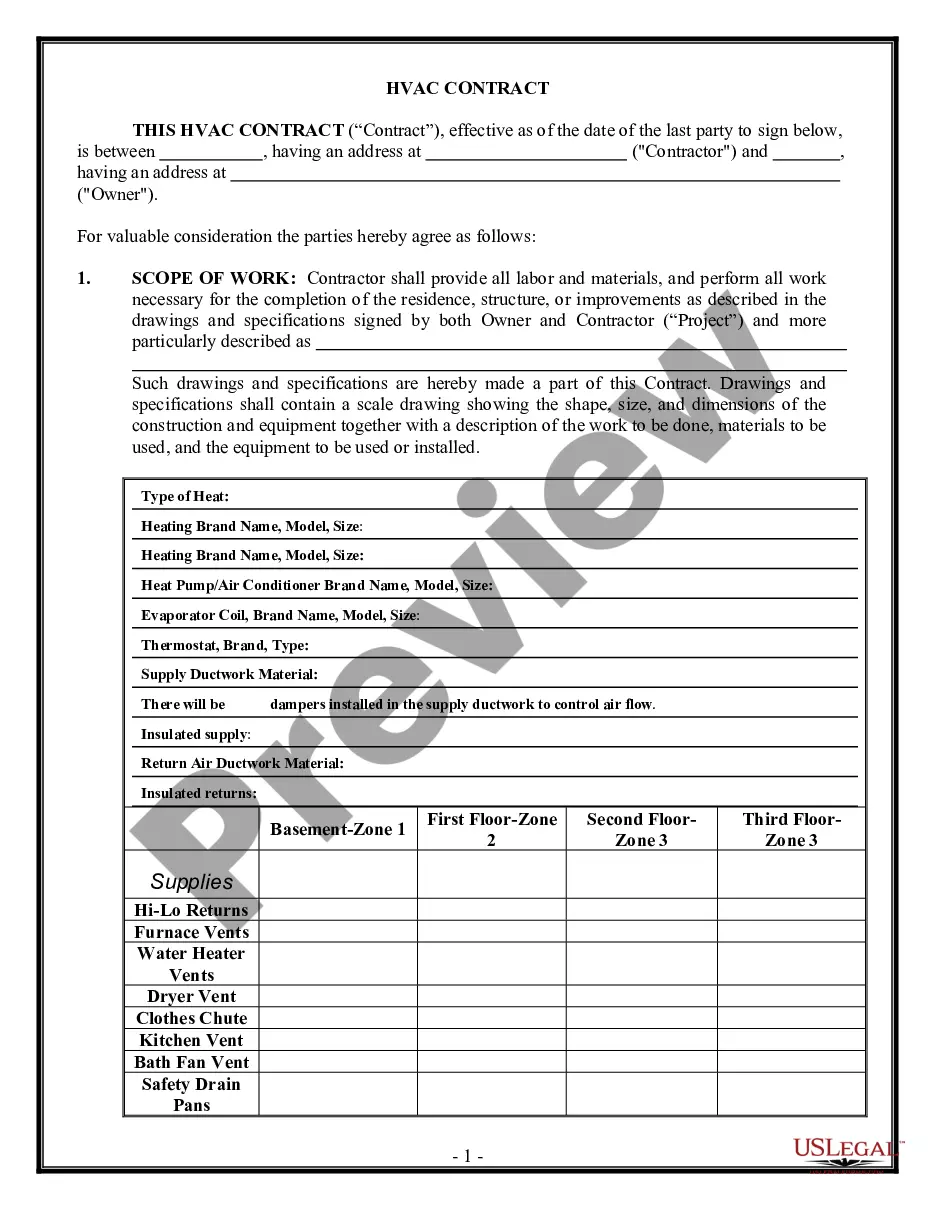

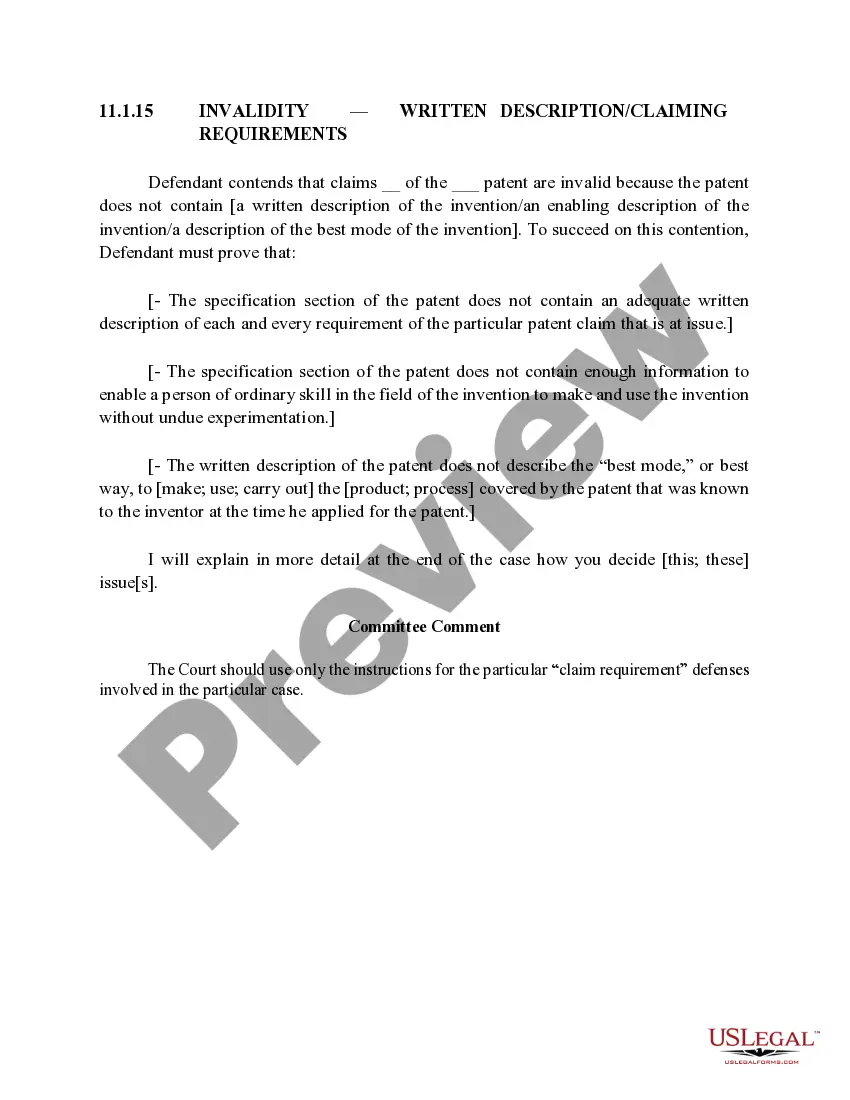

This form is a due diligence checklist that outlines information pertinent to non-employee directors in a business transaction.

Ohio Nonemployee Director Checklist

Description

How to fill out Nonemployee Director Checklist?

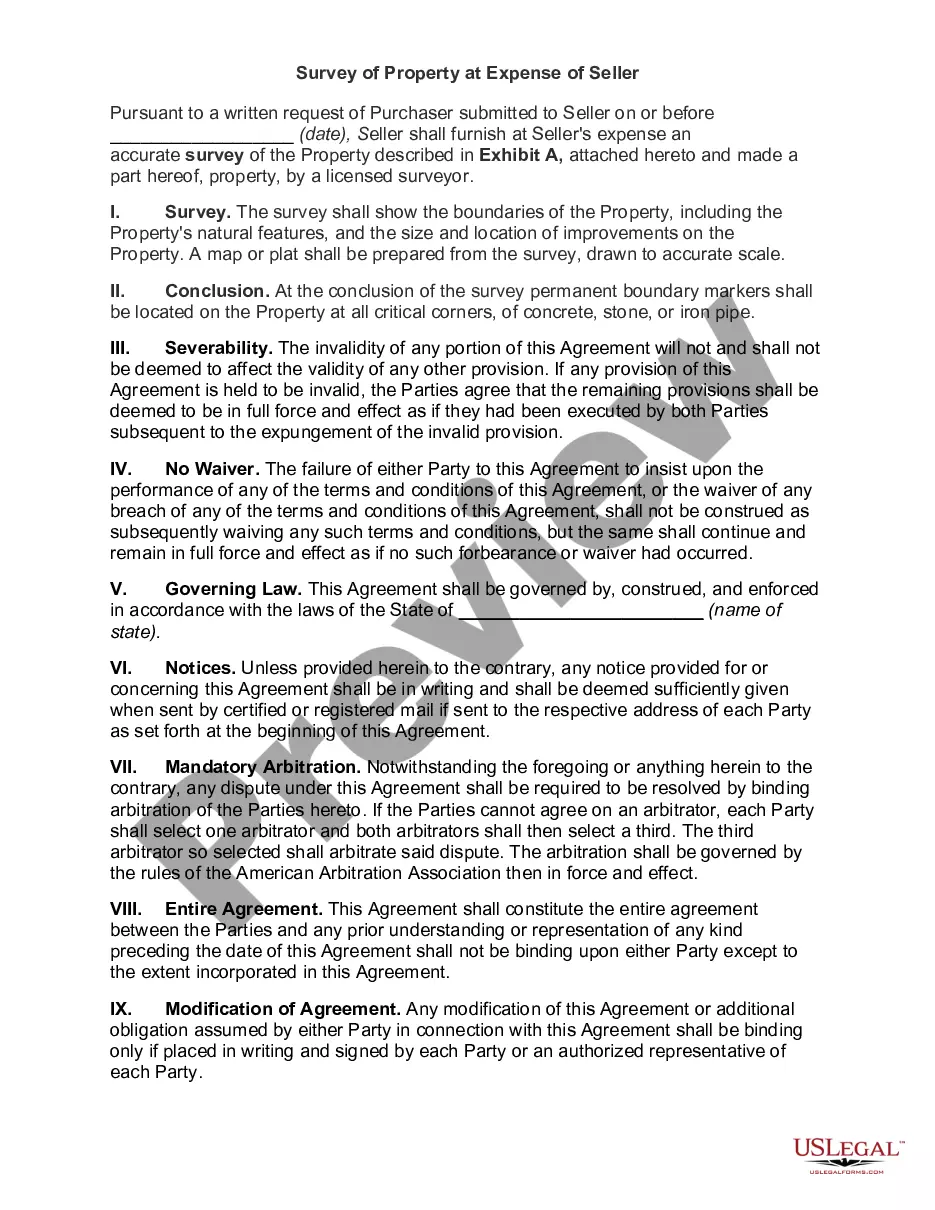

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can obtain or create.

By utilizing the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms like the Ohio Nonemployee Director Checklist within moments.

Read the form description to confirm that you have chosen the right document.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you currently hold a monthly subscription, Log In and download the Ohio Nonemployee Director Checklist from your US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form’s details.

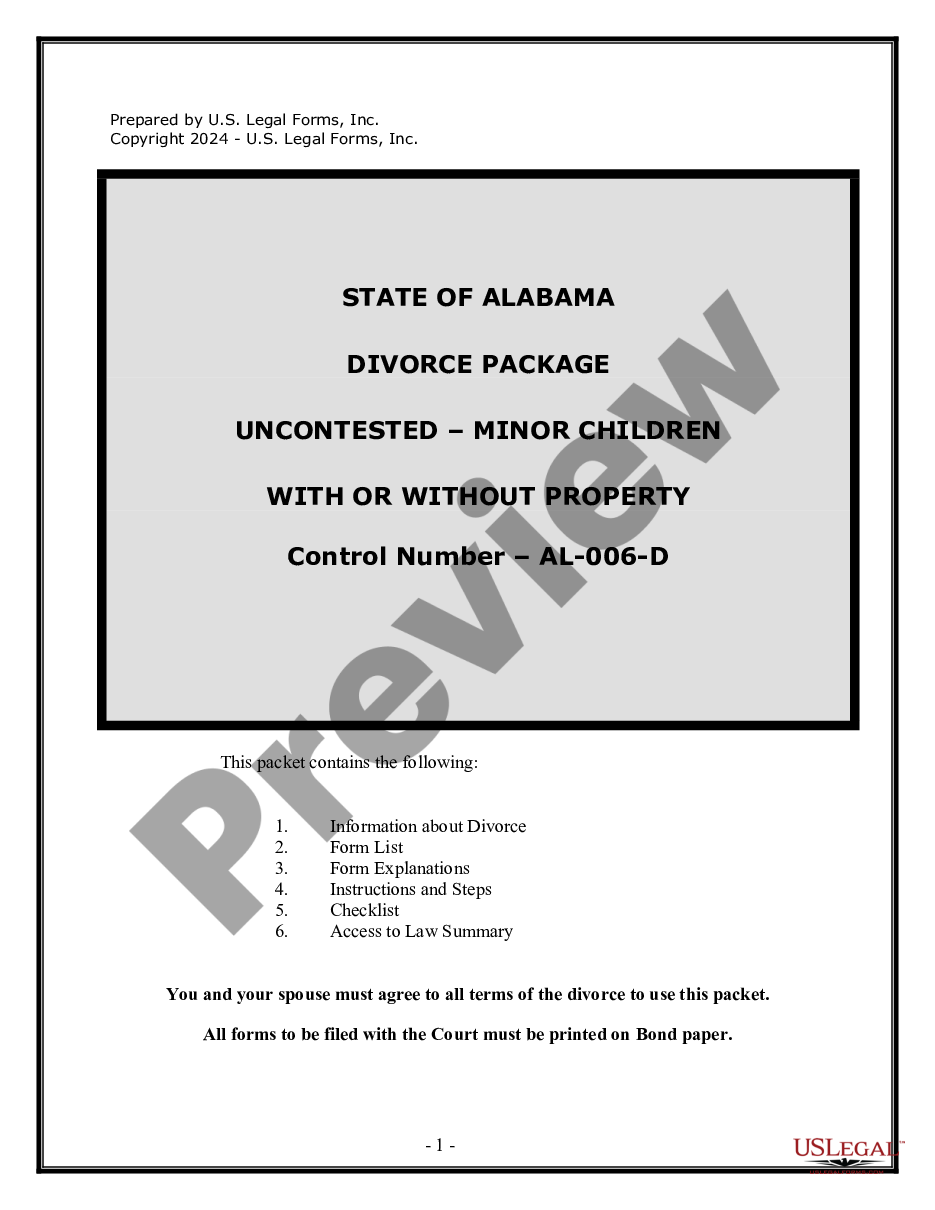

Form popularity

FAQ

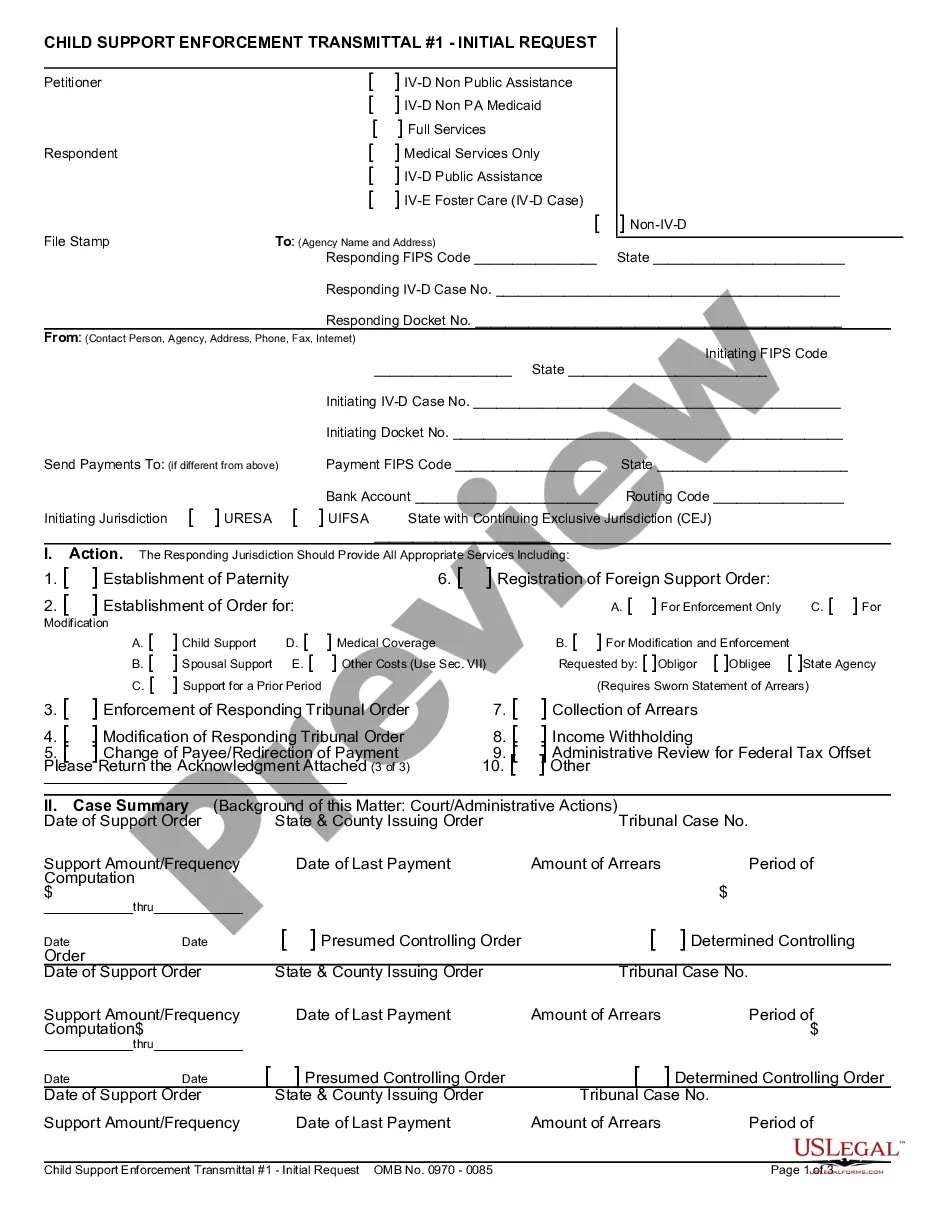

Individuals claiming to be irrebuttably presumed to be full-year nonresidents for Ohio income tax purposes must file this form no later than the 15th day of the 10th month following the close of their tax year.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Ohio. Ohio only requires you to file Form 1099-NEC with the Ohio Department of Taxation if state withholding is reported. Business owners in Ohio can file Form 1099-NEC with the IRS with Wave Payroll.

To be eligible to file the IT NRS, an individual must meet all of the following five criteria: You had no more than 212 contact periods in Ohio during the tax year; You had at least one abode outside of Ohio for which you did not claim depreciation during the tax year.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

An Ohio resident must pay Ohio income tax on his or her worldwide income, subject to credits for taxes paid in other jurisdictions. A nonresident, however, only pays Ohio income tax on income earned or received in Ohio.

Paper filing, Ohio return says attach any 1099(s) and copy of all supporting documents? Attach your W-2. Do not attach any 1099s unless it shows state (OH) income tax withholding. TurboTax automatically prints out a copy of the entire federal return, when it prints the OH return.

Simply add an additional amount on Line 4(c) for "extra withholding." That will increase your income tax withholding, reduce the amount of your paycheck and either jack up your refund or reduce any amount of tax you owe when you file your tax return.