Ohio Notice of Default on Promissory Note Installment

Description

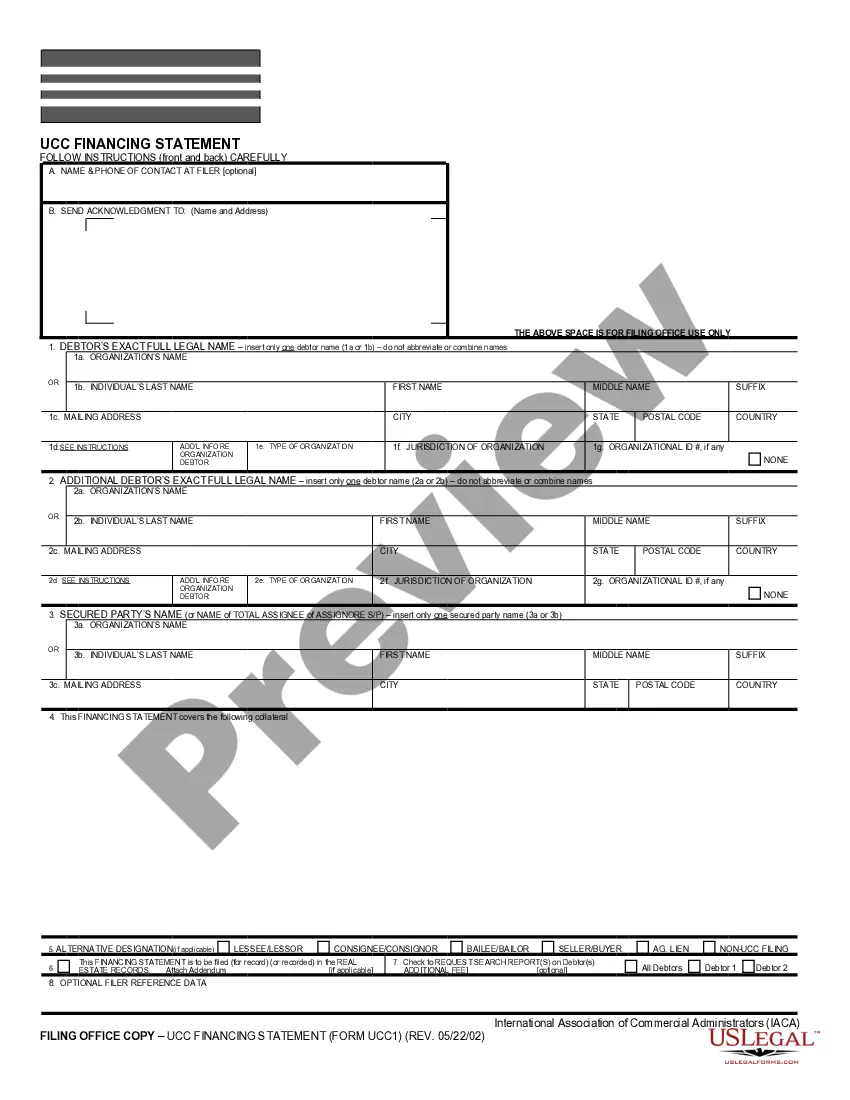

How to fill out Notice Of Default On Promissory Note Installment?

Are you in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Ohio Notice of Default on Promissory Note Installment, designed to comply with federal and state regulations.

Once you find the correct form, simply click Acquire now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Ohio Notice of Default on Promissory Note Installment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific area/county.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

To write a Notice of Default on Promissory Note Installment in Ohio, begin by clearly stating the intent of the notice. Include essential details such as the borrower's name, property address, and specific reasons for the default. Be sure to reference the terms of the promissory note that have not been met. To simplify this process, you can use UsLegalForms, which offers templates designed specifically for Ohio notices, ensuring you meet all legal requirements.

If someone defaults on a promissory note, start by reviewing the agreement for its terms and conditions. Next, consider sending a notice of default, which formally addresses the issue and provides the borrower an opportunity to respond. Utilizing resources like uslegalforms can help you navigate the complexities surrounding the Ohio Notice of Default on Promissory Note Installment, ensuring you take appropriate action.

To legally enforce a promissory note, the creditor must provide proof of the debt and the terms of the agreement. This often involves sending a notice of default and may require filing a lawsuit if the borrower does not comply. Familiarizing yourself with the Ohio Notice of Default on Promissory Note Installment can enhance your understanding of the enforcement process.

A notice of default on a promissory note serves as a formal declaration that a borrower has failed to meet their payment obligations. This document outlines the specific defaults and often provides a timeframe for the borrower to rectify the situation before further action is taken. Knowing this process is crucial when you deal with defaults in Ohio, as it delineates the next steps under the Ohio Notice of Default on Promissory Note Installment.

When you face a default on a promissory note, remedies can include the collection of the amount owed through legal action, obtaining a judgment against the borrower, or pursuing collateral if secured. Additionally, the creditor may choose to negotiate a settlement or a revised payment plan with the borrower. Understanding your options under the Ohio Notice of Default on Promissory Note Installment can guide you through the process effectively.

A notice of default typically includes several key components: the borrower's details, the lender's information, and a clear statement of the default. It should outline the specific terms breached and the total amount owed. Additionally, it may provide a timeframe for the borrower to remedy the default. When you use the Ohio Notice of Default on Promissory Note Installment form from US Legal Forms, you will have a professionally crafted document that highlights all necessary details and legal requirements.

To issue a default notice in Ohio, you will need to start by reviewing the terms of your promissory note. Ensure that you provide a clear statement of the default, including the amount due and any relevant due dates. It is important to send the notice to the borrower by a reliable method to document delivery. Utilizing the Ohio Notice of Default on Promissory Note Installment template from US Legal Forms can simplify this process and ensure compliance with state requirements.

An example of a default notice could include a formal letter stating the borrower's name, the amount owed, and the referenced Ohio Notice of Default on Promissory Note Installment. It should outline the violations, specify the time frame for remedying the default, and detail the potential consequences if the situation is not addressed. This sets clear expectations for the borrower.

To write a default notice, begin with a clear subject line and include pertinent details about the default, such as the outstanding amount and the terms violated. Reference the Ohio Notice of Default on Promissory Note Installment to create a context for the situation. It’s important to communicate clearly and specify the next steps the borrower should take to rectify the default.

In Ohio, the statute of limitations for a promissory note is generally six years. This means that creditors have six years from the date of default to take legal action to recover the owed amount. Being aware of the Ohio Notice of Default on Promissory Note Installment can help both lenders and borrowers navigate this timeline effectively.