Ohio Checklist - Action to Improve Collection of Accounts

Description

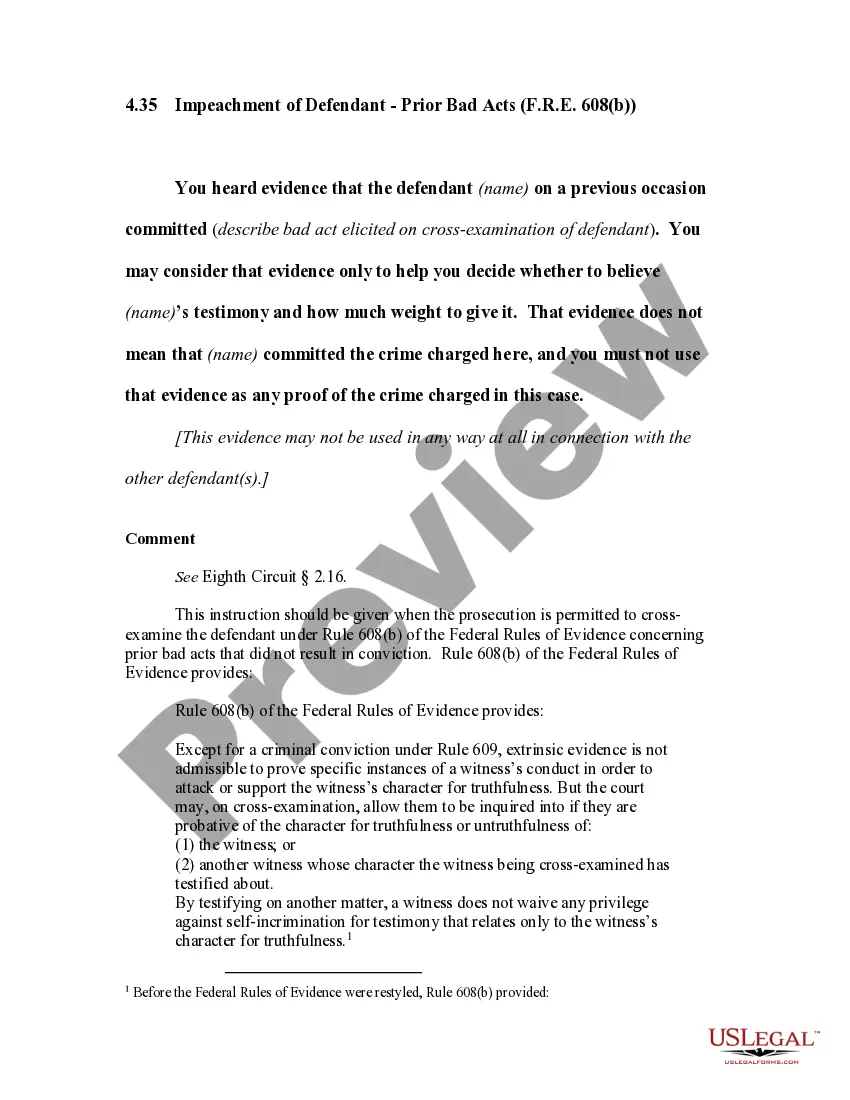

How to fill out Checklist - Action To Improve Collection Of Accounts?

You may spend numerous hours online looking for the valid document template that complies with the federal and state requirements you will require.

US Legal Forms offers a vast assortment of valid forms that can be evaluated by professionals.

You can obtain or print the Ohio Checklist - Action to Enhance Collection of Accounts through our service.

Review the form description to confirm you have selected the right form. If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Acquire button.

- Then, you can complete, modify, print, or sign the Ohio Checklist - Action to Enhance Collection of Accounts.

- Every valid document template you purchase is yours indefinitely.

- To have an additional copy of any obtained form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow these simple steps.

- First, ensure you have selected the correct document template for the region/city of your choice.

Form popularity

FAQ

Improving the collection of accounts receivable involves refining your overall credit and collection policies. By training your team on effective collection techniques and maintaining clear communication, you can foster a culture of payment. Leverage the Ohio Checklist - Action to Improve Collection of Accounts to assess and enhance your existing policies.

To improve receivables collection, consider automating your invoicing and follow-up communications. Automation can minimize human error and ensure timely reminders to clients. The Ohio Checklist - Action to Improve Collection of Accounts can serve as a valuable tool to assist you in outlining steps to implement these automation strategies.

Enhancing accounts receivable (AR) collection begins with establishing a systematic follow-up process. Utilizing reminders and consistent communication fosters accountability among clients. With resources like the Ohio Checklist - Action to Improve Collection of Accounts, you can create a robust framework for managing and boosting your AR collections.

Several strategies can aid in bettering collections, such as timely invoicing, offering discounts for early payments, and setting up flexible payment plans. Each strategy encourages prompt payments while accommodating different customer needs. The Ohio Checklist - Action to Improve Collection of Accounts can help you explore and implement these strategies effectively.

The 5 C's of accounts receivable management are Character, Capacity, Capital, Conditions, and Collateral. These elements help evaluate credit risk and guide companies in decision-making regarding credit extensions. Utilizing the Ohio Checklist - Action to Improve Collection of Accounts can streamline this assessment, enhancing your receivables management.

To improve debts collection, companies should develop personal relationships with their clients. Establishing open lines of communication builds trust, making it easier to discuss outstanding balances. Incorporating the Ohio Checklist - Action to Improve Collection of Accounts can guide you in personalizing your approach and improving engagement with debtors.

Improving collection strategies requires a mix of diligent follow-up and effective communication. Regularly reviewing and adapting your approach can bolster your efforts, as strategies may need adjustments based on customer feedback and payment histories. The Ohio Checklist - Action to Improve Collection of Accounts is an excellent resource to identify and implement best practices for enhancing your collection strategies.

The first step to enhance your collections of accounts receivable involves establishing clear credit policies. By setting defined terms for payments, you provide your customers with expectations they can follow. Additionally, incorporating the Ohio Checklist - Action to Improve Collection of Accounts helps reinforce these policies, ensuring your processes remain effective and transparent.