This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Are you in a location where you require documentation for either business or personal purposes almost every working day.

There are numerous legal document templates accessible online, but locating reliable ones is challenging.

US Legal Forms provides thousands of form templates, such as the Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property, designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Locate all the document templates you have purchased in the My documents list. You can download another copy of the Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property at any time, if needed. Click on the desired template to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the template for the Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Find the template you need and ensure it corresponds to the correct city/region.

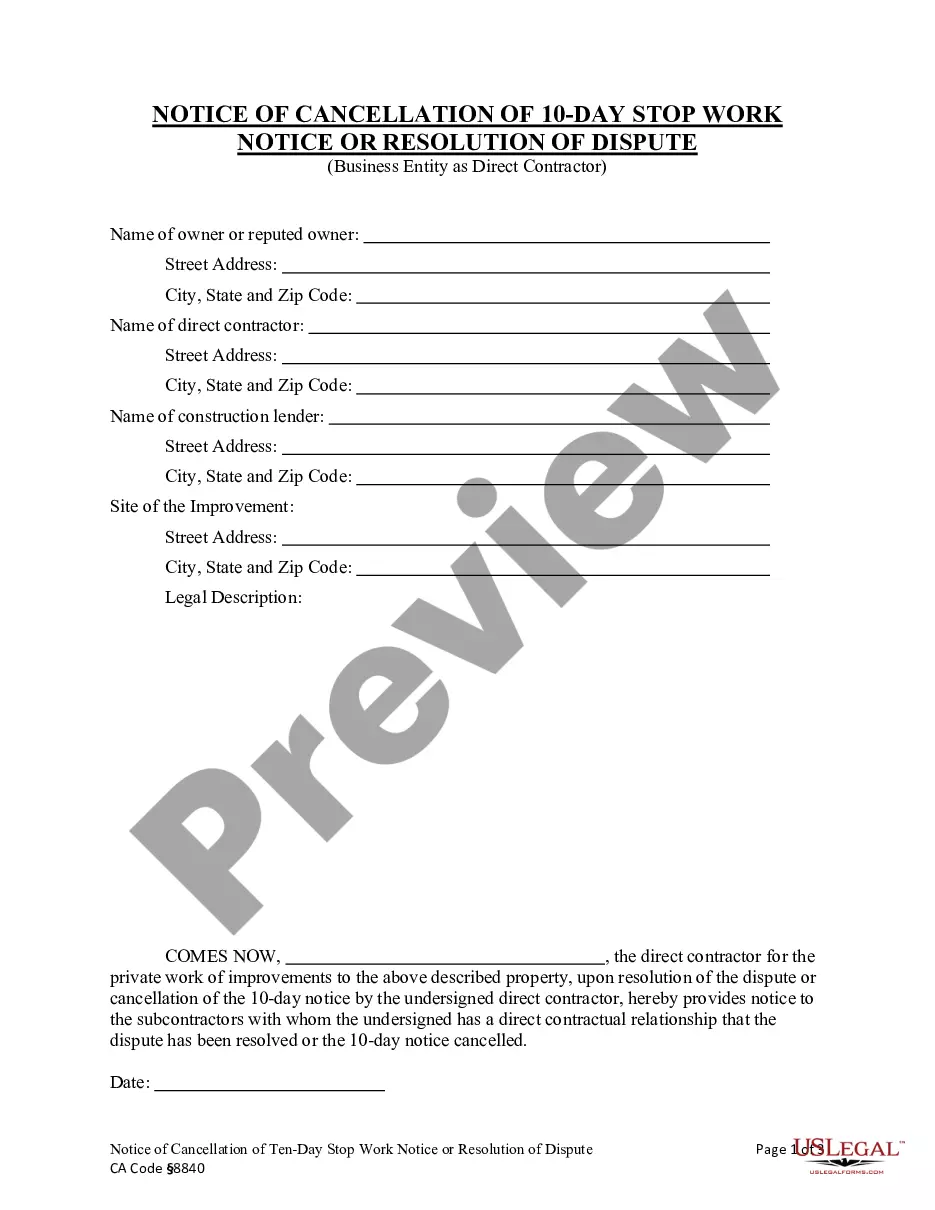

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the appropriate template.

- If the template is not what you are looking for, use the Search field to find the form that meets your requirements.

- Once you find the correct template, click Purchase now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

The speed of obtaining a dissolution in Ohio often depends on the accuracy of your filing and the current workload of the state office. Typically, if you correctly file your Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property online, you can expect a response within a few business days. However, processing times may vary, and using a streamlined service can help expedite the timeline. Always check for updates on your application status online.

Yes, you can initiate a divorce online in Ohio without appearing in court. Many online services guide you through filing the necessary paperwork, which may include details about the Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property, particularly if assets are involved. While it is possible to complete this process without legal representation, consulting a professional may ease your concerns and improve your understanding of the process.

To dissolve an LLC online in Ohio, first visit the state's business filing website. You will need to submit the appropriate forms related to the Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property. The process includes providing entity information and paying any required fees. After submission, you can track the status of your dissolution request online.

Yes, you can file for a dissolution without a lawyer in Ohio. Many individuals choose to handle this process independently by completing the necessary forms for an Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property. However, if you're unsure about any step or want to ensure accuracy, legal resources are available to assist you. Remember that understanding the requirements can help you avoid common pitfalls.

Yes, you can file for dissolution online in Ohio. The state provides an online portal through which you can submit your Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property. Using this method is convenient and efficient, allowing you to complete your filing from anywhere. Make sure to have all necessary documentation ready to ensure a smooth process.

Section 1706.33 lays out provisions related to merger and acquisition processes involving LLCs. This section can become particularly significant when considering an Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property in the context of corporate restructuring. Familiarizing yourself with these regulations can enhance your strategic decision-making in business transitions.

Section 1706.30 provides guidance on the winding up process for an LLC, detailing how to manage remaining assets and liabilities. This section is particularly relevant when executing an Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property. Understanding this process ensures that all obligations are satisfied before finalizing the dissolution.

Section 1776.22 outlines the regulations related to the financial aspects of LLCs, including the distribution of assets during dissolution. When engaging in an Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property, adhering to this section will facilitate a smoother distribution process among stakeholders. This knowledge helps protect your interests as you wind down the business.

Section 1706.16 focuses on the rights and obligations of members of an LLC, especially regarding internal disputes and ownership interests. This section can be pivotal in situations where an Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property is necessary. By knowing these rights, members can navigate conflicts more effectively.

Section 3105.17 pertains to the division of property and interests during divorce proceedings, which can include business interests. When facing a dissolution involving an Ohio Agreement Dissolving Business Interest in Connection with Certain Real Property, understanding this section is critical. It ensures that all property, whether real or business-related, is fairly considered during legal separations.