Ohio Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

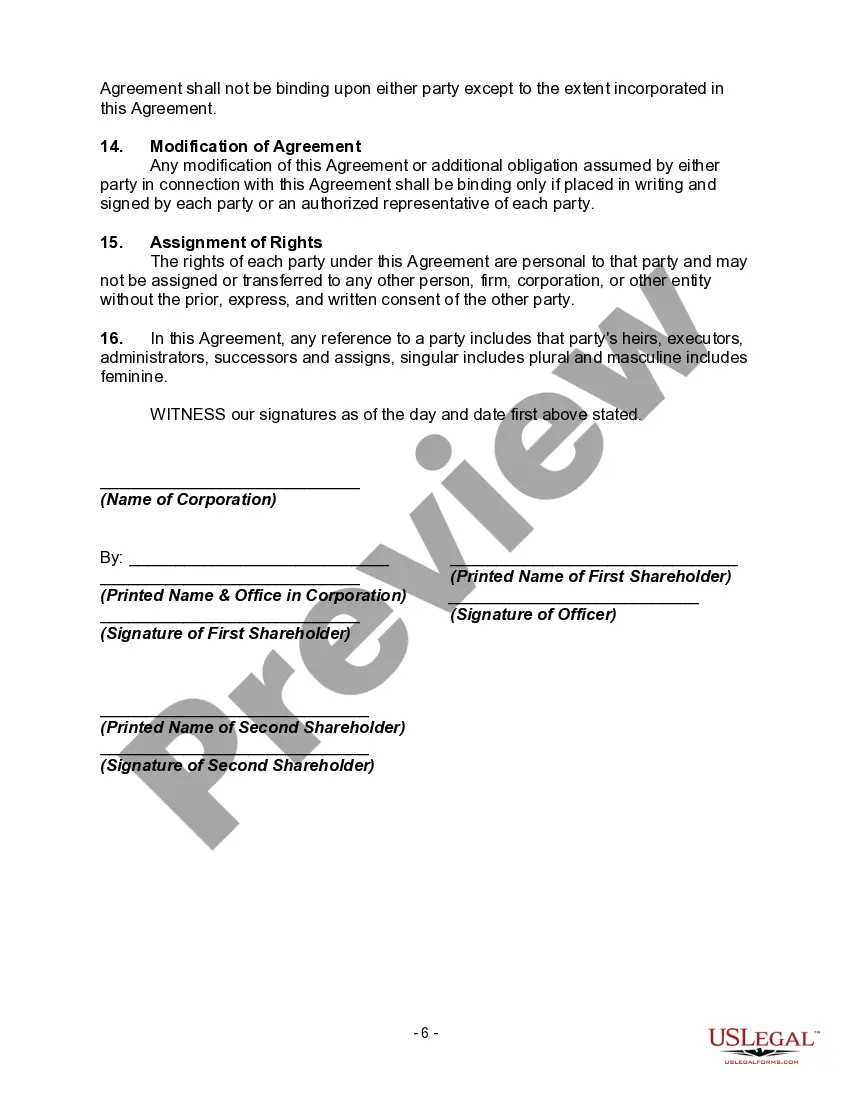

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse array of legal form templates that you can download or print.

By using the website, you will access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can retrieve the latest versions of forms such as the Ohio Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy-Sell Provisions in moments.

Click the Preview button to review the form's content.

Read the form details to confirm that you have selected the correct form.

- If you already have an account, Log In and download the Ohio Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy-Sell Provisions from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously saved forms from the My documents section of your profile.

- If you are looking to use US Legal Forms for the first time, here are a few simple tips to get started.

- Ensure you have selected the correct form for your region.

Form popularity

FAQ

Yes. Most companies that raise investment (on Crowdcube or elsewhere) include a drag along procedure in their articles of association. The procedure is designed to ensure that minority shareholders cannot block an exit by the majority.

What Are Buy-Sell Agreements? Buy-Sell agreements or forced buyouts are one way for the majority to force out a minority. This allows a majority to force a minority to sell their shares often in the context of a company-wide buyout.

Events Covered Under a Buyout Agreementa divorce settlement in which a partner's ex-spouse stands to receive a partnership interest in the company. the foreclosure of a debt secured by a partnership interest. the personal bankruptcy of a partner, or. the disability, death, or incapacity of a partner.

The answer is usually no, but there are vital exceptions. However, there are a few situations in which shareholders must sell their stock even if they would prefer to hold onto their shares. The two most common are when a company gets acquired and when it has an agreement among shareholders calling for forced sales.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

A buyout agreement is a contract between the shareholders of a company. The agreement determines whether a company must buyout a departing shareholder or whether a company has the right to buyout a shareholder when a certain event, such as a shareholder's death, occurs.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

If an individual is purchasing or selling shares in the company or industry with another business or person, they should use a share purchase agreement. For instance, if there are two partners for a business, they have equal rights and shares.

A partnership buyout is when the director of a company buys out the shares of their partner and terminates a partnership agreement or buys out the co-director over time until the full share has been purchased.

In general, shareholders can only be forced to give up or sell shares if the articles of association or some contractual agreement include this requirement. In practice, private companies often have suitable articles or contracts so that the remaining owner-managers retain control if an individual leaves the company.