Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Are you currently in the position in which you require documents for either company or individual functions just about every day time? There are a lot of legitimate papers web templates accessible on the Internet, but locating ones you can rely on is not easy. US Legal Forms delivers a large number of form web templates, like the Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that happen to be published in order to meet federal and state needs.

When you are previously knowledgeable about US Legal Forms internet site and get an account, simply log in. After that, you can obtain the Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse design.

If you do not come with an profile and need to begin to use US Legal Forms, abide by these steps:

- Find the form you require and make sure it is for that right area/area.

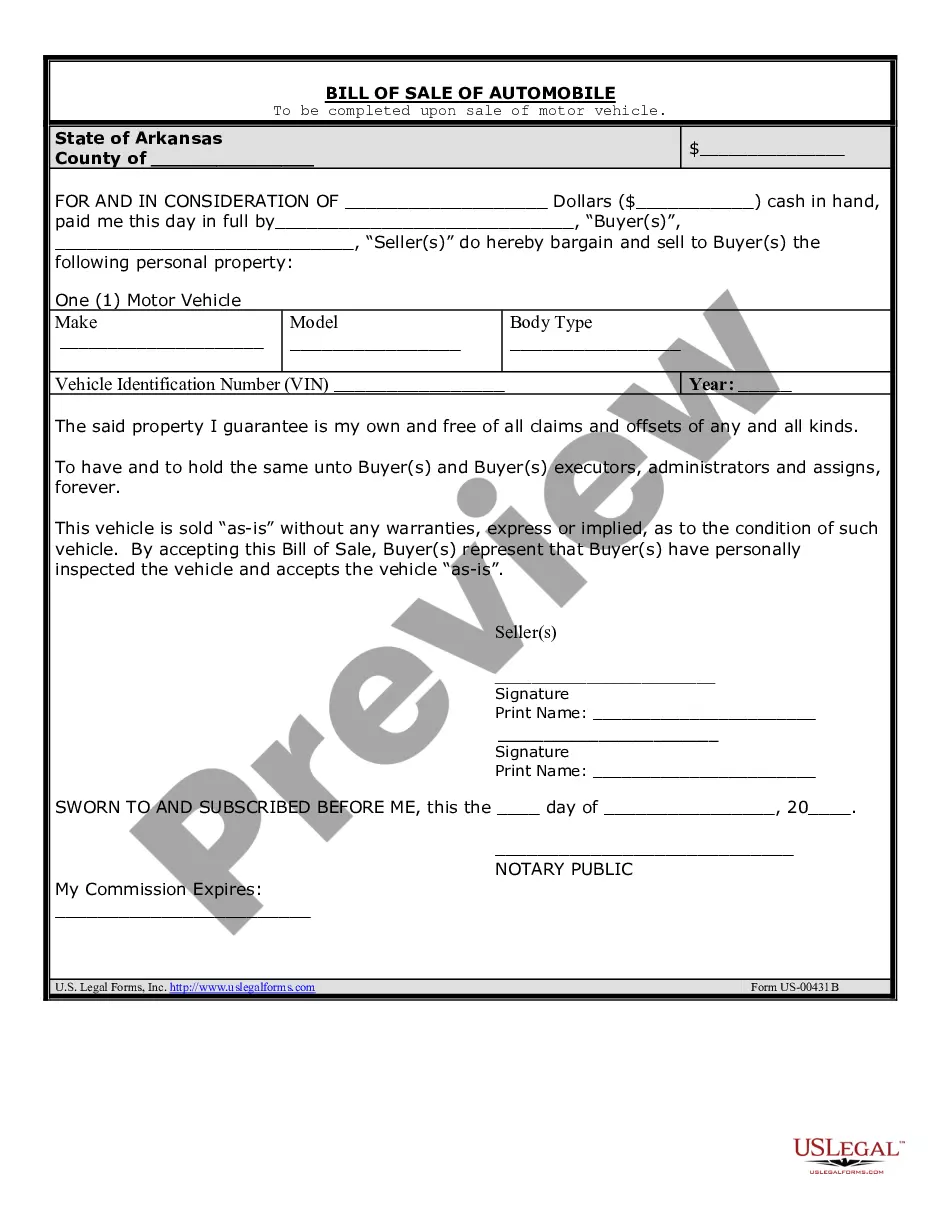

- Utilize the Preview key to analyze the shape.

- Browse the description to ensure that you have selected the correct form.

- In the event the form is not what you are seeking, take advantage of the Look for area to obtain the form that meets your requirements and needs.

- If you discover the right form, click on Get now.

- Pick the rates prepare you desire, fill out the desired details to generate your bank account, and purchase the order using your PayPal or credit card.

- Choose a handy paper structure and obtain your copy.

Find all of the papers web templates you possess bought in the My Forms food selection. You can aquire a extra copy of Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse whenever, if required. Just go through the needed form to obtain or print out the papers design.

Use US Legal Forms, one of the most considerable assortment of legitimate varieties, to conserve time as well as stay away from faults. The services delivers professionally produced legitimate papers web templates that you can use for a range of functions. Produce an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

A will is a legal document that spells out how you want your affairs handled and assets distributed after you die. A trust is a fiduciary arrangement whereby a grantor (also called a trustor) gives a trustee the right to hold and manage assets for the benefit of a specific purpose or person.

In California, a trustor (person who creates a trust) can confer a ?power of appointment? on trust beneficiaries, empowering them to designate to whom they want to give their shares of the trust.

A trust is especially important in California, where probate is expensive and lengthy. It will help save your loved one's time, money, and a lot of hassle. Besides, with trusts like a living trust, you can still buy, sell, and trade assets as usual. You can also move assets to and from the Trust as you please. Do I Need A Trust In California? 6 Important Factors to Consider hermancelaw.com ? blog ? do-i-need-a-trust-in-ca... hermancelaw.com ? blog ? do-i-need-a-trust-in-ca...

Having a trust in the state of Ohio keeps your loved ones out of probate court. Instead of your family experiencing a lengthy probate court process to gain access to your assets and distribute them as you intended, a living trust takes the hassle of probate court out of the equation.

Make a trust document: Now it's actually time to put the legal trust document together. You can technically do this by yourself, but you may want to consult with a lawyer or financial advisor. Get the trust document notarized: Now you have to sign the trust in front of a notary public. How to Create a Living Trust in Ohio - SmartAsset SmartAsset ? estate-planning ? living-trust-... SmartAsset ? estate-planning ? living-trust-...

$1,000 to $3,000 How much does a Trust cost in Ohio? The cost of creating a trust in Ohio varies depending on the complexity of your estate and the attorney's fees. The average cost for a basic Revocable Living Trust ranges from $1,000 to $3,000, while more complex trusts may cost more. Ohio: Make A Revocable Trust Online in 12 Minutes | Snug getsnug.com ? ohio-trusts getsnug.com ? ohio-trusts

Any asset that is controlled by the will goes through probate. Probate can cause estate administration to be slower, more burdensome and more costly. Assets that are controlled by a trust are not subject to probate. Avoiding probate is generally a good strategy for estate planning. A Will or Trust? - OSU Farm Office - The Ohio State University osu.edu ? blog ? will-or-trust osu.edu ? blog ? will-or-trust