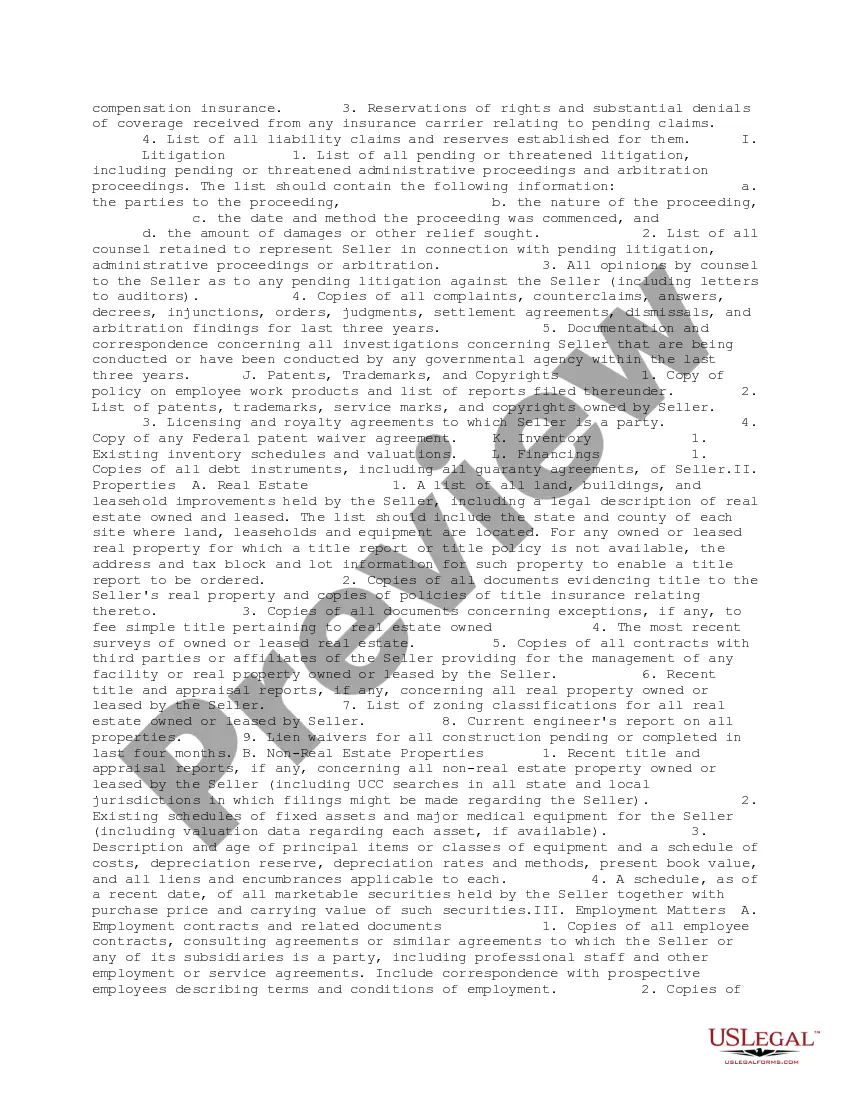

This form is a list of requested due diligence documents for hospital acquisition. The list consists of documents and information to be submitted to the due diligence team.

Ohio Due Diligence Document Request List for Hospital Acquisition

Description

How to fill out Due Diligence Document Request List For Hospital Acquisition?

Are you in a situation where you will require documentation for either business or personal purposes almost consistently.

There are numerous legal document templates available online, but finding versions you can rely on isn't easy.

US Legal Forms offers a vast array of form templates, such as the Ohio Due Diligence Document Request List for Hospital Acquisition, which is designed to comply with federal and state regulations.

When you locate the suitable form, click on Acquire now.

Choose the pricing plan you require, fill in the necessary details to create your account, and pay for your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have your account, simply sign in.

- Then, you can download the Ohio Due Diligence Document Request List for Hospital Acquisition template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Select the form you need and make sure it corresponds to the correct city/state.

- Use the Review button to examine the form.

- Check the summary to ensure that you have chosen the correct form.

- If the form isn't what you're looking for, utilize the Search section to find the form that meets your needs and specifications.

Form popularity

FAQ

The due diligence process consists of several crucial steps. First, define the scope of your investigation and identify the relevant documents using the Ohio Due Diligence Document Request List for Hospital Acquisition. Next, collect, analyze, and review the obtained data, focusing on financial, operational, and legal aspects. Finally, prepare your findings in a report and engage with your team to discuss findings and implications, ensuring everyone is on the same page before proceeding with the acquisition.

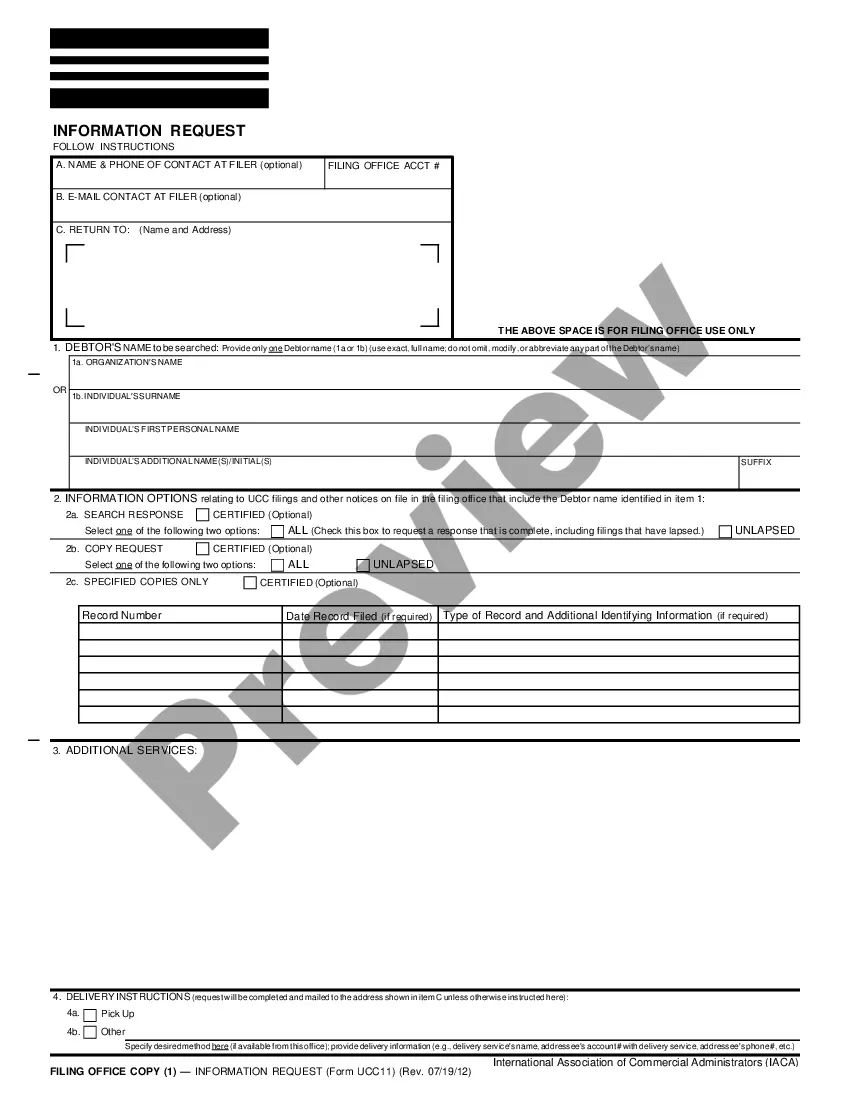

Filing due diligence involves submitting the completed due diligence report to relevant parties within the acquisition process. Make sure to include all documents specified in the Ohio Due Diligence Document Request List for Hospital Acquisition to ensure you cover all legal and operational requirements. Once you have finalized the report, share it with your legal counsel and financial advisors, who will guide you on the next steps. This collaborative approach ensures a thorough understanding of the merger or acquisition.

To create a due diligence report, start by gathering all necessary information regarding the hospital acquisition. Utilize the Ohio Due Diligence Document Request List for Hospital Acquisition, which outlines essential documents to collect, including financial statements and regulatory compliance records. Analyzing this information will help you assess risks and opportunities, providing a clear picture of the target entity's value. Compiling this data systematically ensures you have a comprehensive report ready for stakeholders.

A due diligence checklist is a tool that outlines the specific documents and tasks needed to complete the due diligence process. This list helps buyers ensure they cover all necessary aspects of an acquisition. The Ohio Due Diligence Document Request List for Hospital Acquisition is an excellent resource for organizing your checklist and making your acquisition process efficient.

Yes, a buyer can back out after due diligence if they uncover significant issues or risks related to the hospital acquisition. This period allows for thorough assessment, enabling buyers to protect their investments. The Ohio Due Diligence Document Request List for Hospital Acquisition provides a framework for identifying red flags and making informed choices.

A due diligence request refers to the list of documents and information a buyer seeks from a seller to assess the value and risks associated with an acquisition. This process helps ensure the buyer makes an informed decision. Utilizing the Ohio Due Diligence Document Request List for Hospital Acquisition facilitates clear communication and organization of necessary documents.

The 4 P's of due diligence include People, Product, Processes, and Intellectual Property. Each element plays a vital role in assessing the overall health and viability of a hospital before acquisition. To effectively evaluate these aspects, refer to the Ohio Due Diligence Document Request List for Hospital Acquisition, which helps in organizing and gathering related documentation.

An acquisition checklist serves as a structured guide for buyers during the hospital acquisition process. It outlines essential steps and considerations, ensuring critical tasks are completed efficiently. By following the Ohio Due Diligence Document Request List for Hospital Acquisition, you can streamline your due diligence and make informed decisions.

A due diligence checklist should include financial statements, tax returns, employee contracts, and operating agreements. Additionally, it should cover regulatory compliance documents and any pending litigation. By utilizing your Ohio Due Diligence Document Request List for Hospital Acquisition, you can ensure that all critical areas are addressed, helping you make a well-informed acquisition decision.

Preparing a due diligence checklist involves compiling all necessary documents and information needed for an effective review. Start by outlining the categories and specific items to investigate, ensuring alignment with your Ohio Due Diligence Document Request List for Hospital Acquisition. This checklist will serve as a crucial tool to keep your evaluation organized and focused.