Iowa Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

If you want to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the largest selection of legal documents, available online.

Employ the site’s straightforward and efficient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever.

You will have access to every form you acquired in your account. Check the My documents section and select a form to print or download again.

- Utilize US Legal Forms to access the Iowa Revocable Trust for Minors in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to find the Iowa Revocable Trust for Minors.

- You can also find forms you previously obtained from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/region.

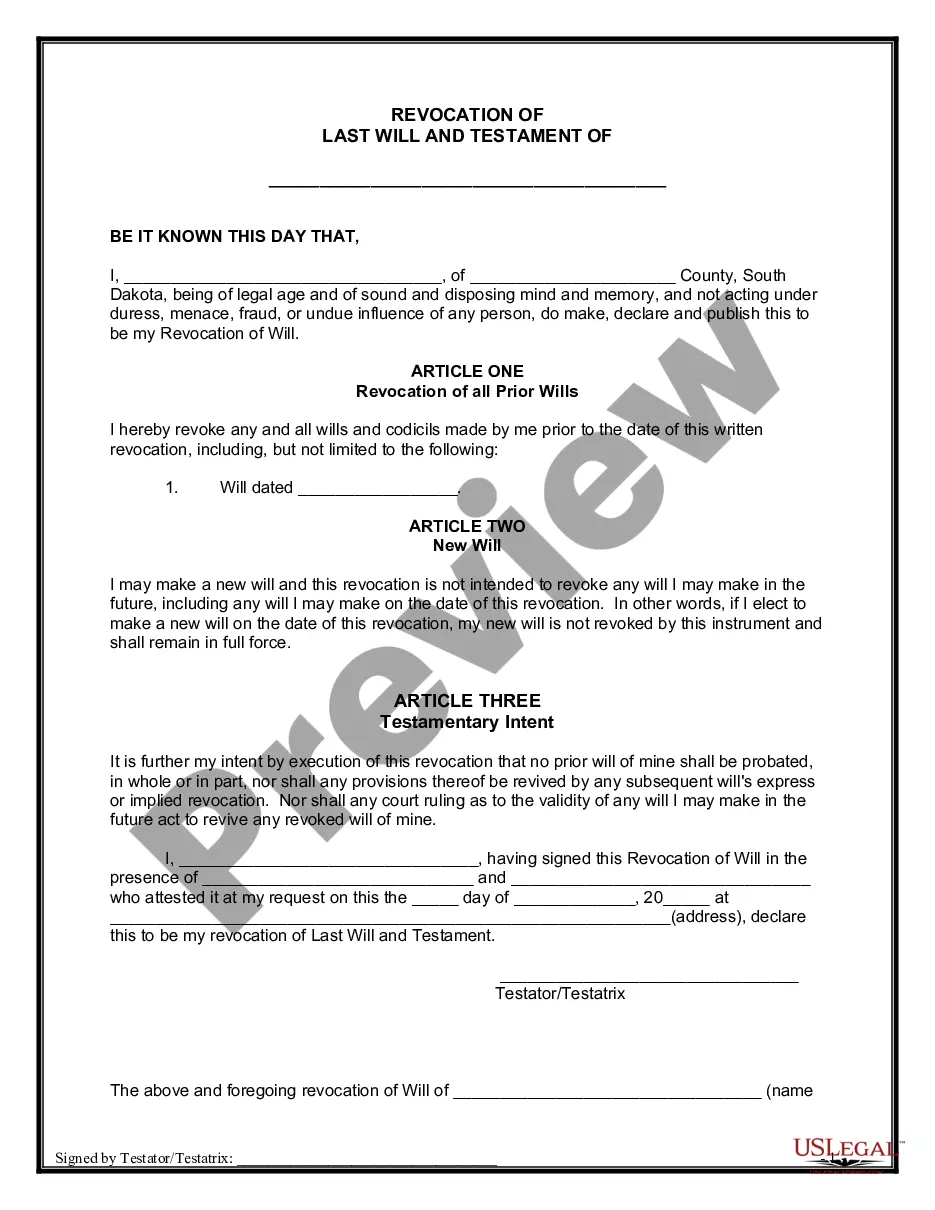

- Step 2. Utilize the Review feature to go through the form’s content. Don't forget to read the explanation.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, select the Get now option. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Iowa Revocable Trust for Minors.

Form popularity

FAQ

Creating an irrevocable trust in Iowa requires specific steps to ensure its validity. First, you need to designate a trustee, who will manage the trust's assets for the benefit of the beneficiaries. Moreover, it’s vital to draft a trust document that outlines the terms of the trust and complies with Iowa laws. If you're considering options that offer more flexibility, like an Iowa Revocable Trust for Minors, exploring platforms such as US Legal Forms can provide you with the necessary tools and resources.

An Iowa Revocable Trust for Minors is often considered one of the best options for protecting and managing assets for younger beneficiaries. This type of trust allows parents to set specific conditions for asset distribution, ensuring that minors receive support at the right time and in the right way. It is essential to consider the individual needs of your family when selecting the appropriate trust.

In Iowa, a trust does not need to be notarized to be legally enforceable. However, notarization can add an additional layer of protection, especially if disputes arise. Proper documentation is crucial, particularly for an Iowa Revocable Trust for Minors, where clear terms can prevent misunderstandings among family members.

Creating a revocable living trust in Iowa involves several key steps, starting with drafting the trust document. This document should clearly outline the terms, beneficiaries, and the trustee, with an emphasis on minors if applicable. Utilizing a platform like USLegalForms can simplify this process, providing templates and guidance tailored for an Iowa Revocable Trust for Minors.

In Iowa, a will does not necessarily need to be notarized to be valid, but it must be signed by two witnesses. However, having your will notarized can strengthen its validity in case of legal challenges. For those considering an Iowa Revocable Trust for Minors, notarization is also not required, but documenting it properly will provide peace of mind.

Iowa trust laws govern how trusts are created, managed, and enforced within the state. The uniformity provided by these laws helps ensure that instruments like an Iowa Revocable Trust for Minors can be relied upon to manage and protect assets effectively for beneficiaries. Understanding these laws can aid in tailoring a trust that meets your family's specific needs.

One significant mistake parents often make is failing to fund the trust properly. Establishing an Iowa Revocable Trust for Minors is only the first step; parents must actively transfer assets into the trust to ensure it effectively protects their children’s inheritance. Without proper funding, the trust may not serve its intended purpose, leaving minors without needed resources.

In Iowa, the primary difference between a will and a trust lies in how they distribute assets. A will becomes effective after death and is subject to probate, while a trust, such as an Iowa Revocable Trust for Minors, can manage assets during your lifetime and continue after your death, bypassing probate. Additionally, a trust provides greater control over how assets are distributed and can provide for minors in a structured way.

A minor trust is usually a specialized type of trust designed specifically to benefit a minor child. This trust allows a trustee to manage funds on behalf of the child until they are legally capable of doing so themselves. An Iowa Revocable Trust for Minors stands out in this category, as it offers both flexibility in terms of management and protection of the child’s assets, all while fitting seamlessly into estate planning.

Trusts can be categorized into several types, including revocable, irrevocable, living, and testamentary trusts. Each category serves different purposes and offers unique benefits based on the needs and intentions of the trust creator. For those interested in setting up a flexible arrangement for minors, an Iowa Revocable Trust for Minors falls under the revocable trust category, providing the ability to alter the terms as needed.