Ohio Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator

Description

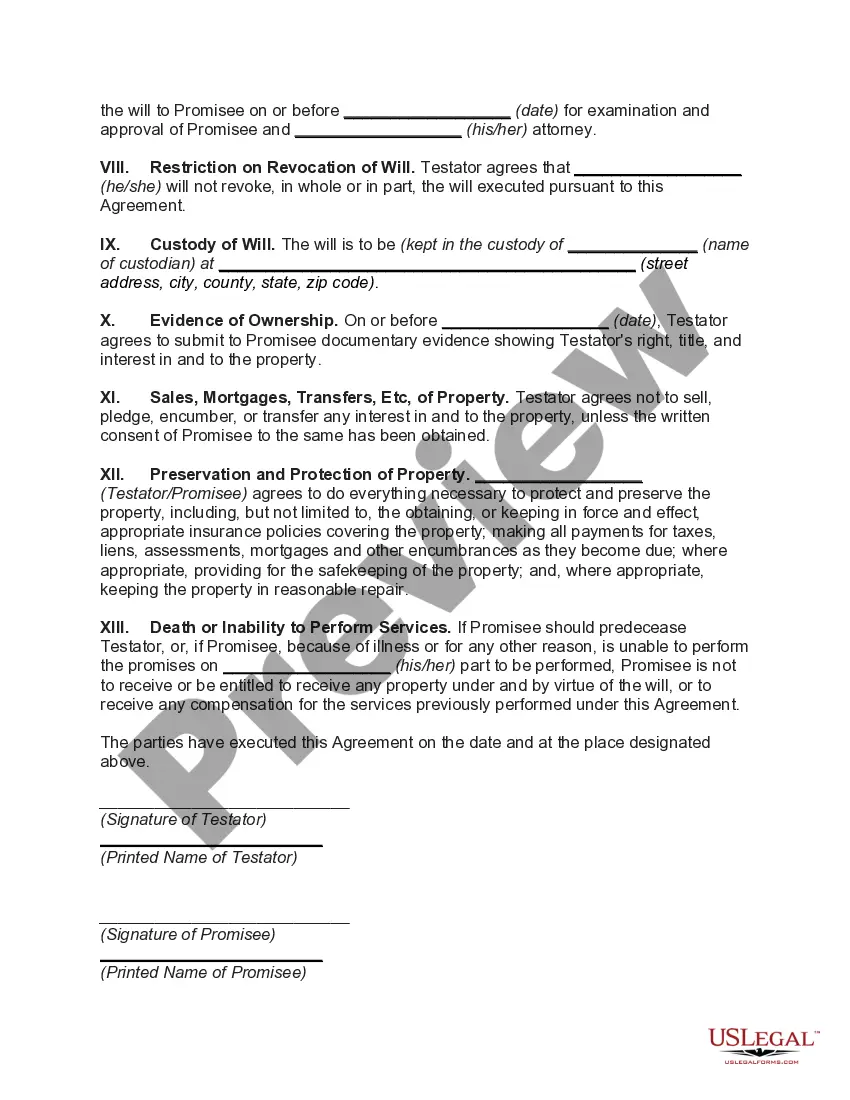

How to fill out Agreement To Devise Or Bequeath Property To A Person Performing The Personal Services Of Lifetime Care For A Future Testator?

It is feasible to devote time online attempting to locate the sanctioned document template that fulfills the federal and state requirements you desire.

US Legal Forms provides thousands of legal documents that can be reviewed by professionals.

It is easy to acquire or print the Ohio Agreement to Devise or Bequeath Property to a Person Providing Personal Services of Lifetime Care for a Future Testator from the service.

If available, utilize the Review button to check the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, edit, print, or sign the Ohio Agreement to Devise or Bequeath Property to a Person Providing Personal Services of Lifetime Care for a Future Testator.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the form details to confirm you have picked the appropriate form.

Form popularity

FAQ

In Ohio, an executor generally cannot sell property of the estate without obtaining the approval of all beneficiaries unless the will provides specific authority to do so. This regulation is essential in the context of the Ohio Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator. Beneficiaries should stay informed about their rights to help prevent unauthorized transactions.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

A gift given by means of the will of a decedent of an interest in real property.

Testamentary Gifts Traditionally, a gift of real property in a will is known as a devise. Traditionally, a gift of money in a will is known as a legacy. Traditionally, a gift of personal property other than money in a will is known as a bequest. Today, any gift of personal property may be known as bequest or legacy.

BENEFICIARY - A person named to receive property or other benefits.

Leaving Your Property Some Other Way Before you list those specific bequests, you will name a beneficiary or beneficiaries to get "everything else" in your estate-- that is, all of the property that is left over after the specific gifts are distributed.

Bequests are assets given in a will or a trust. A bequest might be a specific amount of money or assets, a percentage of those assets, or what is left over after heirs and other obligations are paid from an estate.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

A bequest is the act of shifting assets to individuals or organizations, through the provisions of a will or an estate plan. The IRS has an estate and gift tax exemption of $11.7 million as of 2021 ($12.06 million for 2022).

Legacy, also called Bequest, in law, generally a gift of property by will or testament. The term is used to denote the disposition of either personal or real property in the event of death.