Ohio Estate Planning Data Sheet

Description

How to fill out Estate Planning Data Sheet?

Choosing the right authorized record web template can be a have difficulties. Of course, there are tons of templates available online, but how do you find the authorized develop you want? Utilize the US Legal Forms site. The services provides a large number of templates, such as the Ohio Estate Planning Data Sheet, which you can use for business and private requires. All of the varieties are examined by pros and meet federal and state specifications.

Should you be presently registered, log in to the account and click the Obtain key to find the Ohio Estate Planning Data Sheet. Use your account to check with the authorized varieties you might have ordered earlier. Visit the My Forms tab of your own account and obtain one more copy from the record you want.

Should you be a whole new user of US Legal Forms, listed below are easy instructions so that you can stick to:

- Initially, ensure you have chosen the proper develop for your area/state. You are able to check out the form utilizing the Preview key and study the form outline to make certain this is the right one for you.

- When the develop fails to meet your expectations, utilize the Seach industry to get the right develop.

- When you are certain the form is acceptable, click on the Get now key to find the develop.

- Pick the pricing prepare you want and enter the required information. Create your account and pay money for an order with your PayPal account or Visa or Mastercard.

- Pick the submit structure and download the authorized record web template to the gadget.

- Comprehensive, change and print and indication the received Ohio Estate Planning Data Sheet.

US Legal Forms is definitely the most significant catalogue of authorized varieties where you can see a variety of record templates. Utilize the company to download skillfully-created paperwork that stick to status specifications.

Form popularity

FAQ

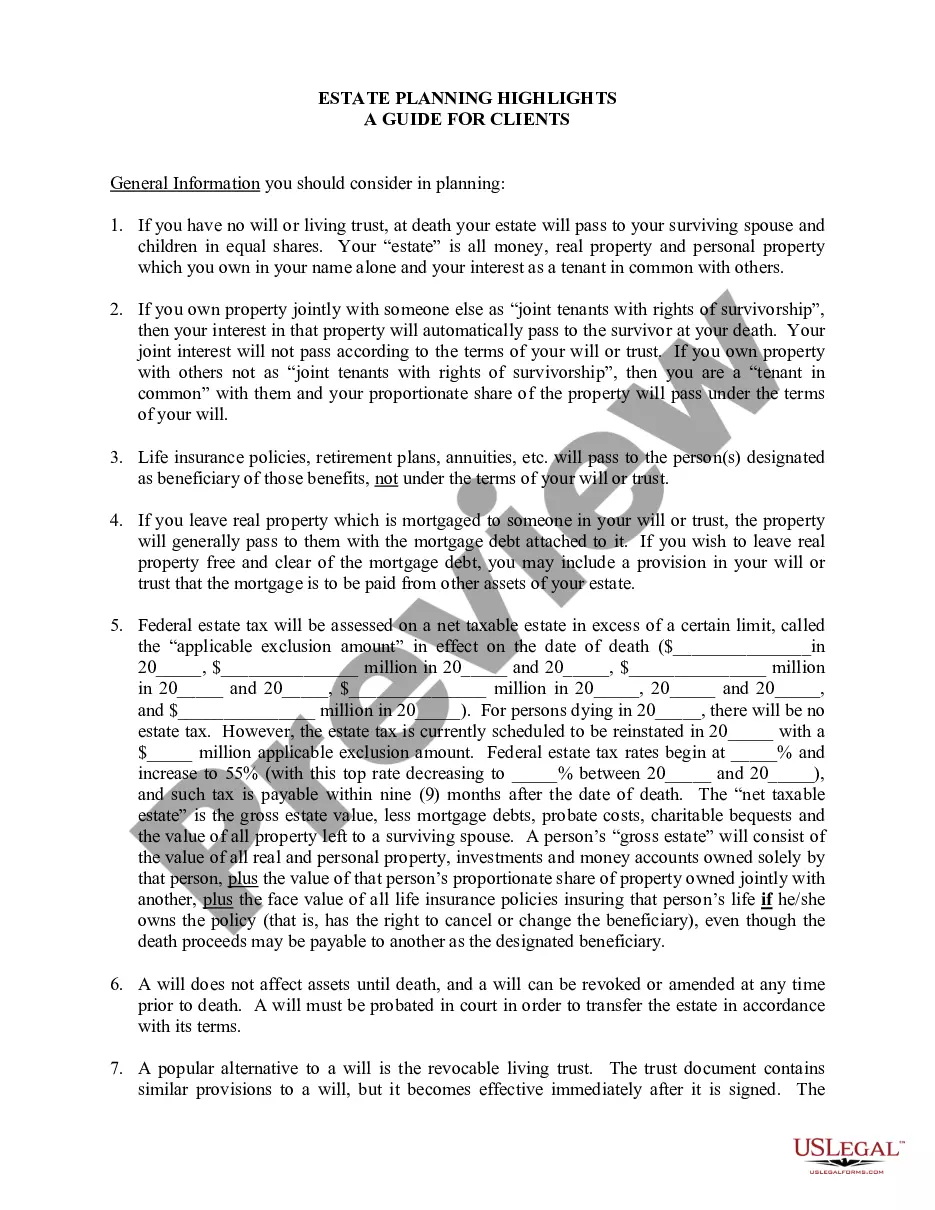

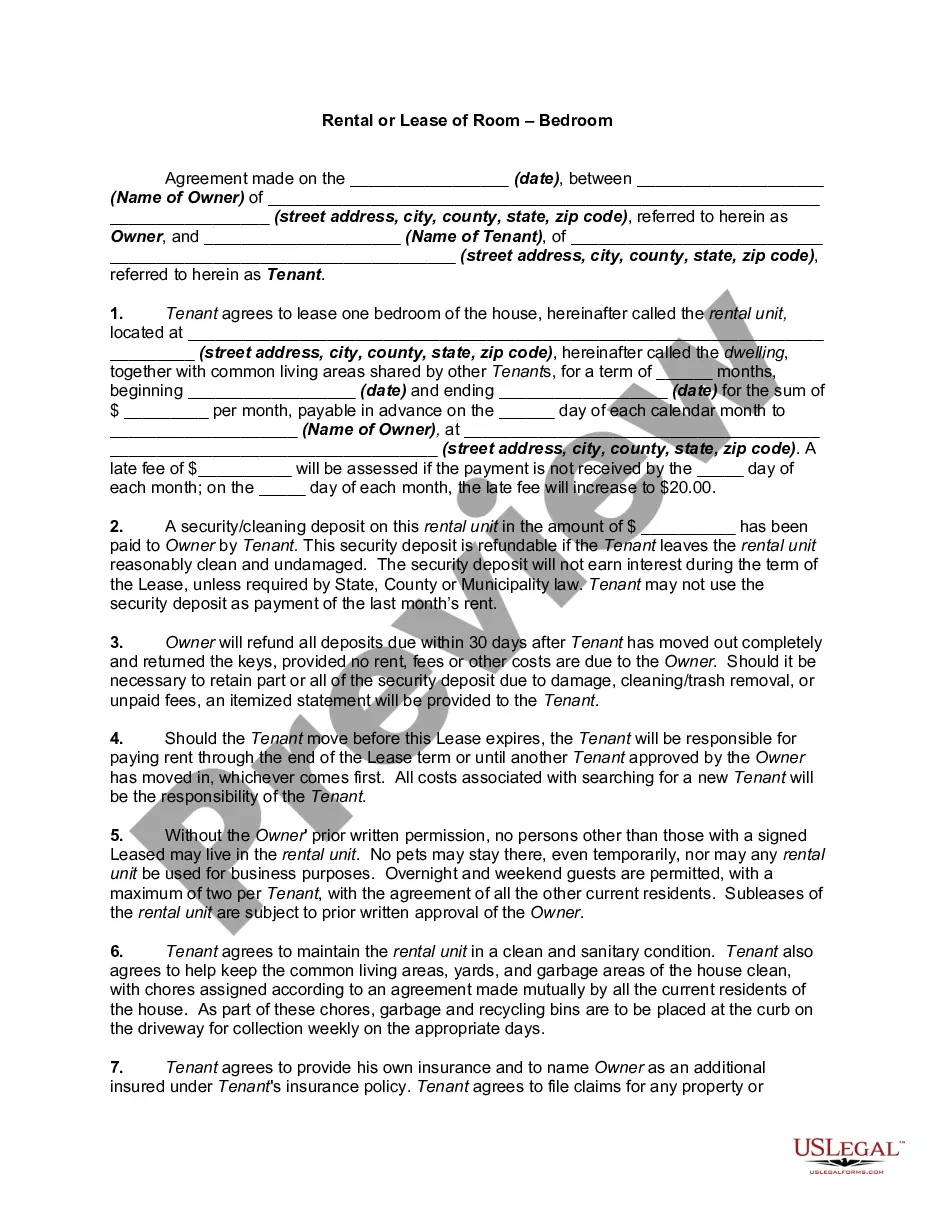

In Ohio, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

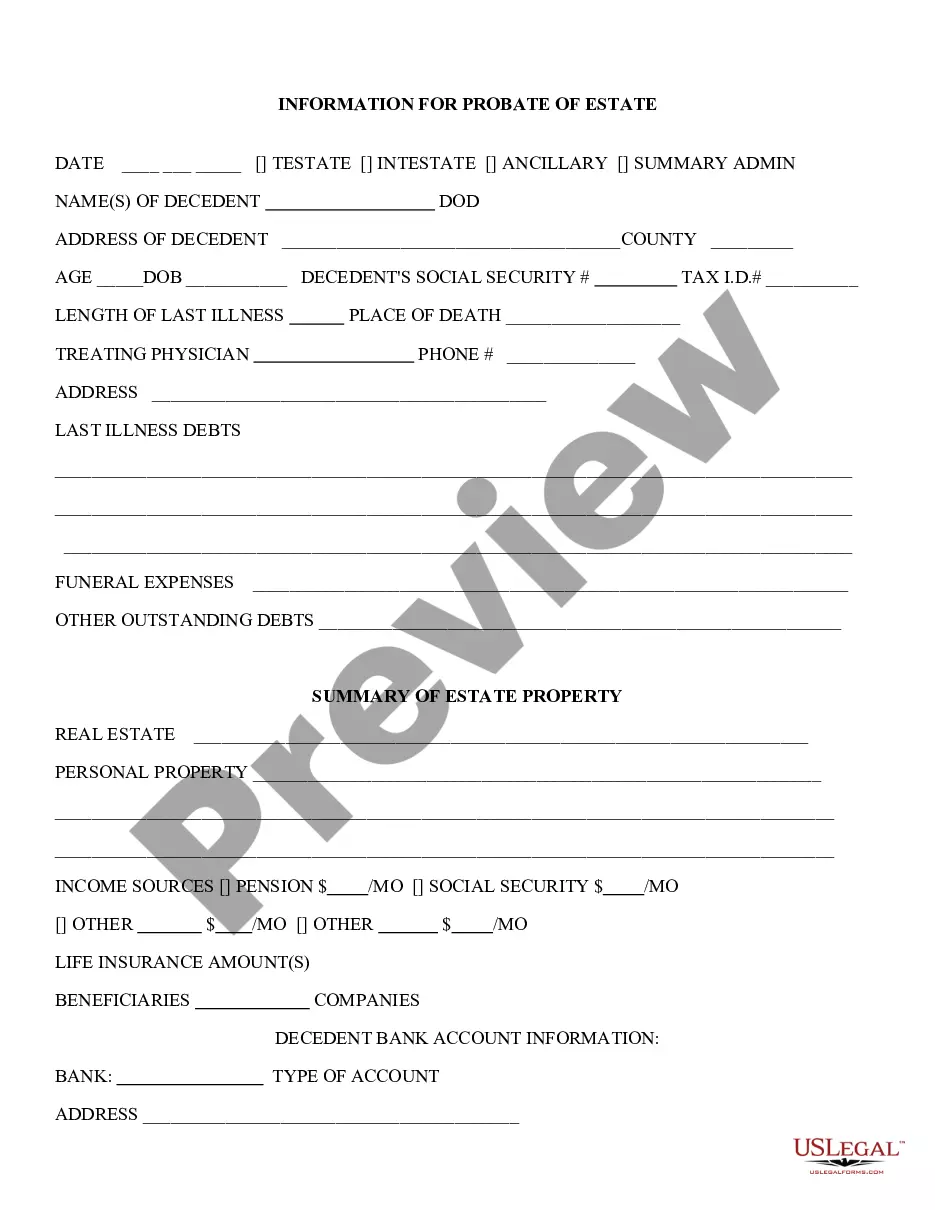

Probate assets include: Property that is solely in the decedent's name. Bank accounts that are solely in the deceased's name. Stocks and bonds. Vehicles such as automobiles and boats. Business Interests.

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

No, not all estates must go through probate. In fact, if your estate solely consists of one of the following, you may not need to go through probate at all: Survivorship deed (property automatically transferred to surviving owner) Assets held by a married couple.

For personal property valued at $35,000 or less (if the deceased person was survived by a spouse) or $5,000 or less (if there is no surviving spouse), a small estate affidavit can be used to transfer the property to the beneficiaries without going through probate, provided that no other probate proceedings have ...

Hourly fees are most common, followed by a percentage of the estate. Hourly rates for probate attorneys in Ohio typically range from $250 to $400 per hour.

Estate Plan Drafting In Ohio, the cost for comprehensive estate plan drafting can range from $550 to $4250, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Ohio can range from $150 to $850. A trust in Ohio typically costs between $550 and $2950.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses, whichever is less. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.