Ohio Memorandum to Stop Direct Deposit

Description

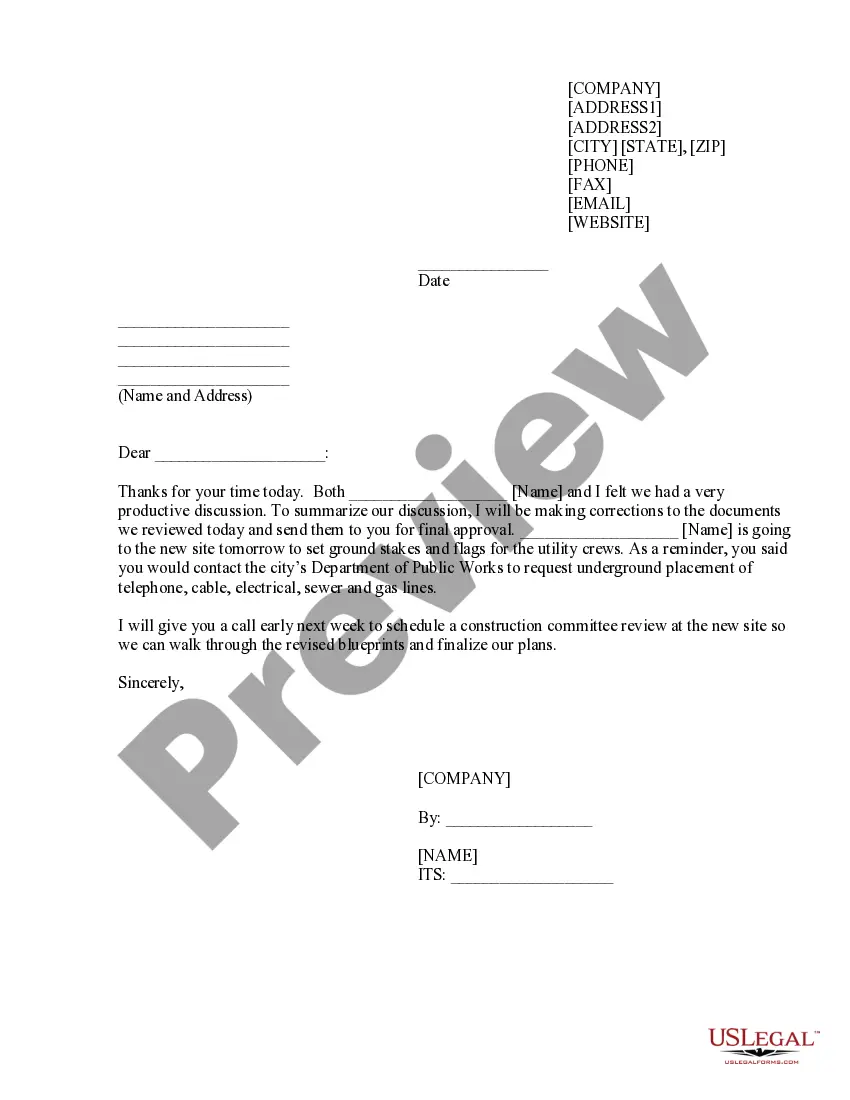

How to fill out Memorandum To Stop Direct Deposit?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for personal and business needs, organized by categories, states, or keywords. You can access the most recent versions of forms such as the Ohio Memorandum to Stop Direct Deposit in just seconds.

If you already have an account, Log In to retrieve the Ohio Memorandum to Stop Direct Deposit from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Ohio Memorandum to Stop Direct Deposit. Each template saved in your account does not expire and is yours indefinitely. So, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Ohio Memorandum to Stop Direct Deposit with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- Ensure you have selected the right form for your city/county.

- Click the Preview button to examine the contents of the form.

- Review the form description to confirm you have chosen the correct one.

- If the form doesn't meet your needs, utilize the Search field at the top of the page to locate the one that does.

- Once you are satisfied with the form, validate your choice by clicking the Get now button.

- Next, choose the pricing option you prefer and provide your credentials to register for an account.

Form popularity

FAQ

To file the Ohio 501, first gather all necessary financial documents, including income statements and previous tax filings. You can complete the form online or by printing it and filing it by mail. It’s crucial to be thorough, as inaccuracies may lead to processing delays. Using platforms like US Legal Forms can simplify this process by providing clear instructions and templates for accurate completion.

The Ohio 501 form is a document used for specific tax purposes within the state of Ohio. It requires detailed information about your earnings and tax deductions. Filing this form helps the state track tax obligations accurately. Additionally, it relates to transactions that may affect direct deposit settings, hence the relevance to the Ohio Memorandum to Stop Direct Deposit.

In Ohio, the Ohio Memorandum to Stop Direct Deposit generally must be filed on an annual basis. This ensures that your direct deposit status remains current and prevents unwanted deductions. It is important to stay informed about any updates to the filing requirements, as regulations may change. Regular filing helps to maintain compliance with state laws.

You may have entered the wrong date when processing payroll. Verify the check date first. If the check date is incorrect and you use a payroll processing company, call your payroll processer for support. If caught early enough, it may be possible to adjust the check date and have true same-day processing.

Employee Requests Direct Deposit be Stopped Depending on the situation, they may instruct the employee to reopen their account or contact the bank for assistance. If they determine the payment should be stopped, the payroll office can complete the stop pending form.

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account. Click here for a sample "stop payment order."

To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. You can give the order in person, over the phone or in writing. To stop future payments, you might have to send your bank the stop payment order in writing.

Sometimes when your direct deposit doesn't show up as planned, the reason is simply that it has just taken a few extra days to process. This might be due to holidays or because the request to transfer money accidentally went out after business hours. Give it at least 24 hours before you start worrying.

Cancellation by the Financial Institution: The financial institution receiving the direct deposits may cancel direct deposit. The institution must provide you and your payroll office 30 days written notice of the cancellation. The cancellation will not take effect until the Research Foundation processes it.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.