Ohio Equity Incentive Plan

Description

How to fill out Equity Incentive Plan?

You are able to spend hours on-line looking for the legal papers format that meets the state and federal requirements you need. US Legal Forms provides a large number of legal types which can be evaluated by professionals. It is possible to down load or print out the Ohio Equity Incentive Plan from my support.

If you currently have a US Legal Forms account, you may log in and click on the Obtain switch. Following that, you may complete, edit, print out, or indication the Ohio Equity Incentive Plan. Every single legal papers format you purchase is your own property permanently. To obtain an additional version of the obtained kind, check out the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site initially, keep to the simple instructions under:

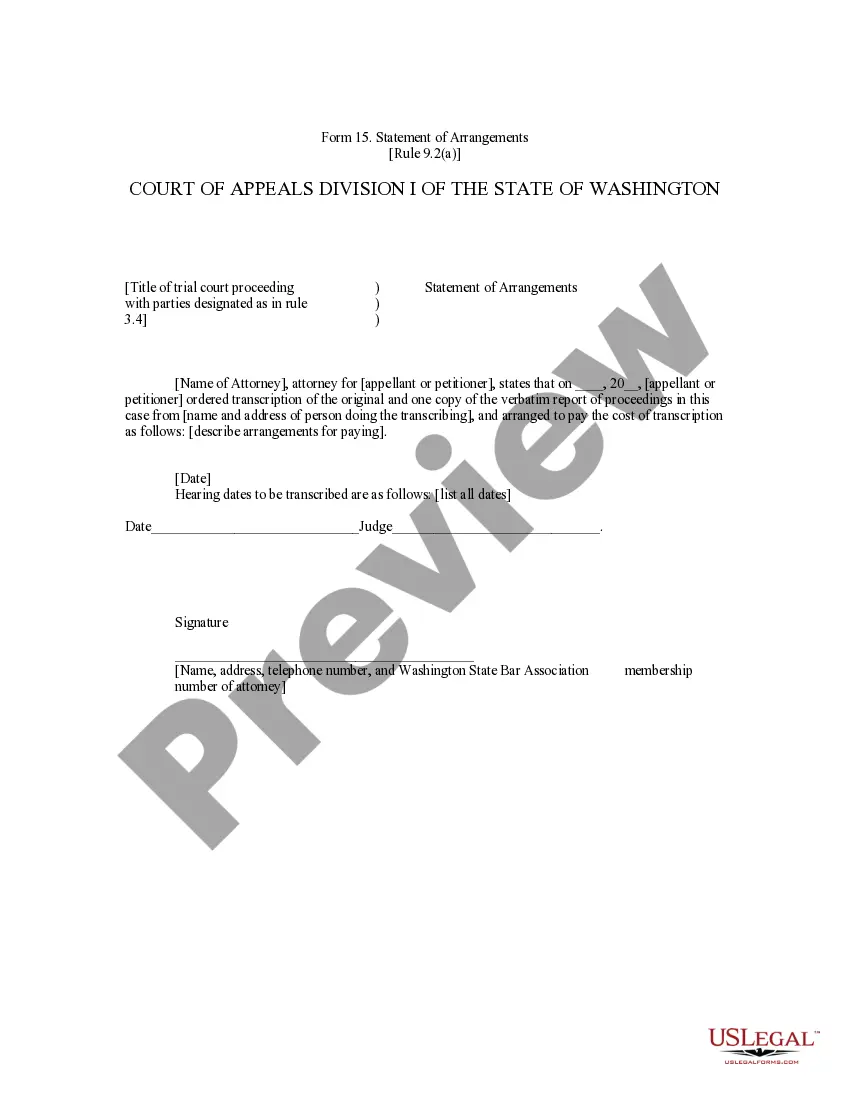

- First, be sure that you have selected the correct papers format to the state/town of your choice. Read the kind information to make sure you have picked the appropriate kind. If accessible, take advantage of the Review switch to check through the papers format also.

- In order to get an additional edition in the kind, take advantage of the Lookup industry to get the format that meets your needs and requirements.

- Once you have located the format you need, just click Get now to carry on.

- Select the prices program you need, type in your references, and register for a free account on US Legal Forms.

- Complete the purchase. You may use your bank card or PayPal account to cover the legal kind.

- Select the structure in the papers and down load it for your system.

- Make alterations for your papers if possible. You are able to complete, edit and indication and print out Ohio Equity Incentive Plan.

Obtain and print out a large number of papers themes while using US Legal Forms web site, which provides the biggest assortment of legal types. Use expert and state-specific themes to take on your small business or personal demands.

Form popularity

FAQ

Omnibus Equity Incentive Plan means the equity compensation plan the Board of Directors has adopted whereby options, shares, and other share awards may be granted to the Corporation's Directors, officers, employees, and consultants.

An equity incentive program offers an employee shares of the company they work for. Shares can be awarded through stock options, stocks, warrants, or bonds.

There are four common methods of granting equity or equity incentives in an LLC: (1) outright membership interest or membership unit grants, (2) LLC incentive units (aka ?profit interests?), (3) a phantom or parallel unit plan (aka. synthetic equity), and (4) options to acquire LLC capital interests.

Incentive Percentage means the percentage, if any, of the total base salaries of the Participants during an Award Cycle, as determined by the Board, in the case of company wide performance or performance of senior executives, and as determined by management, in the case of individual, division or department performance ...

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

An equity incentive program offers an employee shares of the company they work for. Shares can be awarded through stock options, stocks, warrants, or bonds. Stock options are the most common and recognizable form of employee equity.

A form of equity incentive plan to be used by a public company for granting awards such as stock options, stock appreciation rights, restricted stock, restricted stock units, performance share awards, other equity-based awards, and cash awards.

Typical range is between 5% and 20% of the company's fully diluted capitalization.