In this guaranty, two corporations guarantee the debt of an affiliate corporation.

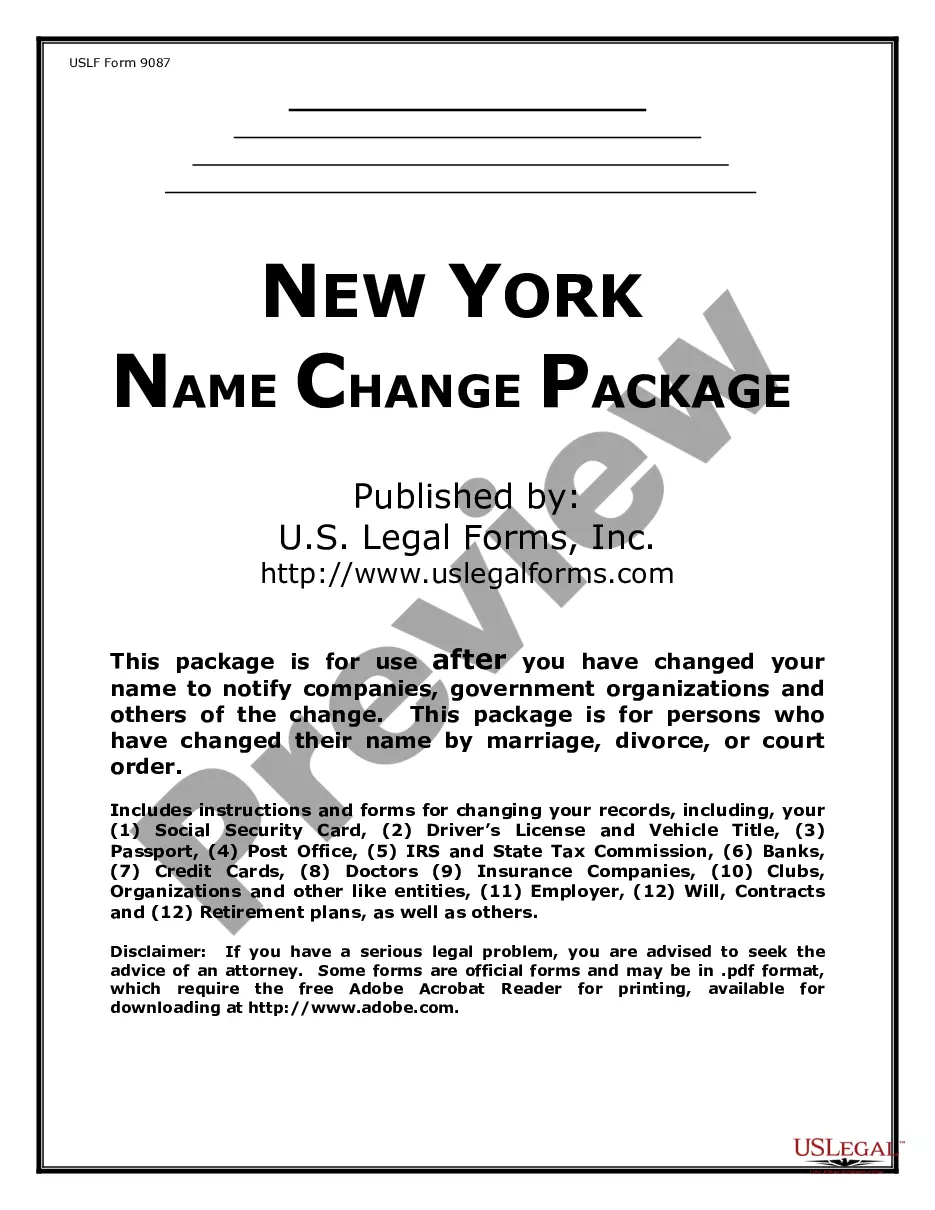

Ohio Cross Corporate Guaranty Agreement

Description

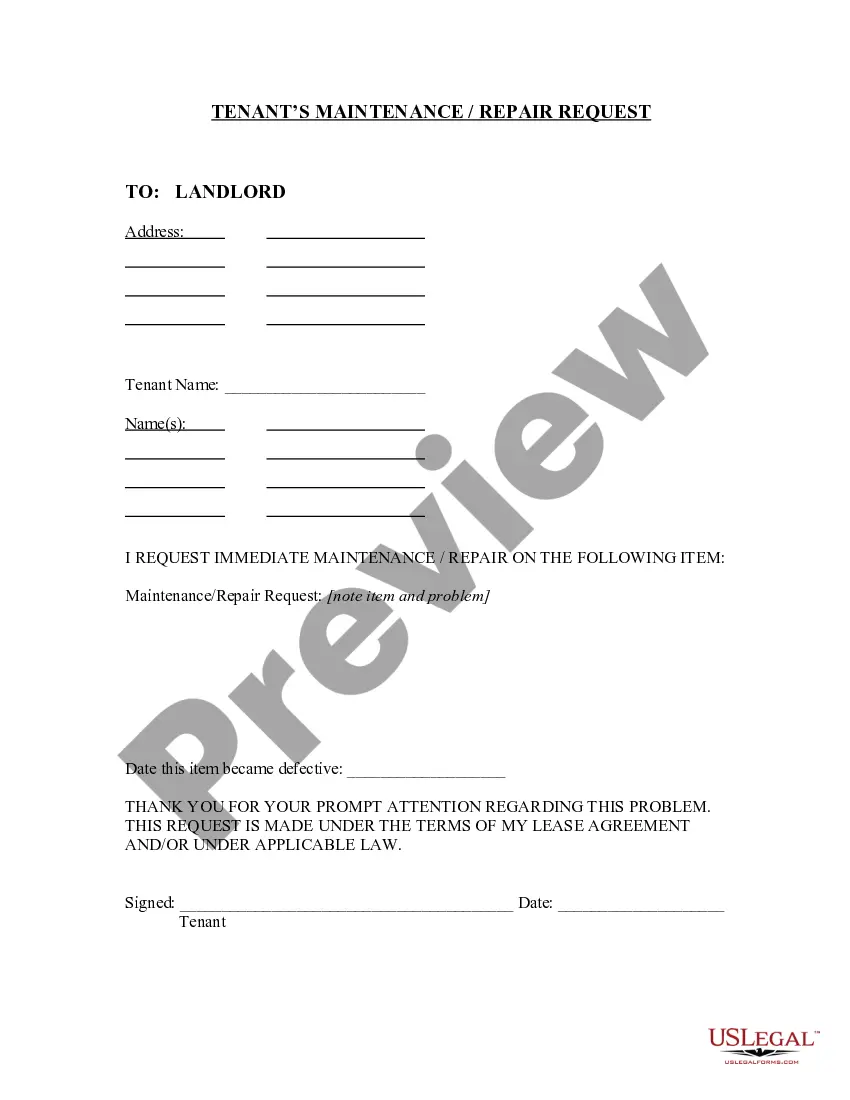

How to fill out Cross Corporate Guaranty Agreement?

Have you ever been in a situation where you required documentation for organizational or specific goals nearly all the time.

Numerous authorized document templates are available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Ohio Cross Corporate Guaranty Agreement, crafted to comply with state and federal regulations.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Ohio Cross Corporate Guaranty Agreement at any time, if necessary. Just select the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally designed legal document templates that you can use for various needs. Create your account on US Legal Forms and start simplifying your life.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Cross Corporate Guaranty Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

- Utilize the Preview button to view the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to locate the form that fits your needs and expectations.

- Once you find the suitable form, click on Purchase now.

- Choose the payment plan you desire, complete the required information to create your account, and make the payment using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Yes, a company can guarantee another company's obligations through an Ohio Cross Corporate Guaranty Agreement. This arrangement helps establish trust and allows companies within a group to support each other financially. Using platforms like uslegalforms can assist in creating these agreements, ensuring all legal aspects are covered effectively.

Cross default in an Ohio Cross Corporate Guaranty Agreement triggers default on multiple obligations if one debt goes unpaid. This clause protects lenders by ensuring that a failure to meet any financial commitment can lead to comprehensive consequences for the borrower. It creates a more secure environment for lending, as financial health is closely monitored across all related entities.

A guarantee agreement, such as the Ohio Cross Corporate Guaranty Agreement, is designed to provide assurances regarding repayment of debt. It establishes a clear obligation for the guarantor to fulfill repayments if the primary debtor fails to do so. This agreement strengthens trust between parties and can lead to improved terms on loans or credit facilities.

The cross guarantee in an Ohio Cross Corporate Guaranty Agreement allows one company to guarantee the debts of another within the same corporate group. This arrangement enhances the creditworthiness of each entity, as the financial strengths of all parties are pooled together. This mutual support can make it simpler for all companies involved to access funding and undertake larger projects.

The guarantee clause in an Ohio Cross Corporate Guaranty Agreement serves to assure lenders and investors that they will receive payment if the borrowing company defaults. This clause acts as a safety net, giving lenders confidence that they can recover their investments. With this assurance, companies often find it easier to secure loans and create stronger financial relationships.

A guarantee typically refers to a promise by an individual or entity to fulfill another's financial obligations. In contrast, a corporate guarantee specifically involves a business entity assuming responsibility for another's debts or obligations. Understanding this difference is crucial when navigating financial agreements like the Ohio Cross Corporate Guaranty Agreement, as it can affect liability and trustworthiness.

Writing a guarantee agreement requires you to include essential details such as the parties involved, the obligations being guaranteed, and any relevant terms or conditions. Clearly outline responsibilities and ensure all parties sign the document to make it legally binding. Utilizing the US Legal Forms platform can guide you in crafting a comprehensive contract suited to your needs.

A cross company guarantee involves multiple companies guaranteeing each other's obligations, helping to improve trust in multi-company transactions. In this arrangement, if one company defaults, the others take on the financial responsibility. This collaborative approach solidifies financial relationships and encourages business growth across the board.

A cross corporate guarantee involves multiple corporate entities agreeing to guarantee each other’s obligations. This arrangement provides a network of support among the companies, strengthening their financial positions. Utilizing an Ohio Cross Corporate Guaranty Agreement helps clarify these interconnected obligations, ensuring that all parties are aware of their commitments.

A guaranty agreement must be signed by the guarantor, who is usually a representative of the corporate entity providing the guarantee. It's important for the signing individual to have the authority to bind the corporation legally. In the context of an Ohio Cross Corporate Guaranty Agreement, it is also advisable for other involved parties to acknowledge the document to prevent future disputes.