Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

US Legal Forms - among the largest collections of legal templates in the USA - provides a wide range of legal document formats that you can download or print.

By utilizing the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of documents such as the Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation featuring Noncompetition Provisions in just minutes.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- If you currently hold a subscription, Log In and download the Ohio Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously acquired forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple guidelines to get started.

- Ensure you have chosen the correct form for your area/county.

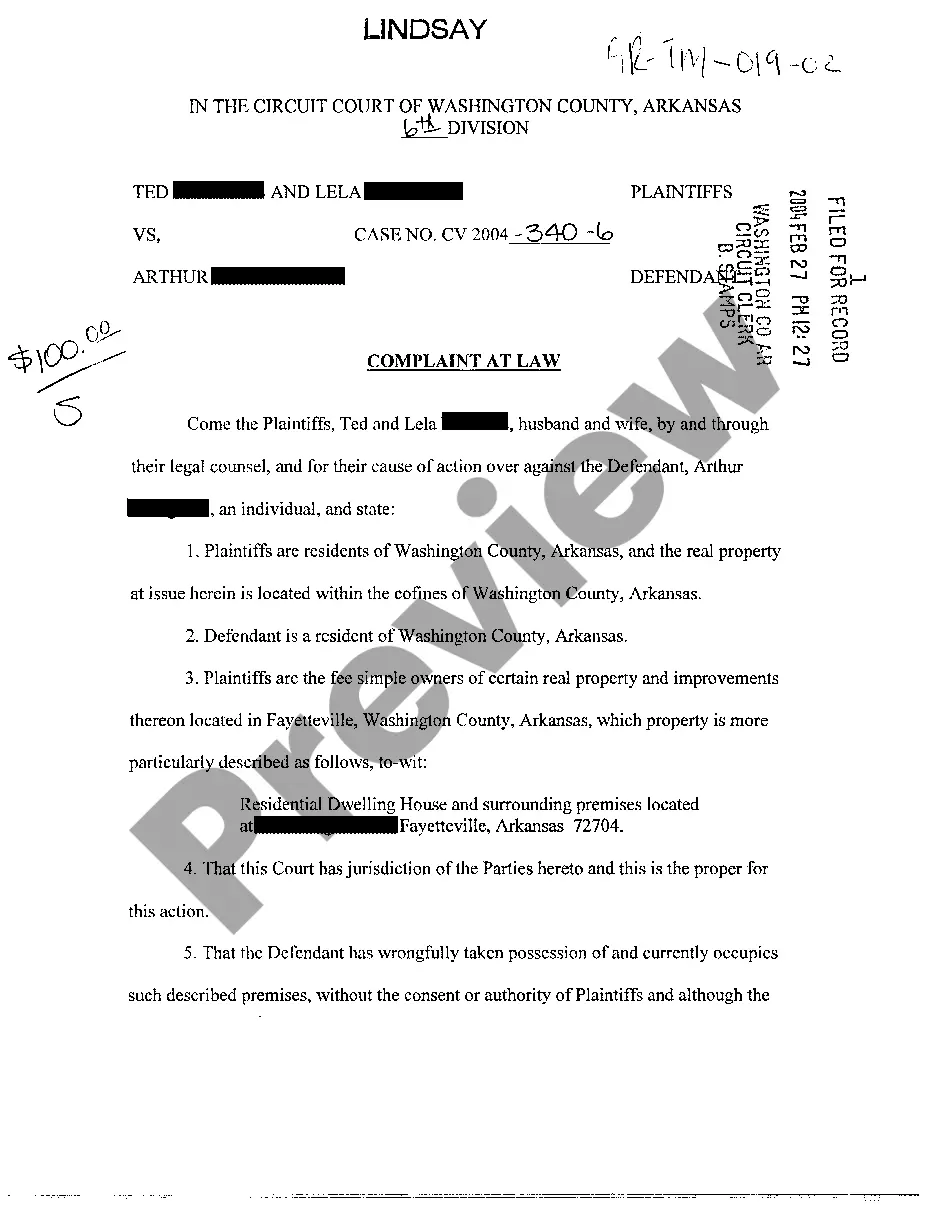

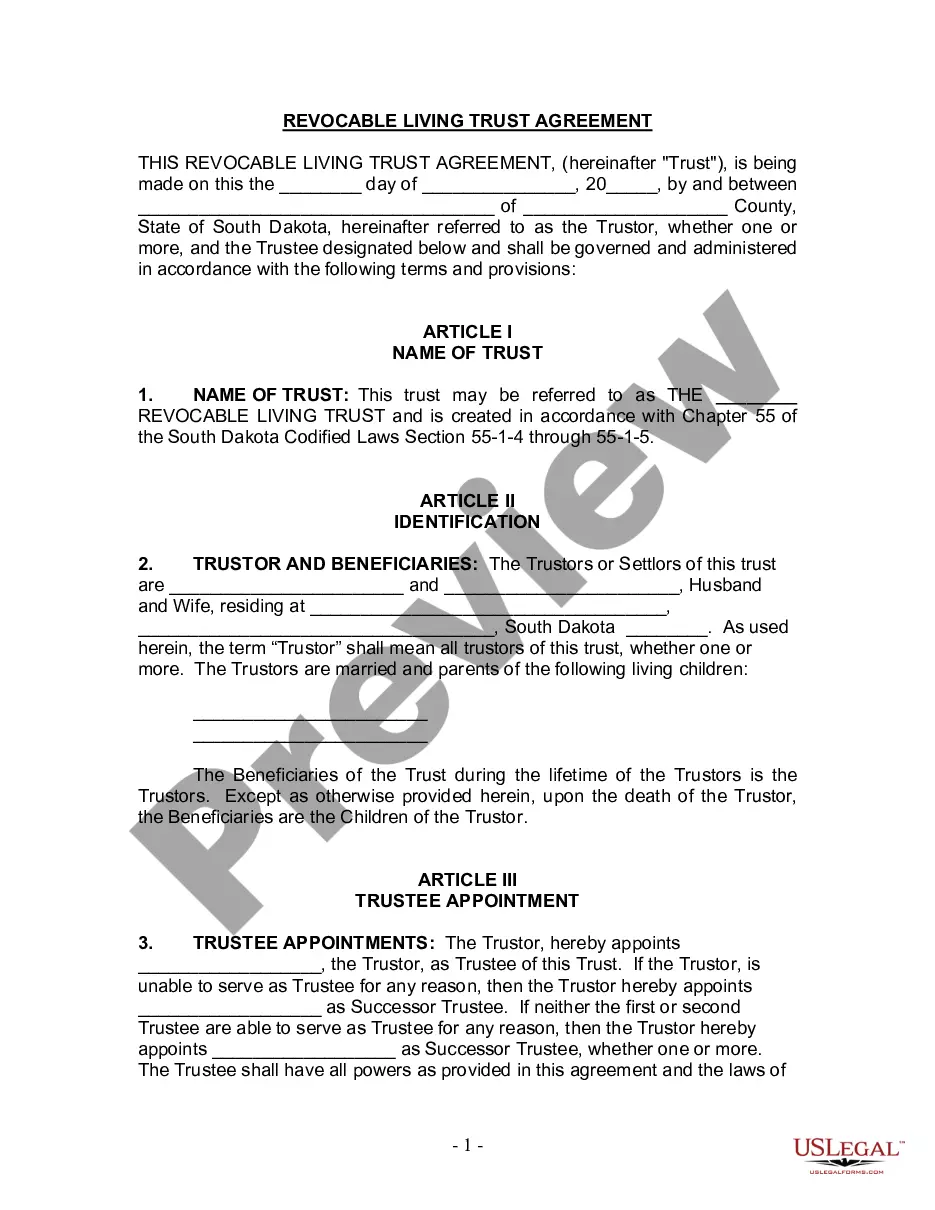

- Review the Review option to analyze the content of the form.

Form popularity

FAQ

sell agreement consists of three common elements: a triggering event, a valuation method and a funding strategy.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

Your agreement should include detailed information about your business' worth. It is important for these numbers to be as accurate as possible. Because your company's value may not remain the same, you should consider having it professionally appraised or using a clearly defined formula to value the business.

Types of buy-sell agreements include cross-purchase agreements, redemption agreements, hybrid buy-sell agreements, company purchase agreements, and asset purchase agreements . Consider your options carefully when engaging in a buy-sell agreement and speak with corporate lawyers to learn about your legal rights.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

An entity-purchase agreement is one form of a buy and sell agreement: a legally binding contract commonly used by sole proprietorships, partnerships, and closed corporations that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business.

Here is how buy-sell agreements work:Determine which events invoke a triggered buyout.Establish who has rights and purchase obligations.Identify the names and address of the purchasers.Set a purchase price or valuation with applicable discounts.Establish payment terms as well as their intervals.More items...

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.