Ohio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Discovering the right lawful document design can be a struggle. Needless to say, there are tons of themes available on the net, but how will you get the lawful kind you want? Take advantage of the US Legal Forms web site. The services provides 1000s of themes, including the Ohio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan, which can be used for company and personal requires. Every one of the kinds are checked out by pros and meet federal and state demands.

When you are presently authorized, log in to the accounts and click on the Down load key to have the Ohio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. Utilize your accounts to check from the lawful kinds you possess purchased earlier. Go to the My Forms tab of your accounts and get another version from the document you want.

When you are a fresh customer of US Legal Forms, listed below are straightforward guidelines for you to stick to:

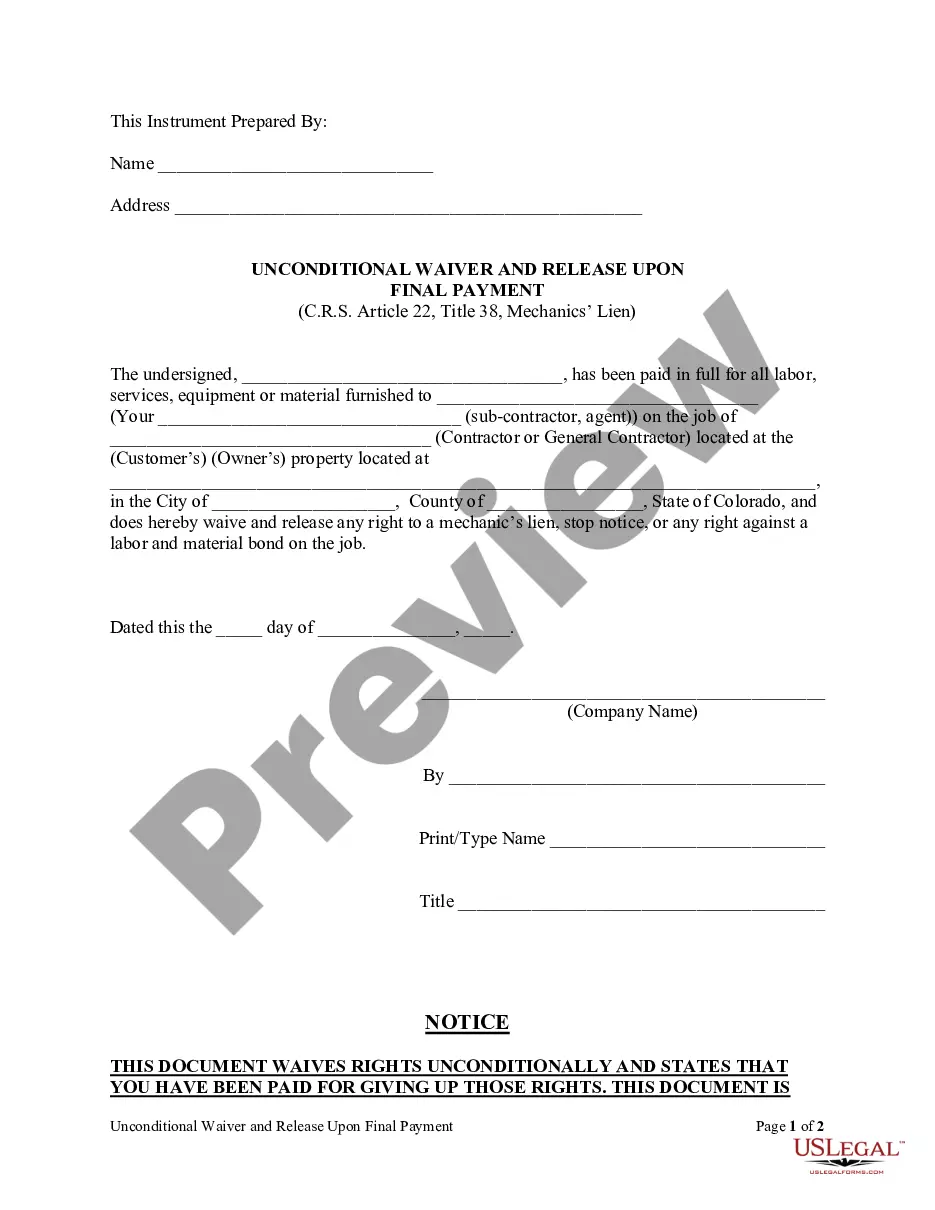

- Initial, make certain you have selected the proper kind to your area/state. You may look through the shape while using Review key and read the shape outline to make certain it will be the right one for you.

- If the kind fails to meet your needs, utilize the Seach discipline to discover the right kind.

- When you are certain the shape is suitable, go through the Get now key to have the kind.

- Choose the pricing program you desire and type in the essential information. Create your accounts and buy the order with your PayPal accounts or Visa or Mastercard.

- Select the document structure and down load the lawful document design to the product.

- Full, revise and produce and sign the received Ohio Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

US Legal Forms may be the most significant local library of lawful kinds in which you can discover numerous document themes. Take advantage of the company to down load expertly-created papers that stick to express demands.

Form popularity

FAQ

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

A security interest is retained in or taken by the seller of the collateral to secure part or all of its price. A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.

To protect its security interest, a secured party must take steps to ?perfect? its lien. A lien is usually perfected by filing a financing statement with the Secretary of State, or in some cases with the county recorder. The secured party may sometimes perfect its lien by being in possession of the collateral.

A security interest is not enforceable unless it has attached. Attachment of a security interest generally requires a written security agreement, description of collateral, secured party's giving value, and the debtor having rights in collateral.

Below are the primary methods for perfecting a security interest: Filing a financing statement in the appropriate public office; Take or retain possession of the collateral; Obtain or retain control of the collateral over the collateral; or.

In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest. Once the security interest has ?attached,? it is effective between the debtor and the creditor.