Ohio Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

How to fill out Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

If you want to total, obtain, or print legitimate papers layouts, use US Legal Forms, the largest collection of legitimate forms, that can be found online. Use the site`s simple and hassle-free research to get the files you require. Numerous layouts for company and personal reasons are categorized by types and says, or key phrases. Use US Legal Forms to get the Ohio Receipt and Release Personal Representative of Estate Regarding Legacy of a Will in just a couple of click throughs.

In case you are currently a US Legal Forms buyer, log in for your bank account and click the Down load option to obtain the Ohio Receipt and Release Personal Representative of Estate Regarding Legacy of a Will. You can also gain access to forms you formerly delivered electronically within the My Forms tab of your own bank account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

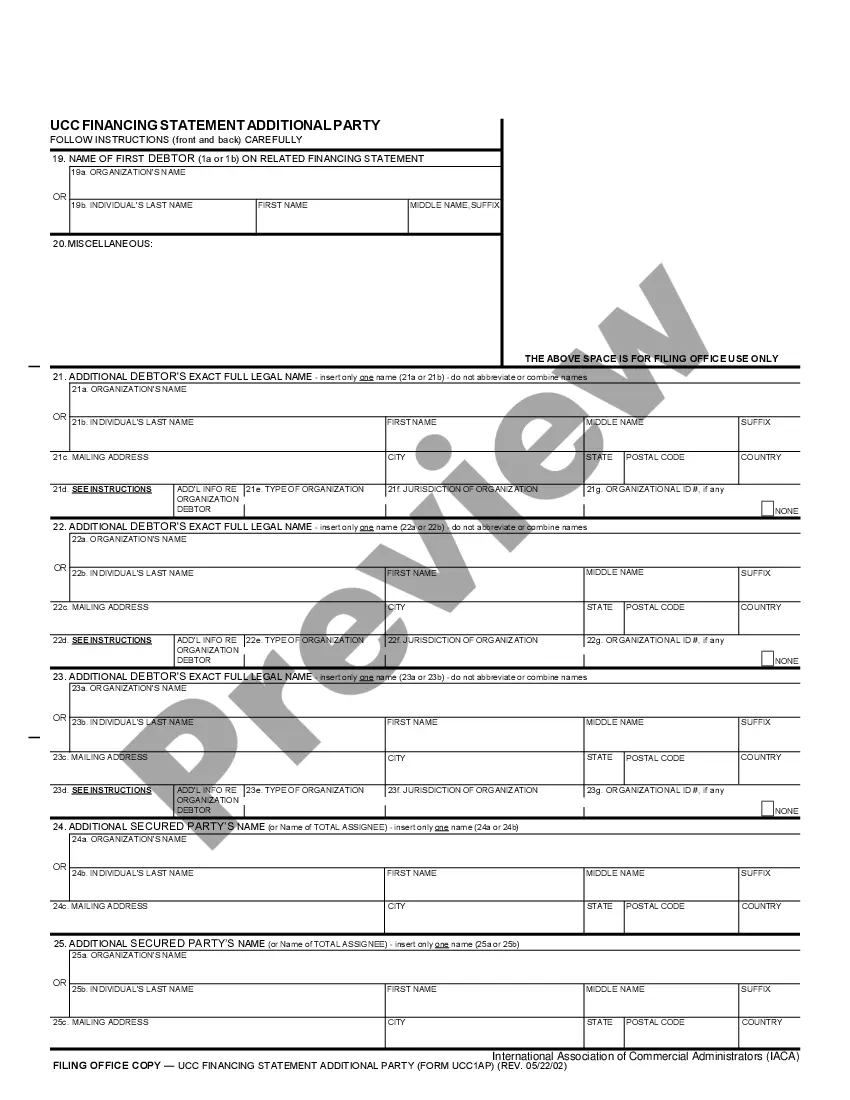

- Step 1. Ensure you have selected the shape for that appropriate area/country.

- Step 2. Use the Preview choice to examine the form`s information. Do not forget to see the information.

- Step 3. In case you are not happy with the develop, utilize the Research industry at the top of the display screen to locate other types of your legitimate develop format.

- Step 4. When you have located the shape you require, select the Buy now option. Select the costs strategy you like and add your credentials to sign up for an bank account.

- Step 5. Method the transaction. You may use your credit card or PayPal bank account to perform the transaction.

- Step 6. Pick the structure of your legitimate develop and obtain it in your product.

- Step 7. Full, change and print or sign the Ohio Receipt and Release Personal Representative of Estate Regarding Legacy of a Will.

Every single legitimate papers format you acquire is your own property permanently. You may have acces to every single develop you delivered electronically in your acccount. Click on the My Forms area and select a develop to print or obtain yet again.

Be competitive and obtain, and print the Ohio Receipt and Release Personal Representative of Estate Regarding Legacy of a Will with US Legal Forms. There are many skilled and condition-distinct forms you can utilize for your personal company or personal requires.

Form popularity

FAQ

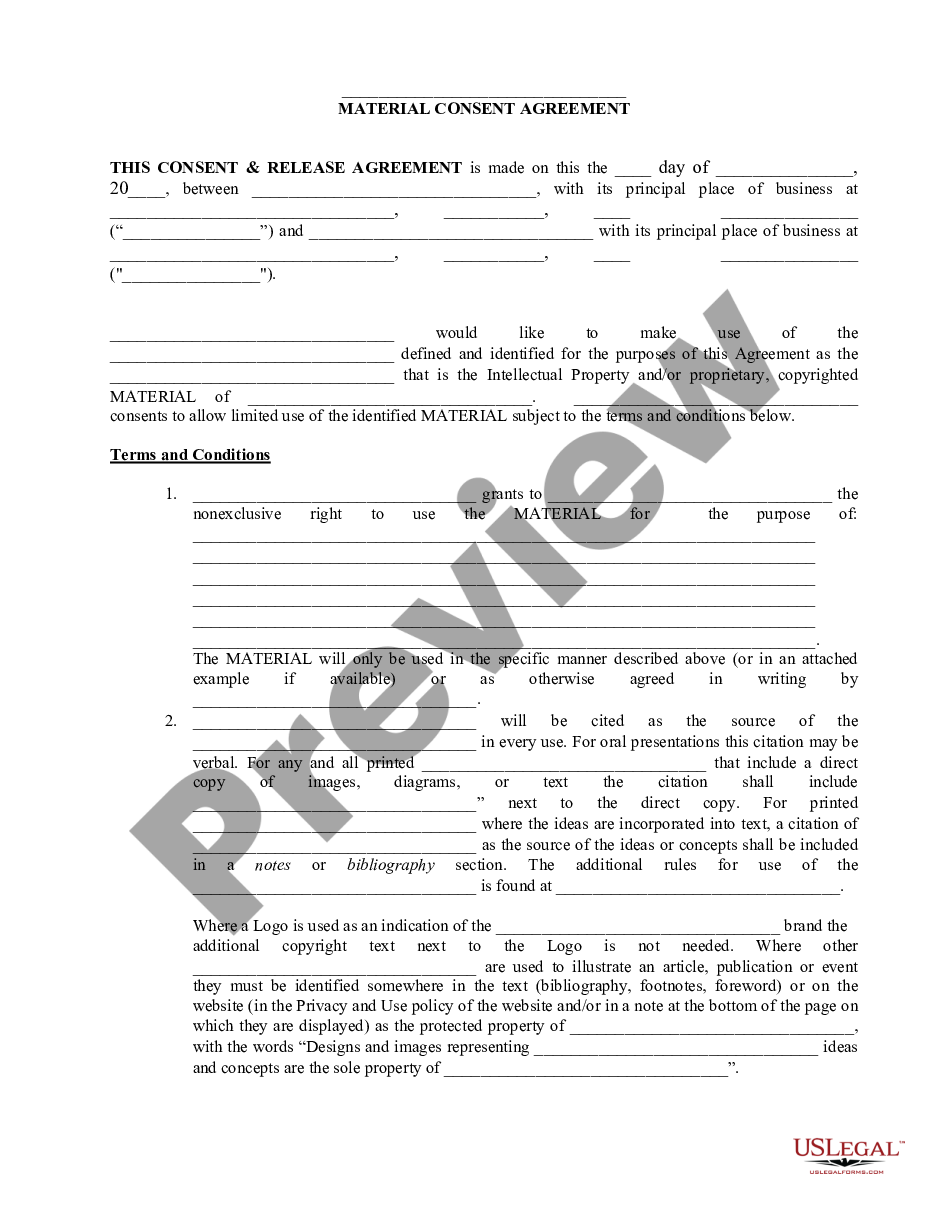

A Receipt and Release Agreement is the means by which a beneficiary of an estate may acknowledge receipt of the property to which he is entitled, and agree to release the executor from any further liability with respect thereto.

This is a legal process in which the assets of the deceased are identified and distributed to their heirs. One of the things that is often required during probate is a copy of the deceased's final receipt. This is a document that shows all of the transactions that occurred in the final days of the person's life.

The executor or personal representative should obtain a written receipt from the beneficiary to confirm that the legacy has been paid. It is also a good idea to provide the beneficiaries with a copy of the financial records and ask them to provide a receipt to acknowledge payment.

If the decedent did not have a will (or the will did not specifically say the Executor has the power to sell real estate), then the real property may only be sold 1) if all beneficiaries or heirs consent, or 2) though a court-supervised ?land sale? proceeding.

The Receipt And Release will state that the beneficiary releases the Trustee from any and all claims, damages, legal causes of action, et cetera, known or unknown, regarding the administration of the Trust. Third, there may be unknown liabilities at the time of the distribution, most commonly income tax.

What is a receipt and release? A Receipt and Release Agreement is the means by which a beneficiary of an estate may acknowledge receipt of the property to which he is entitled, and agree to release the executor from any further liability with respect thereto.

The Receipt And Release should provide that the beneficiary agrees to immediately refund to the Trustee part or all of the distributed Trust property and assets (or the cash proceeds resulting from the sale thereof) that may be requested in writing by the Trustee if it is subsequently determined that: (1) part or all ...

If the executor or administrator distributes any part of the assets of the estate within three months after the death of the decedent, the executor or administrator shall be personally liable only to those claimants who present their claims within that three-month period.