Ohio Holiday Vacation Policy

Description

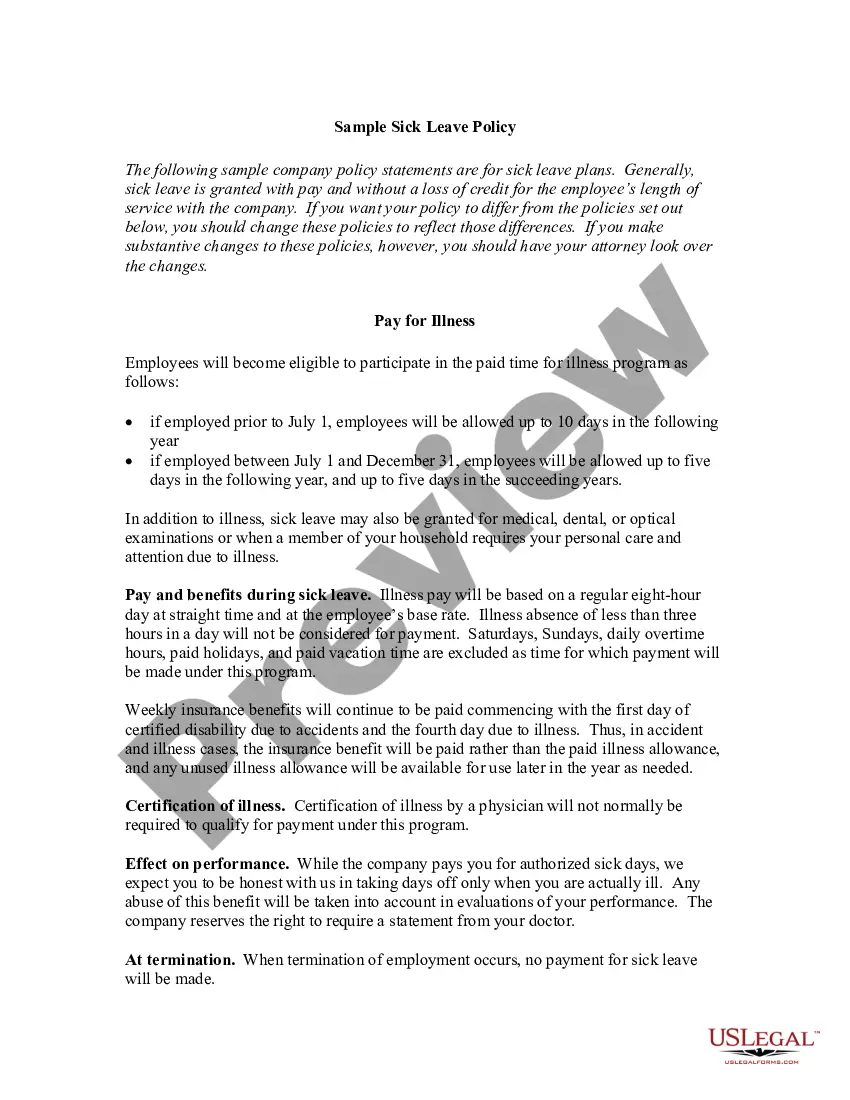

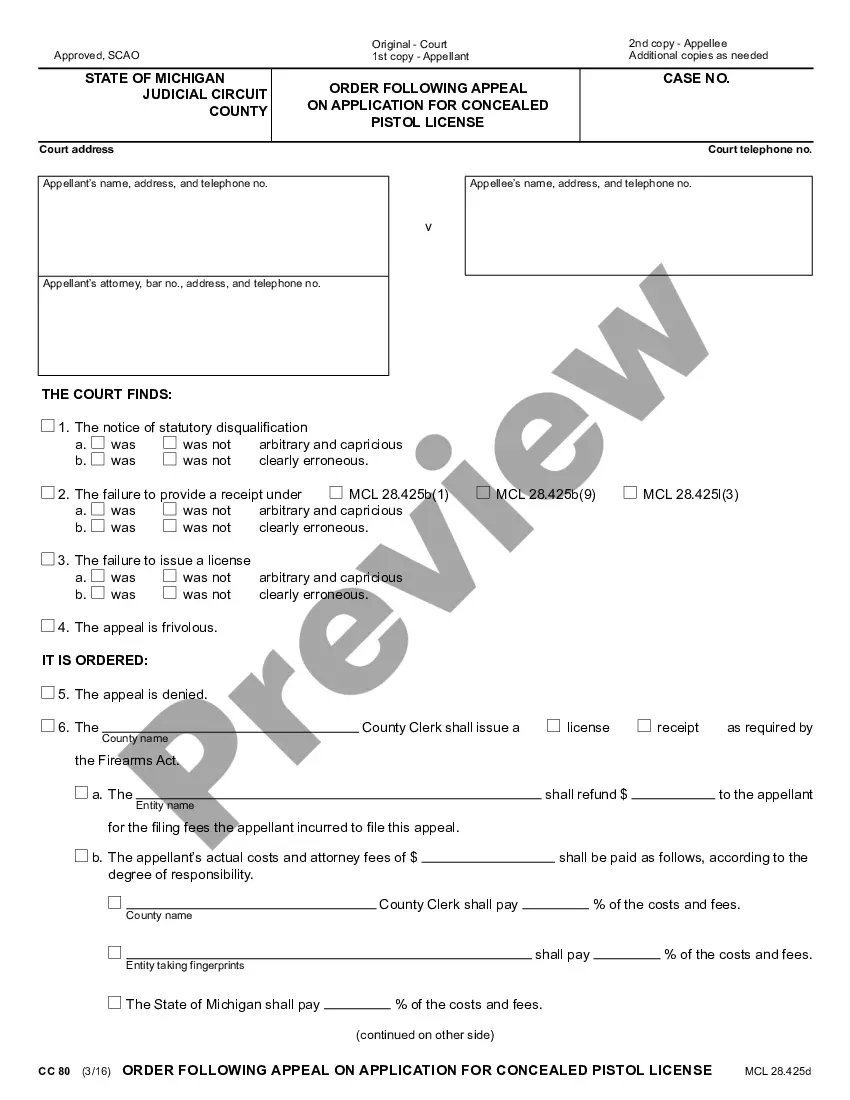

How to fill out Holiday Vacation Policy?

Finding the appropriate legitimate document template can be challenging. There are numerous templates accessible online, but how can you find the authentic form you need.

Utilize the US Legal Forms website. This service provides an extensive collection of templates, including the Ohio Holiday Vacation Policy, suitable for both professional and personal needs. All forms are reviewed by experts and meet state and federal regulations.

If you are already registered, Log In to your account and then click on the Acquire button to obtain the Ohio Holiday Vacation Policy. You can use your account to search for the legal documents you may have purchased in the past. Go to the My documents tab in your account to download another copy of the document you need.

US Legal Forms is the largest repository of legal forms, where you can find diverse document templates. Leverage this service to download professionally designed documents that comply with state laws.

- First, ensure you have selected the correct form for your city/county. You can review the form using the Preview button and examine the form details to ensure it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- When you confirm that the form is suitable, click on the Purchase now button to obtain the form.

- Select your desired pricing plan and enter the required information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Ohio Holiday Vacation Policy.

Form popularity

FAQ

As in most other states across the country, California employers do not have to pay their employees any extra money just because they work on official holidays....This includes:New Year's Day.Memorial Day.Independence Day.Labor Day.Columbus Day.Veterans Day.Thanksgiving Day.Christmas Day.

Under Ohio law, accrued vacation is considered an earned benefit that the employee has a legal entitlement to. Therefore, an employee's right to pay for vacation that was not used during employment will normally survive the employee's termination or resignation, and payment will be owed.

Ohio: While use-it-or-lose-it policies are allowed, accrued vacation time must be paid out at the end of employment if a vacation policy is silent on the matter. Oregon: Use-it-or-lose-it policies are allowed, but employers must pay out accrued vacation time if a vacation policy is silent on the issue.

Day, President's day, Memorial day, Independence day, Labor day, Columbus day, Veterans day, Thanksgiving day, Christmas day and any day appointed and recommended by the governor of Ohio or the president of the United States. Employees shall be paid for these holidays as specified in the rules herein.

Because Ohio law considers vacation pay a deferred payment of an earned benefit, an employer generally cannot withhold accrued vacation pay at the end of employment (just like it cannot withhold wages from a final paycheck).

The following list contains the state holidays recognized by Ohio.New Year's Day (January 1)Martin Luther King Jr.Presidents' Birthday (3rd Monday in February)Memorial Day (last Monday in May.Independence Day (July 4)Labor Day (1st Monday in September)Columbus Day (2nd Monday in October)Veterans Day (November 11)More items...

Federal law designates the same legal holidays outlined by Ohio law, which means state employees who work on those days are entitled to receive premium pay (at least one-and-one-half times the regular wage rate).

The Bureau of Wage & Hour Administration only goes back two years when auditing records. Is my employer required to pay me for holidays? No, the State of Ohio has no requirements for the payment of holiday, vacation, or sick time.

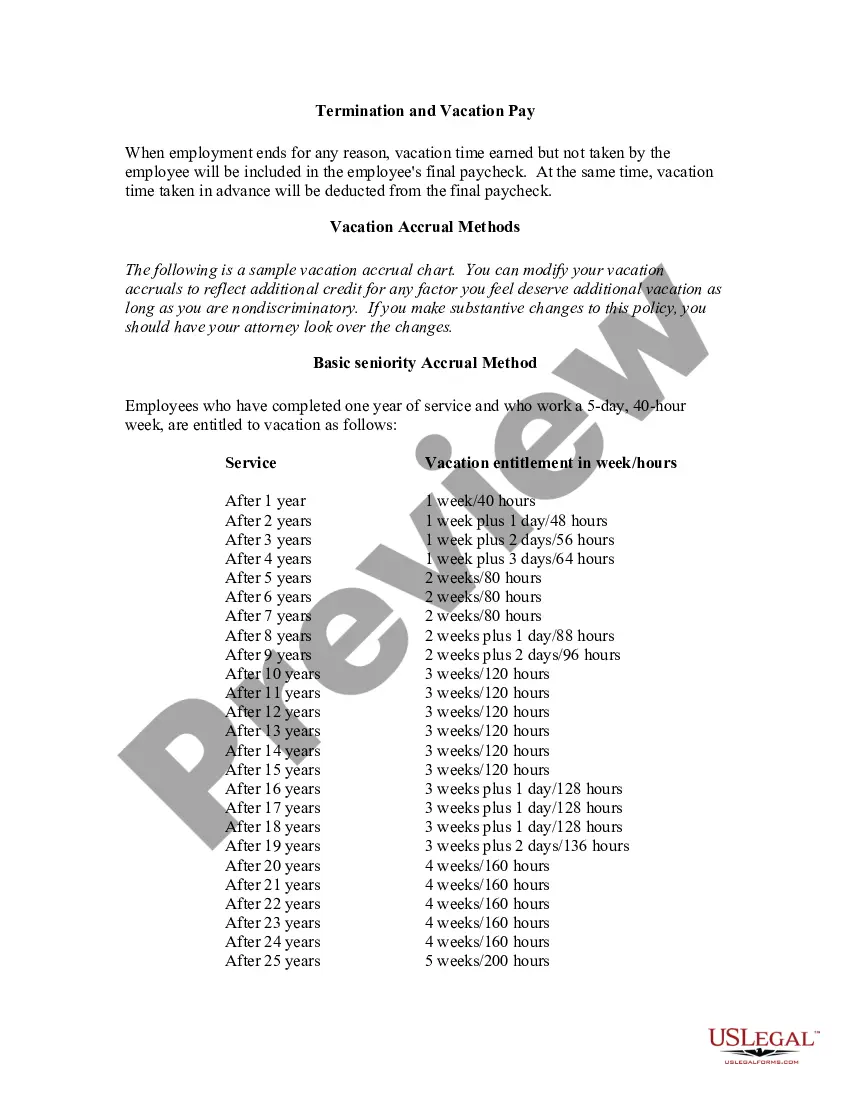

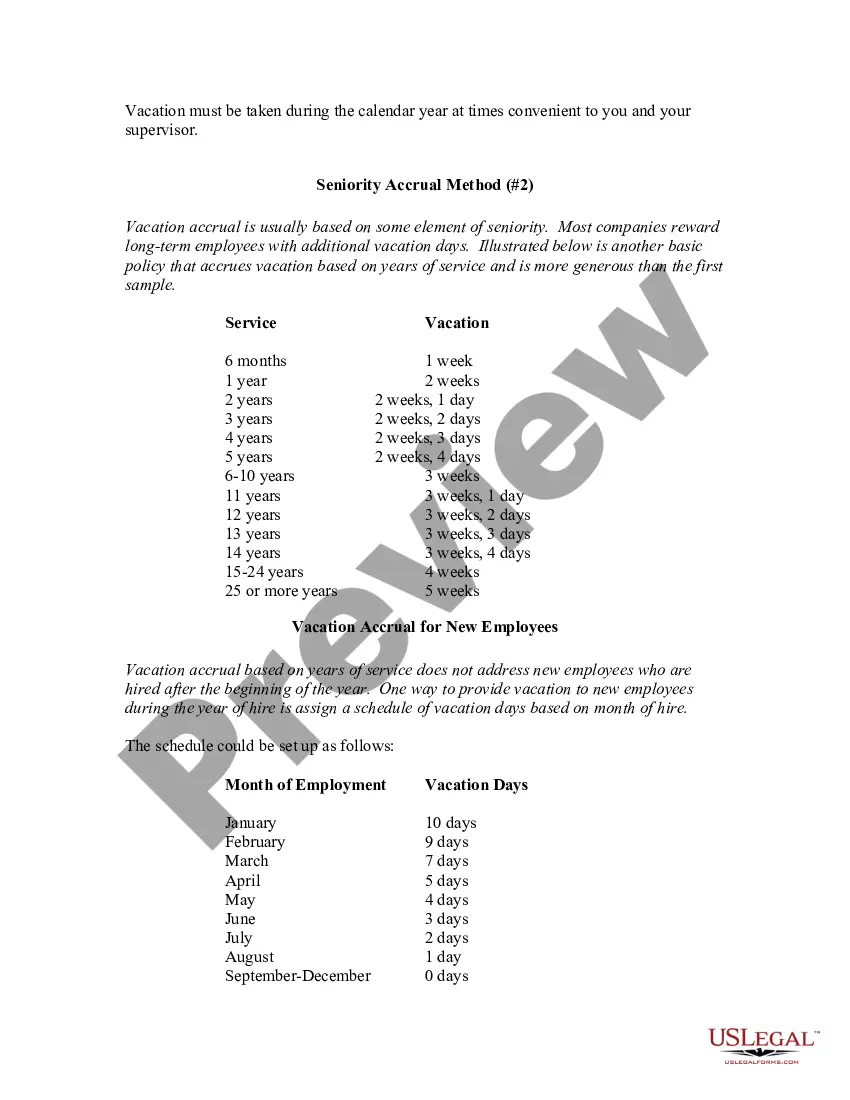

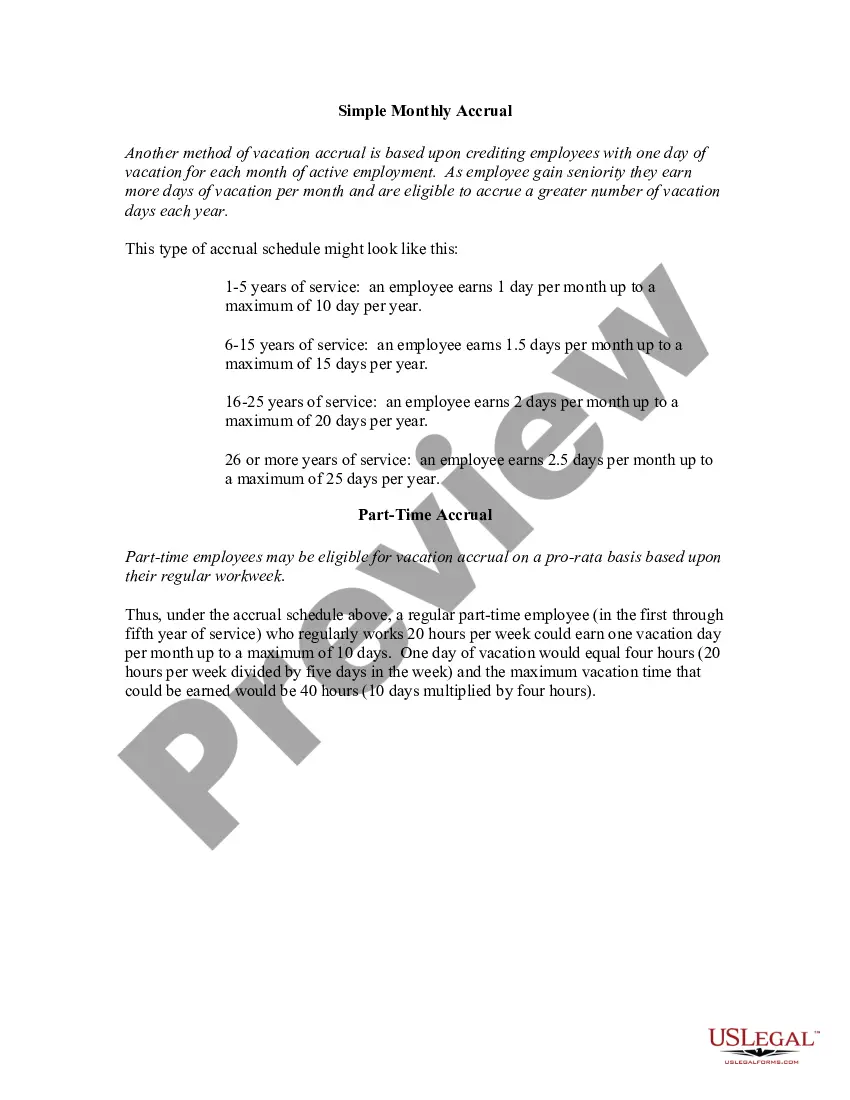

Typically accrual, 2 weeks sick and 2 weeks vacation to start plus 3 personal days. Increases to 3 weeks vacation after 5 years. You work, you get your paid vacation days, you enjoy your vacations!

No, the State of Ohio has no requirements for the payment of holiday, vacation, or sick time.