Ohio Packing Slip

Description

How to fill out Packing Slip?

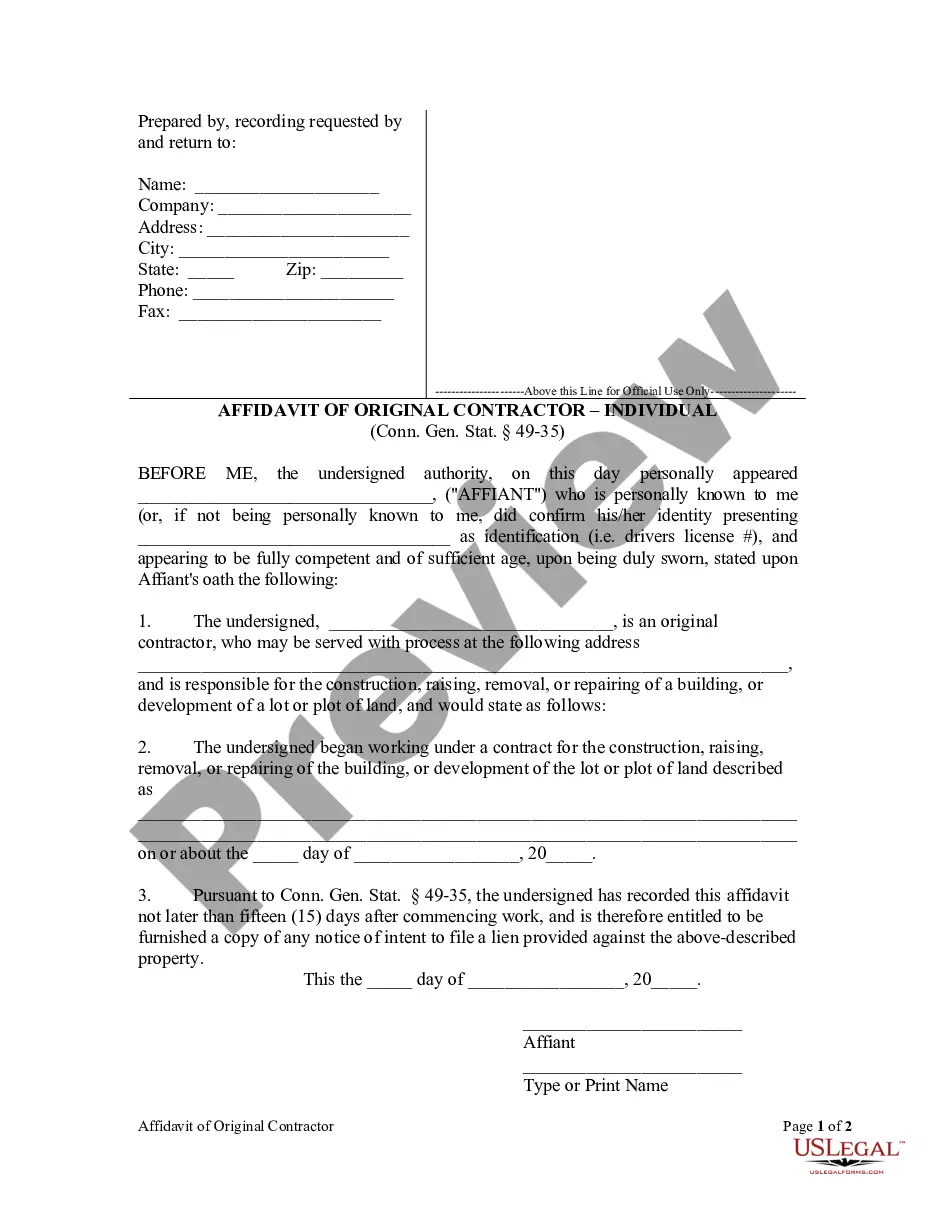

You can dedicate time online searching for the legal document template that aligns with the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that have been reviewed by experts.

You can either download or print the Ohio Packing Slip from our resources.

If available, use the Review option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Ohio Packing Slip.

- Every legal document template you procure is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Review the form synopsis to guarantee you have chosen the correct form.

Form popularity

FAQ

If you are a nonresident earning income in Ohio, you are generally required to file a nonresident tax return. This ensures that you report your earnings correctly and comply with state tax laws. Retaining your Ohio Packing Slip during this process will help you maintain accurate records of your filings. Always check with a tax advisor to confirm your specific filing requirements.

To file Ohio it 501, complete the form accurately, ensuring you provide all necessary information regarding your income and deductions. You can file online through the Ohio Department of Taxation website for quicker processing. Remember to keep a copy of your submission and the Ohio Packing Slip as confirmation of your filing. This organized approach will help you manage your tax responsibilities effectively.

Ohio 4708 must be filed by nonresident individuals and businesses that earn income in Ohio. This form ensures that those who generate income within the state comply with Ohio tax obligations. As you prepare to file, consider that having your Ohio Packing Slip organized can assist in this process. Staying informed about your filing requirements helps you avoid any unexpected issues.

The 501 Ohio form is a tax return used by businesses to report income and expenses to the state. This form helps the Ohio tax department assess your tax obligations accurately. When you submit your 501 form, keep a copy of your Ohio Packing Slip for your records. It provides proof of your filing in case any questions arise later.

Yes, you need to file an SD 100 if your business operates in certain municipalities that levy a local income tax. This form is essential for reporting your taxable income. As you gather documents, make sure you include your Ohio Packing Slip for your records. Failure to file can result in unnecessary penalties, so be diligent with your filings.

In Ohio, you typically need to file form 501 annually. This form is essential for businesses aiming to maintain compliance with state taxation rules. Remember to keep a record of your Ohio Packing Slip, as it serves as proof of your submission. Filing on time helps you avoid penalties and ensures smooth operations.

To file for tax exempt status in Ohio, you need to complete the appropriate application form specifying your qualification. Gather all required documentation to support your request. After submitting your application, you will receive an Ohio Packing Slip confirming your request. Ensure that you follow up with the tax office if you do not receive a response in a timely manner.

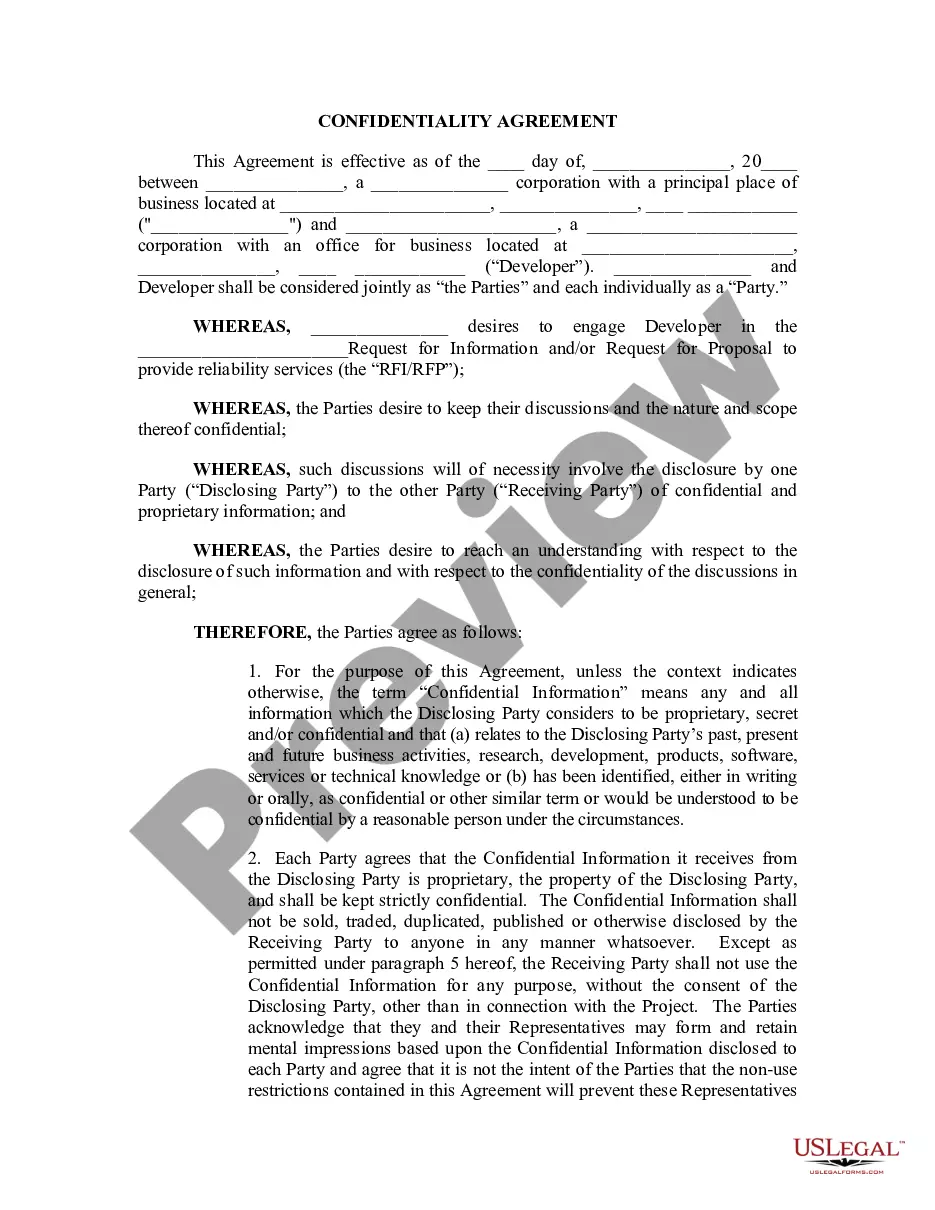

The responsibility for creating and managing the packing slip falls on the seller or the shipping department. This team ensures that the packing slip accurately details the contents of the shipment. Clear accountability in preparing packing slips benefits both parties and reduces complications. US Legal Forms provides various resources to help you navigate this process smoothly.

Packing slips are issued by the seller or the business fulfilling the order. It serves as a detailed summary of the items included in a shipment. The slip helps ensure that the right products are delivered, thereby preventing any issues during the delivery process. If you’re looking for an easy way to create one, US Legal Forms can provide the necessary tools.

The responsibility for preparing the packing slip usually falls on the seller or the fulfillment team. This document should accurately reflect the items being shipped to avoid confusion. Proper preparation of packing slips can enhance the customer experience and streamline operations. If you need templates or guidance, US Legal Forms has various resources available.