Ohio Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

Are you currently in a circumstance where you require documents for potential business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides an extensive array of form templates, such as the Ohio Guaranty without Pledged Collateral, that are crafted to meet federal and state requirements.

Choose the pricing plan you want, fill in the required details to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms site and have your account, just sign in.

- Then, you can download the Ohio Guaranty without Pledged Collateral template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

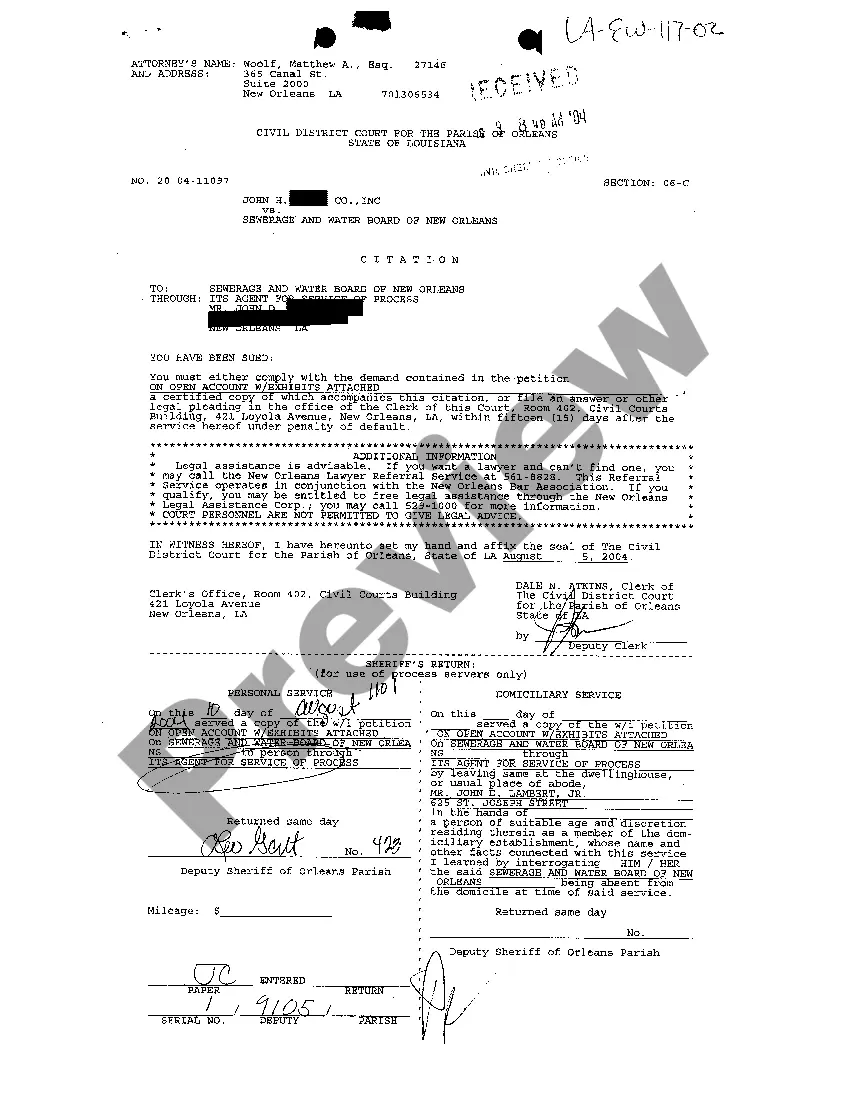

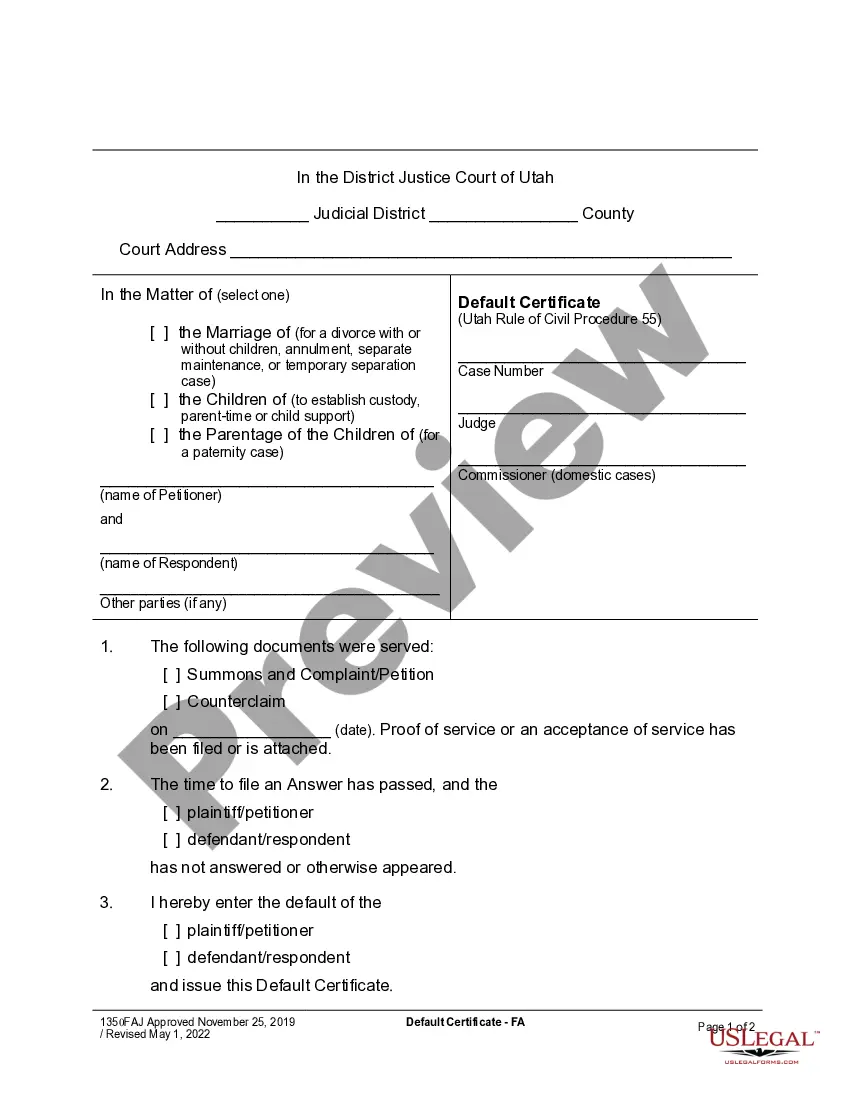

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review button to assess the form.

- Read the information to ensure that you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- When you find the appropriate form, click on Get now.

Form popularity

FAQ

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

An offer to guarantee must be accepted, either by express or implied acceptance. If a surety's assent to a guarantee has been procured by fraud by the person to whom it is given, there is no binding contract.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

Substance over form Just because the word 'guarantee' has been used, that does not make it a guarantee. In writing The guarantee must be evidenced in writing to be enforceable. Signed The document must be signed by the guarantor or their authorised agent. Their name can be written or printed.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.

An advance payment guarantee acts as collateral for reimbursing advance payment from the buyer if the seller does not supply the specified goods per the contract. A credit security bond serves as collateral for repaying a loan. A rental guarantee serves as collateral for rental agreement payments.

Guarantee. 1) v. to pledge or agree to be responsible for another's debt or contractual performance if that other person does not pay or perform.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.