Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client

Description

How to fill out Resignation Letter From Accounting Firm To Client As Auditors For Client?

If you require to compile, acquire, or produce authentic document templates, utilize US Legal Forms, the largest assortment of lawful forms, accessible online.

Utilize the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are sorted by categories and states, or keywords. Use US Legal Forms to obtain the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client in a few clicks.

Every legal document template you purchase is yours for years. You have access to every document you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms member, Log In to your account and click on the Download button to find the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/region.

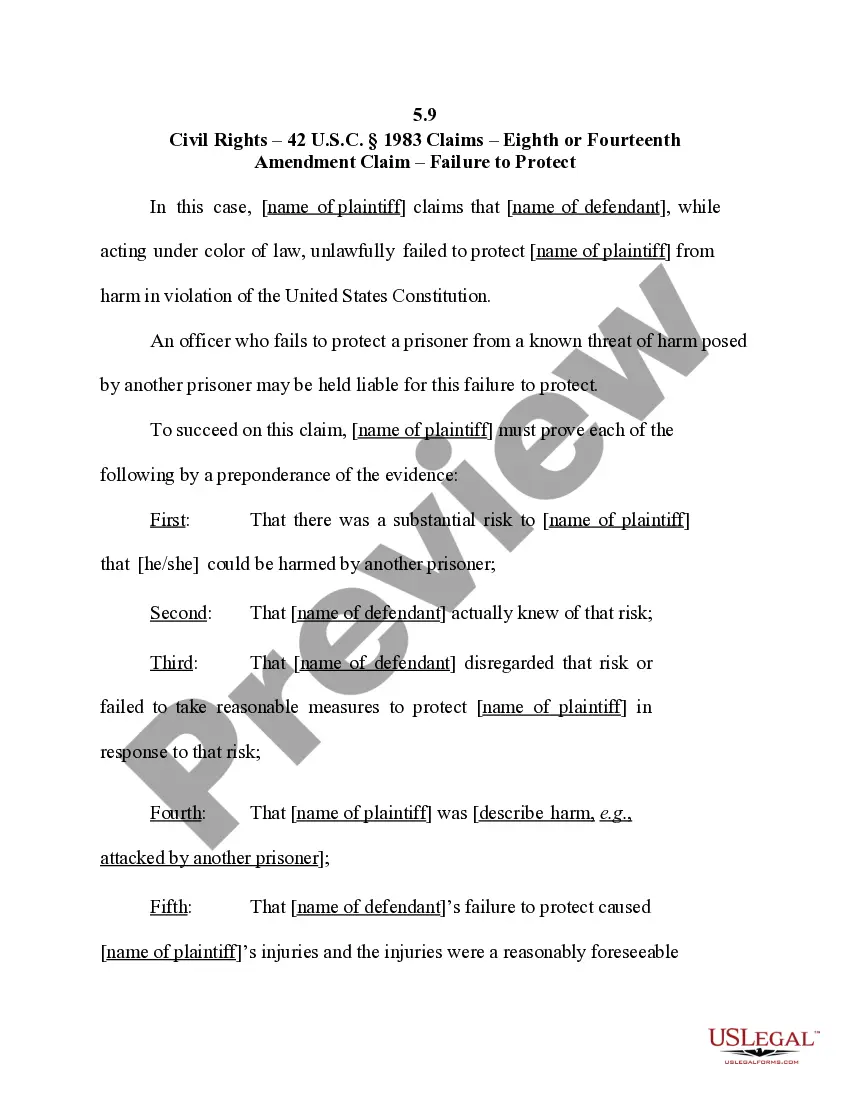

- Step 2. Use the Review option to examine the form’s contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, select the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your system.

- Step 7. Complete, edit, and print or sign the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client.

Form popularity

FAQ

To politely end a contract, prioritize transparency and professionalism. You should inform the client well ahead of time and kindly explain your reasoning. A useful tool can be the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client, which provides a formal way to convey your message. This ensures that you leave on good terms and preserves your professional reputation.

Respectfully terminating a contract involves clear communication. Notify your client about your intent well in advance and provide a concise reason. Utilizing a structured format, like the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client, can help you articulate your decision effectively. This helps maintain a professional relationship moving forward.

Breaking up with a client can be challenging, but professionalism is key. Begin by expressing your gratitude for their business and state your reasons honestly but tactfully. You might use an Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client to ensure you document the conversation properly. This approach ensures clarity and goodwill.

To cancel a client respectfully, start by communicating openly. Schedule a meeting or send a clear message that explains your decision. It is helpful to mention the positive experiences you shared. Offering them a template, such as an Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client, may help ease the process.

To politely terminate a contract with a client, begin by reviewing your agreement and checking for any specific termination clauses. Next, communicate your decision clearly and respectfully through a written notification, such as an Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client. In the letter, express your gratitude for the partnership and outline the reasons for your decision while offering assistance to ensure a smooth transition. Finally, maintain a professional tone throughout and consider scheduling a follow-up conversation to address any concerns.

To politely disengage a client, start by communicating openly about any challenges or concerns you have experienced together. Offer solutions where possible, but be clear about your decision. Sending an Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client serves as a formal notice and helps close the relationship on positive terms. Always aim to maintain goodwill, as this can benefit your professional network.

Firing an accounting client requires tact and professionalism. Schedule a meeting or phone call to discuss your decision, then follow up with a formal letter. Utilizing an Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client helps present your case clearly and respectfully. This approach ensures a smooth exit and preserves your firm's reputation.

Writing a client termination letter involves clearly stating your intention to end the relationship. Begin with a polite address and a brief explanation for your decision. Incorporate the Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client format for clarity and professionalism. Finally, express gratitude for their past business and offer assistance during the transition.

To terminate a contract with an accountant, begin by reviewing your contract's terms regarding termination. You typically need to provide written notice, outlining your decision to end the professional relationship. Using an Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client can make this process straightforward. Always ensure you keep a copy of the correspondence for your records.

Writing a letter to terminate a client should be done with clear intent and professionalism. An Ohio Resignation Letter from Accounting Firm to Client as Auditors for Client should clearly state that you no longer wish to provide services, along with the reasons for this decision. Offering to assist during the transition can help maintain a positive relationship.