Ohio Authority of Partnership to Open Deposit Account and to Procure Loans

Description

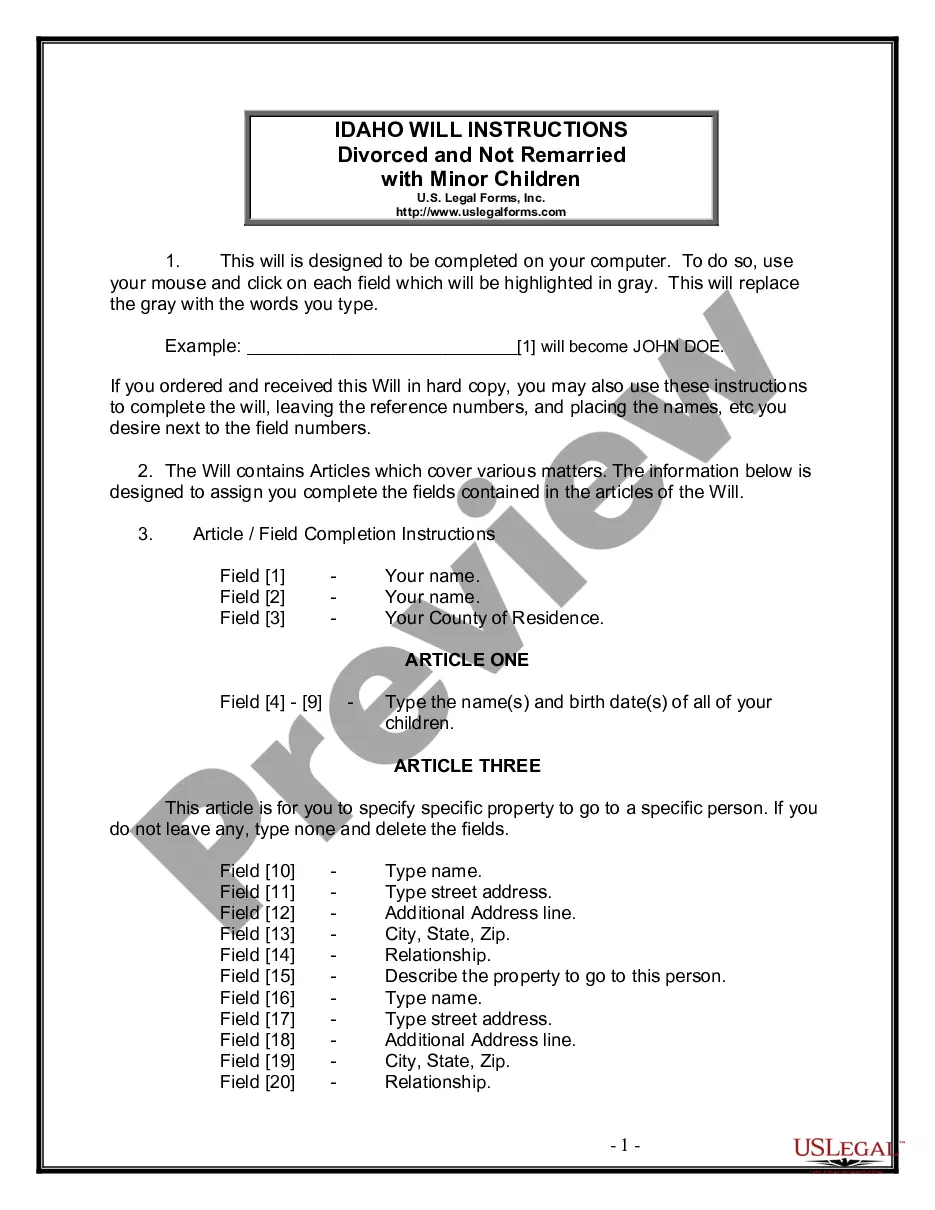

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

Locating the correct legal document template can pose a challenge.

It's obvious that there is an array of online templates available, but how do you locate the legal document you need.

Make use of the US Legal Forms website. This service offers a vast selection of templates, such as the Ohio Authority of Partnership to Open Deposit Account and to Obtain Loans, suitable for both business and personal requirements.

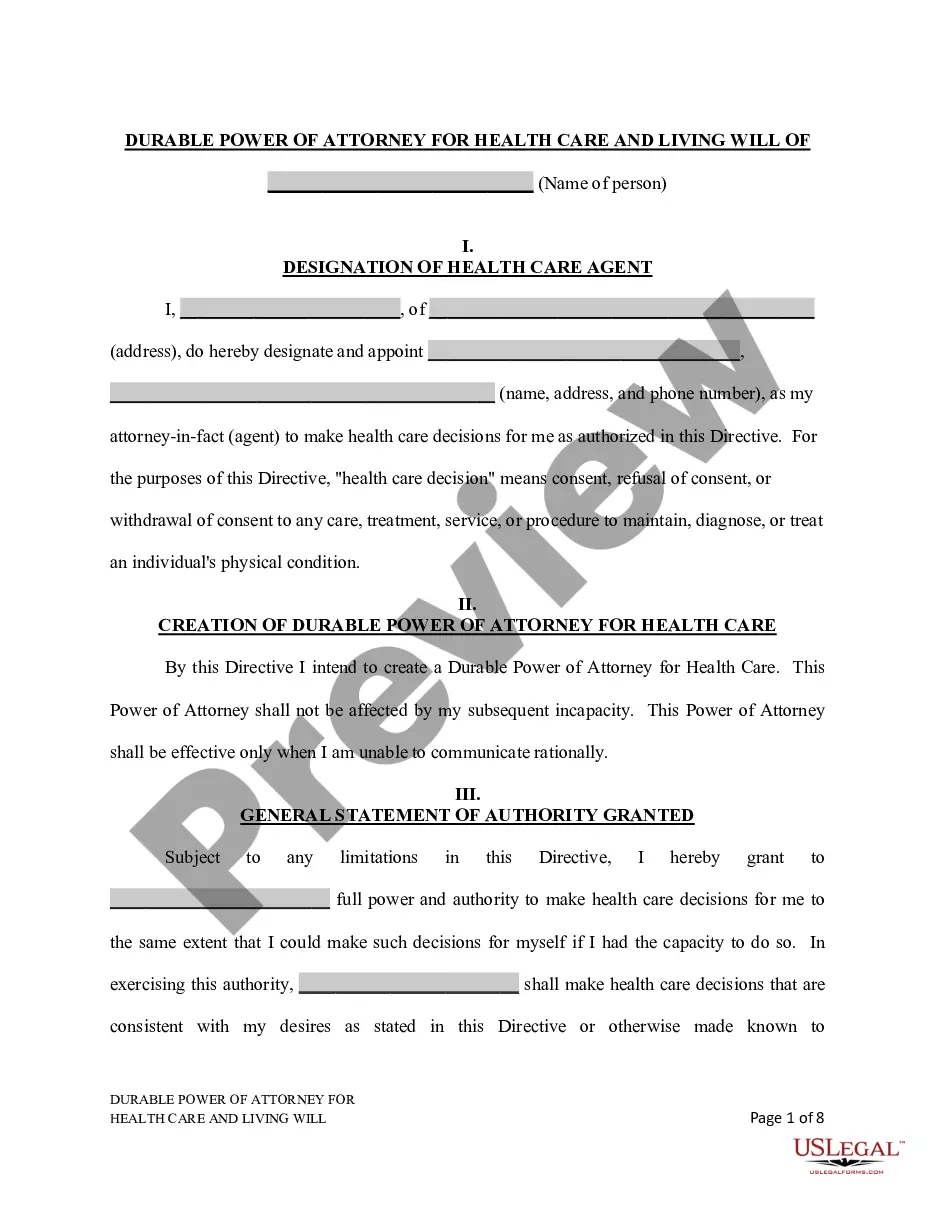

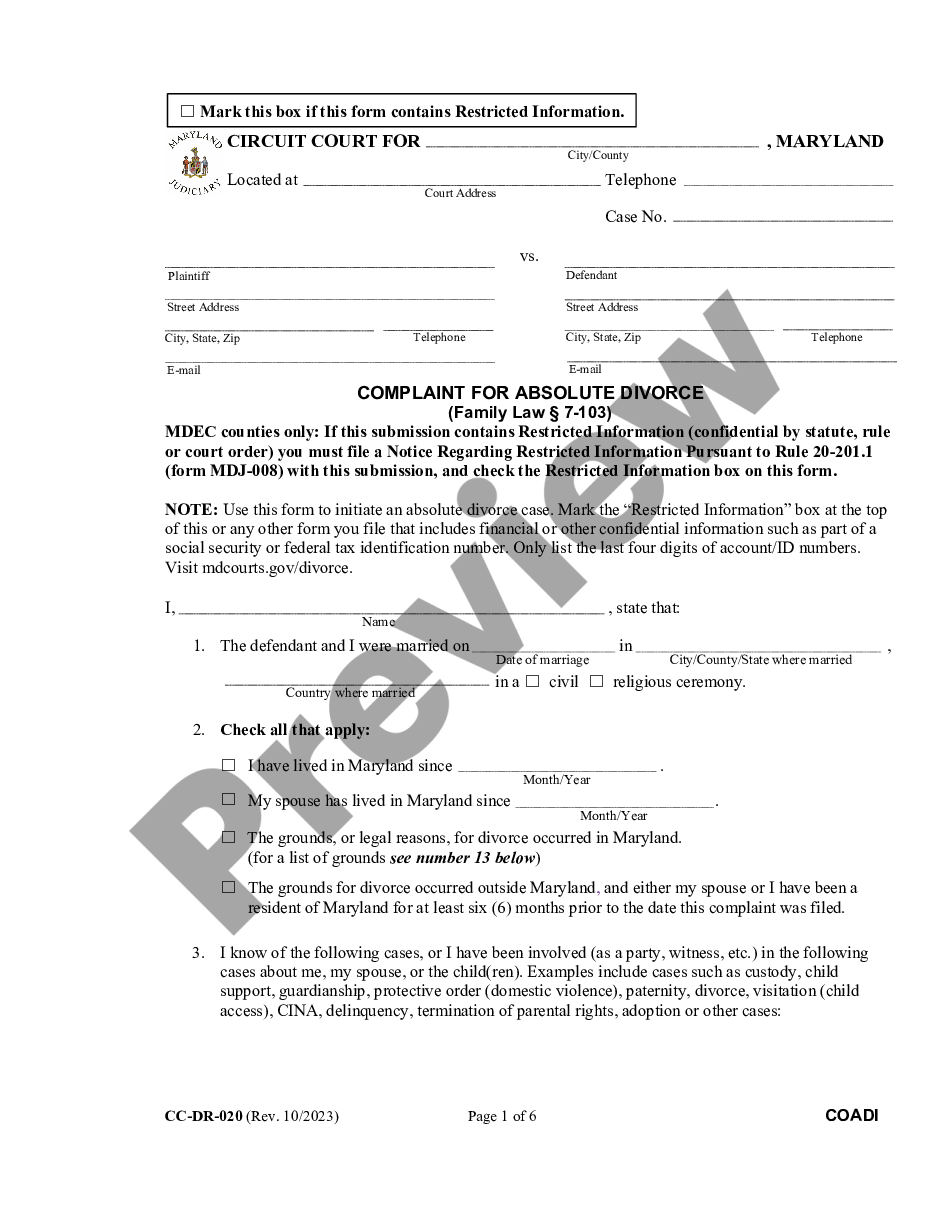

If the form does not satisfy your requirements, use the Search field to find the correct form. Once you are sure that the form is appropriate, click the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Ohio Authority of Partnership to Open Deposit Account and to Obtain Loans. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted paperwork that adheres to state requirements.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you have already registered, Log In to your account and click the Obtain option to retrieve the Ohio Authority of Partnership to Open Deposit Account and to Obtain Loans.

- Utilize your account to search for the legal documents you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow the simple steps outlined below.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review option and read the form details to confirm it is suitable for your needs.

Form popularity

FAQ

Sweeney added that most banks require a certified copy of a DBA to open a business bank account, since entrepreneurs aren't allowed to use their personal bank account under their business name. "Filing for a DBA allows entities to do business under another name without having to form a new organization," Sweeney said.

Collect the required Know Your Customer (KYC) documents that are required for opening the account. The bank will process the account opening formalities and open the start-up Business Account. Once the Business Account is opened, the start-up can take benefit of the other facilities offered by the bank.

Documents Required for Opening Company Current AccountPAN card of Director.Passport.Voter Identity Card.Driving License.Aadhaar card issued by Unique Identification Authority of India (UIDAI)Senior Citizen Card issued by State/Central Govt.Fisherman Identity card issued by State/Central Government.Arms License.

Most banks will let Single-Member LLCs open a bank account with their SSN, and some might even suggest it. We recommend using your EIN instead of your SSN for privacy and easier record keeping. If you formed your LLC by following our LLC filing instructions, you should have obtained an EIN from the IRS.

If you are a single-member LLC or sole proprietorship, an EIN is not required to open a business bank account because you are technically still classed as an individual in the eyes of the IRS.

Sweeney added that most banks require a certified copy of a DBA to open a business bank account, since entrepreneurs aren't allowed to use their personal bank account under their business name. Filing for a DBA allows entities to do business under another name without having to form a new organization, Sweeney said.

These are some of the most common requirements to open a business bank account.Employer Identification Number (EIN) or Social Security Number (SSN)Personal identification.Business formation documents.Ownership agreements.Business license.Certificate of assumed name.Monthly credit card revenue.31-Jan-2021

Details you'll need to apply online:Name and address of business.Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-XXXXXXX, or, if the LLC is a single member LLC, the EIN of the company or the Social Security Number (SSN) of the single member.More items...

Although there is no state or federal law that requires members of an LLC to open a separate business checking account, it's a recommended practice to do so to sustain those liability protections.

Common business accounts include a checking account, savings account, credit card account, and a merchant services account. Merchant services accounts allow you to accept credit and debit card transactions from your customers. You can open a business bank account once you've gotten your federal EIN.