Ohio Sample Letter for Written Acknowledgment of Bankruptcy Information

Description

How to fill out Sample Letter For Written Acknowledgment Of Bankruptcy Information?

Choosing the right legal record web template could be a have a problem. Of course, there are plenty of layouts available on the Internet, but how do you find the legal kind you require? Take advantage of the US Legal Forms website. The service offers 1000s of layouts, including the Ohio Sample Letter for Written Acknowledgment of Bankruptcy Information, which you can use for business and personal demands. All the varieties are inspected by specialists and meet federal and state needs.

In case you are currently authorized, log in to the accounts and click on the Acquire switch to find the Ohio Sample Letter for Written Acknowledgment of Bankruptcy Information. Make use of your accounts to search through the legal varieties you possess bought previously. Check out the My Forms tab of the accounts and have another duplicate in the record you require.

In case you are a new customer of US Legal Forms, listed here are simple instructions for you to stick to:

- Initial, make certain you have chosen the proper kind to your town/state. You can check out the form utilizing the Preview switch and read the form outline to guarantee this is basically the best for you.

- In the event the kind is not going to meet your preferences, make use of the Seach discipline to discover the correct kind.

- Once you are certain that the form would work, click on the Purchase now switch to find the kind.

- Opt for the prices prepare you need and enter in the essential info. Make your accounts and pay money for the transaction using your PayPal accounts or Visa or Mastercard.

- Choose the file structure and acquire the legal record web template to the system.

- Complete, edit and produce and sign the acquired Ohio Sample Letter for Written Acknowledgment of Bankruptcy Information.

US Legal Forms is the most significant collection of legal varieties for which you can see different record layouts. Take advantage of the company to acquire professionally-manufactured papers that stick to state needs.

Form popularity

FAQ

While no specific cash exemption is listed in the federal bankruptcy exemptions, a wildcard exemption allows you to protect up to $1,325 in any property and use up to $12,575 of any unused portion of a homestead exemption to protect money.

The Trustee cannot take and sell your car, truck, or van if its equity is less than Ohio's exemption amount of $3,675. If your vehicle's equity is exceptionally more than $3,675, the trustee may try to take your vehicle and sell it to pay your unsecured creditors.

The Chapter 7 bankruptcy process involves selling all the debtor's non-exempt assets. The sale of assets generates funds to pay off the debtor's debts as much as possible. Ohio courts impose a ?stay? during the bankruptcy process that prohibits creditors from trying to collect on their debts.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

How To File Bankruptcy in Ohio for Free Collect Your Ohio Bankruptcy Documents. ... Take a Credit Counseling Course. ... Complete the Bankruptcy Forms. ... Get Your Filing Fee. ... Print Your Bankruptcy Forms. ... File Your Forms With the Ohio Bankruptcy Court. ... Mail Documents to Your Trustee. ... Take a Debtor Education Course.

You can keep up to $500 in cash in your bank account or on hand. There is also a wildcard exemption, where you can exempt up to $1,325 for any property you choose. So technically, you could keep $1,825 of your cash when filing for Chapter 7 bankruptcy in Ohio.

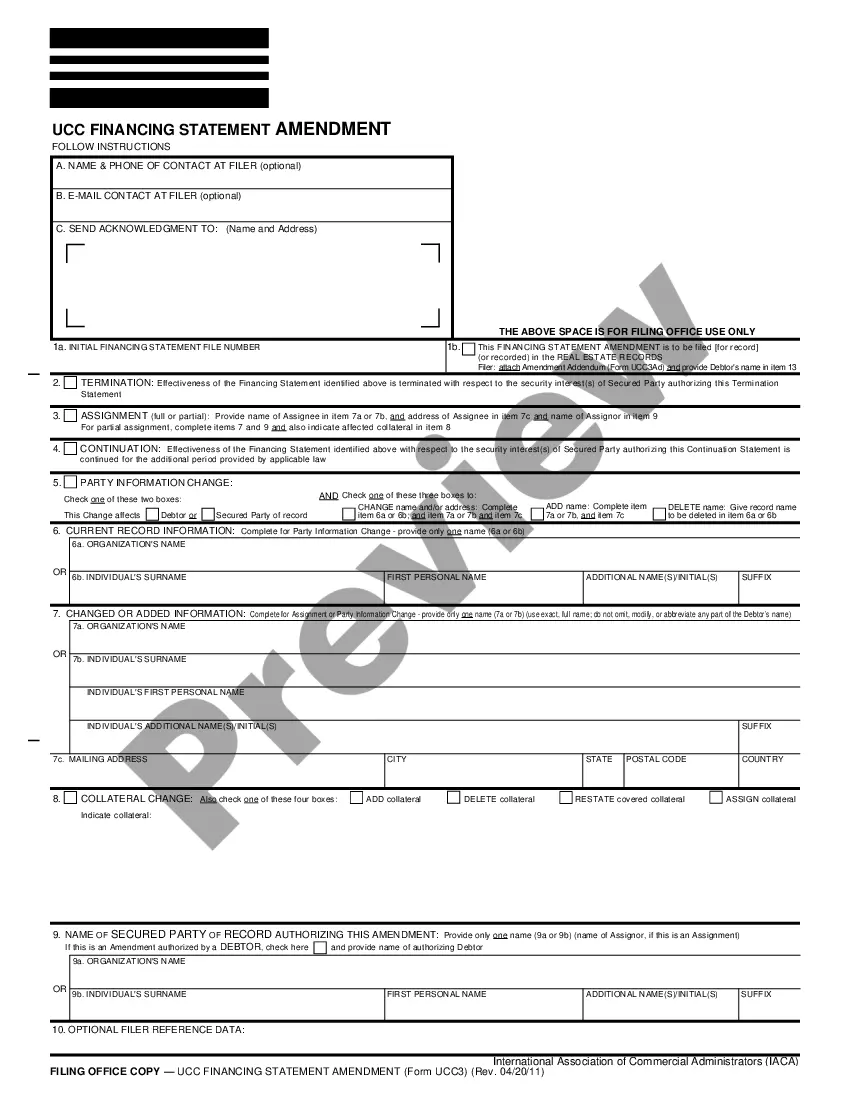

A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed.

How to File for Chapter 13 Bankruptcy in Ohio Step 1: Gather Your Financial Documents. ... Step 2: Determine if You Qualify for Chapter 13 Bankruptcy. ... Step 3: Attend a Pre-Filing Online Credit Counseling. ... Step 4: Complete & File Bankruptcy Forms. ... Step 5: Pay a Chapter 13 Filing Fee. ... Step 6: Provide Your Trustee with Documents.