Ohio Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

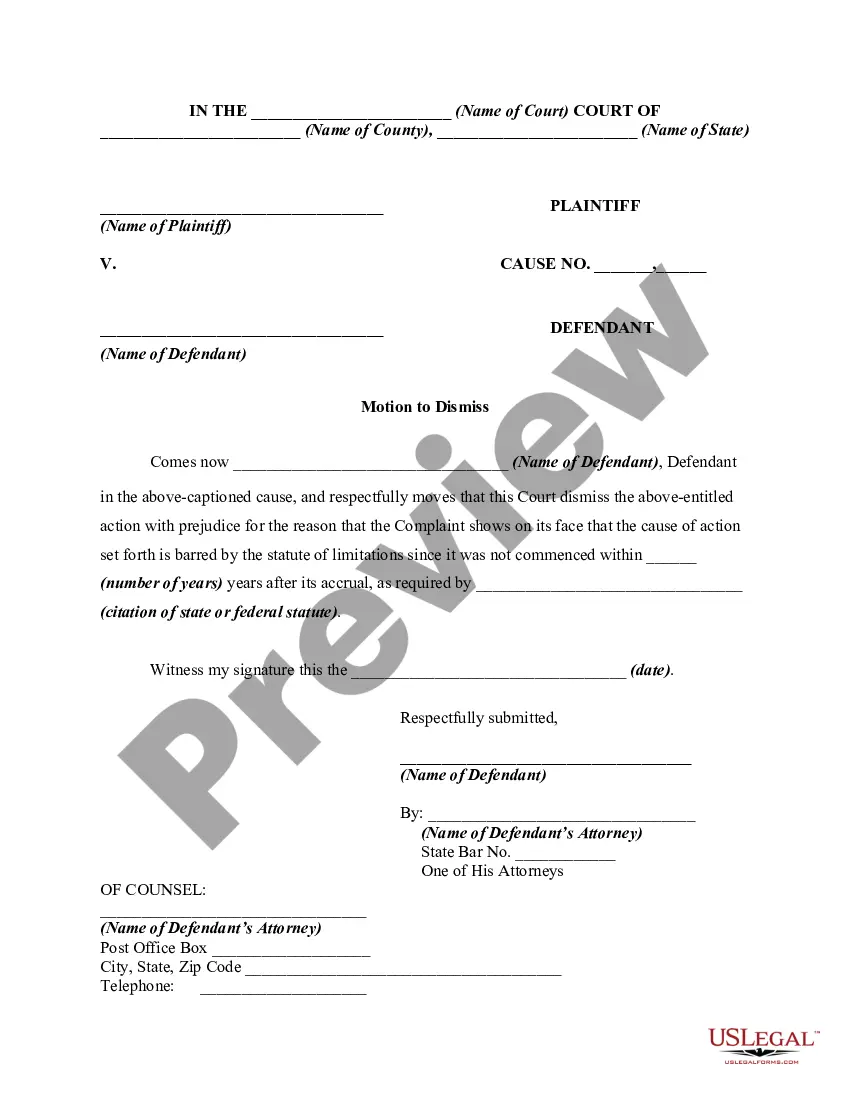

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

US Legal Forms - among the biggest libraries of lawful forms in the USA - gives an array of lawful document themes it is possible to download or printing. While using site, you can get a huge number of forms for business and individual functions, categorized by groups, states, or keywords and phrases.You will discover the most up-to-date variations of forms like the Ohio Sample Letter for Request for IRS not to Off Set against Tax Refund in seconds.

If you already possess a membership, log in and download Ohio Sample Letter for Request for IRS not to Off Set against Tax Refund through the US Legal Forms collection. The Download key will show up on every form you see. You have accessibility to all earlier downloaded forms from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the first time, here are simple recommendations to get you started off:

- Be sure you have picked the right form for the area/area. Click the Review key to analyze the form`s information. Read the form description to actually have selected the correct form.

- If the form does not satisfy your specifications, take advantage of the Lookup industry at the top of the display to find the one which does.

- In case you are content with the form, affirm your option by clicking on the Buy now key. Then, pick the pricing prepare you prefer and offer your references to sign up to have an accounts.

- Procedure the transaction. Use your credit card or PayPal accounts to perform the transaction.

- Choose the format and download the form in your system.

- Make adjustments. Complete, revise and printing and signal the downloaded Ohio Sample Letter for Request for IRS not to Off Set against Tax Refund.

Each and every design you included with your account lacks an expiration day which is your own permanently. So, if you would like download or printing another copy, just check out the My Forms segment and click in the form you require.

Obtain access to the Ohio Sample Letter for Request for IRS not to Off Set against Tax Refund with US Legal Forms, probably the most considerable collection of lawful document themes. Use a huge number of skilled and condition-certain themes that meet up with your business or individual demands and specifications.

Form popularity

FAQ

If your refund is greater than the total outstanding debt, it will be applied to the debt and you will receive the balance. Otherwise, your entire refund will be applied in partial satisfaction of the debt.

The IRS may, for example, choose not to offset an overpayment against an outstanding federal tax refund because of undue hardship. However, the IRS's authority not to offset generally disappears once the offset has been done?it cannot reverse an offset.

The ?Notice of Intent to Offset? tells you that you have a delinquent debt and part or all of your federal payments will be seized by the government. Federal tax refunds are typically offset by the IRS, although they may also accept other forms of federal payments.

If a taxpayer has a California income tax debt and is entitled to a federal income tax refund, we are authorized to withheld from that refund, or offset it, to pay the balance due. As you can see, our partnership with other state and federal agencies help resolve either delinquent income taxes or other government debt.

Prevent an offset Pay the full amount listed on the Intent to Offset Federal Payments (FTB 1102). Use the payment coupon included in the letter when you send your check or money order. To make a payment online, visit Payment options .

In response to the COVID-19 pandemic, the government has paused all collections through the Treasury Offset Program until June 30, 2023. This means, as a taxpayer, the IRS won't seize your 2023 federal income tax refund for a student loan offset.

Offset letter BFS will send you a letter explaining why your federal refund was reduced and that it may take several weeks before the federal refund reaches FTB. They will also send any remaining federal refund amount to you. To get a copy of your letter, contact us.

2 Why am I receiving an Ohio Income Tax Refund Offset letter? The agency or agencies shown on the letter have reported to the Department of Taxation that you owe one or more debts. The Department is required to apply your Ohio income tax refund as partial or complete payment of the debt(s).